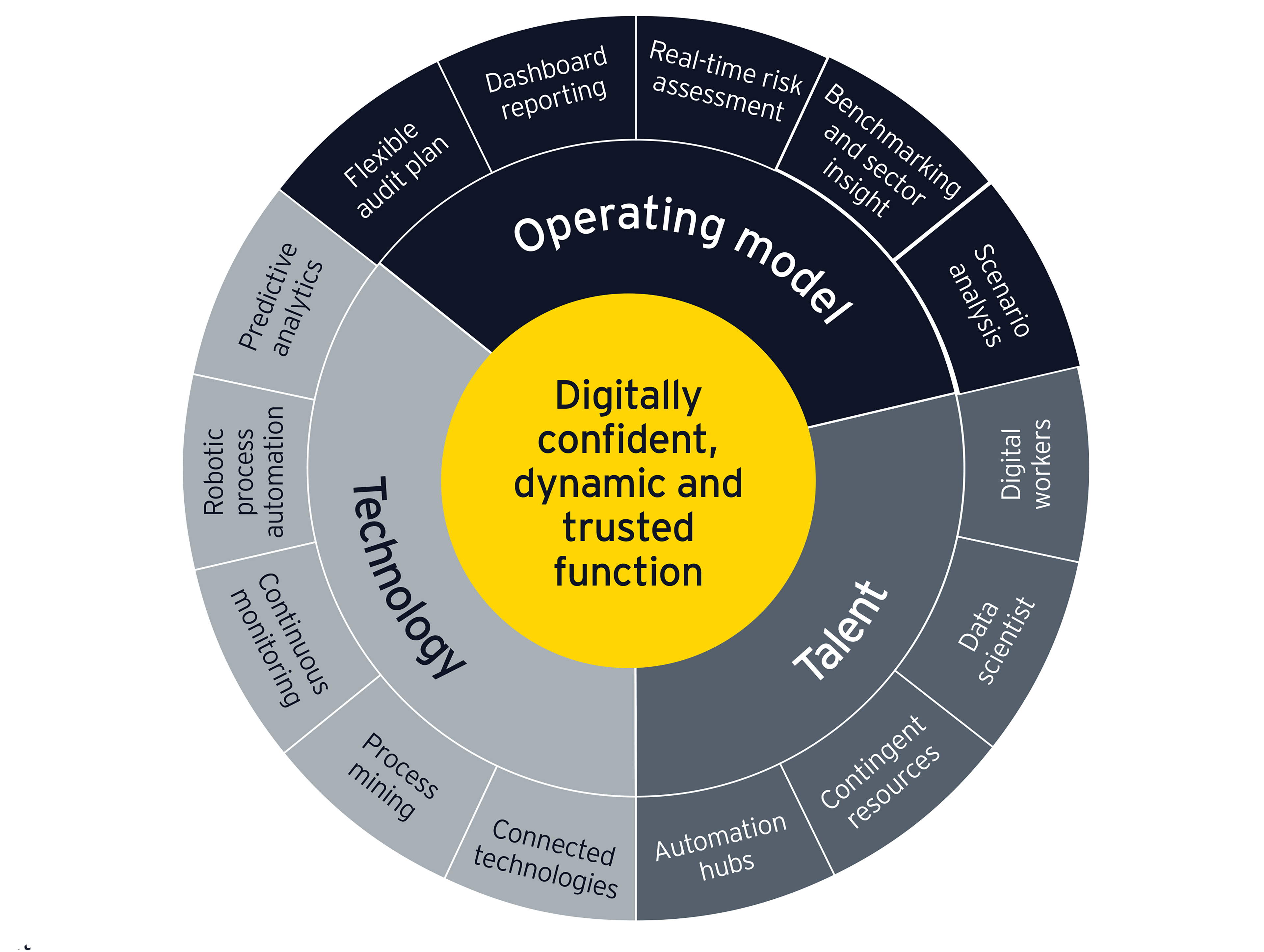

Operating model

Moving from a linear operating model to an ecosystem of tools and resources demands wider skills and experience. An IA function of IT and Finance generalists can no longer be effective. The resources and design disposition used to optimize the assurance activities IA provides are different from those you need to provide insights. These in turn demand different skills from those designing technology enhancements that allow for an improved control environment.

Transitioning some of the fixed costs of an in-house IA function to a more flexible cost base adds agility to the operating model. Moreover, a third party can add insights and perspectives above and beyond the in-house function, which enhances the overall control environment while building valuable insights.

An effective progressive operating model will not only embrace real-time risk assessments and dashboard reporting, but also offer a flexible IA plan. By utilizing advanced analytics, IA functions can model alternative potentialities, plot risks and highlight gaps in strategic plans. However, one of the major challenges facing traditional IA teams is that they don’t have the skills to execute complex analytics. Moreover, technology is evolving rapidly, making a major investment in one tool today redundant tomorrow. IA needs access to a wider toolbox of skills and technology to be effective in the longer term.

Technology

Companies that can fully integrate IA tools within the digital architecture of their operations will benefit from a frictionless flow of data using the same taxonomies and the same data sources as every other part of the business. This will allow IA to analyze much broader data sets than it was able to previously, now enabling the building out of actionable insights for the C-suite. It will facilitate greater transparency, remove duplication and accelerate the pace of insight into real time.

By migrating to advanced technologies, tools and platforms already in use by the wider company, IA can become more agile, efficient and transparent. Real-time analytics can deliver instant insight into potential risks faster and more consistently across the business and across geographies. These technologies also enable better communication to non-audit professionals, using dashboards, data visualization and analytics to create meaningful, real-time reports for the C-suite.

Talent

The progressive IA ecosystem has a talent mix that includes data scientists and digital workers. Digital tools are replacing linear and sequential approaches of “plan, execute, report” into a compressed and simultaneous activity. Fluid monitoring can respond quickly to changing needs. And as the volatility of the operating environment continues to challenge companies across the world, this agility is no longer a nice-to-have but a must-do.

Far-sighted audit chairs are harnessing the digital fluency of young team members to accelerate and lead transformation. Unfettered by decades of doing things in rigid and specific ways, they can innovate creating new uses for established technologies that better meet emerging needs.

Some senior executives may be surprised that IA departments do not need to house all the required source of this talent, skills or technologies. The purpose of creating an ecosystem made up of third parties, guest auditors and other talent allows for greater risk and insight coverage through skills and technologies not possessed as a fixed cost within the department.

The next chapter for IA functions

In the current world of rapid change, an IA model built as an ecosystem can take advantage of capabilities, assets and the provider’s scale to bring flexibility in skills, technologies and cost. Many organizations that have optimized their IA function operate this teaming model and do so at an operating cost at or below that of running a full in-house function.

As the IA function accelerates its journey from rear-facing reporter to forward-looking advisor, building a hybrid model that blends internal teams with external expertise can deliver flexible and future-proofed capabilities.

The future IA function will act as an all-seeing watchtower challenging the full risk landscape for its business leaders. To continue to be the guardians of trust, IA needs to drive over, around and through the organization; be fluid and agile; and always respond to new challenges and risks while monitoring data in real time.