EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Results show a preliminary indication that sustainability becomes more important when choosing an insurance partner.

In brief:

- This part of EY’s 2023 Insurance Barometer focuses on the importance of sustainability to commercial insurance clients.

- While ESG gets more attention from insurers in their conduct and communication, customer interest in sustainable insurance remains limited.

- However, we see first indications that the younger population is taking sustainability into account when choosing an insurance partner.

After looking at retail clients in 2021, in 2023 EY’s Insurance Barometer, focuses on businesses: self-employed and companies up to 250 employees. The aim is to gain insights into their preferences and intent when purchasing insurance.

This article delves into the perspectives of business clients, i.e. self-employed and SMEs, on sustainability matters related to insurances.

Other findings pertaining to self-employed and small companies with up to 10 employees can be found here and the findings specifically related to SMEs with more than 10 employees are available here.

Sustainability is not a decisive factor for business clients buying insurance products

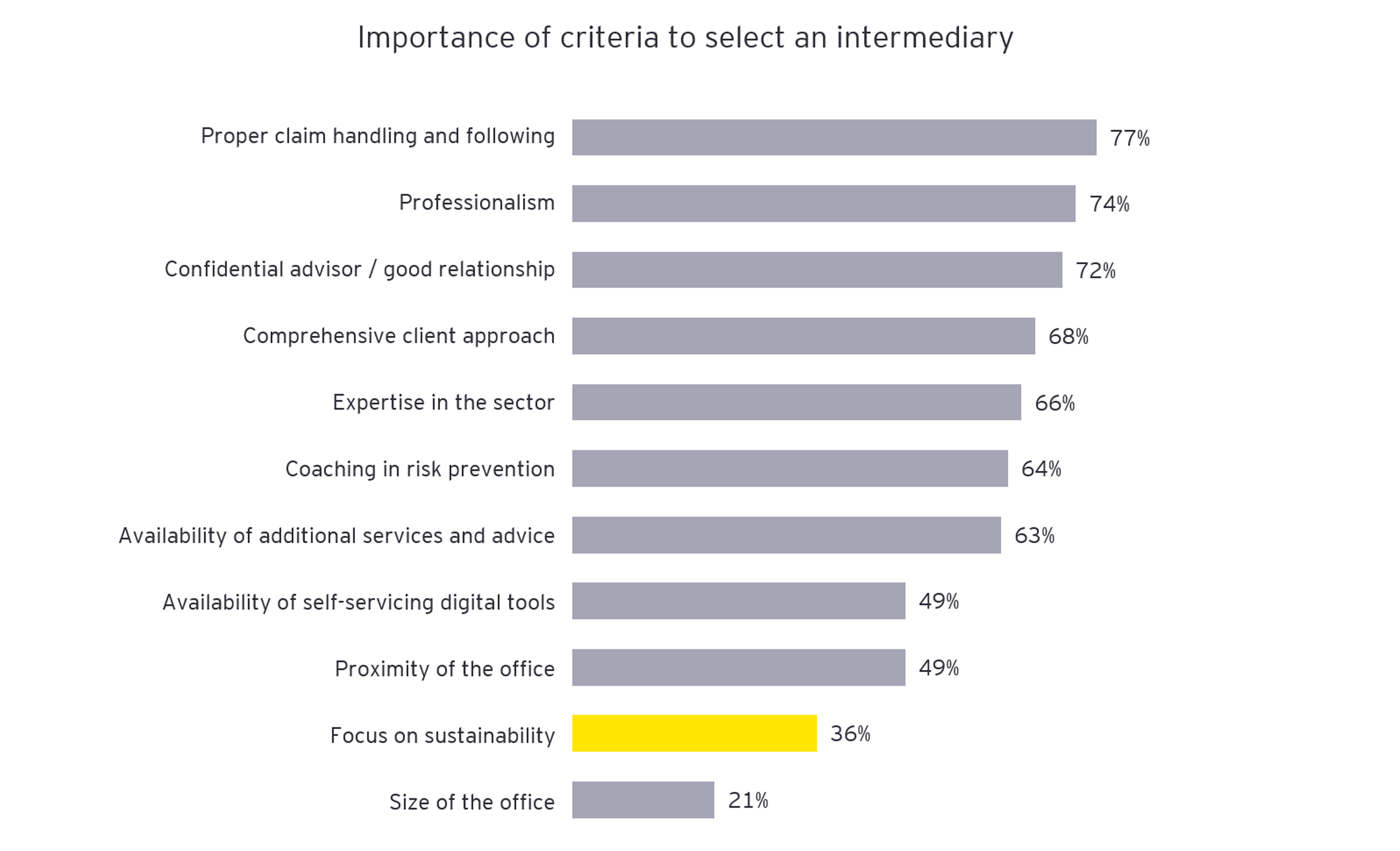

We asked respondents to rank the importance of criteria for selecting an intermediary. Notably, the criterion of 'focus on sustainability' landed in the 11th position (36% of the respondents answered ‘focus on sustainability’ by their intermediary as ‘extremely important’ or ‘very important’), suggesting it holds a relatively low importance in their decision-making process.

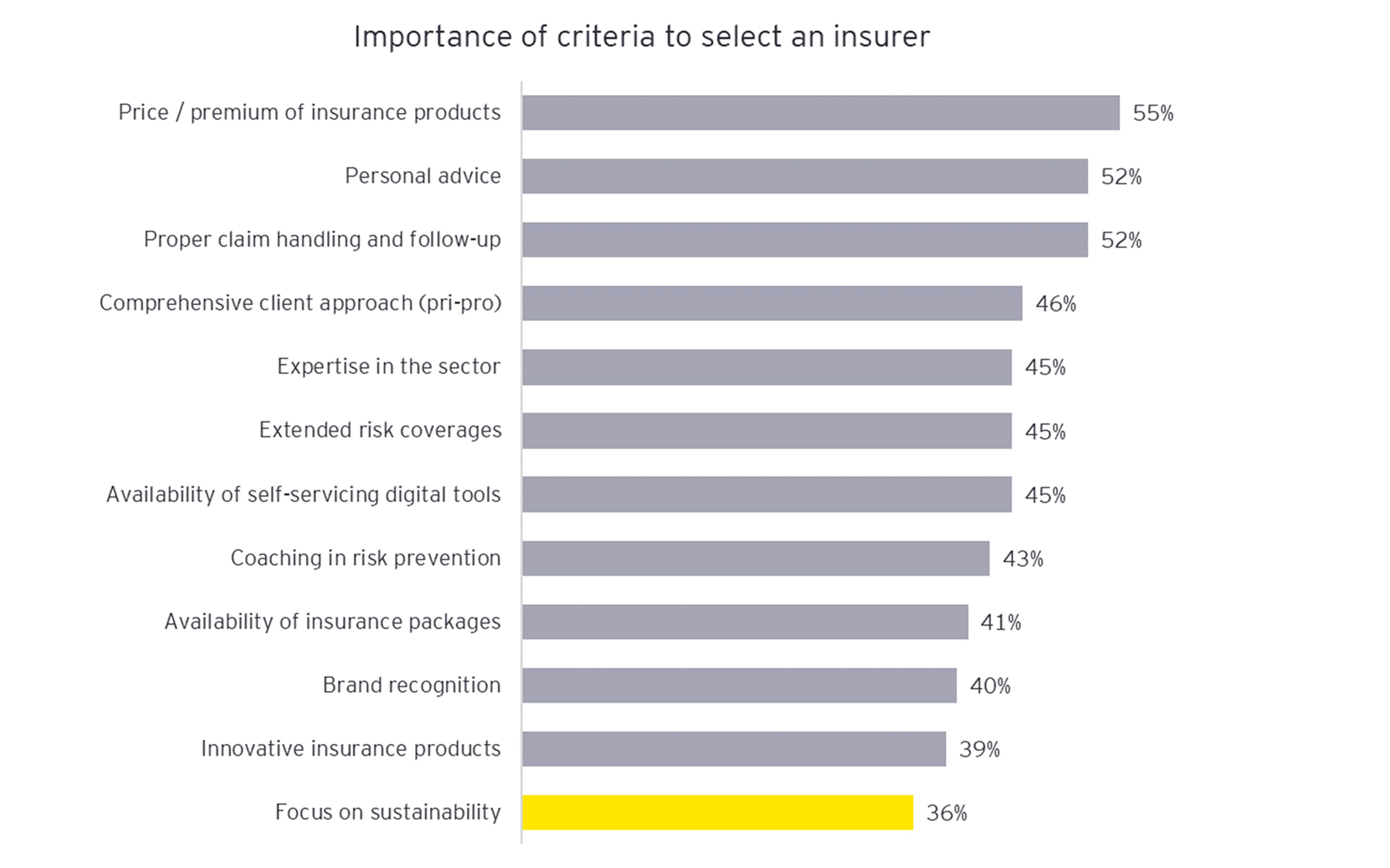

Among business clients dealing directly with an insurer, the sustainability factor also receives a score of 36%, making it the least significant criterion among the 12 options provided to respondents.

However, when we distinguish the results based on the size of the entities, a notable distinction arises. In the scenario of business clients working directly with insurers, medium-sized (with 11 to 50 employees) and large SMEs (with 51 to 250 employees) are more inclined to consider sustainability as a crucial aspect in their decision-making process.

The observation that sustainability gets more attention from business leaders of larger SMEs does not come as a surprise, as these are likely more inclined to communicate their own sustainability initiatives and efforts.

Younger business leaders seem to place more emphasis on sustainability

A cross-comparison of responses across different age categories reveals that business leaders aged 18 to 24, and to a lesser degree, those aged 25 to 34, show a heightened attention to sustainability considerations. This trend is evident when assessing the importance of sustainability in the selection of an intermediary.

Within the first age category (18 to 24), sustainability is ranked as the third most important criterion out of 11. In the second age group (25 to 34), sustainability is ranked ninth, while among older age groups, it is second-to-last.

These findings align with the broader pattern of younger individuals giving more weight to sustainability factors in their decision-making compared to their older counterparts.

Although sustainability currently matters to a limited number of customers, insurers should consider integrating sustainable offerings into their services, particularly for younger business leaders.

Low willingness to pay a higher premium for sustainable insurance products

Similar results are observed when inquiring about the willingness to pay a higher premium for insurance products. The survey focused specifically on commercial car / fleet and commercial fire & property insurance. In both cases, over 60% of business owners are not willing to pay a higher premium for a sustainable insurance contract. However, this percentage differs strongly across the various age groups.

More about the EY Insurance Barometer 2023

SMEs have different expectations between insurers and intermediaries

Business clients select their insurers and intermediaries based on various criteria.

Insurance: pricing matters more for businesses than retail clients

Self-employed and small companies up to 10 people behave very much like retail customers for their insurance, but are more price sensitive.

Newsletters EY Belgium

Subscribe to one of our newsletters and stay up to date of our latest news, insights, events or more.

Summary

Overall, business leaders exhibit a low level of interest in sustainability factors when selecting their insurance partner. However, younger commercial business leaders, as well as larger SME leaders are placing more emphasis on this topic.