EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

Closer collaboration with ESAs and stronger controls

If one thing becomes clear when reading through the 64 articles of DORA, it is the fact that ESAs will play a key role in the overall market digital resilience. Companies can expect a higher supervision from ESAs and stronger controls, with obligations such as

- defining specific policies,

- implementing a mature IT Risk Management Framework,

- sharing mandatory reporting for major ICT-related incidents,

- designing robust Business Continuity Plans (BCPs) and Disaster Recovery Plans (DRPs),

- performing mandatory annual resilience testing approved by the Executive Committee.

ESAs are expecting a whole new range of reporting and communication from financial institutions, a source of information that will aim to deepen the knowledge of the EU cyber intelligentsia.

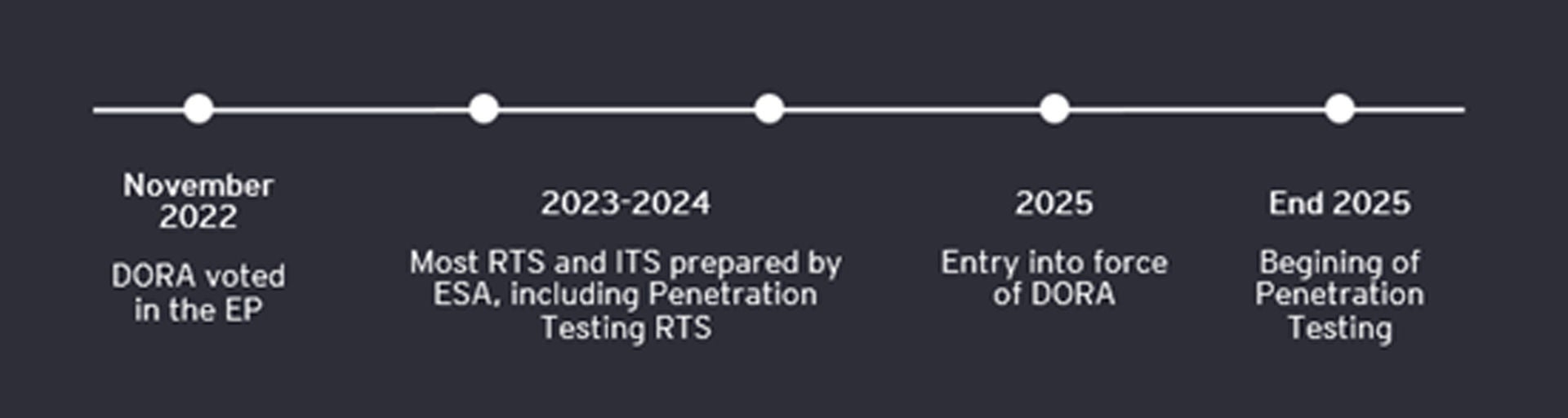

One of the major changes is the Digital Operational Resilience Testing, based on the Thread-Led Penetration Testing. There are two categories in this area:

- The first one is a mandatory annual internal testing with a report of the results to be provided to the ESAs (following a specific format provided by the regulator). It is applicable to all actors of the financial sector.

- The second one is an advanced testing to perform once every three years. It isapplicable to companies answering to specific criteria that the regulator will define in the coming months. This advanced testing, done by an external entity, will allow ESAs to issue a certificate stating the company's compliance regarding penetration testing. Failing to obtain it could result in a potential halt of the company's activities.