EY refers to the global organisation, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY Studio+ helps organizations build differentiated experiences that adapt with customers and drive sustainable long-term value. Read more on studio.ey.com.

Read more

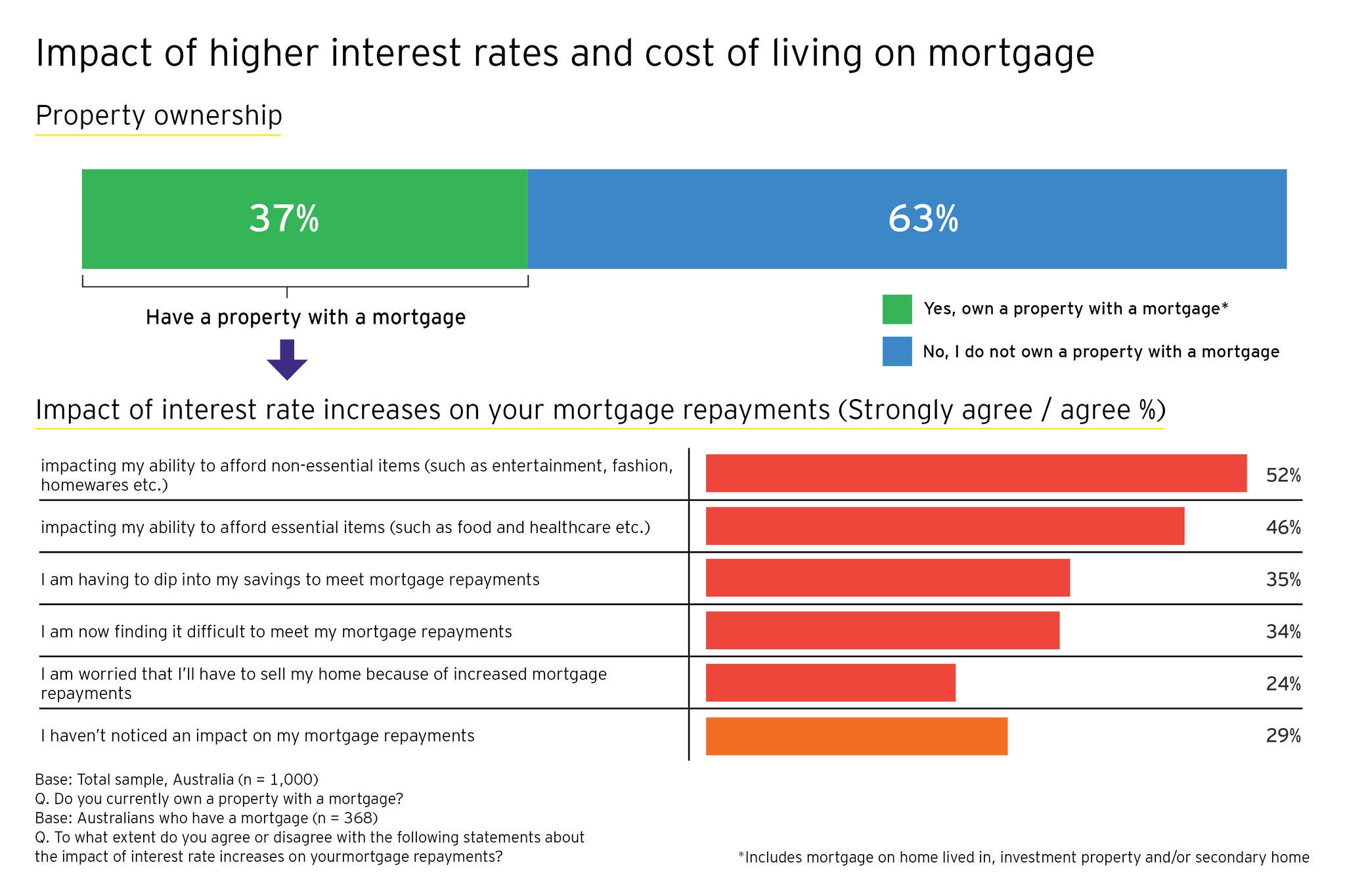

Economists often observe that nations enter recession at a sprint but come out at a much slower pace. The 12th EY Future Consumer Index suggests they may once again be right, as a quarter of Australians expect the economy to be in a similar position in three years’ time and just over a third (34%), anticipate it will be worse.