Chapter 1

Analysis: global energy crisis

Divergence and diversification will help accelerate the renewables market and improve energy security.

The natural gas market has been on a rollercoaster ride over the past year. Even before the war in Ukraine, prices had soared, and the volatility is set to continue as many global leaders look urgently to reduce their reliance on Russian gas.

A multitude of factors have led to the steep rise in gas prices. Seasonal drought in Latin America reduced its hydropower capability; Asia’s recovery from COVID-19 lockdowns put pressure on gas supplies; and there is increasing competition between Europe and Asia for liquefied natural gas (LNG), plus supply and transport constraints among gas producers. All served to create a perfect storm.

There is no quick fix either. Major infrastructure projects, such as increasing LNG capacity with floating storage and regasification units, have long lead times. Pipelines can also take years to complete and are incredibly complex if they cross third countries. Delaying the phasing out of nuclear power in the coming years is also tricky, as it is a polarizing issue affected by local public sentiment.

Despite all this, greater diversification of gas sources and improved energy security is expected from the mid-2020s, with infrastructure build-out already underway. A larger mix of other fuels and technologies is also expected to be more readily available by then, and subsidies for alternatives — such as biomass or hydrogen-fired turbines — could reduce the cost of these technologies substantially.

For consumers faced with pricing pressures, power purchase agreements (PPAs)1 could be a way for developers to secure long-term price certainty, and the accompanying revenue assurance could incentivize new renewable rollout.

Amid the high price levels for gas, the EU is proposing a fundamental rewriting of its energy policy2, with ambitious new renewable energy targets. Proposals for its revised energy strategy are expected soon. The UK3 and Germany4 have already announced plans to accelerate their rollouts of renewable energy, and more countries could follow suit.

Increasing energy security and reducing Europe’s reliance on Russian gas will not be straightforward, but a diversified strategy is necessary in the years ahead to accelerate the deployment of renewables, other fuels and technologies.

Chapter 2

Key developments

From tripling onshore wind to investing in green hydrogen — who’s doing what in renewable energy.

Energy security has risen to the top of priority lists, with governments around the world looking to accelerate and broaden the scope of their renewables programs to help reduce their reliance on imported energy at this volatile and unpredictable time.

Download the RECAI top 40 ranking (pdf) for details on technology-specific scores, and see methodology for details on how ranking and scores are determined.

In this edition of RECAI, we look at some of the interesting and varied approaches to renewable energy expansion amid the heightened importance of energy security in 10 markets.

Chapter 3

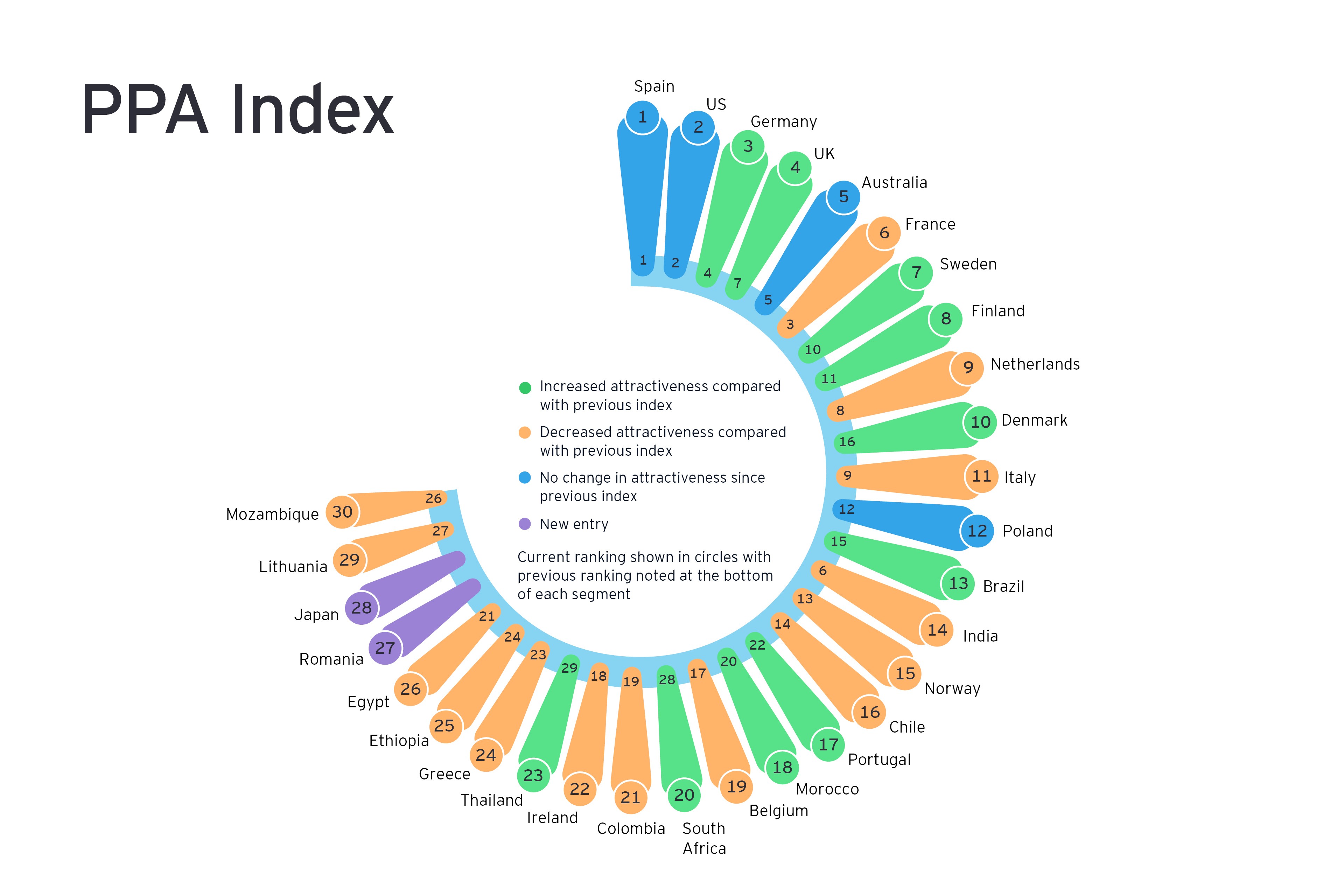

PPA Index

The balance of power is shifting as the PPA market continues to grow.

The PPA market is continuing to grow as a result of exceptionally high and volatile power market prices, and new corporate ambitions following COP26. However, barriers currently slowing growth include supply chain delays and holdups with planning approvals and grid connections. These are leading to a shortage of projects ready to build. Greater demand for PPAs, fewer projects and escalating equipment costs have also resulted in higher PPA prices and a more balanced seller-buyer market. Economics are still strong in many locations, however, with low, fixed PPA prices attractive against high, unpredictable wholesale prices.

The EY corporate PPA Index uses key parameters from four pillars to analyze and rank the growth potential of a nation’s corporate PPA market. For details on data and methodology, download the EY corporate PPA Index (pdf).

Chapter 4

Regional focus: Latin America

Major gains in renewables generation to be had if the region can overcome challenges.

Latin America could be seen as a sleeping giant in the renewable energy sector, blessed with abundant sunshine, vast hydroelectricity potential and favorable locations for onshore wind.

Brazil’s renewable capacity and generation far outstrips that of other Latin American markets, and it is a global leader in hydroelectricity production. However, an overreliance on hydro has left it susceptible to the impacts of drought. Solar power production has been hindered by local content requirements that often prevent developers from accessing long-term funding from the development banks. The country’s exchange rate is also presenting problems for companies seeking to import solar panels. However, the recent move to allow project financing in US dollars should give renewables developers a boost.

Chile has been a success story for the region, having achieved very low renewable auction prices, and it has some of the greatest potential in Latin America for solar power. The country is now targeting a leadership position in green hydrogen, according to research5 used by the Chilean government, where it will be able to produce green hydrogen at US$1.05 per kilogram by 2030.

Developing its renewables industry could become even more important, because Chile is an importer of LNG and faces increased competition in the market as Europe increases its imports rate.

Argentina has introduced programs such as RenovAR,6 which has aided the development of large-scale wind and solar photovoltaic projects. However, a change in government and priorities has resulted in such projects losing momentum. Mired by financial challenges, the market has been pushing for greater foreign investment. China has dominated investment7 in Argentina’s renewable energy sector and signed a deal to build the US$8b Atucha III nuclear power plant,8 which had previously stalled.

Despite possessing some of the world’s best potential for solar power, constitutional reform is threatening Mexico’s renewables sector, with the government seeking to restore state dominance9 in the electricity sector. While unsuccessful so far,10 the constitutional amendment would return control11 of the power sector to state-run utility Comisión Federal de Electricidad (CFE). To meet clean energy goals, Mexican wind and solar industry associations estimate that an additional US$10b of investment12 in renewables will be needed by 2024, but this could prove a tall order as proposed reforms have scared away investment.

Markets across Latin America are facing a variety of challenges and taking divergent approaches to enhancing their energy security. If some of these challenges can be overcome, however, the region will be able to make major gains in renewables.

Chapter 5

Insight: floating technologies

As the cost of power soars, development of floating wind and solar power could accelerate.

To accelerate decarbonization, breakthroughs to help emerging technologies go mainstream will be needed. One technology that could play an increasing role in expanding the rollout of renewables is floating generation.

Developers are becoming increasingly interested in floating wind because floating turbines can offer access to stronger and more consistent wind found around deep water, without the high cost of fastening turbines to a deep seabed. Given that 80%13 of Europe’s potential offshore wind power, and 58% of the US’s, is found in waters deeper than 60m, technological and engineering advances could unlock significant generation capacity.

Floating solar panels are also gaining interest for their ability to skirt opposition to solar farms on land where they must compete with agriculture and amenity value, which can be a major issue, particularly in small countries.

However, there are engineering challenges to overcome for both. Wind turbines need to be robust enough to handle significant buffeting from wind, rain and salt water, so getting them to float in the right place can be difficult. Meanwhile, floating solar farms are susceptible to capsizing in extreme weather.

Neither technology has yet to take off fully because of higher costs of energy production. However, floating wind is beginning to look more viable, particularly in the current environment. Over the past year, wholesale electricity prices in Europe have hovered around €200/MWh (US$217/MWh),14 while the cost of energy from floating wind stands at around US$200/MWh.15 Increasing investment in research and innovation will help to bring production costs down.

The case for floating wind is also bolstered by the fact it can be used to produce green hydrogen. Projects are already being planned both in the Celtic Sea and off the Scottish coast that would combine electrolysis, desalination and green hydrogen production on a floating wind platform. The first to come online in 2027 will be Project Dylan,16 a joint venture between Source Energie and ERM Dolphyn.

Floating technologies are several years away from going mainstream, but — as the cost of power soars — an attractive investment climate is forming that could put them on the fast track to widescale adoption.

Related articles

Summary

There has been unprecedented volatility in the natural gas market over the past year because of high demand and supply constraints. The war in Ukraine has also prompted European nations to look urgently at reducing their reliance on Russian gas. Accelerating the deployment of renewables and developing emerging technologies and new fuels, such as floating wind and green hydrogen, will be key to reducing demand for gas and bolstering the world’s energy security.