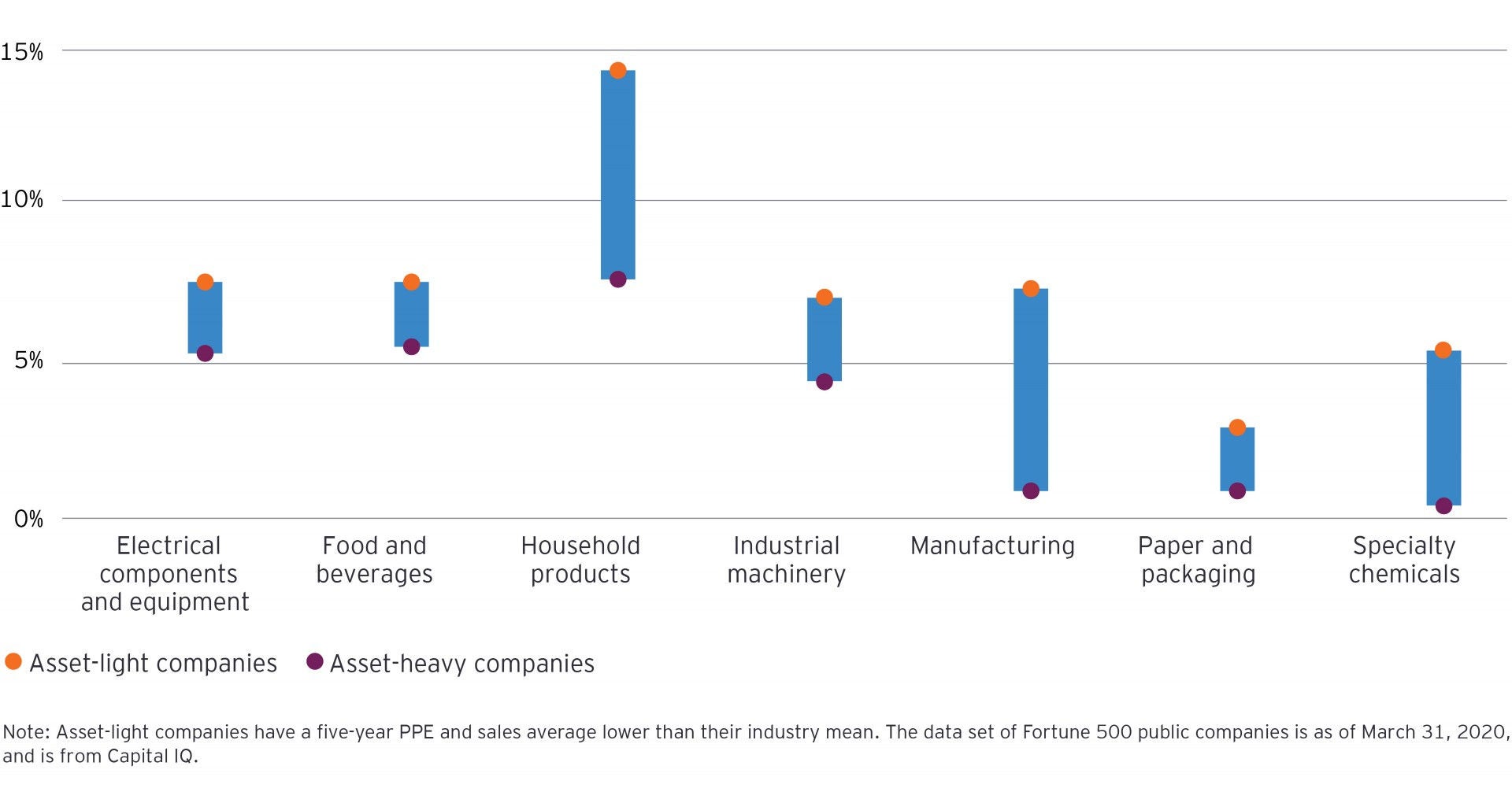

Once seen as just a defensive tactic used by underperforming companies, asset-light strategies and business models are now becoming an essential tool to fuel growth and strengthen an ecosystem of partnerships. Recent Ernst & Young LLP research indicates that regardless of market position, an asset-light approach can help companies achieve higher total shareholder returns (TSR),1 among other financial benefits.

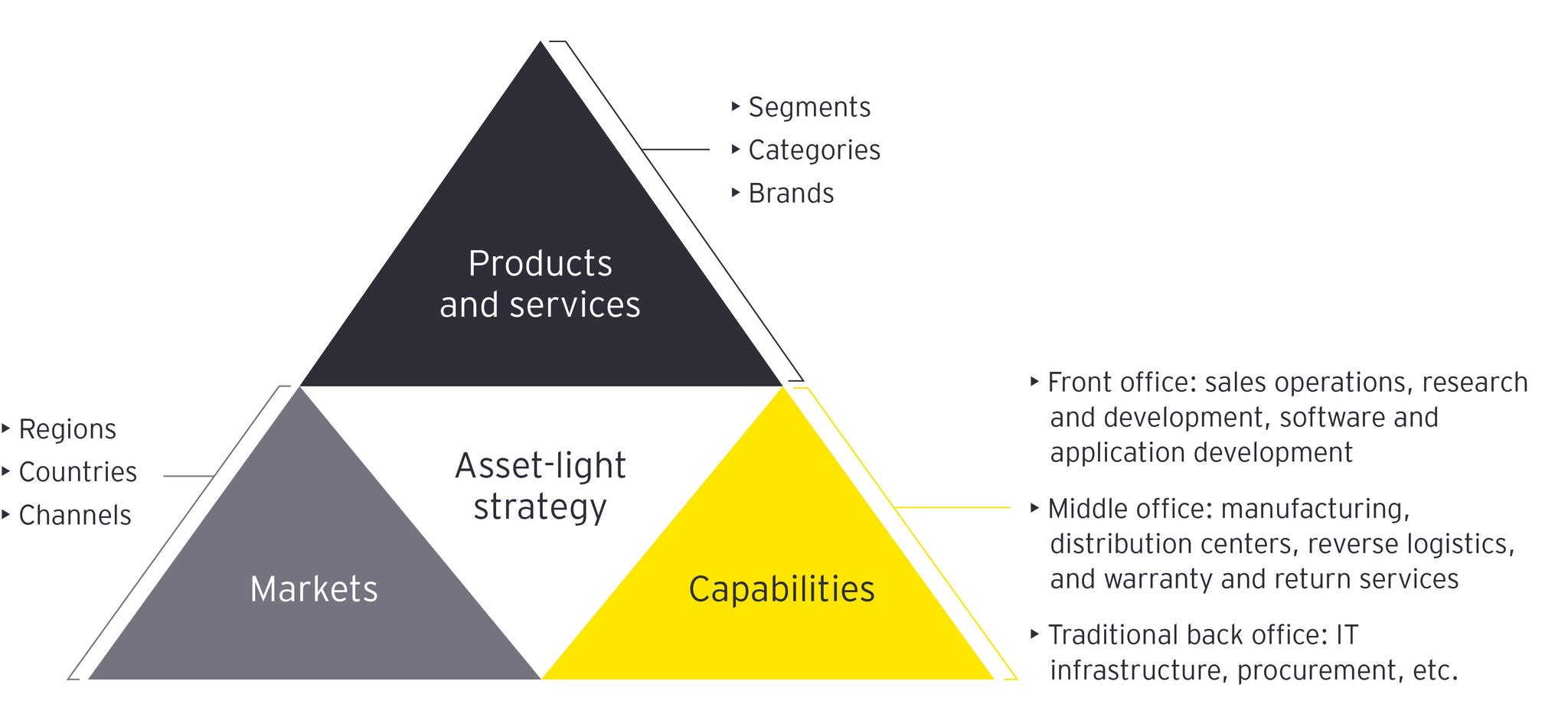

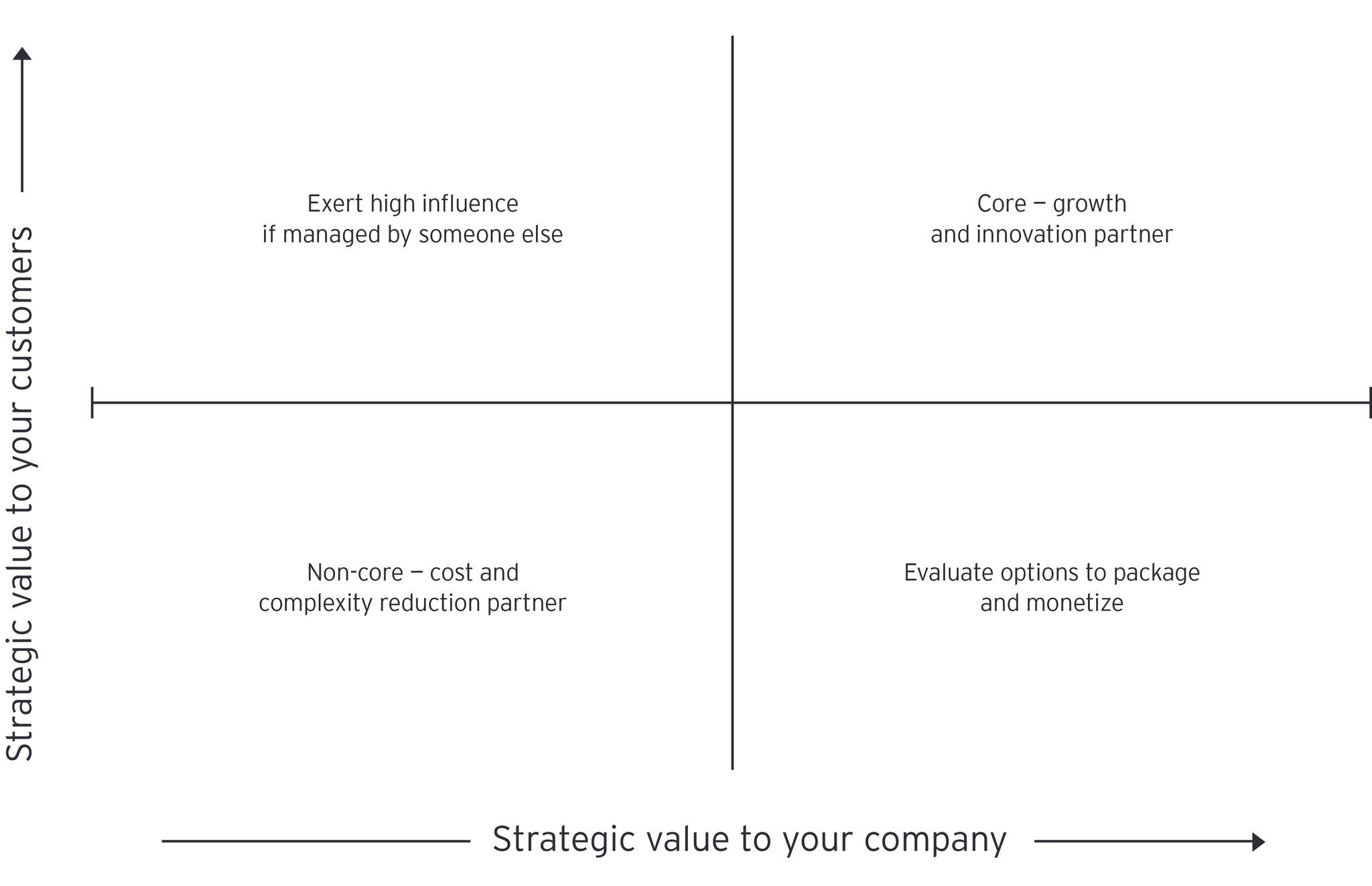

An asset-light strategy or business model involves transferring capabilities, such as people, process and technology, to “better owners” in order to enable companies to transition fixed costs to a variable cost structure, enhance agility, and facilitate a shift of resources that allows a focus on core capabilities.

“Today, companies of all types and sizes are using asset-light strategies to deal with massive market disruption and drive continued growth,” said Willem Appelo, former Worldwide Vice President Supply Chain, Strategy, Innovation and Deployment, Johnson & Johnson, and a leading authority on business transformation. “C-suite executives are taking this moment in time to review business models, assets and partnerships as they prepare their businesses to move forward post-pandemic. To remain competitive, they must make changes irrespective of their financial position,” he added.

The current COVID-19 crisis has prompted companies to conduct a comprehensive review of business portfolios and make long-overdue operational changes. Companies are also adopting an asset-light model to navigate market conditions.

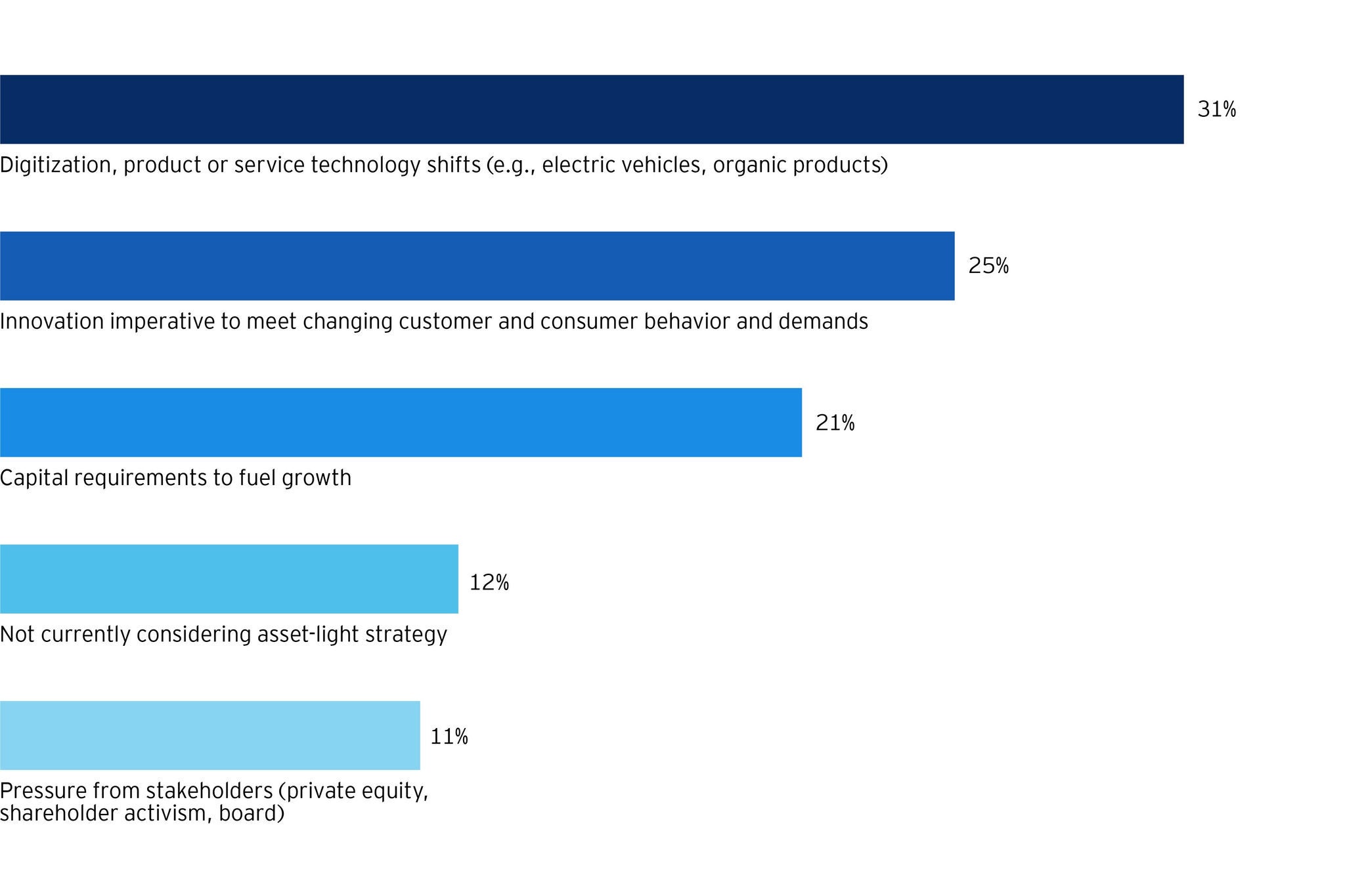

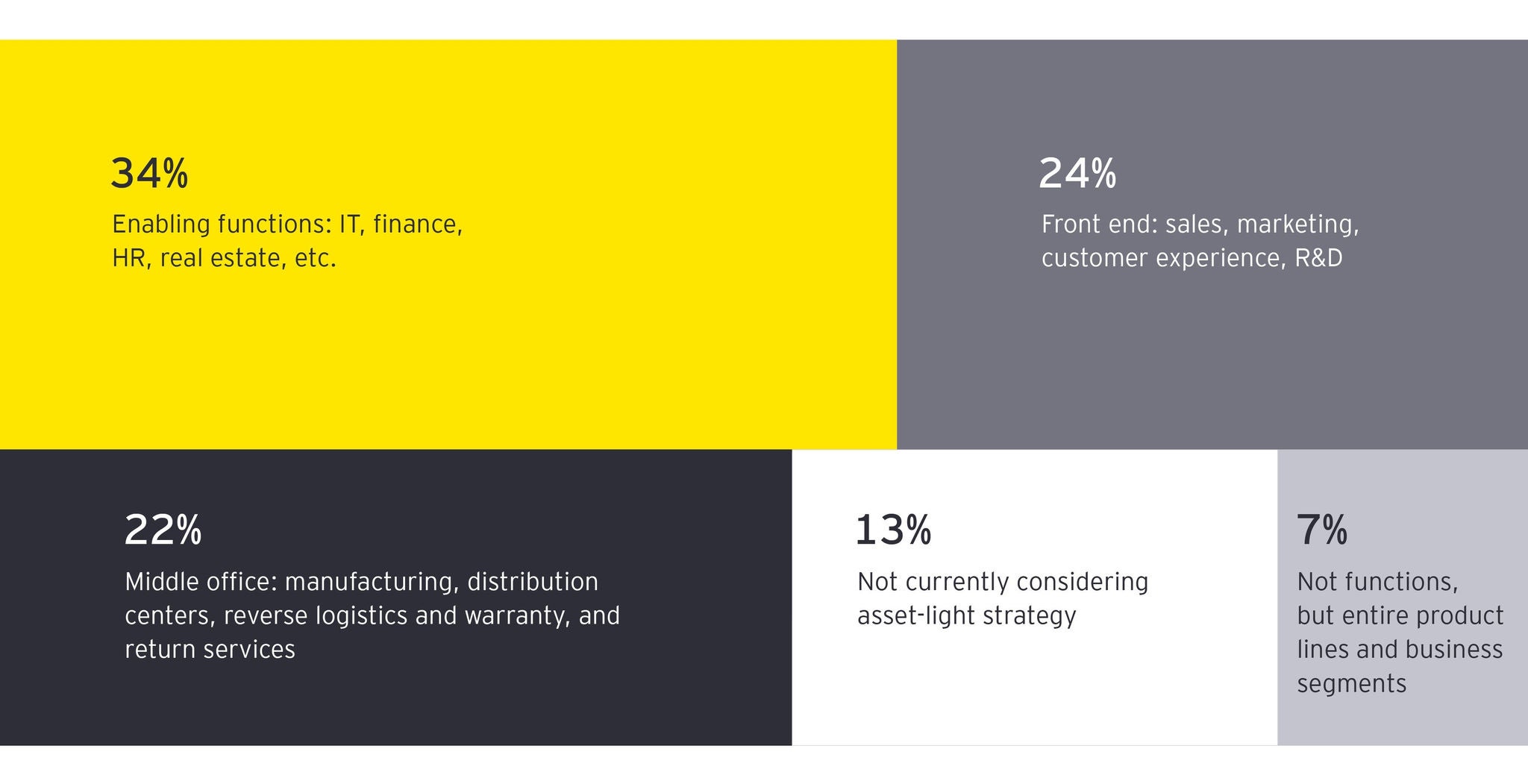

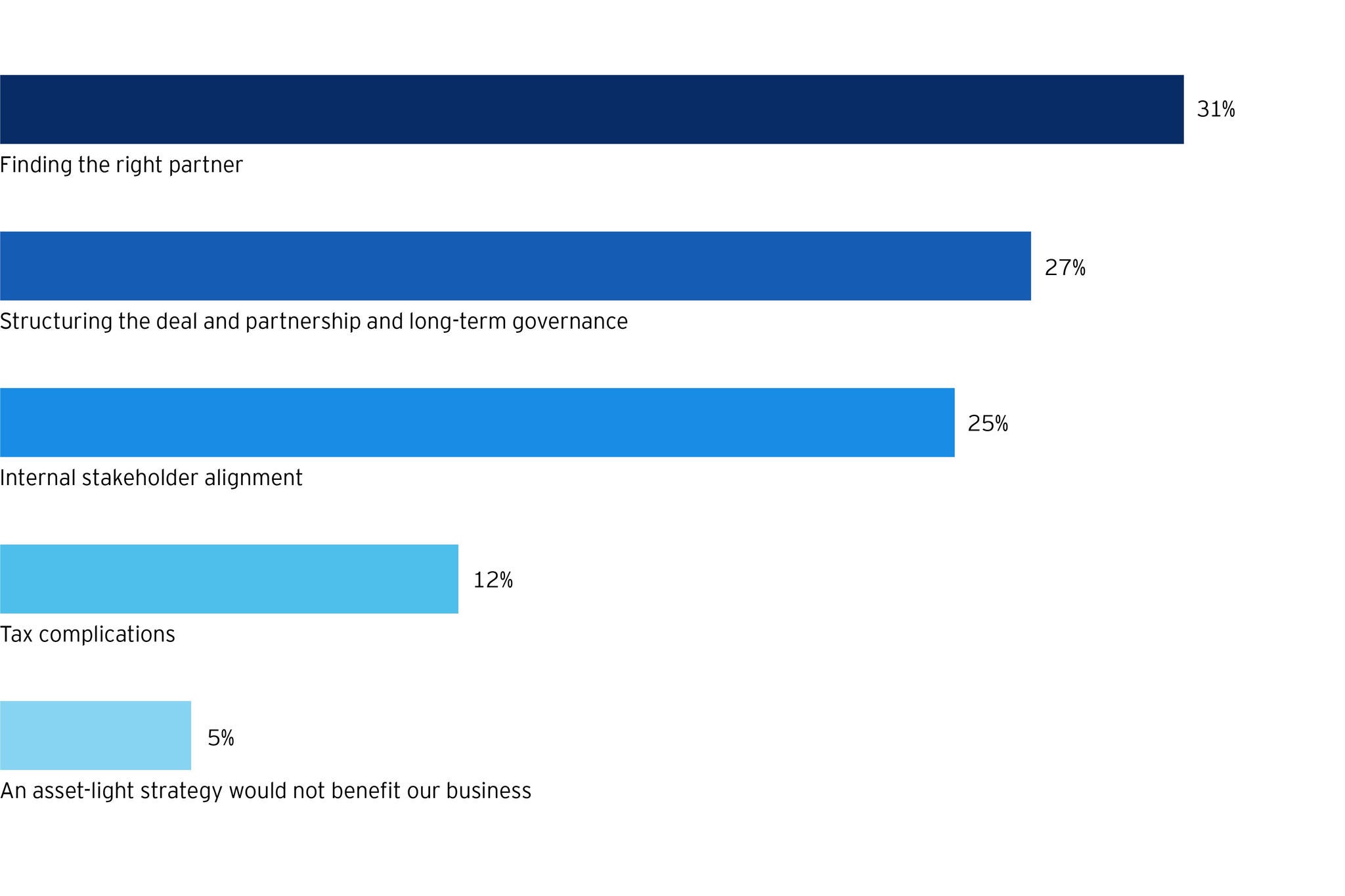

In a February 2021 Ernst & Young LLP asset-light strategy webcast poll, with responses from more than 1,000 C-suite executives, 31% said digitization and technology shifts have prompted them to consider asset-light strategies, 25% said the trigger is imperatives to meet customer demand, and 21% said capital requirements to fuel growth are driving them to consider such strategies.