EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

Discover how EY's global renewables team can help your business transition to the world of renewable energy.

Read more

The natural gas market has been on a rollercoaster ride over the past year. Even before the war in Ukraine, prices had soared, and the volatility is set to continue as many global leaders look urgently to reduce their reliance on Russian gas.

A multitude of factors have led to the steep rise in gas prices. Seasonal drought in Latin America reduced its hydropower capability; Asia’s recovery from COVID-19 lockdowns put pressure on gas supplies; and there is increasing competition between Europe and Asia for liquefied natural gas (LNG), plus supply and transport constraints among gas producers. All served to create a perfect storm.

There is no quick fix either. Major infrastructure projects, such as increasing LNG capacity with floating storage and regasification units, have long lead times. Pipelines can also take years to complete and are incredibly complex if they cross third countries. Delaying the phasing out of nuclear power in the coming years is also tricky, as it is a polarizing issue affected by local public sentiment.

Despite all this, greater diversification of gas sources and improved energy security is expected from the mid-2020s, with infrastructure build-out already underway. A larger mix of other fuels and technologies is also expected to be more readily available by then, and subsidies for alternatives — such as biomass or hydrogen-fired turbines — could reduce the cost of these technologies substantially.

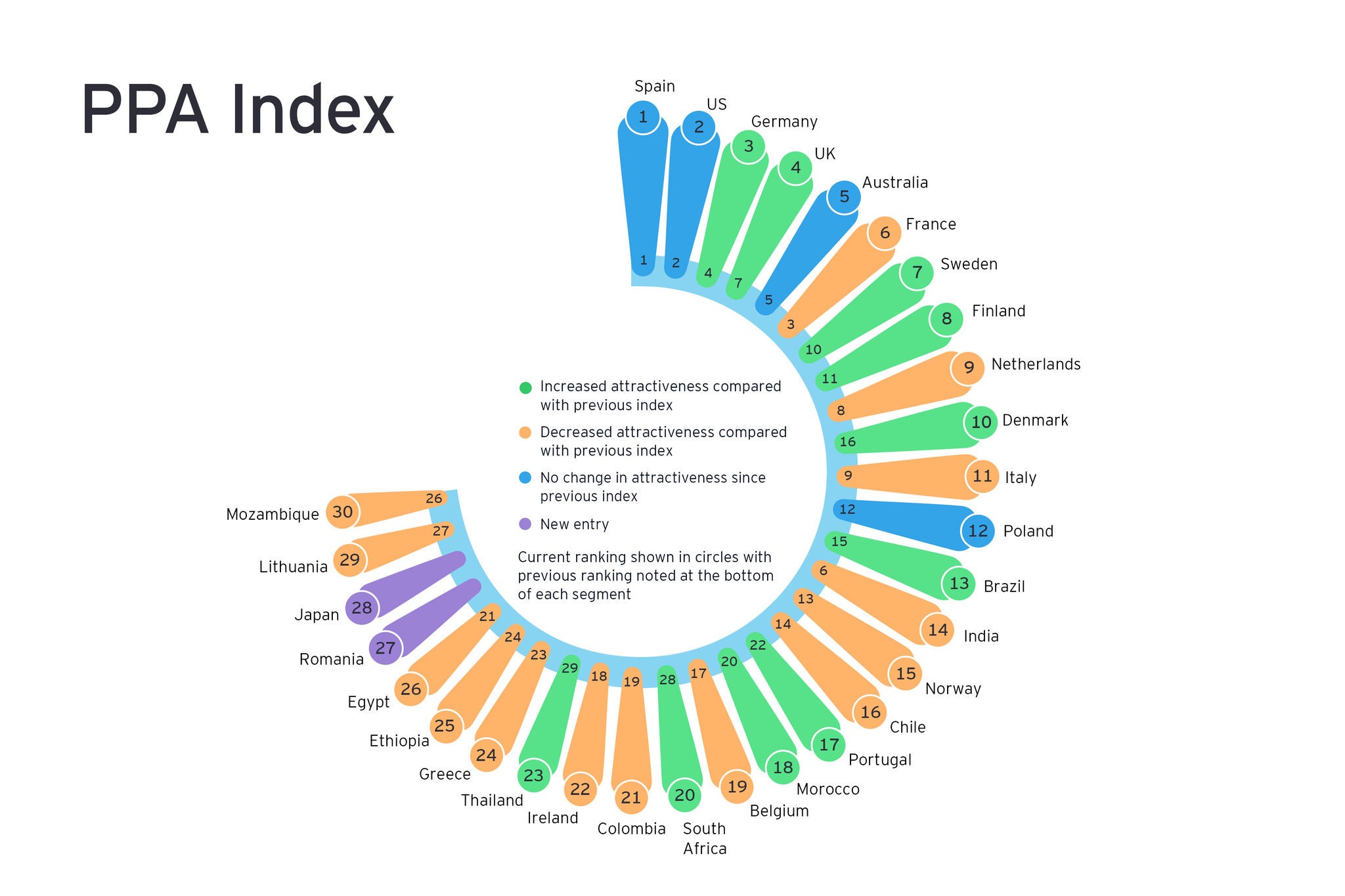

For consumers faced with pricing pressures, power purchase agreements (PPAs)1 could be a way for developers to secure long-term price certainty, and the accompanying revenue assurance could incentivize new renewable rollout.

Amid the high price levels for gas, the EU is proposing a fundamental rewriting of its energy policy2, with ambitious new renewable energy targets. Proposals for its revised energy strategy are expected soon. The UK3 and Germany4 have already announced plans to accelerate their rollouts of renewable energy, and more countries could follow suit.

Increasing energy security and reducing Europe’s reliance on Russian gas will not be straightforward, but a diversified strategy is necessary in the years ahead to accelerate the deployment of renewables, other fuels and technologies.