EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Customer Tax Operations and Reporting Services

The team

Your business challenge

Multinational corporations and taxpayers worldwide must comply with a range of complex regulations wherever they do business. This requirement puts additional pressure and demands on already-busy teams as they:

- Document and accurately classify customers

- Manage customer and transaction data

- Report customer information to global tax authorities

The responsibility to comply with multiple regulations is significant, especially so for financial institutions, given the volume and complexity of their customers. Failure to comply comes at a high financial and reputational cost.

Key features

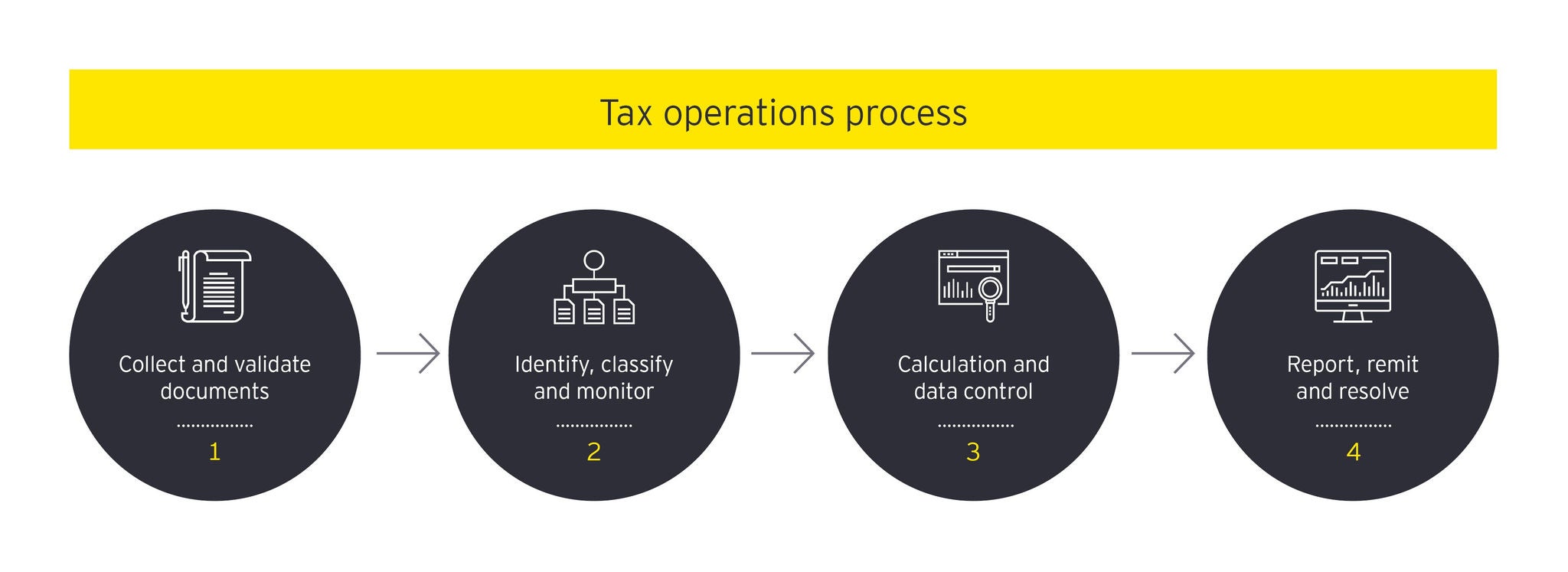

CTORS is an integrated suite of customer tax operation services which can be provided in a modular or end-to-end approach. From start to finish, EY CTORS simplifies the complexity of customer tax operations, reduces cost and risk, and improves your customer tax function through the use of workflow, data management, analytics and governance to effectively help manage global tax regulations.

Since 2009, the EY CTORS team has been helping multinational corporations meet their customer-related reporting and operational tax obligations. Over the last decade, CTORS has evolved from advising on the US Foreign Account Tax Compliance Act (FATCA), one of the first regulations addressing tax transparency, to a detailed technology solution dealing with an ever-growing number of new cross-border regulatory regimes, including the Common Reporting Standard (CRS), Withholding Tax and other domestic reporting, US CH3/61, Mandatory Disclosure Rules – DAC 6 and tax crime.

Technology

All of EY CTORS managed services are underpinned by a suite of secure, connected, cloud-based technology solutions supporting each stage of the customer taxation lifecycle.

|

Tool |

Description |

|

|---|---|---|

|

Collect and validate |

eTFV |

Document validation technology which uses automation and optical character recognition to import and validate tax forms and self-certifications with standardized results and intuitive dashboards. |

|

Identify, classify and monitor |

CTDM |

Standard data model and repository that classifies accounts, manages changes in circumstance using our proven rules engine and maintains an electronic audit trail |

|

Report |

EY FIRST |

Technology that generates and supports submission of required account holder reports to over 100 tax jurisdictions, providing accurate and timely filing compliance |

|

Transparency and governance |

TOCC |

Dashboard solution providing real-time consolidated status updates of services using underlying CTORS technology (eTFV/GTRS/CTDM) |

|

GTRS |

Workflow tool supporting delivery on reporting services relating to FATCA, CRS and MDR |

|

|

ROC |

Control framework, including a comprehensive suite of tools to support certification and pre-emptively identify issues |

|

|

IGAA |

Portal-based knowledge management and sharing which consolidates EY’s worldwide customer tax knowledge rules from 100 jurisdictions, and enables efficient distribution, traceability and Q&A functionality |

Our latest thinking

Three steps to future-proofed customer tax withholding and reporting

Re-engineering data flows is key to holistic and efficient customer tax withholding and reporting, as demand for transparency mounts.

Why customer experience and tax reporting need a joined-up approach

Tax authorities demand more detailed customer tax reporting – here are four ways organizations can balance it.

How businesses are responding to the wider customer tax reporting net

Organizations need to transform their people, processes and technology to meet fast-changing obligations and mitigate risk.

How the right conversations can empower finance transformation strategies

Companies need more open dialog about how to effectively implement new technology. Finding the headspace for these conversations is key.

Our globally connected tax network can help your tax function address complex issues, making sure you can operate confidently in today’s disruptive landscape.

How EY can help

-

Our international tax planning professionals can help support you with the tax aspects of cross-border situations and transactions. Find out how.

Read more -

Our domestic tax planning professionals can help you build strong compliance and reporting foundations as well as sustainable tax strategies. Learn more.

Read more -

Our tax and finance operate solution can help your business manage risk, realize value from data, drive innovation and improve efficiencies. Find out how.

Read more -

Our tax policy professionals can help you stay ahead of potential tax changes, better manage tax risk and understand key tax trends. Find out more.

Read more