University as real estate operator

For better or for worse, colleges and universities are no longer just in the “business” of education, research and public service (if they are land grant institutions). They are also large-scale real estate owners and operators. Academic buildings with classrooms and labs, student centers and dorms, athletic facilities, administrative buildings, retail and parking garages, energy, steam, cooling or other systems, and sometimes even hospitals all add up to a complex real estate portfolio.

While the state of these facilities influences a student’s decision to attend an institution, their design, construction and maintenance are not exactly core to university missions and can even be considered a distraction from the delivery of education. The question naturally arises: does your institution have enough time, energy, money and expertise to pour into these non-core but increasingly essential activities.

The power of a P3

In the face of these new, overwhelming real estate operation considerations, a public-private partnership (P3) may be an institution’s best option. P3s can provide greater flexibility and efficiency when building, financing and managing infrastructure and facilities.

They can help to offset risk, promote designs of new facilities that fit into the existing structures, and confirm that the new facilities are both of high quality and attractive to prospective students. But perhaps the greatest benefit of a P3 for an institution and its leadership is the time and energy they no longer need to spend on non-academic activities, allowing them to instead focus on delivering an academically excellent experience for their students.

The usefulness of P3s to institutions is evidenced by their increasing popularity in recent years. There has been approximately a 50% year-over-year increase in the value of the P3 transactions, and some speculate that the volume may reach $5b over the next five years.⁴

What is a public-private partnership?

A P3 is a contract between a public agency or nonprofit and a private sector entity, in which they can share skills, technology and responsibility when delivering a product or service.⁵

In the case of higher education, P3s can be a benefit in a variety of ways, including:

- Front-office, student-facing functions (e.g., enrollment management, student affairs, education delivery)

- Back-office functions (e.g., finance, human resources, technology)

- Facilities (e.g., student housing, labs, food service, parking, transportation)

What can a P3 do for me?

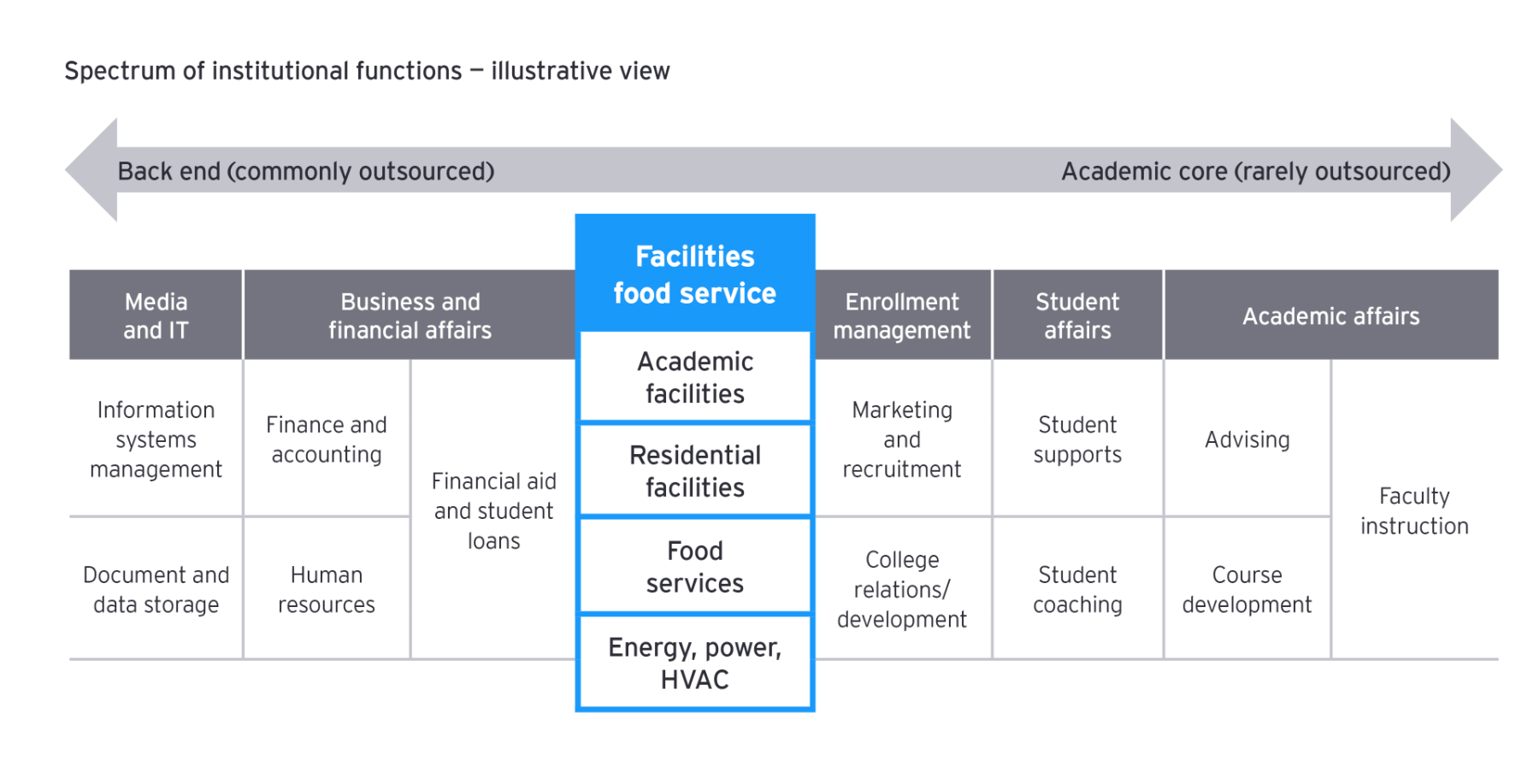

Though institutional functions previously considered sacred and core to the teaching and learning mission of universities, such as course design and development, have seen increased outsourcing and partnerships in recent years, the strong majority of P3s focus on facilities and food services (see below). These projects tend to be the most capital intensive and further afield from university capabilities; they also are some of the first things students see when they enter campus.

For example, on a recent project called Merced 2020, the University of California Merced (UC-Merced) contracted in a P3 for a $1.3b campus expansion to ultimately accommodate 10,000 students — nearly doubling the physical capacity of the campus.⁶ It includes a 39-year concession to build and operate 1 million square feet of classroom spaces, research labs, housing, recreational area and dining facilities. The project is being financed by approximately $600m in UC revenue bonds and $700m in private debt/equity investment.