EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

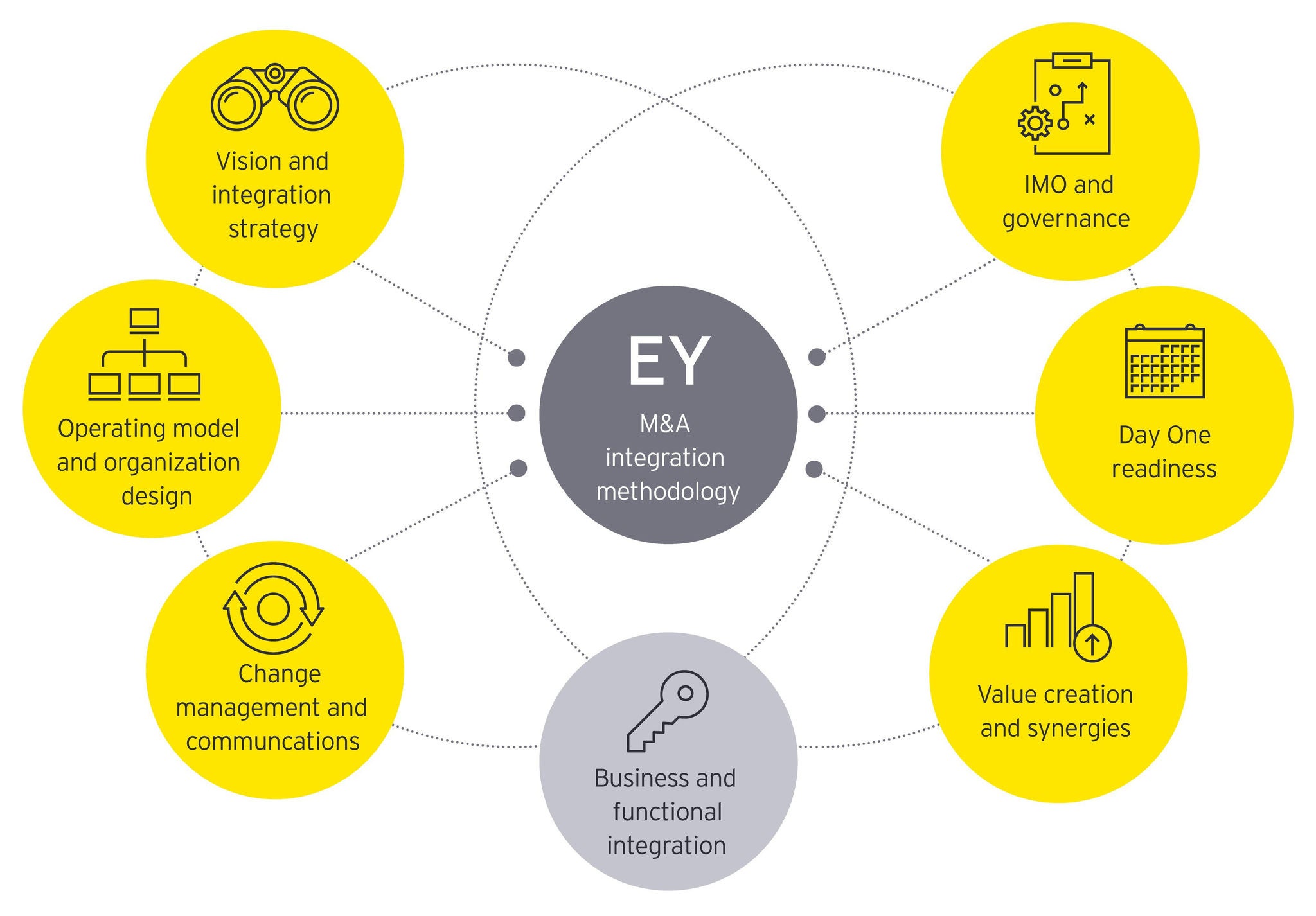

EY-Parthenon M&A Integration Consulting teams can help you integrate assets while preserving value, accelerating synergy realization and minimizing risk.

Read more

A typical M&A integration timeline should include the following nine phases:

1. Vision and mergers & acquisitions integration strategy

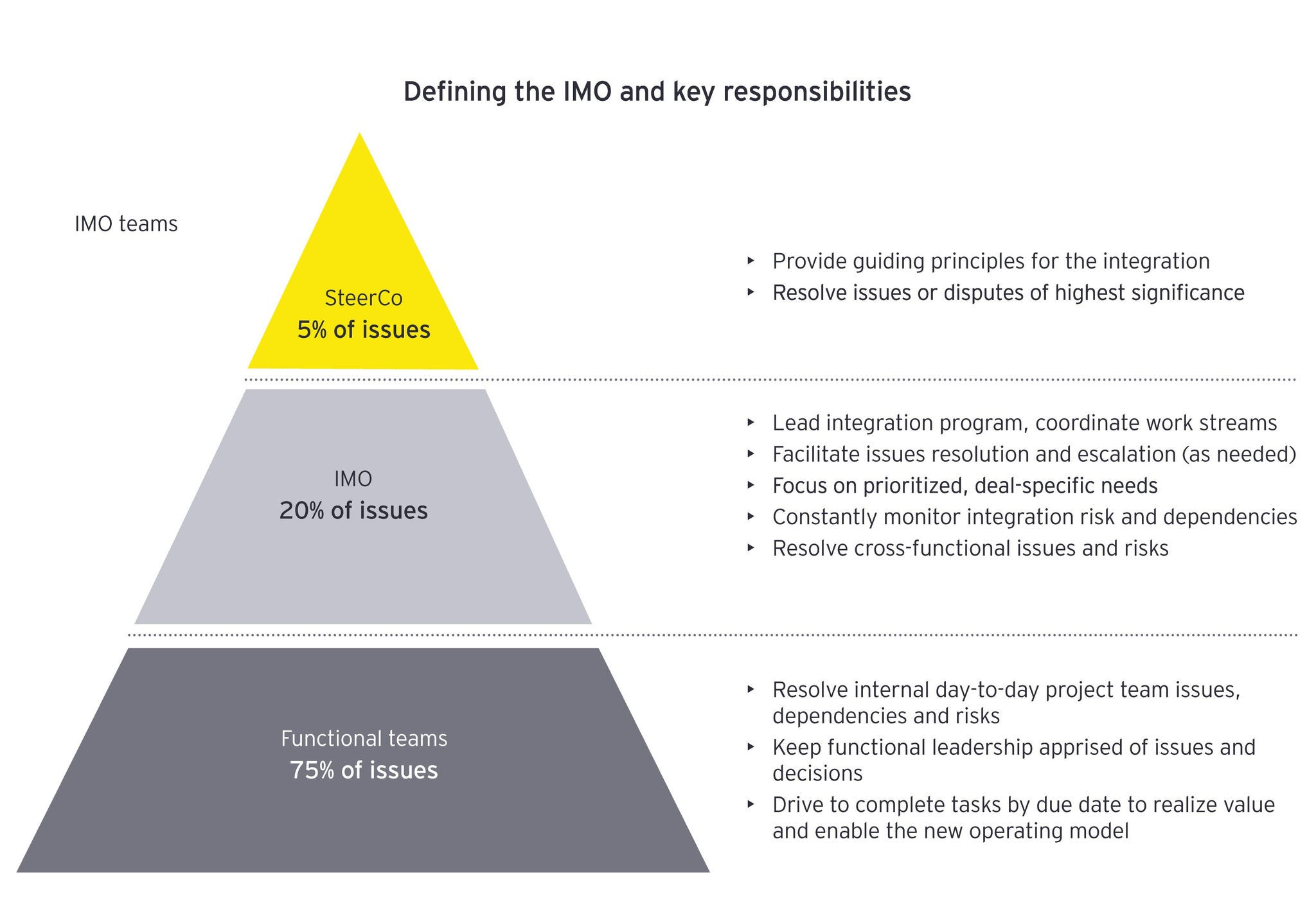

The initial responsibility in an M&A integration is to define and determine the value drivers and guiding principles of the deal that supports the vision and integration strategy. A strong grasp of executive leadership’s priorities from the beginning promotes program alignment throughout the integration.

M&A integration leaders and their teams will often need to work with the CEO or business unit president (deal executive) to determine the value drivers of the deal. They will also need to work with the deal team to understand the deal context, model and assumptions, as well as get a clear picture of how to quantify and measure the commitments made to the board and the Street. The integration leader will then need to take this information and work with the deal executive and the SteerCo to document and communicate the value drivers and how the broader integration team will work to enable the deal’s value. These guiding principles will drive the integration strategy, along with the degree and speed of the integration.