Environmental, social and governance (ESG) principles have risen with astonishing speed to the top of the strategic agendas for senior leaders and boards in insurance. Approaches to adoption vary considerably across the industry, however, and range from pure regulatory compliance to new, purpose-led corporate strategies driven by the United Nations’ sustainable development goals (SDGs).

Further, there is uncertainty about the best ways to track the impact of ESG and insurers’ progress toward their goals over the near, mid and longer terms and its potential impacts on value creation and value destruction. Communicating that progress to stakeholders is an additional challenge.

In a previous article, we suggested four top-line metrics that can act as leading indicators of the efficacy of ESG strategies, and help manage perceptual issues that threaten insurers’ value during the next three to 18 months.

- Total shareholder return (TSR)

- Brand value

- Economic net worth (ENW)

- Return on capital

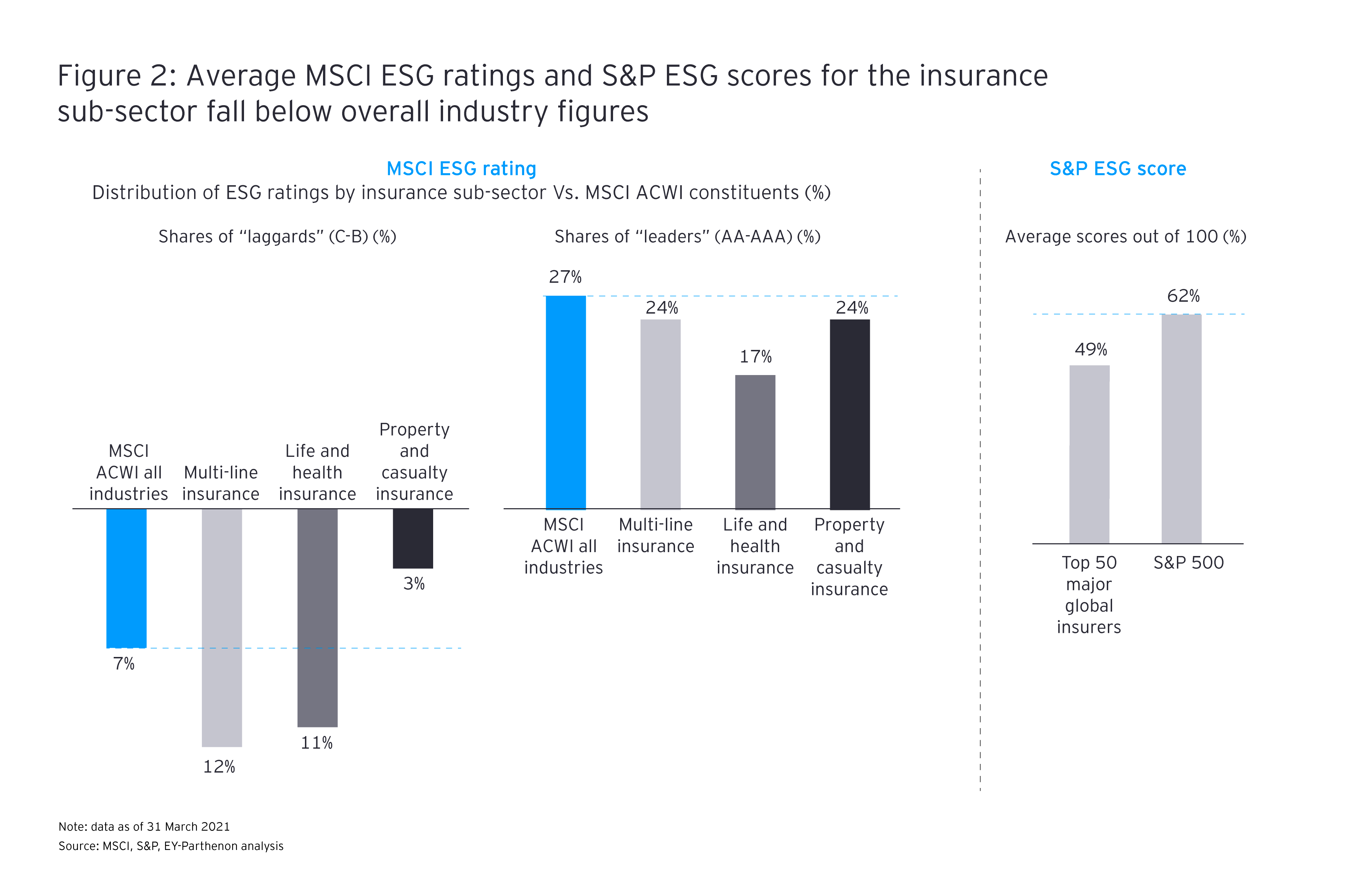

This article will closely examine ESG ratings and their potential impact on insurers’ stock prices. Specifically, we will explore a few core issues:

- How insurers are rated and the varying approaches used by rating organizations.

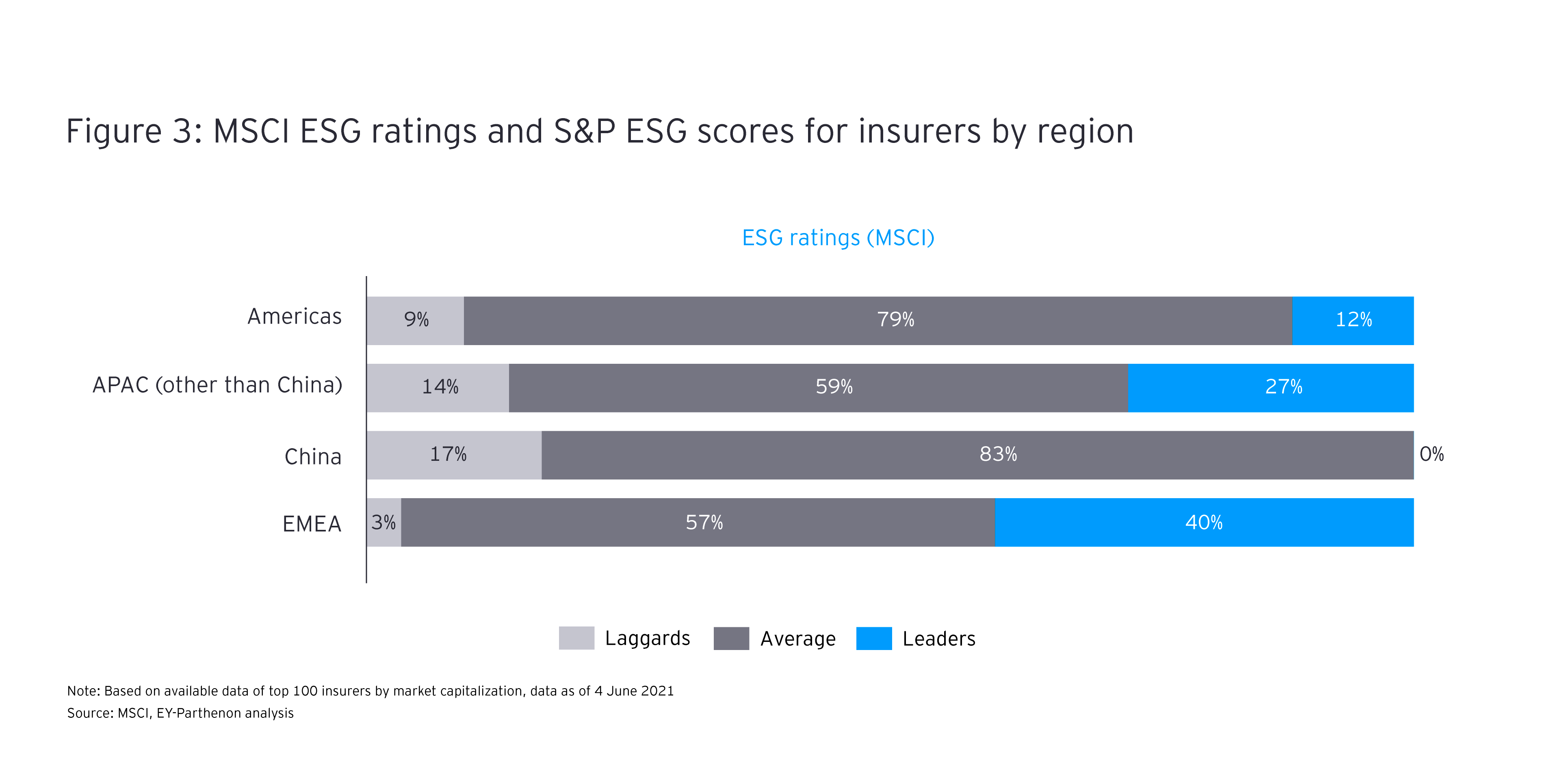

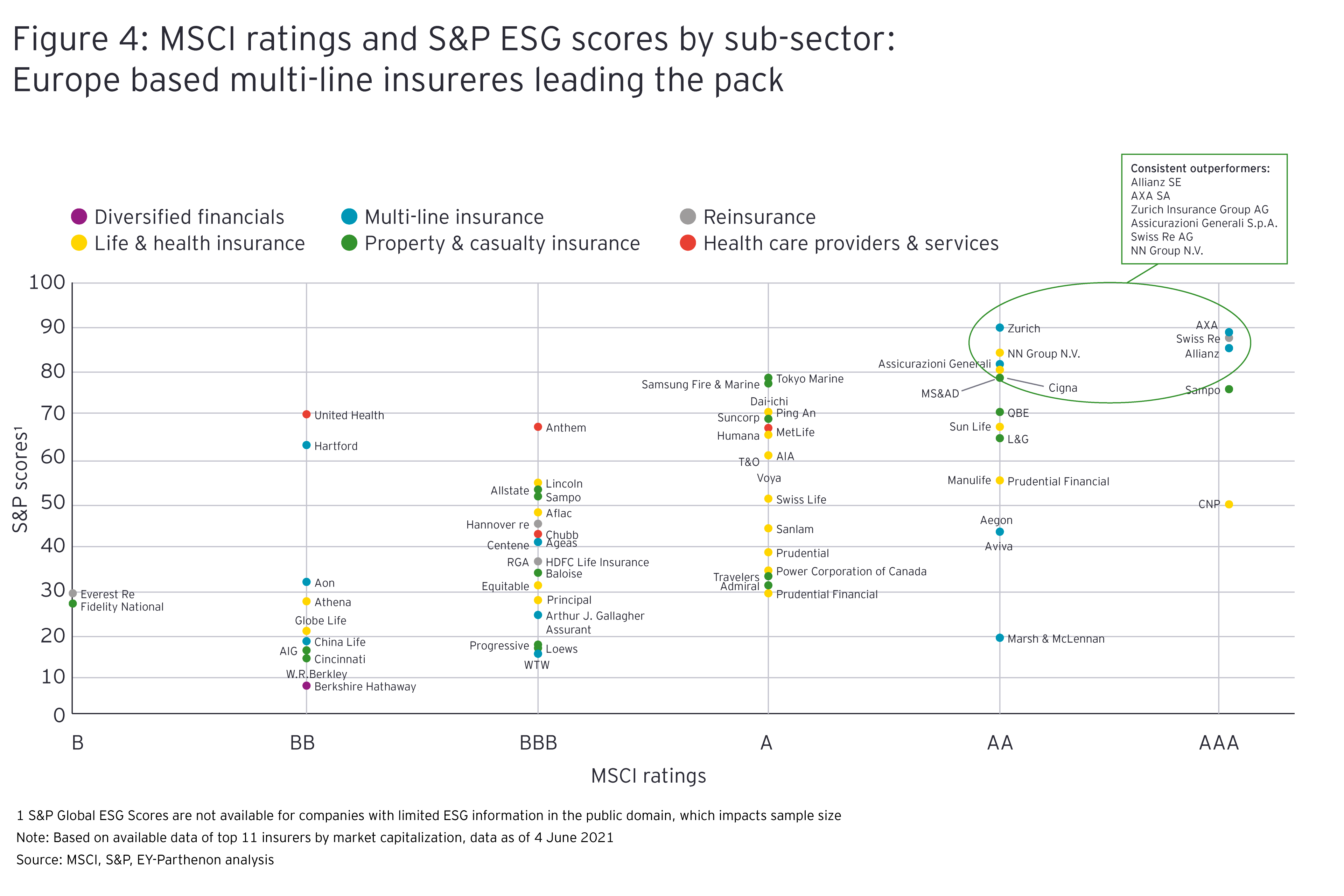

- Differences in ratings across the sector.

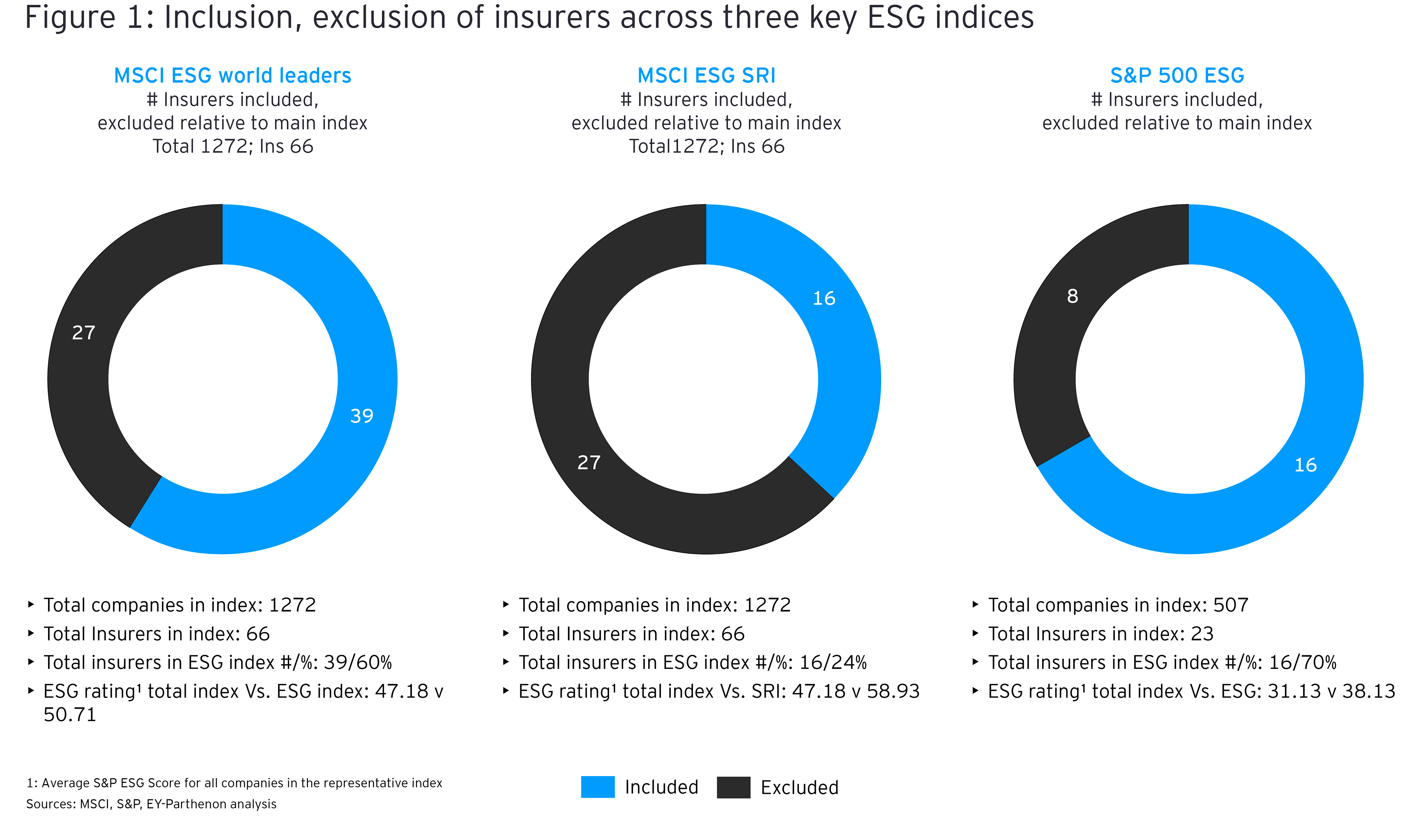

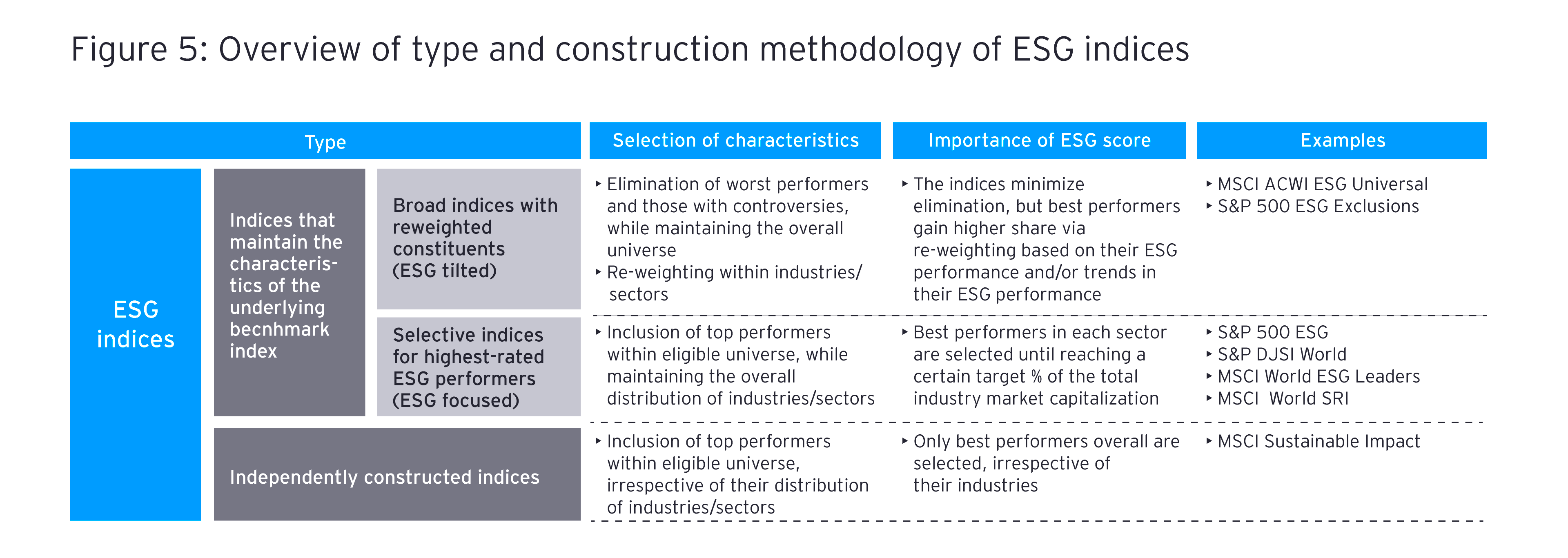

- How these ratings determine inclusion in ESG indices and the different approaches used to build ESG-tagged ETFs (Exchange-traded funds) and index tracker funds.

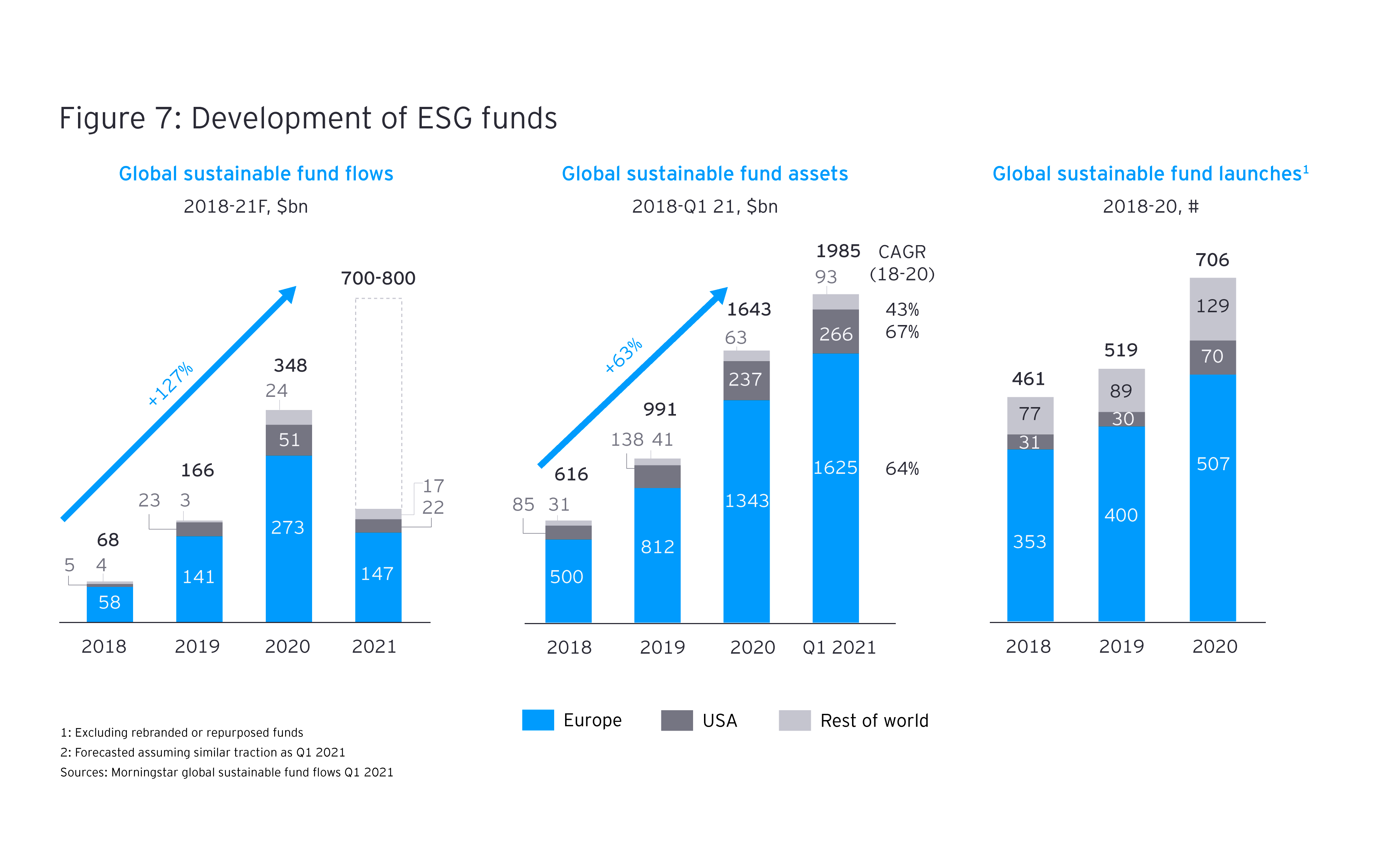

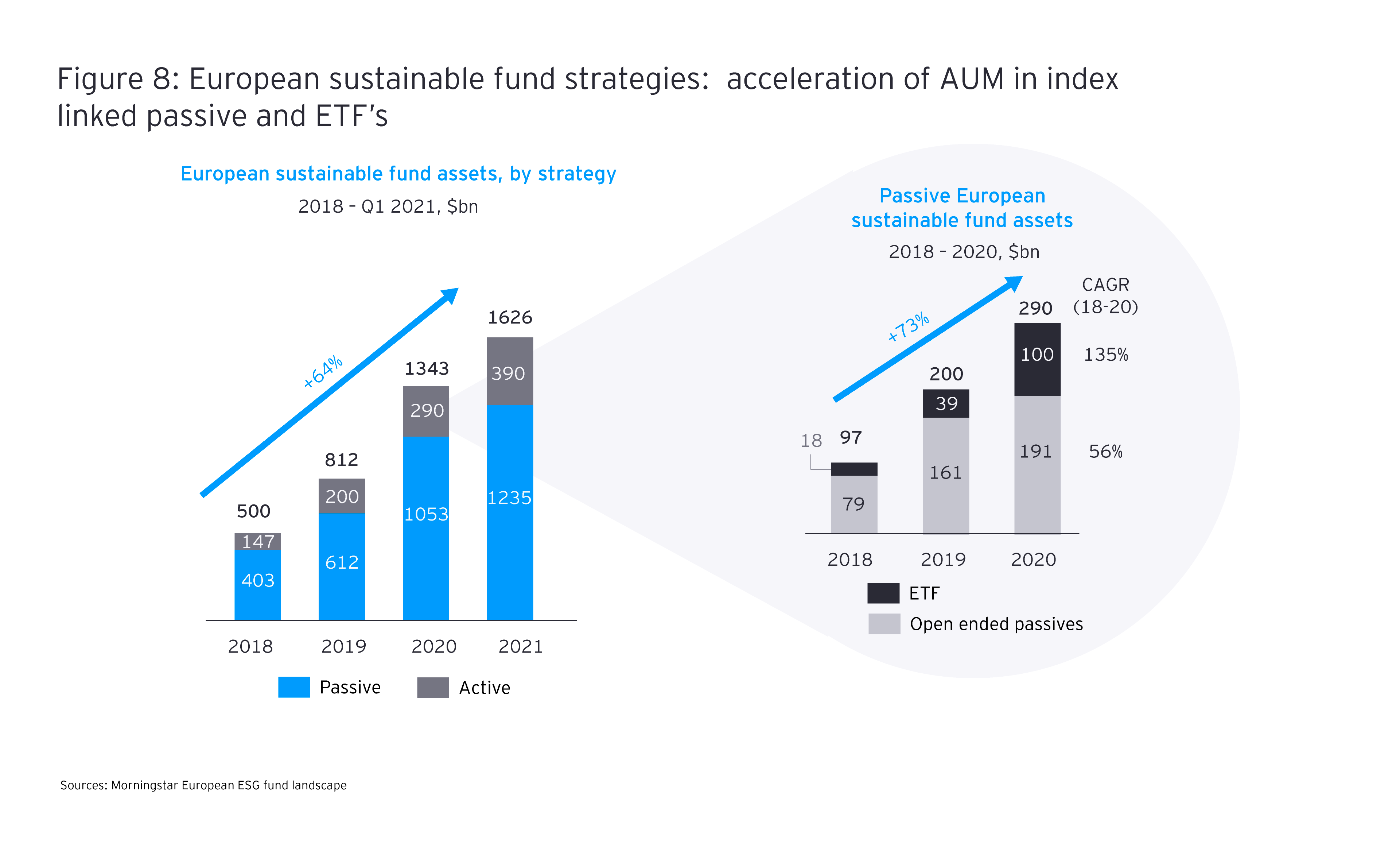

- The increased investment flows into these funds and the inevitable impact on trading volumes, volatility and share price.

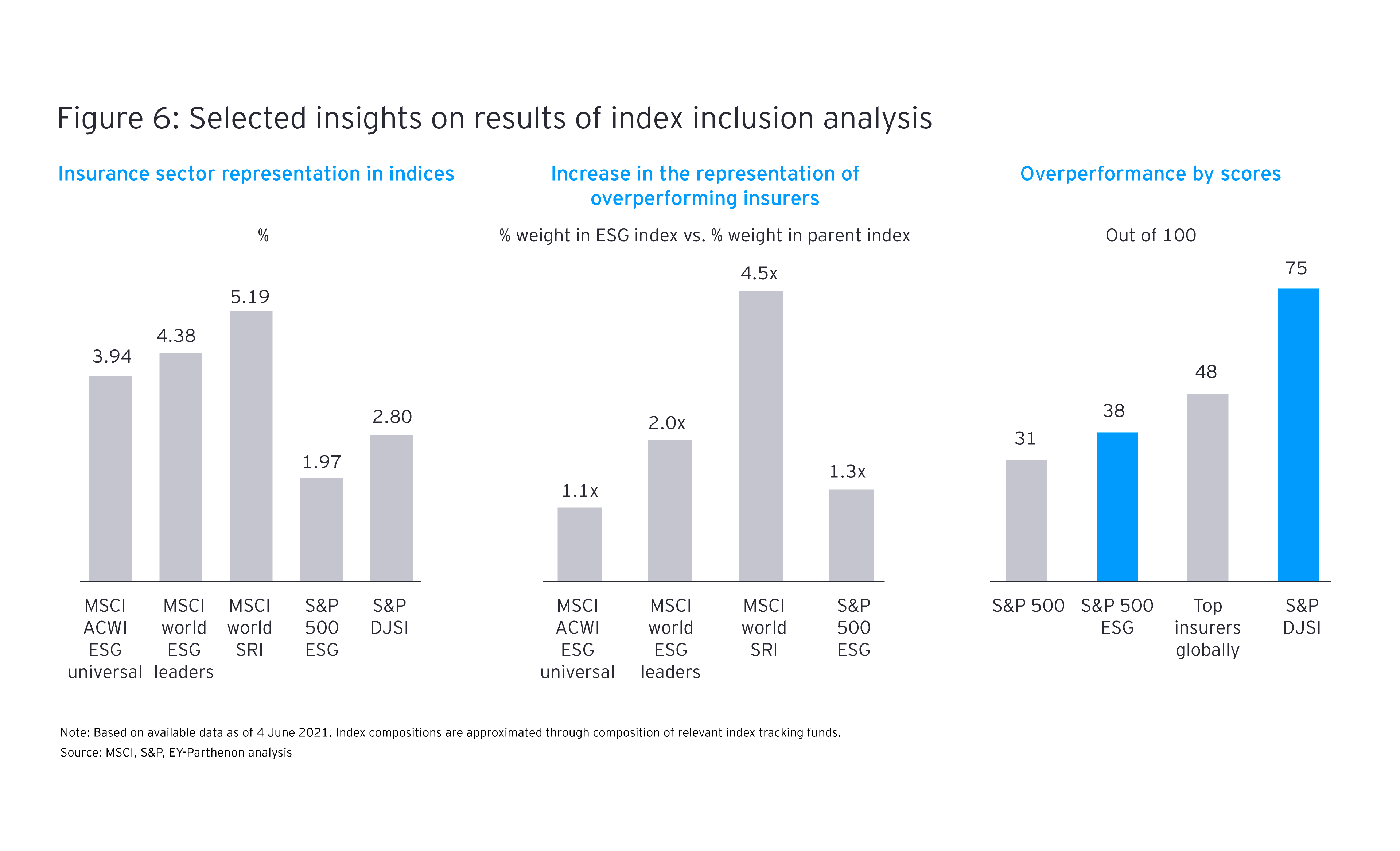

To drive our analysis, we created a database of the top 100 insurers by market cap, covering ESG scores and rankings data decomposed by sub-sector and their inclusion into five key ESG indices1 :

- MSCI World SRI Index

- MSCI ACWI ESG Universal Index

- MSCI World ESG Leaders Index

- S&P 500 ESG Index

- S&P DJSI World Enlarged Index ex. Alcohol, Tobacco, Gambling, Armaments, Firearms and Adult Entertainment

We have selected these five indices based on the broad acceptance of MSCI, S&P and Dow Jones ratings and their indices as benchmarks, as well as the scale of flows into funds that track these indices. We intend to conduct further analysis to see how insurers’ inclusion and relative weights in key indices change over time and to define the implications in terms of the impact on shareholder returns and access to capital.

For C-suite leaders and boards, the most critical question is likely to be – what to do about these ratings? We believe that the following actions are critical, and plan to explore them in more detail in future articles in this series.

- Become fully educated on the rating criteria applied by major agencies, including MSCI, S&P and Moody’s, and how these criteria evolve, as they inevitably will.

- Understand index construction for the major agencies and how your equity or bond could be included or excluded.

- Identify the “must-have” indices for your company.

- Assess your ratings relative to your peer group, how these are decomposed by “E” vs. “S” vs. “G”, and the relative weightings among these three lenses.

- Create a cohesive communication strategy, including a clear storyline and meaningful KPIs, that can be easily shared with and understood by the investor and analyst community.

Because ratings are largely a function of ESG strategies, it’s critical that board directors and senior leaders ensure their organizations have a cohesive and well-documented strategy in place and are rigorously executing it.