EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY sustainable finance teams helps financial services companies define sustainability goals that create value and make a measurable difference. Learn more.

Read more

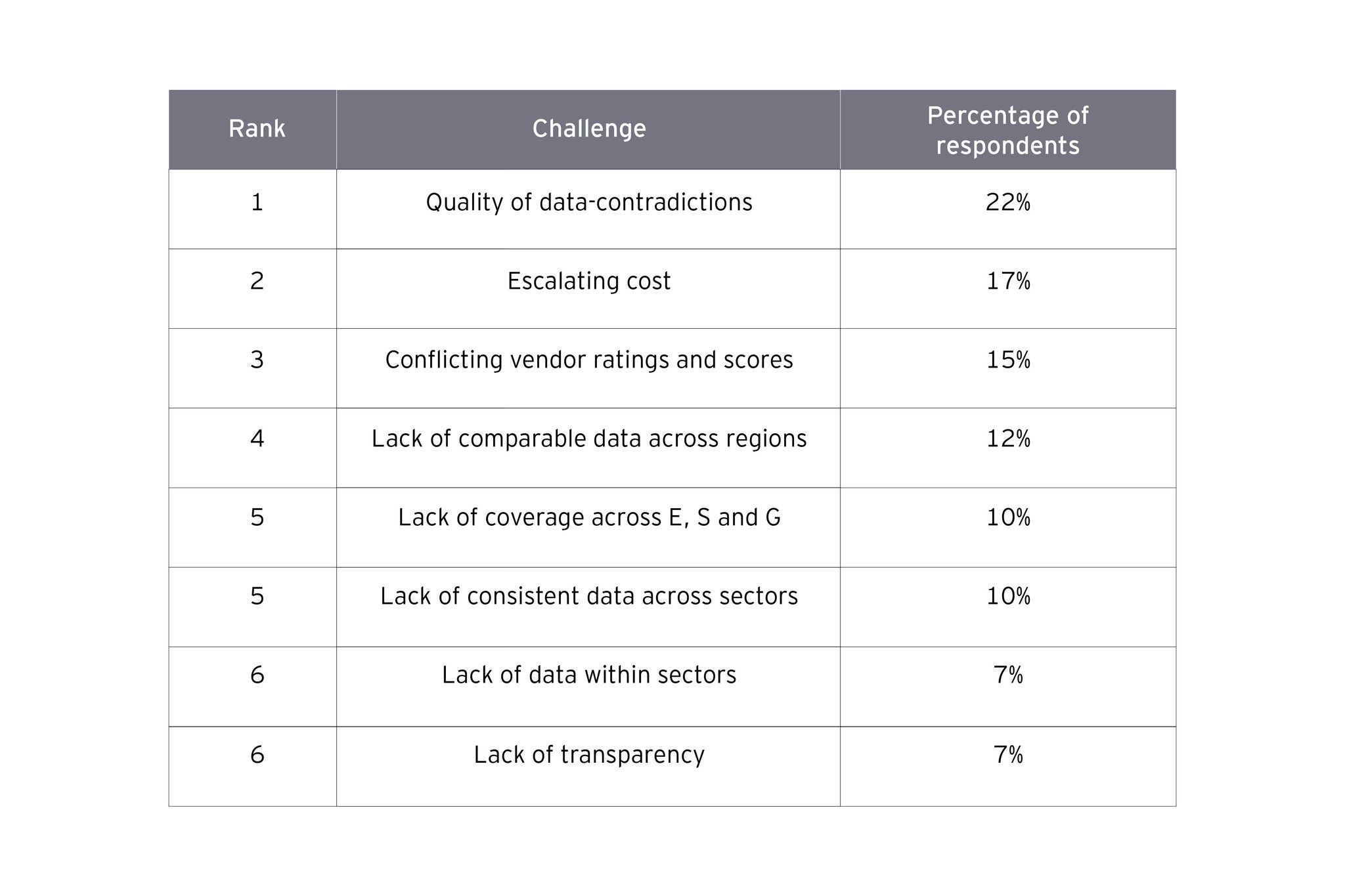

More broadly, the lack of consistency, standardization and independent assurance undermines the credibility of ESG data markets as a whole. This is a growing concern, given the increasing costs of compliance failures and the threat from damaging allegations of greenwashing – as illustrated by a number of recent regulatory fines and high-profile resignations at major financial institutions7.

These concerns are fuelling appetite for regulation – especially of leading data vendors. In April 2022, the European Commission published a consultation on ESG ratings that will feed into an impact assessment of a possible EU intervention into ESG data markets. In a recent feedback statement, the UK’s FCA also cited a “clear rationale” for regulatory oversight of ESG data and rating providers.

Robust data management is increasingly important

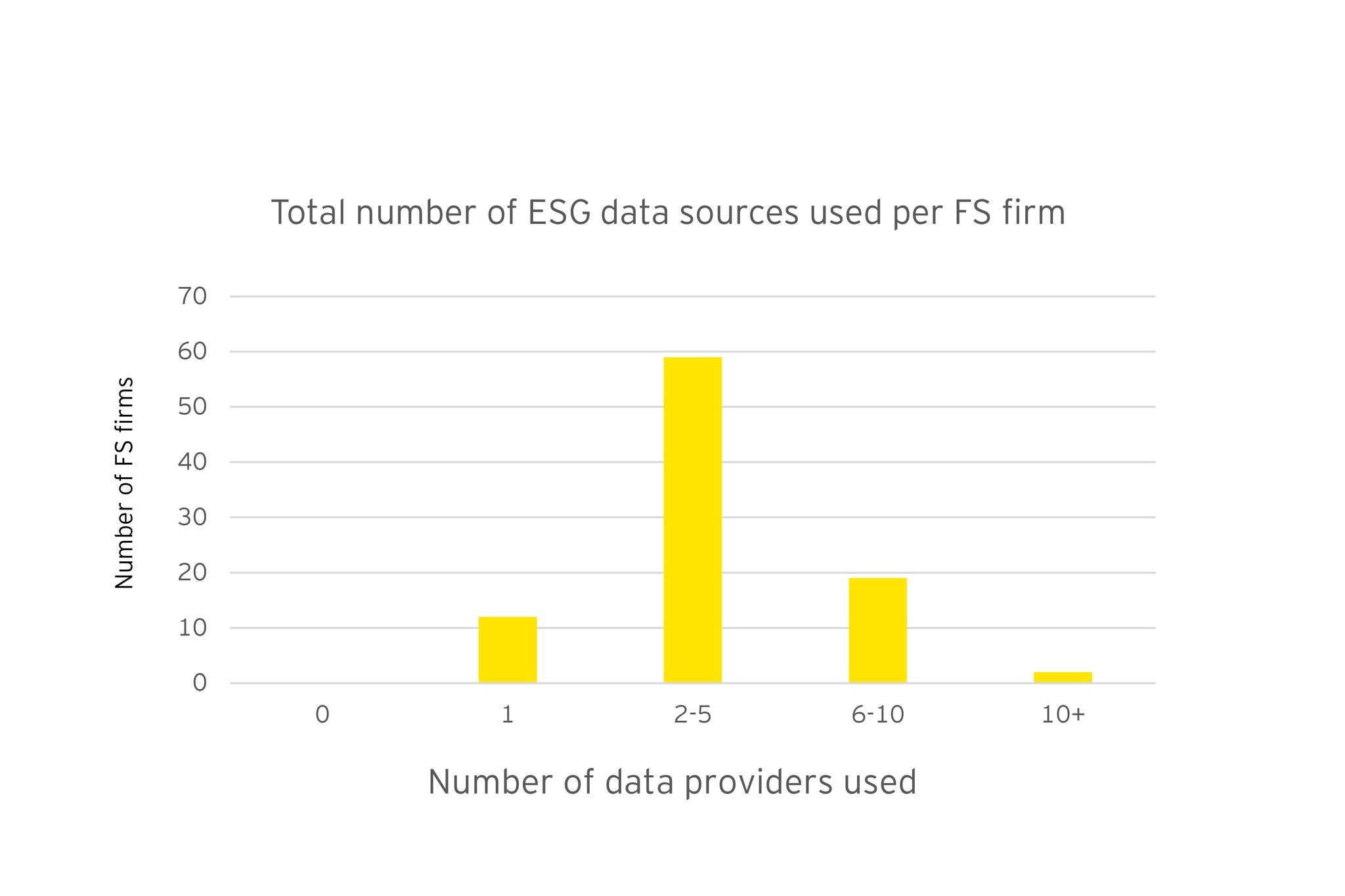

Many buyers of ESG data could use it more efficiently and effectively. One common problem is that many different activities require ESG data, including regulatory reporting such as SFDR disclosures, financial reporting, portfolio management, stress testing, strategic planning and procurement. Without central coordination, firms can acquire multiple ESG data licenses in a haphazard way. Apart from the excessive costs incurred, this can also lead to confusion over data management and access.

Excessive costs are not the only problem. Many firms are also failing to extract full value from the data they have purchased. That is partly about failing to use all the data that’s available to licensees, and partly about failing to identify all of the potential applications for that data within the business.

Finally, the relative novelty of ESG data means that operations and governance can sometimes be weak. A lack of suitable technology, data professionals and oversight can lead to overreliance on manual processing, an absence of effective data validation, information silos and a loss of version control – all of which breed inefficiencies and confusion.

In response, use of strategic data management is increasing. There is clear scope for firms to cut costs and increase benefits by integrating ESG data into enterprise-wide data management strategies. After all, ESG data is increasingly being used alongside conventional financial disclosures as part of investment decision-making and for a range of client and regulatory reporting.

Looking ahead

ESG data markets are more dynamic than ever. Data coverage and categories are advancing rapidly, but there are still many gaps, questions and inconsistencies to be addressed. Quality does not always keep up with quantity.

These shortcomings will take time to address, and vendors cannot solve every problem. Even so, innovation from industry leaders and new entrants will continue to drive improvement. We are starting to see movement towards collaboration on industry platforms. Besides privately led initiatives to develop open-source platforms to exchange ESG data in a harmonized way, we also see regulators like the EU Commission pushing forward with their plan to launch the European Single Access Point (ESAP). ESAP is intended to act as a direct access point for obtaining ESG and financial company data in machine-readable form. Companies would be asked to provide annual financial statements and management reports and, once CSRD comes into effect, sustainability reports including detailed information on the EU Taxonomy. The proposal also opens up the possibility of collecting additional data on a voluntary basis, provided that certain technical and qualitative standards are adhered to8.

All this will help to improve the availability, quality and accessibility of ESG data as well as the efficiency with which financial institutions work with and use ESG data. The availability and quality of reported data should receive a further boost once the Non-Financial Reporting Directive (NFRD) and Sustainable Finance Disclosure Regulation (SFDR) take their full effect.

Even so, it’s highly likely that many users of ESG data will need to rely on multiple data providers for the foreseeable future. The good news is that there are actions users can take now to trim costs, reduce risks and maximize the value they derive from ESG data. The following focus areas will be critical to any ESG data strategy:

- Migrating to a single data later which supports all ESG use cases and is accessible for all involved teams, will strip out the cost of duplication and lower the data risk around inconsistency.

- Using a data model that integrates key ESG frameworks into a single data model and visualizes the data lineage will help identify overlaps between different frameworks and support the rationalization of external data sources.

- Embedding an ESG data governance operating model can be leveraged to streamline the data governance activities required, to provide a holistic view of priority data management initiatives.

Natalie Brandau, Manager, Wealth and Asset Management, Ernst & Young GmbH Wirtschaftsprüfungsgesellschaft co-authored this article

Jo Freeman-Young, Sustainability Actuary, Consulting, Financial Services, Ernst & Young LLP co-authored this article