EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

All payments players need to systematically explore the new product opportunities from ISO 20022.

In brief

- Regulators worldwide depend on SWIFT messages to protect the integrity of the global financial system by monitoring, preventing and tracking the financing of criminal or terrorist activities.

- ISO 20022 became a mandatory standard in 2019, with an initial cutover from MT by March 2023, and a transition to native ISO 20022 messaging by the end of 2025.

- Banks and other payment processors worldwide are well underway on their ISO 20022 journeys.

Banks, payments networks and any other financial institutions that process large cross-border payments are upgrading their infrastructures to the new ISO 20022 messaging standard, which brings more effective real-time controls against fraud and money laundering, as well as a range of richer new payments services yet to be developed. Several Asian and Middle Eastern countries have already migrated their national payments infrastructures to ISO 20022, with most of Europe and North America switching over in 2023–24.

SWIFT messaging nurtures the global financial system

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) has been operating the trusted closed message type (MT) computer network for communication between member banks worldwide since the 1970s. Based in Belgium, SWIFT is overseen by the National Bank of Belgium (NBB) and a committee composed of representatives from the US Federal Reserve, the Bank of England (BoE), the European Central Bank (ECB), the Bank of Japan (BoJ) and other major banks. The SWIFT platform has around 11,000 users and processes about 45 million communications a day1, most of them are money transfer transactions. Financial institutions (FIs) and brokerage houses that use SWIFT have codes that identify each institution as well as credentials that authenticate and verify transactions.

The MT workhorse showing its age

The sustained transition from traditional payment methods to digital payments.

(e.g., e-wallets; mobile payments; buy now, pay later (BNPL; e-commerce), accelerated by the COVID-19 pandemic, is creating new strains on MT-based cross-border payment infrastructures.

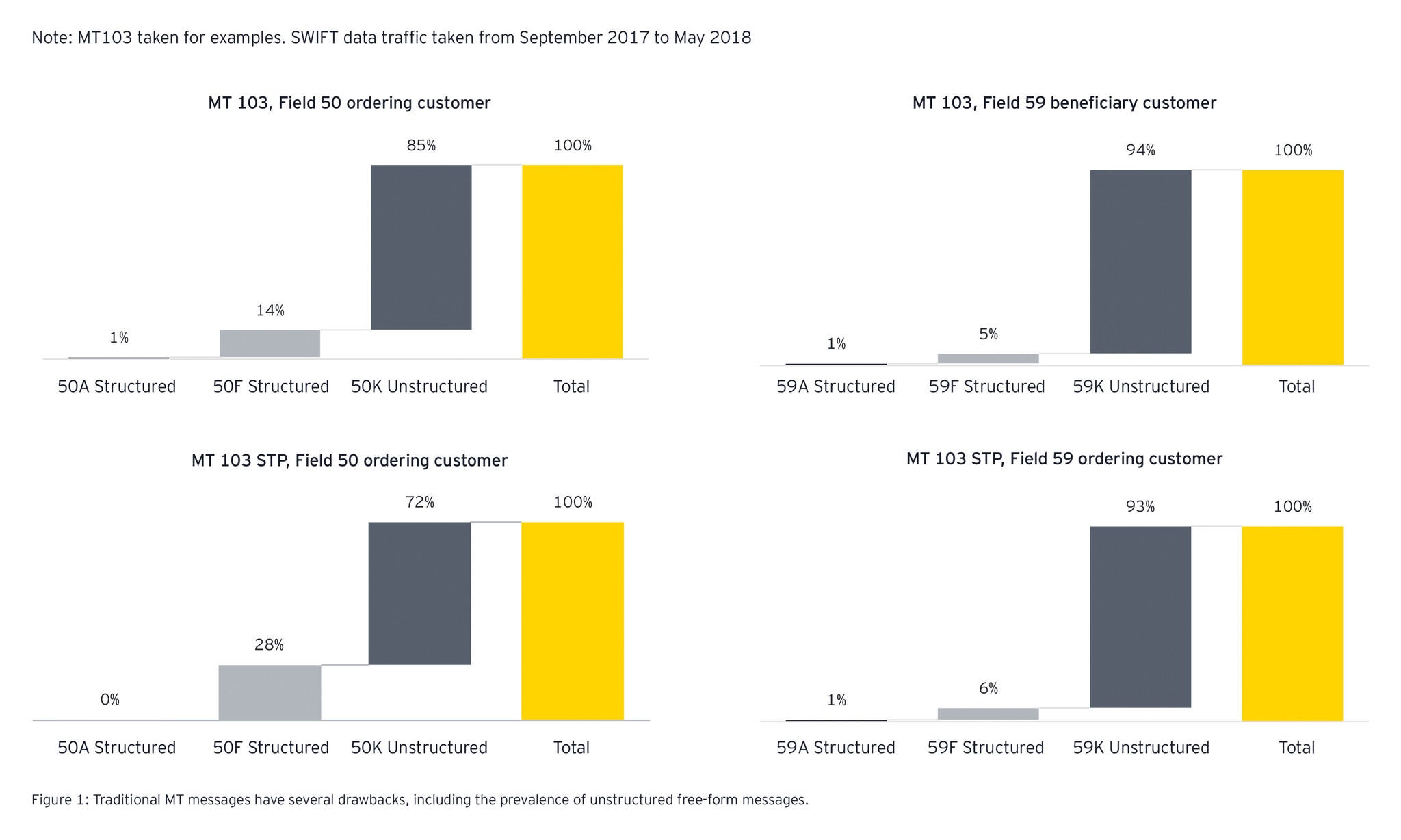

In many ways, traditional MT messages are ill-equipped to deal with the sophistication of these modern digital payment flows and the enhanced financial crime controls required by regulators. Some of them are:

- Fire-and-forget messages

- Unstructured data and free-form messages

- Customized and extended messages

The new ISO 20022 standard

Several domestic and cross-border payment protocols have emerged in the half-century since the advent of SWIFT MT messages. China and Russia have developed their Cross-Border Interbank Payment System (CIPS) and Financial Messaging System of the Bank of Russia (SPFS) networks, respectively, and the Association of Southeast Asian Nations (ASEAN) countries are connecting their domestic real-time and QR-code-based payments rails for instant cross-border payment flows. In India, NPCI and TerraPay has enabled cross-border payments on the unified payments interface (UPI) platform, while several banks have adopted distributed ledger technology from Ripple for cross-border payments.

In 2004, SWIFT defined the ISO 20022 standard, which was designed to improve payment processing efficiency and interoperability with these emerging payments mechanisms by replacing proprietary message formats with a standard format and data element definition. The new standard includes:

- A modeling methodology that captures financial business areas, business transactions and associated message flow in a syntax-independent way.

- A central dictionary of business items used in financial communications.

- A set of extensible markup language (XML) and ASN.1 design rules to convert the message models into XML or ASN.1 schemas, whenever the use of the ISO 20022 XML or ASN.1-based syntax is preferred.

ISO 20022 became a mandatory standard in 2019, with an initial cutover from MT by March 2023, and a transition to native ISO 20022 messaging by the end of 2025. It promises several operational benefits:

- Consistency

- Security

- Enhanced visibility

- Efficiency

- Automation

In addition to greater payment processing efficiency, lower costs and risks, the richer messaging enabled by ISO 20022 promises to unlock a range of new commercial opportunities. Migration to ISO 20022 is well underway. By the end of 2023, 79% of the total volume and 87% of the total value of high-value payments worldwide are expected to use the new standard.

Managing the ISO 20022 transition

Banks and other payment processors worldwide are well underway on their ISO 20022 journeys. The most immediate concerns are issues with legacy payment technology platforms, e.g., MT to MX converters and translators should enable legacy platforms to cope with the new ISO 20022 XML message formats. EY teams are supporting financial services clients worldwide to prepare for the initial technology and data problems that can be expected:

- Truncation of data

- ISO addresses

- New data fields

- Expanded remittance information

- Impact on peripheral platforms

Evolvement of payment-operating models

A period of stabilization should follow the initial ISO 20022 go-live in March 2023, with iterative fine-tuning of payment technology, operations, risk and compliance processes and technology.

- Transition from ISO 20022 to business as usual (BAU)

- Preparations for subsequent migrations

- Pay down technical debt incurred

- Internal optimization

- Customer communications

- Industry relations

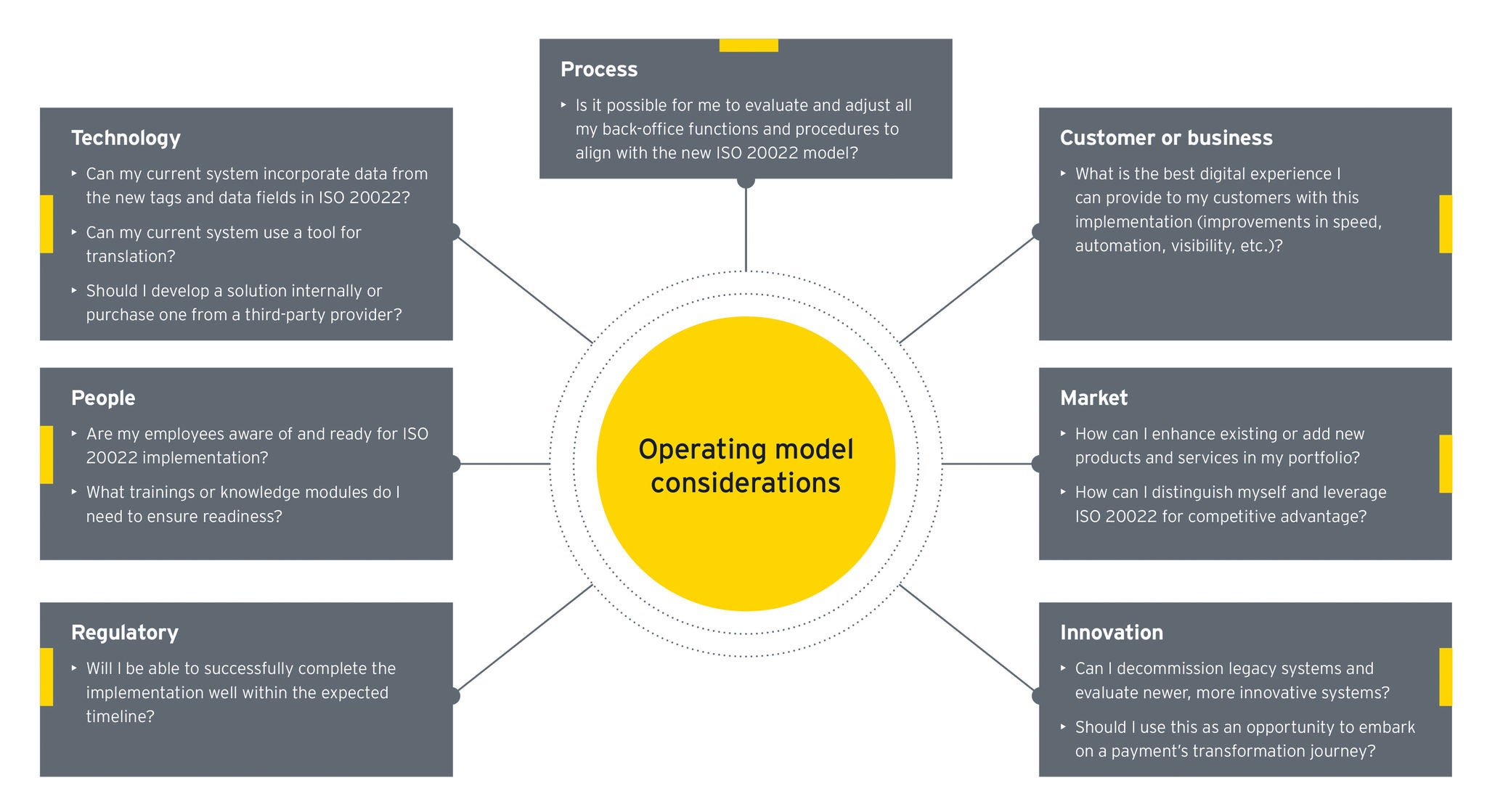

Complying with the ISO 20022 implementation is crucial for banks and FIs from a global compliance perspective. However, they must look beyond incremental improvements, and to use it as a catalyst in their payment transformation journey. EY teams believe that to strategically leverage ISO 20022, changes to seven key areas of the broader payment-operating model is required.

Seven key areas of the payment-operating should adapt to realize ISO 20022 benefits

One of the largest cross-border payment banks globally is leaning into the operating model changes required, by incorporating ISO 20022 into their technology, service and operations roadmaps, and actively promoting awareness of the benefits of using the ISO20022 standard.

Native ISO 20022 offers a unique opportunity to create a modern, interoperable and global payment infrastructure, with a richer messaging set enabling faster, safer and more innovative payment services that can be delivered cost effectively by banks and FinTechs alike.

Related articles

How to unlock the power of enhanced data post ISO 20022

Providers need to act quickly as the new standard offers better services for customers and the opportunity to monetize data. Read more.

How the rise of PayTech is reshaping the payments landscape

PayTech’s relentless disruption of the payments landscape means that only PSPs that offer value beyond payments can compete. Learn more.

How banks can find a winning position in the buy-now-pay-later market

As BNPL gains popularity with consumers and merchants, banks will need to carefully consider their position in this growing market.

Summary

Even when there are complexities as well as benefits in the ISO 20022 migration, the infrastructure upgrade will bring more effective real-time controls against fraud and money laundering. The article explores how the SWIFT messaging underpins the global financial system, the MT workhorse showing its age as well as how important it is for the payment-operating models to evolve to deliver on the ISO 20022 promise.