EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Domestic tax compliance and reporting services

What EY can do for you

In today’s ever-changing tax landscape, the complexity of domestic compliance across all taxes, tax reporting and statutory accounting continues to grow. As the demands on tax functions intensify, the constant pressure to achieve more with limited resources has become a pressing challenge. Companies need to re-evaluate their existing domestic compliance and reporting operating model, and assess the synergy between data, technology, talent and processes to determine if their current approach is fit for purpose, now and for the future.

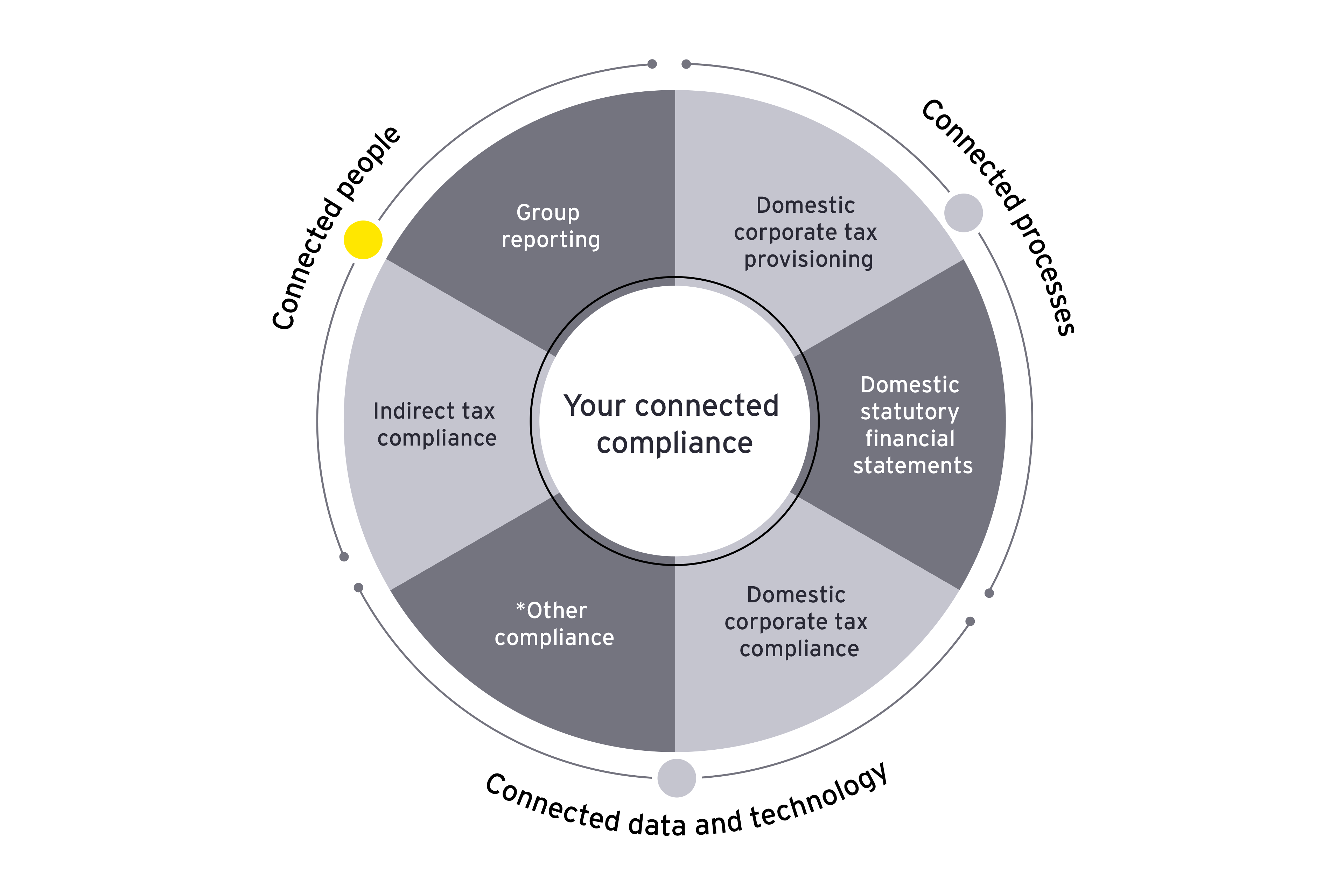

The EY Connected Tax Compliance and Reporting approach has been designed to connect all compliance and reporting outputs by a common delivery approach, enabled through one technology ecosystem. By bringing together the right mix of talent, processes and technology, EY teams provide quality tax compliance and reporting services, while also identifying valuable business insights.

In addition to cost savings, we help you manage risk, freeing up your time to focus on driving your business forward and seizing new opportunities for growth.

Connected people

EY teams focus on building relationships with you, grounded in a detailed knowledge of your business, to give you valuable insights from connected EY teams across compliance and advisory. Our relationship-based model and extensive EY network across sectors and markets allows you to connect to the right professionals at the right time to help you make informed business decisions. Through fostering our long-term relationships, we stay aligned with your business’s growth, providing continuous support as you evolve and thrive.

Connected processes

Tax and finance teams often find themselves spending too much time on low-value data manipulation tasks, limiting their availability to provide value-add insights. Through connected processes driven by technology automation, EY teams can help you improve governance, strengthen controls and unlock time savings for your tax functions. This gives you the freedom to concentrate on achieving your business objectives while we handle the intricate details of tax compliance and reporting. Our connected compliance process is the same across all compliance and reporting outputs and adheres to a common five-step approach that drives quality outputs, effective governance and clear communication. This approach provides greater visibility and helps create an efficient and robust process that is tailored to your needs.

Connected data and technology

EY technology is driven from a common data platform, reimagining the entire tax compliance and reporting process. The platform helps to save time and drive insights, all while giving you a clear audit trail from a single source. The EY technology ecosystem is agile and evolves with the changing compliance landscape. From tax data analysis to BEPS 2.0 Pillar Two and ESG reporting, we can cater to your diverse needs and help you drive a digital tax agenda that is fit for today and tomorrow.

The EY Connected Compliance and Reporting approach harmonizes talent, processes and technology, providing top-tier tax compliance and reporting services. After assessing your current compliance and reporting framework, EY teams help to identify areas for improvement and innovation. There is no one-size-fits-all approach, and we support clients in a multitude of ways including outsourcing, co-sourcing, data quality assessments, process improvements and secondments.

The team

Our latest thinking

Why five years of transforming tax and finance functions is paying off

New tax operating models in the last five years delivered value to businesses, EY survey shows. The next five years will add even more. Read more.

How transformation is shaping global indirect tax

The trends that are driving transformation at a global scale and how indirect tax functions can best prepare and add value. Find out more.

How tech and trust transformed a tax operating model

Global pharmaceutical player Boehringer Ingelheim is reimaging its tax operating model to boost quality and efficiency. Learn more in this case study.

How tax accounting teams should prepare for BEPS changes

Why tax accounting teams need to prepare for the implementation of BEPS, and how the obstacles may vary from country to country. Learn more.

Five steps tax accounting teams can take for BEPS 2.0

With BEPS 2.0 due to come into force in late 2023/early 2024, tax accounting teams prepare for Pillar Two rules on global minimum taxation. Learn more.

How increased global competition is reshaping tax priorities

The 2025 EY Global Tax Policy and Controversy Outlook explores changing global tax policies and their impact on businesses. Learn more.