EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

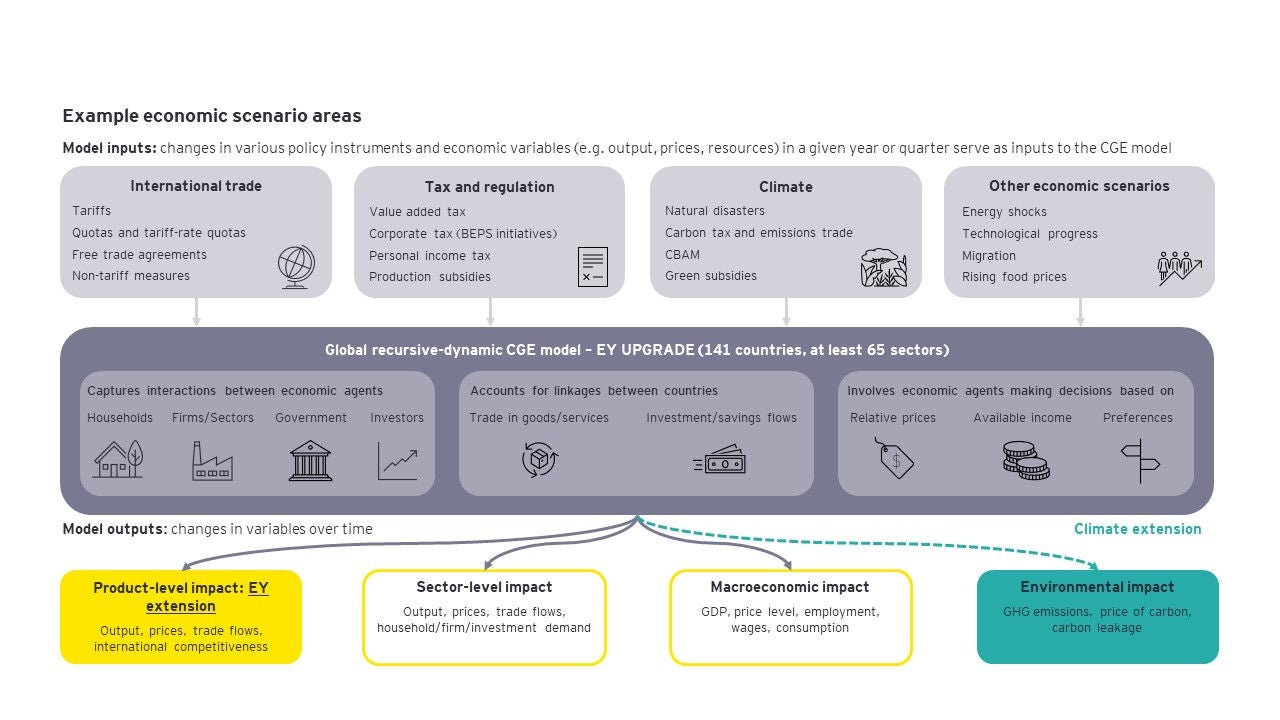

Computable General Equilibrium modelling

What are CGE models?

Computable General Equilibrium (CGE) modelling is a leading quantitative methodology for evaluating the effects of various economic scenarios on different parts of the economy. These models are widely used in economic impact assessments by the European Commission, World Bank, UNCTAD, OECD and government bodies (e.g. tax and customs authorities).

CGE models allow for the examination of a wide range of scenarios, from tax or trade regime changes to climate-related effects, technological advancements, and geopolitical shifts. The model's strength lies in its global coverage and its ability to capture inter-industry and inter-country connections. This makes it especially well-suited to study changes in sectors' global competitiveness under various external and internal shocks.

Our EY UPGRADE CGE model is highly flexible and incorporate various extensions suited to specific case studies. These extensions include, but are not limited to, advanced trade policy mechanisms, energy-environment-economy interactions and recursive-dynamic modelling.

How does EY improve upon common CGE modelling approaches?

Most of the existing CGE approaches focus on analyses at the level of aggregate sectors (e.g. manufacturing of electronic products). By contrast, the regulatory dialogue, such as trade policy negotiations and tax consultations, as well as climate-related policies (e.g. CBAM) often concern specific products (e.g. semiconductors) rather than entire industries. As a result, policy institutions (e.g. the European Commission) stressed the need to develop a CGE modelling methodology that facilitates product-level analyses.

To address such shortcomings of common CGE models, EY EAT developed an EY UPGRADE CGE model, based on the latest advances in academic literature, which allows us to incorporate product-level (Harmonised System 6 digit or finer) detail in our analysis.

Furthermore, our automated procedure enables us to run highly detailed simulations, without extensive effort required to prepare the model for an individual case study. We efficiently handle up-to-date product-level trade data from sources such as Eurostat Prodcom and national customs offices. Additional improvements to our model arise from automated CGE database updates based on national accounts data and recognised sources such as Shared Socioeconomic Pathways.

How can we support our clients?

The high level of product detail in our EY UPGRADE CGE model enables us to go beyond the economy-wide or sector-level changes. We can analyse the impact of very specific regulations that directly affect our clients and their surrounding economic environment (e.g. upstream and downstream industries).

The results of our CGE modelling applications have been successfully used in:

- Dialogue with regulatory bodies (e.g. governments, European Commission, etc.) in understanding the impact of proposed regulations

- Public reports on the impact of specific policies (e.g. climate change, tax incentives)

- Macroeconomic outlooks on the upcoming challenges to various industries.

Example of EY UPGRADE CGE modelling application

Business case

Suppose that the tariff on the imports of screws, bolts and related articles (a CBAM product covering HS6 codes 731811-731829) from third countries to the EU increased by 30 percentage points. What is the expected economic outcome for EU manufacturers of metal products and how will this affect other industries and the EU economy overall?

Standard approach vs. EY solution

In most CGE modelling databases (e.g. GTAP), screws, bolts and related articles are a part of the broad manufacturing of metal products sector. Instead of proceeding with the analysis on the sectoral level and relying on simplifying assumptions, EY UPGRADE CGE model uses the HS6 level trade data from public sources (e.g. Eurostat Prodcom) and automated data processing algorithms to disaggregate the manufacturing of metal products sector into i) screws, bolts and related articles and ii) other metal products. Thanks to this disaggregation procedure, we are able to simulate the impact on the production, prices and trade flows of screws, bolts and related articles, rather than solely reporting the outcomes for the entire metal products industry.

Results

Product-level impact

EY UPGRADE model allows us to simulate the impact on product-level variables, such as gross output (production), prices and trade flows.

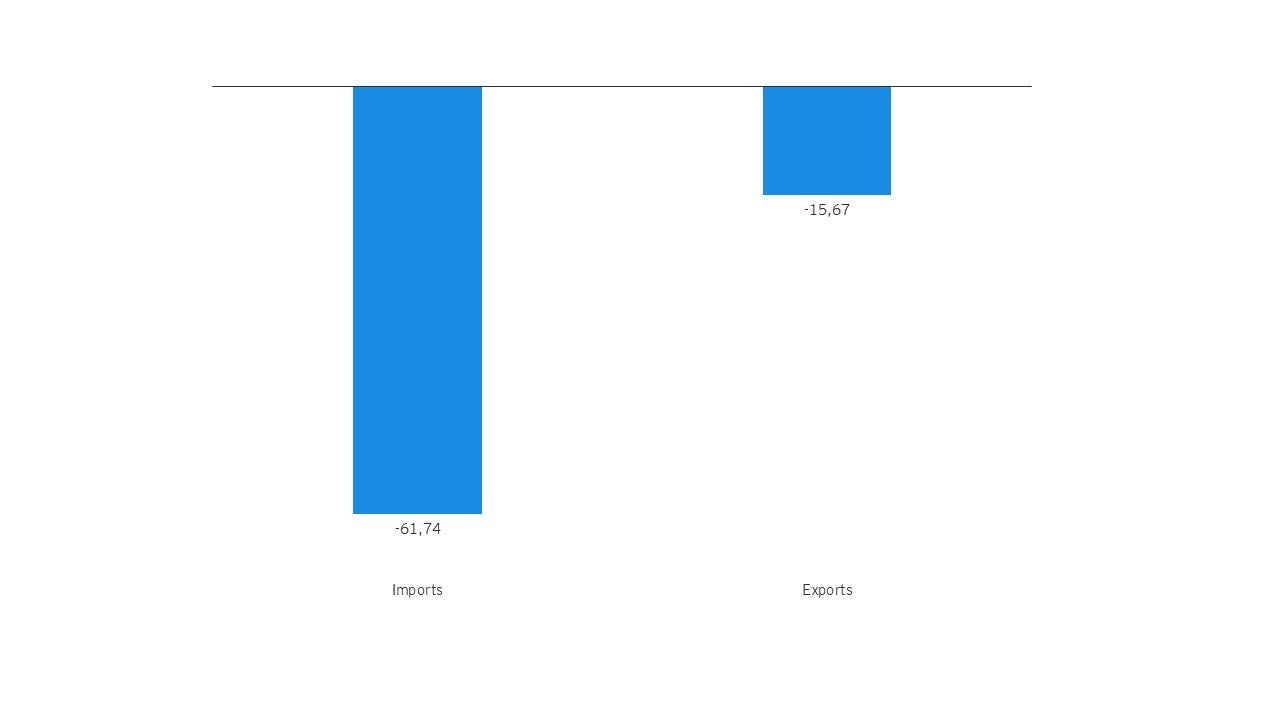

a) Imports to EU and exports from EU of screws, bolts and related products (percentage change)

Following a rise in tariffs, that EU users of screws, bolts and related articles reduce their demand for the more expensive imported product and increase the demand for EU variety, thus leading to a fall in imports. Moreover, the higher internal demand for screws, bolts and related articles manufactured within the EU increases their price, thus lowering their international competitiveness and leading to a reduction in exports.

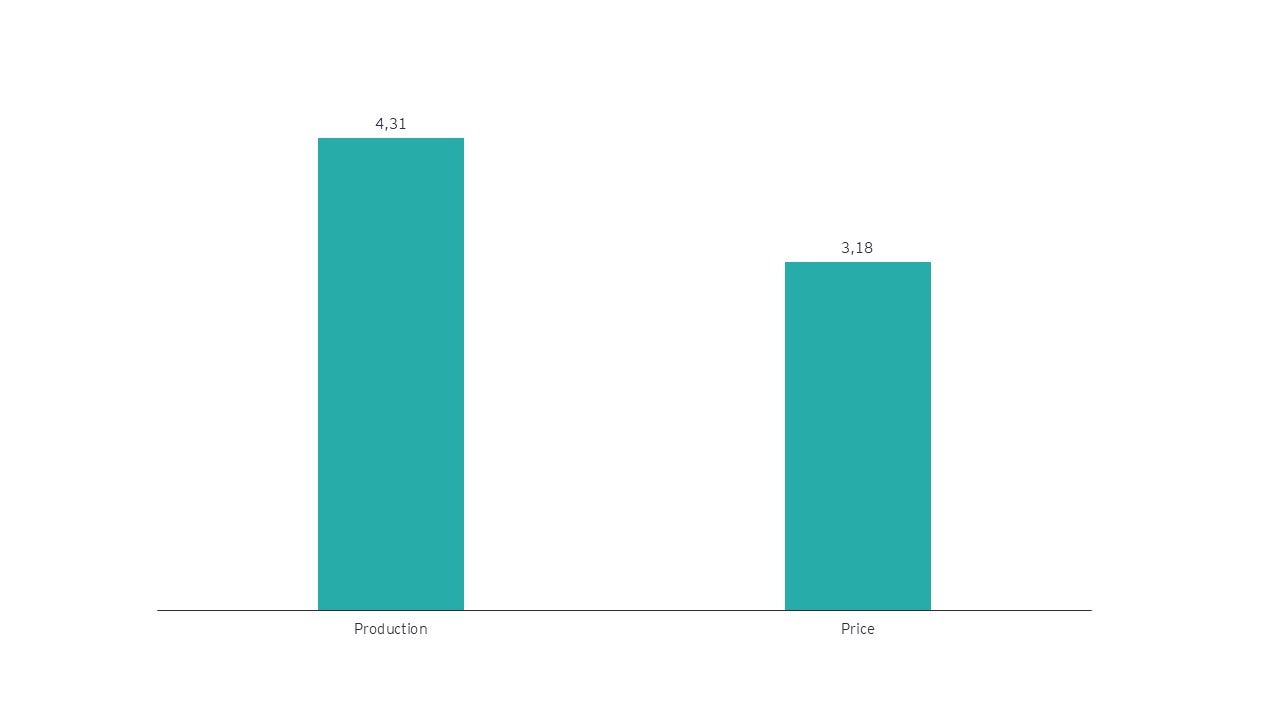

b) EU production and prices of screws, bolts and related articles (percentage change)

The EU producers of screws, bolts and related articles increase their production to meet the higher demand, motivated by increased market prices and revenue opportunities.

Sector-level impact

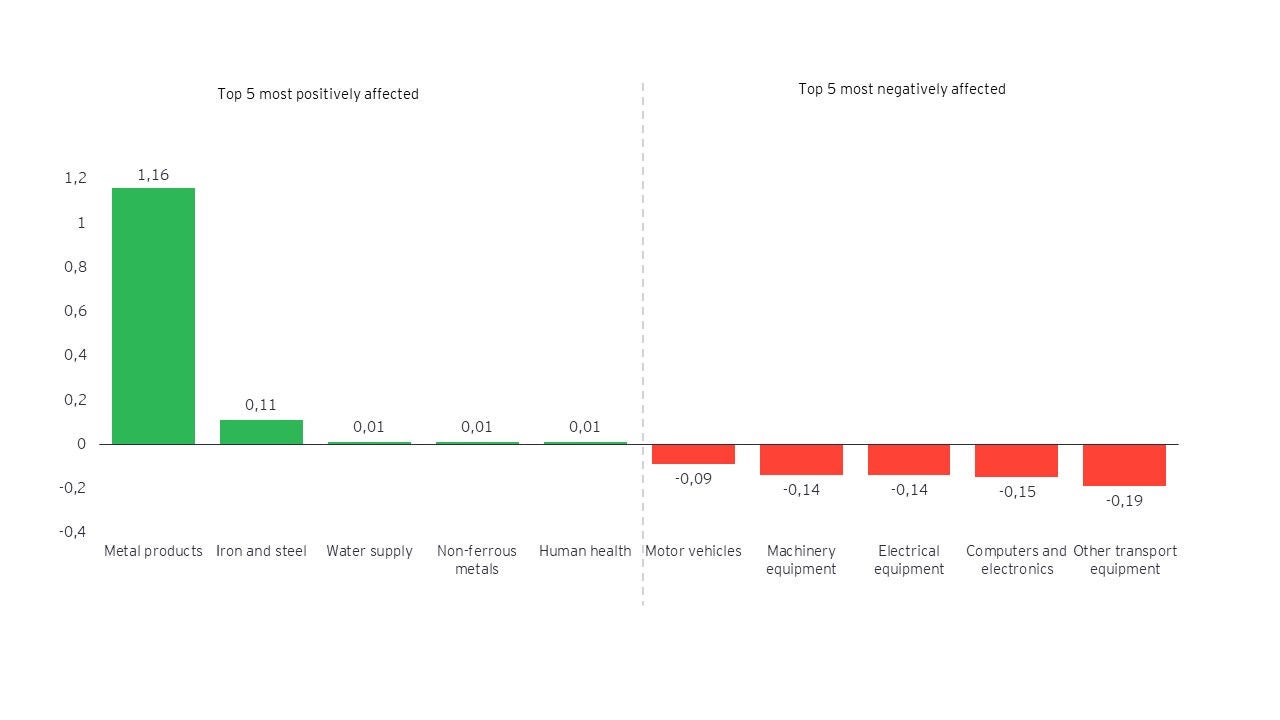

An increase in the production of screws, bolts and related articles leads to an increase in demand for goods and services produced by upstream suppliers of the manufacturing of metal products sector, primarily in the iron and steel industry, thus raising their production. In such way, the CGE model is able to capture the economic impact on key industries along the supply chain.

At the same time, however, the heavy users of metal products, especially the sectors which relied heavily on imported screws, bolts and related articles, will face a rise in production costs due to the tariff. This rise in production costs will be translated onto higher prices of goods produced in such sectors, thus lowering their international competitiveness and reducing EU domestic demand (as consumers will shift part of their demand on other goods and services). This will lead to a fall in output in sectors relying on metal products, most notably in transport, electrical and machinery equipment. Hence, using our product-level EY UPGRADE CGE model, we can identify the EU sectors gaining and losing due to a tariff increase on a specific product.

EU gross output (production) in the most affected industries (percentage change)

How EY can Help

-

Our Regulatory Impact Analysis from Economic Analysis Team can help your business by conduct a qualitative or quantitative assessment of the regulation’s impact on Demand, Supply, Public Finance, Value added, Labour market, Prices, Other economic variables

Read more -

EY Economic Analysis Team (EY EAT) estimates the size of the shadow economy in various sectors and economies, assesses its consequences, and develops recommendations for fighting the shadow economy.

Read more -

Our Consumer Demand Analysis by Economic Analysis can help your business answers questions such as: What are the common demand patterns across customers, how considered changes in taxation may impact the Client’s sales

Read more -

Our other economic analyses by Economic Analysis Team can help your business with services like spatial analysis, commercial due diligence, economic costs of diseases.

Read more

Direct to your inbox

Stay up to date with our Editor's Picks newsletter.