EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY Malta is delighted to share its quarterly Banking Recovery and Resolution Newsletter for Q3 2022. In this newsletter, we will be providing a snapshot of publications, updates to legislation and consultations issued in the last quarter around the banking recovery and resolution framework.

This newsletter provides a high-level overview of the publications issued by the different EU and local stakeholders and bodies dealing with recovery and resolution matters, in the third quarter of 2022.

May we kindly remind you that we will be organizing a seminar on Tuesday 29th November entitled Reaching Local Bank’s Resolvability: State of Play and Expectations. Kindly click on this link to register or email maria.calleja@mt.ey.com for further details.

EBA publishes its work programme for 2023

On 29 September 2022, the European Banking Authority (EBA) published its annual work programme for 2023, describing the key strategic areas of work for the Authority for the coming year, as well as related activities and tasks.

In 2023, the EBA will continue delivering on the priorities defined for the period 2022-2024 in its programming document. Its focus will be on: i) finalising the Basel implementation in the EU, ii) running an enhanced EU-wide stress test, iii) providing data to all stakeholders, iv) addressing the new challenges arising from the digitalisation of finance, and v) further contributing to the build-up of the capacity to fight ML/FT and to protect consumers in the EU. Moreover, it will continue to pay particular attention to the European ESG agenda, in its regulatory and risk assessment mandates, as well as in its own organisation, building on its recent EU Eco-Management and Audit Scheme (EMAS) registration.

Given the political agreements reached in 2022 on the Digital Operational Resilience Act (DORA) and Markets in Crypto-Assets (MiCA) legislations, the EBA will also actively start its preparations to be able to discharge the new oversight responsibilities it will receive, together with the European Insurance and Occupational Pensions Authority (EIOPA) and the European Securities and Markets Authority (ESMA). Against this background, it will continue to foster all possible internal and external synergies, working closely with Competent Authorities and other European bodies, and carry out the modernisation of its organisation engaged in recent years. Against that background, the number of over-arching activities was further reduced to facilitate coordination and readability,

The work programme benefitted from the recommendations of the EBA’s Advisory Committee on Proportionality.

The 2023 work programme may be accessed through this link.

EBA publishes Guidelines on transferability to support the resolvability assessment for transfer strategies

On 28 September 2022, the EBA published its final Guidelines on transferability to support the resolvability assessment for transfer strategies. In particular, the guidelines on transferability provide guidance relating to (i) the definition of the transfer perimeter and (ii) the steps to operationalise the implementation of the transfer. The transferability Guidelines complement the resolvability Guidelines, which were published on 13 January 2022. Institutions and resolution authorities should comply with these Guidelines in full by 1 January 2024.

Transferability is defined as the elements of resolvability that will facilitate the transfer of an entity, a business line or a portfolio of assets, rights and/or liabilities (“transfer perimeter”) to an acquirer, a bridge institution, or an asset management company. The Guidelines deal with the transfer perimeter definition, separability (that is, how to facilitate separation of an entity or a business from the rest of the group in resolution) and operational transfer of this perimeter.

The transferability Guidelines aim at supporting the assessment of the feasibility and credibility of transfer strategies and include requirements relating to the implementation of transfer tools. The transferability Guidelines include proportionality measures, as they do not apply to institutions subject to simplified obligations or earmarked for liquidation, unless resolution authorities decide so (in full or in part). In addition, discretion is left to authorities with regards to the extent of application of the Guidelines in cases where the transfer tool is only part of the variant strategy.

These Guidelines maybe accessed through this link.

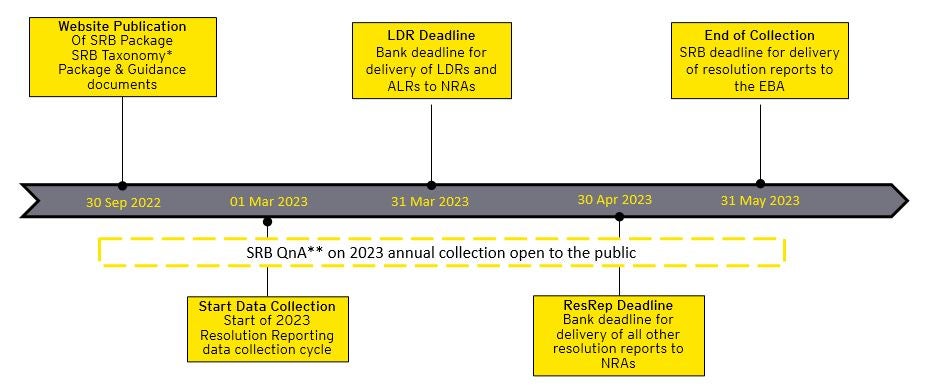

2023 Resolution Reporting

On 26 September 2022, the SRB published a series of guidance to assist banks in the 2023 resolution reporting.

For the 2023 reporting, the SRB once again highlights the importance of high quality, complete and timely data submissions. The ability to provide the necessary data to support the implementation of the resolution strategy, is a key resolvability issue, to be adequately considered by banks’ top management. To ensure banks meet the reporting deadlines (see timeline below), the SRB recommends that all banks implement the following measures:

To support high quality and complete data, the resolution reports should be submitted in line with the published guidance, with validation checks performed by the bank ensuring, among others, reconciliation with its FINREP and COREP regulatory reports (where applicable);

Banks should ensure that they have the necessary IT processes in place to facilitate a timely, controlled and robust reporting process generating consistent and reliable results; and

Data quality and availability on time are key items to consider within the resolvability assessment. In this context the SRB can consider the failure to comply with the information requirements as an impediment to resolvability, potentially significant. It is therefore important that the quality of and deadlines for the resolution reporting submissions are respected.

The SRB, in collaboration with the National Resolution Authorities (NRAs), is starting its annual Resolution Reporting Data Collection exercise. During the 2023 edition, the collection will be based on data as at 31 December 2022. The process will integrate lessons learned from the previous exercises and take into account the feedback received from NRAs as well as the industry.

The scope of the reports has evolved to reflect the needs of resolution planning, while limiting the burden of reporting for banks. Nevertheless, the SRB retains the flexibility to request additional information wherever and whenever it deems necessary to do so.

As concerns the reporting perimeters, (Sub)-Consolidated views are based on the prudential or resolution scopes of consolidation, whereas Resolution Groups are to be defined by Internal Resolution Teams (IRTs), in collaboration with the respective institutions.

The timelines for reporting are as follows:

More information may be obtained through the following links:

- General information on 2023 Resolution Reporting;

- Guidance to the 2023 Liability Data Report – LDR v1.0

- Guidance to the 2023 Critical Functions Report - CFR v1.0

- Guidance to the 2023 Financial Markets Infrastructure Report – FMIR v1.0

- Annex on Insolvency Ranking 2022 v1.02

- SRB Level 3 data quality checks v1.01

- SRB taxonomy extensions:

- EBA ITS on disclosure and reporting on MREL and TLAC

- 2023 Template Additional Liability Data Report v1.0

Guidance to the 2023 Additional Liability Data Report v1.0

SRB Administrative contributions

On 22 April 2022, the SRB issued the Resolution Planning Booklet.

Although the SRB is an independent EU agency, it is not publicly funded. Instead, banks operating across the Banking Union must pay an annual levy towards the running costs of the SRB.

The determination and raising of Administrative Contributions is based on the Commission Delegated Regulation (EU) 2017/2361 of 14 September 2017 on the final system of contributions to the administrative expenditures of the Single Resolution Board, which came into force on 8 January 2018 and was amended by Commission Delegated Regulation (EU) 2021/517 of 11 February 2021. Some changes have been introduced from the 2022 administrative contributions cycle onwards. The SRB will calculate and raise individual annual contributions in Q3. Additionally, the SRB can raise advance instalments in order to pre-finance its expenditures of the financial year until the annual individual contributions are raised in Q3.

The SRB’s Administrative Contributions cycle for 2022 is as follows:

2022 individual annual contributions

- Institutions were consulted on the preliminary determinations of the 2022 individual annual contributions between 22 June and 7 July 2022;

- The individual Contribution Notices were issued on 2 September 2022. The deadline for payment is 7 October 2022;

- 2,237 entities and groups have been notified about their 2022 individual annual contributions;

- The total amount of annual contributions to be raised for financial year 2022 is equal to EUR 75 million;

- The amounts raised by way of advance instalments have been deducted from the concerned institutions's individual annual contributions.

More information may be obtained from the below links:

2022 advance instalments on administrative contributions

- Institutions were consulted on the preliminary determinations of the advance instalments between 10 January and 23 January 2022. A total of 10 institutions submitted comments;

- The individual Contribution Notices were issued on 16 February 2022. The deadline for the payment was 23 March 2022;

- 120 entities and groups have been notified about their 2022 advance instalments;

- The total amount of 2022 advance instalments to be raised is equal to EUR 30,000,000.

The Administrative Contributions (ADMC) Portal

The SRB has developed the ADMC Portal to improve the communication with institutions regarding the contributions to the administrative expenditures of the Board.

As of the 2022 annual cycle, institutions will be requested to use the ADMC Portal to:

- Verify/update their contact details;

- Provide any comments they may have during the consultation;

Retrieve all documents related to the administrative contributions.

SRB publishes MREL dashboard Q1.2022

On 26 July 2022, the SRB issued the MREL dashboards for Quarter 1 of 2022.

The MREL dashboards are based on bank data reported to the SRB and cover entities under SRB’s remit. The first section of the dashboard focuses on the evolution of MREL targets for resolution entities and non-resolution entities, outstanding stock and shortfalls in Q3.2021 under the BRRD II framework. It also includes an overview of gross issuances of MREL instruments during the last quarter. The second section highlights recent developments in the cost of funding.

The main data issued under this MREL dashboards include the following:

MREL monitoring Q1.2022

- MREL final targets for resolution entities

- MREL instruments of resolution entities

- Shortfalls of resolution entities

- MREL targets and shortfalls of non-resolution entities

Market activity and cost of funding

- Market access and MREL issuances

- Cost of Funding

Key findings are included hereunder:

- For resolution entities, the average MREL final target including the combined buffer requirement (CBR), to be respected by 1 January 2024, amounted to 26.3% Total Risk Exposure Amount (TREA), showing a slight increase with respect to Q4.2021;

- The average MREL shortfall with respect to the final 2024 targets (including the CBR) stood at 0.5% TREA (or about EUR 36.7 bn), growing with respect to Q4.2021 by EUR 4.7 bn, but remaining below the level registered in Q1.2021;

- For non-resolution entities, the average MREL shortfall (including the combined buffer requirement (CBR)) against the final target amounted to 0.9% TREA (or EUR 19.3 bn), continuing the decreasing trend observed in the previous quarter, albeit at a slower pace;

- As regards MREL intermediate 2022 targets (including the CBR), almost all banks met the requirements. The very few banks with a shortfall are being closely monitored;

- Notwithstanding the uncertain financial markets conditions in the first quarter of the year, SRB banks’ issuance volume amounted to EUR 84 bn, increasing by around 42% with respect to the last quarter of 2021 and by around 11% year-on-year; and

- Given the geopolitical tensions and the volatility of financial markets, MREL funding costs deteriorated in the second quarter of 2022, resulting in a widening of spread levels.

The Q1 2022 SRB MREL Dashboards may be accessed through this link.

Contact us

Karl Mercieca

EY Malta Financial Services Regulatory Compliance

Partner

karl.mercieca@mt.ey.com

Maria Calleja

EY Malta Financial Services Regulatory Compliance

Manager

maria.calleja@mt.ey.com

Upcoming events calendar

- 26 November - EY Sustainability Hackathon

- 30 November - IFRS Updates 2022

- 1 & 2 December - Financial Modelling in Excel | Building a 3-Statement Model from Scratch - FULLY BOOKED

- 7 December - Expatriates: The immigration process and personal taxation treatment