EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY Malta is delighted to share the first, in a series of Credit Institutions Regulatory Compliance Newsletter.

This newsletter provides a high-level overview of some of the major developments we’ve seen coming out over the past months, including some key EU publications that came about towards the end of 2021 with an outlook for 2022 implementation. Following this first newsletter, any subsequent ones will cover developments happening in the previous quarter.

Within this newsletter, we will explore the:

- developments on the publication of the proposed CRD VI (and CRR III);

- MFSA’s transposition status of the CRD V into the local legal framework;

- focus on the ECB’s 2022 Climate Risk Stress Tests;

- the application of the Euro Short Term Rate (€STR) as from January 2022;

- guidance from EBA, EIOPA and ESMA on ICT Outsourcing Arrangements; and

- the announcement of phasing out temporary pandemic collateral easing measures.

Apart from these quarterly newsletters, EY shall be organising round table discussions focusing on credit institutions regulatory compliance. Further information on these events will be provided in due course.

Banking Package 2021: new EU rules to strengthen banks’ resilience and better prepare for the future

Sources: Banking Package 2021 | EU ; The EU's Banking Package 2021 has started the Basel 4 endgame | EY ; CRD V Transposition Status | European Commission

In October 2021, the European Commission adopted a review of the EU banking rules – the Capital Requirements Directive (CRD) and the Capital Requirements Regulation (CRR) – that will ensure that EU banks become more resilient to potential future economic shocks, while contributing to Europe's recovery from the COVID-19 pandemic and the transition to climate neutrality. The review mainly consists of the following legislative elements:

- a legislative proposal to amend further the Capital Requirements Directive;

- a legislative proposal to amend further the Capital Requirements Regulation;

- a separate legislative proposal to amend the CRR in the area of resolution.

In this package, other than implementing the remaining aspects from the BASEL 3 framework in strengthening the resilience of EU banks to economic shocks, the EU has taken the opportunity to incorporate additional regulatory updates, including:

- Sustainability in contributing to the green transition within the ESG (environmental, social and governance) sector;

- Stronger supervision by ensuring sound management of EU banks and better protecting financial stability through amendments to the bank crisis management framework impacting the Bank Recovery and Resolution Directive and the CRR;

- The introduction of a new framework and classification system that will require reauthorisation of all existing third-country branches; and

- Further measures to harmonise supervisory powers and tools and require the EBA to centralise the publication of annual, semi-annual and quarterly institutional prudential information for the largest institutions within the EU.

While some remaining EU member states [1] have been striving to transpose the latest amendments from the previous CRD package – the CRD V and CRR II – during the first quarter of 2022, the EU has initiated what can be referred to as the Basel 4 endgame through this recent publication. Upon releasing the proposed CRD VI and CRR III, the EU has launched the implementation process of the finalisation of Basel 3 through what is referred to as the Basel 3 Reforms (or Basel 4). The scope of the new CRD VI and CRR III mainly incorporates updates to:

- the standardised approach of credit risk;

- the internal ratings-base (IRB) approach for credit risk;

- the calculation of credit valuation adjustment (CVA);

- the operational risk framework; and

- an output floor limiting the capital benefit from risk models.

By doing so, the EU is attempting to strike a balance between implementing the BCBS (Basel Committee on Banking Supervision) proposals to enhance financial stability and on the other hand to support EU credit institutions’ ability to continue financing economies around Europe. Indeed, some of the Basel 3 Reforms (or Basel 4) are incorporated to reflect specific EU interests, either by tweaking approaches or by providing for a transition period to adjust to specific changes. CRD VI and CRR III also implement the market risk capital changes in the Fundamental Review of the Trading Books (FRTB), although such amendments include a provision allowing the EC to amend the market risk capital calculation approaches if there are any major discrepancies with other major jurisdictions.

Although the Basel timetable calls for the Reforms to be implemented on 01 January 2023, the EU announcement indicates an application date of 01 January 2025, with transitional arrangements applying over a further five-year period. This seems to confirm speculation of a further delay from the Basel timetable and fits with the typical EU and country-level legislative processes. This might be well received by industry players, considering that the EC stated that the impact of implementing the proposed Basel 3 Reform options and all the measures in the proposal, it is expected to lead to a weighted average increase in EU banks’ minimum capital requirements of +0.7% to +2.7% in the medium term by 2025 and between +6.4% to +8.4% in the long term by 2030.

[1] According to the EC’s official website, by February 2022 81% of the member states had fully transposed the CRD V amendments into local legislation, increasing to 96% of member states by April 2022.

MFSA’s Local Transposition of the CRD V

Source: Transposition of the Fifth Capital Requirements Directive | MFSA

The MFSA had issued a circular towards the end of December 2021 whereby it provided an overview of the main amendments introduced in national law to transpose the CRD V. These can be categorised under 3 key legislative bodies:

- Amendments to the Banking Act with specific focus to the following aspects:

- (Mixed) Financial Holding Companies. Article 10CA of the Act introduces a new requirement for Financial Holding Companies and Mixed Financial Holding Companies to seek approval or exemption from such approval from the Authority, in accordance with the conditions set out in the said article. In instances where (M)FHCs do not meet or cease to meet the conditions for approval, the Act provides the competent authority with the power to impose supervisory measures to ensure compliance with consolidated prudential requirements set out by the applicable legislation.

- Intermediate EU parent undertaking. The Banking Act establishes a new requirement for an investment firm licensed in terms of the Act, which is part of a third-country group having one or more other credit institutions or investment firms licensed in Malta or in any another Member State. Such change requires licence holders forming part of these third-country groups to have a single intermediate EU parent undertaking to be established in Malta or in another Member State. This requirement, however, does not apply in instances where the total value of assets of the third-country groups in the EU is less than €40 billion.

- Replacement of the Auditor. The amendments to Article 18 of the Banking Act empower the Authority to require the auditor of a licence holder to be replaced where such auditor breaches his or her obligations set out in this same article.

- Amendments to Subsidiary Legislation in order to transpose certain provisions of the CRD V and parts of Article 62 of the Investment Firms Directive amending the CRD. Such amendments mainly comprise revisions made to the following:

- Administrative Penalties, Measures and Investigatory Powers Regulations (SL 370.25);

- Supervisory Consolidation (Credit Institutions) Regulations (LN 494); and

- Banking Act and Investment Services Act (Supervisory Review) Regulations (LN 495 and SL 370.15)

- Amendments made to the MFSA Banking Rules through revisions and/or introduction of a number of Banking Rules, some of which are also amended to implement certain EBA Guidelines. These mainly impact the following Banking Rules:

- BR/01 (revised) – Application Procedures & Requirements for Authorisation of Licenses for Banking Activities;

- BR/15 (revised) – Capital Buffers of Credit Institutions Authorised under the Act;

- BR/21 (revised) – Remuneration Policies and Practices;

- BR/24 (new rule) – Internal Governance of Credit Institutions Authorised under the Act. With respect to the newly introduced BR/24, banks will now be required to document and make available to the MFSA upon request the data on loans to members of the management body and their related parties. Additionally, the new Rule shall implement the EBA Guidelines on internal governance (EBA/GL/2021/05), hence introducing obligations with respect to the roles of the members of the board of directors, remit of committees of credit institutions and requirements relating to the internal control framework of credit institutions.

Participation in the 2022 ECB Climate Risk Stress Test (CST)

Source: 2022 supervisory climate stress test | ECB Banking Supervision

Stress tests are a powerful tool for supervisors to assess whether banks are resilient enough to withstand financial and economic shocks. The ECB conducts supervisory stress tests annually, in line with Article 100 of the CRD. The ECB’s Supervisory Board has selected climate risk as the focus of the 2022 supervisory stress test exercise, given its increasing significance to the supervisory agenda. The exercise will be complemented by a full supervisory review of banks’ climate-related and environmental risk management practices, which will seek to comprehensively assess how banks have incorporated these risks into their strategy, governance and risk management frameworks and processes.

The ECB considers this stress test to be a learning exercise for banks and supervisors alike. It aims to identify vulnerabilities, industry best practices and the challenges faced by banks. The exercise will also help enhance data availability and quality and allow supervisors to better understand the stress-testing frameworks banks use to gauge climate risk. The output of the stress test exercise will be integrated into the Supervisory Review and Evaluation Process (SREP) using a qualitative approach. However, no direct capital impact via the Pillar 2 Guidance is envisaged. A possible impact of the exercise will be indirect, via the SREP scores on Pillar 2 Requirements.

The stress test comprises three distinct modules:

- Module 1: a questionnaire to qualitatively assess banks’ internal climate risk stress test frameworks.

- Module 2: a peer benchmark analysis of two climate-related metrics. Metric 1 assesses the sustainability of banks’ business models by measuring their income from climate-relevant exposures, such as loans to industries emitting large volumes of greenhouse gases. Metric 2 assesses the extent to which banks are exposed to carbon-intensive industries based on greenhouse gas emissions and loans at the counterparty level.

- Module 3: a bottom-up stress test targeting transition and physical risks. Banks will submit starting points and their own projections based on the ECB’s common methodology and pre-defined scenarios for credit and market risk.

Working with the Euro Short-Term Rate (€STR)

Source: EUR-Lex Document 32021R1848 | EU

On 22 October 2021, Commission Implementing Regulation (EU) 2021/1848 on the designation of a replacement for the benchmark Euro overnight index average was published in the Official Journal. The Implementing Regulation provides that in-scope references to EONIA should be replaced by the euro short-term rate (€STR) and a specified fixed spread adjustment. This was made effective as from 03 January 2022.

The Euro overnight index average (EONIA) is a critical benchmark representing the interest rates on unsecured overnight lending transactions denominated in euros. EONIA is used in the context of overnight index swaps, and a wide range of other products. It is essential for cash settlement and highly relevant for other purposes such as different valuation procedures as applied as part of collateral and risk management processes or accounting.

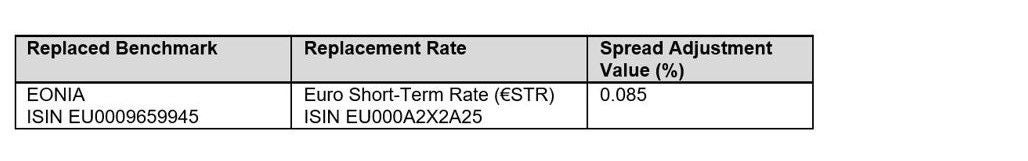

The original methodology for the calculation of EONIA was based on submissions provided by contributing panel banks and which will now be based on the Euro Short-Term Rate plus a fixed spread adjustment equal to 8.5 basis points. Therefore in summary, the replacement rate for the EONIA shall be designated in accordance with the following table:

The €STR uses transaction data included in daily reporting on monetary exchanges from the 52 largest eurozone banks to calculate the average interests rate attached to loans throughout a business day. Only unsecured loans are included, as the rate on secured loans would be affected by the type of underlying collateral. Several key respects distinguish the €STR from alternative benchmarks like the European Overnight Index Average (EOIA), and the London Intrabank Offered Rate (LIBOR).

It is important to note that the €STR is based on transaction data alone, whereas the LIBOR considers the rate that major banks charge to other banks for short term loans. The second main difference is that, by considering money market transactions rather than only intrabank lending (like the EOIA and LIBOR), the €STR incorporates the role of other major actors like money market funds, insurance companies, and other financial corporations.

Sector Specific Guidelines on ICT Outsourcing Arrangements from EBA, EIOPA and ESMA

Source: ICT Outsourcing Arrangements – Sector Specific Guidelines | MFSA

On 24 January 2022, the MFSA issued a circular reminding all applicable institutions on the importance of adhering to a number of guidelines issued by different European authoritative bodies on the concept of outsourcing, becoming applicable not later than 31 December 2022.

For credit institutions, financial institutions and investment firms, the element of outsourcing arrangements within the local legal setting is covered by Banking Rule BR/14 and cross referenced by the Investment Services Rules for Investment Service Providers. Indeed, for the purpose of BR/14, the term outsourcing shall mean “an arrangement of any form between a credit institution and a service provider by which that service provider performs a process, a service or an activity that would otherwise be undertaken by the credit institution.”

The Authority emphasises the importance for authorised persons the requirement to maintain an updated register of information on all outsourcing arrangements at the institution and should appropriately document all current outsourcing arrangements, distinguishing between the outsourcing of critical or important functions and other sourcing arrangements.

Furthermore, the Authority covers the fact that the EIOPA (European Insurance and Occupational Pensions Authority) Guidelines on outsourcing to cloud service providers had come into force on 01 January 2021 and authorised undertakings must ensure their compliance to such guidelines by 31 December 2022. They should review and amend accordingly any existing cloud outsourcing arrangements related to critical or important operational functions or activities.

Likewise, the ESMA (European Securities and Markets Authority) had also issued similar guidelines on outsourcing to cloud service providers, published on 21 June 2021. These guidelines apply from 31 July 2021 and firms should review and amend accordingly any existing cloud outsourcing arrangements with a view to ensuring that they take into account these guidelines by 31 December 2022.

The Circular concludes with making reference to the MFSA’s Guidance on Technology Arrangements, ICT and Security Risk Management and Outsourcing Arrangements issued in December 2020 applicable to credit and financial institutions, insurance and reinsurance undertakings and intermediaries, investment services licence holders, company service providers, virtual financial assets, among others listed in Section 1.1.9 in the said Guidance.

Phasing out temporary pandemic collateral easing measures

Source: ECB Timeline for phasing out pandemic easing measures | EU

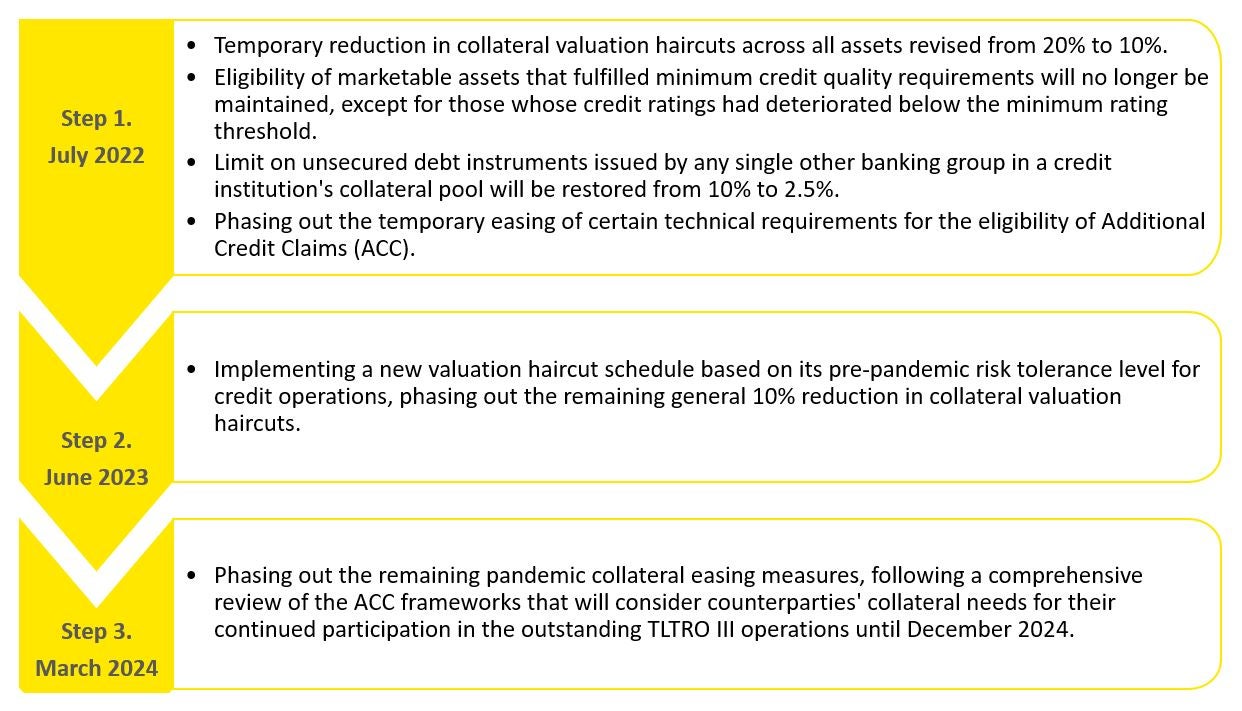

The Governing Council of the European Central Bank (ECB) has decided to gradually phase out the package of pandemic collateral easing measures in place since April 2020. It has been announced that the pandemic collateral easing measures will be gradually phased out in three steps between July 2022 and March 2024. These will gradually restore Euro-system’s pre-pandemic risk tolerance and avoid collateral availability cliff effects. Notwithstanding, the ECB will continue to waive minimum credit quality requirement for Greek Government Bonds (GGBs), allowing National Commercial Banks to accept them as collateral in line with continued eligibility in the Pandemic Emergency Purchase Programme.

The following timeline covers the 3-stepped gradual phasing process with the key highlights in each time-window.

Contact us

Karl Mercieca

EY Malta Financial Services Regulatory Compliance

Associate Partner

karl.mercieca@mt.ey.com

Christian Cassar

EY Malta Financial Services Regulatory Compliance

Manager

christian.cassar@mt.ey.com

Maria Calleja

EY Malta Financial Services Regulatory Compliance

Manager

maria.calleja@mt.ey.com