EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Summary

On 27 January 2022, the European Securities and Markets Authorities (“ESMA”) published a consultation paper on the Guidelines on Certain Aspects of MiFID II Suitability Requirements in order to add the sustainability risks and preference requirements included by the last MiFID II Delegated Regulation1 (the “Guidelines”).

Background

The Directive 2014/65/EU on Markets in Financial Instruments (“MiFID II”) determines that investment firms should obtain the necessary information regarding:

- The client’s knowledge and experience in the investment field relevant to the specific type of product or service

- The person’s financial situation including their ability to bear losses and

- Their investment objectives including their risk tolerance so as to enable the investment firm to recommend to the client or potential client the investment services and financial instruments that are suitable for him/her and, in particular, that are in accordance with their risk tolerance and ability to bear losses

In August 2021, the European Commission published a delegated regulation2 (the “Delegated Regulation”) providing that investment firms should also identify the client’s sustainability preferences.

On 27 January 2022, ESMA opened a consultation on the draft guidelines which address the inclusion of sustainability preferences in a client’s suitability assessment from a practical perspective.

Key changes

The main changes included by the Delegated Regulation and addressed by the Guidelines are:

• The collection of information from clients on sustainability preferences: identify the client’s preferences in relation to the different types of sustainable investment products and to what extent they want to invest in them

• The assessment of sustainability preferences: identify the products that meet the client’s sustainability preferences

• The organizational requirements: provide staff with appropriate training on sustainability topics and keep updated records of the sustainability preferences of the client

Practical considerations

These Guidelines involve some challenges that investment firms are currently facing notably with regards to, inter alia:

Short implementation timeline: since ESMA will collect feedback until the end of April 2022, the final Guidelines should be published shortly before, or more probably after, the application date (2 August 2022) of the Delegated Regulation. This means investment firms should already launch their project on the basis of Guidelines included in the consultation.

Data availability: some disclosures related to taxonomy-alignment and principal adverse impacts are not yet available due to the future application dates of:

- Detailed reporting requirements applicable to investment products, which will become applicable as from 1 January 2023

- Reporting of taxonomy-alignment by companies in scope of the Non-Financial Reporting Directive, which will become applicable as from 1 January 2023 for non-financial undertakings and from 1 January 2024 for financial undertakings

Therefore investment firms may struggle to find the product data they need to ensure the products purchased or advised meet the client’s preferences.

Firms’ inability to meet end investors’ sustainable needs: due to the required assessment granularity and the requirement to ask clients for minimum percentages of sustainable investments, firms may not be in a position to match products to client’s preferences. Where such mismatches between high client expectations and product offering need to be addressed, iterative assessments may become burdensome for clients and may also increase costs for the firm.

When designing their assessment process and drafting their questionnaires, investment firms should consider that most product manufacturers are currently adopting a prudent approach when committing to a rate of Taxonomy-alignment or of sustainable investment. However they should remain agile to swiftly adapt their client information collection processes in a fast- moving and highly competitive environment.

Doubts also remain in relation to potential repercussions of classifying clients with no sustainability preference as “sustainable neutral”. Offering a product with sustainable features to a client who expressed no interest (even when such features are disclosed) could undermine client relationships, in particular in case an ESG product underperforms from a financial perspective.

Front office staff should also have the necessary knowledge and competence with regards to the criteria of the sustainability preferences and should be able to explain them to clients in non- technical terms. In order to help clients to understand the choices to be made in this context, staff should be able to explain the relevant concepts, the distinction between the different elements of the definition of sustainability preferences, but also between these products and products without such sustainability features in a clear manner. In this context, appropriate training should be provided to exposed staff. Broader projects may also be required to ensure communication is clear, concise and not technical while ensuring an optimal client experience on all channels (including mobile devices).

Collecting information from clients on sustainability preferences

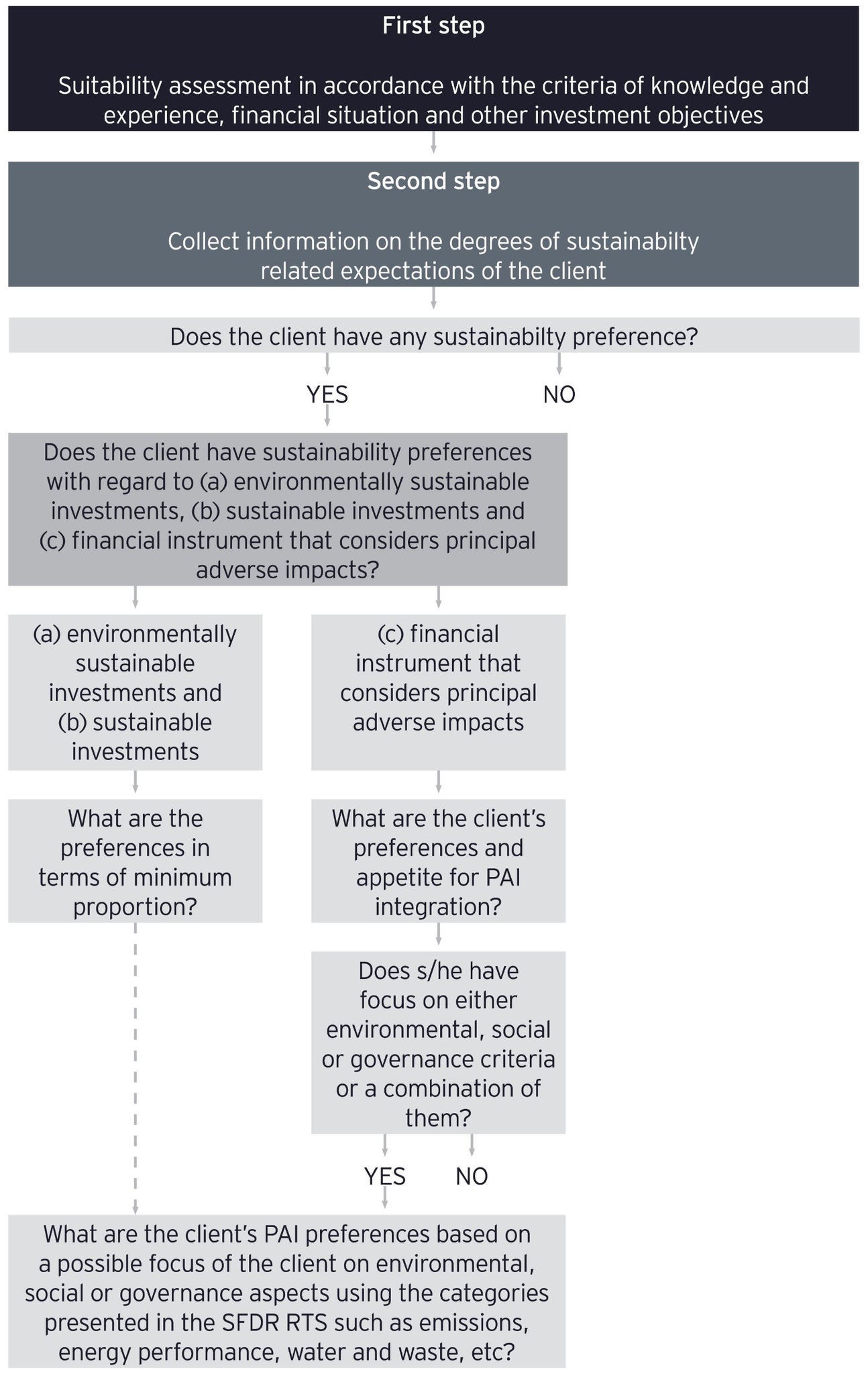

After assessing the client’s knowledge and experience, financial situation and other investment objectives, investment firms should clearly explain what sustainability preferences are and what environmental, social and governance means. Then, the firm should assess the client’s sustainability preferences by identifying:

- Whether the client has any sustainability preferences

- If so, to what extent the client has sustainability preferences with regard to (a) environmentally sustainable investments, (b) sustainable investments and (c) financial instruments that consider principal adverse impacts (“PAIs”)3 and if the client has a preference for, where relevant, a combination of one or more of the three aspects

- For aspects a) and b), what are the client’s preferences in terms of minimum proportion

- For aspect c), which PAIs should be considered including quantitative and qualitative criteria demonstrating that consideration

- Whether the client has a focus on either environmental, social or governance criteria or a combination of them or whether the client does not have such a focus

- Which part of the portfolio (if any) the client wants to be invested in products meeting the client’s sustainability preferences

Special cases

The Guidelines also address some special cases an investment firm can face, for example, when the client has no sustainability preference or when the product does not fit their preference.

Case 1 - Product does not meet the client’s initial sustainability preferences

Where a firm intends to recommend a product that does not meet the initial sustainability preferences of the client in the context of investment advice, it can only do so once the client has adapted his/her sustainability preferences.

Case 2 - The investment firm cannot meet the client’s sustainability preferences

If the firm cannot meet those preferences, it should discuss this with the client when agreeing on the mandate in which the investment strategy is defined and ask the client to adapt his/her preferences. The decision of the client should be documented.

If the client states that he/she has sustainability preferences, and the firm does not have any products with sustainability related factors available, this should also be documented in the suitability report.

Case 3 - The client has no sustainability preference

Where a client does not answer the question whether he has sustainability preferences or answers “no”, the firm may consider this client as “sustainability-neutral” and recommend products both with and without sustainability-related features.

1 Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organizational requirements and operating conditions for investment firms

2 Idem

3 MiFID II Delegated Regulation - Article 2 (7): “sustainability preferences” means a client’s or potential client’s choice as to whether and, if so, to what extent, one or more of the following financial instruments shall be integrated into his or her investment:

(a) A financial instrument for which the client or potential client determines that a minimum proportion shall be invested in environmentally sustainable investments as defined in Article 2, point (1), of Regulation (EU) 2020/852 of the European Parliament and of the Council (*)

(b) A financial instrument for which the client or potential client determines that a minimum proportion shall be invested in sustainable investments as defined in Article 2, point (17), of Regulation (EU) 2019/2088 of the European Parliament and of the Council (**)

(c) A financial instrument that considers principal adverse impacts on sustainability factors where qualitative or quantitative elements demonstrating that consideration are determined by the client or potential client

Reference

Guidelines on certain aspects of the MiFID II suitability requirements

Summary

On 27 January 2022, the European Securities and Markets Authorities (“ESMA”) published a consultation paper on the Guidelines on Certain Aspects of MiFID II Suitability Requirements in order to add the sustainability risks and preference requirements included by the last MiFID II Delegated Regulatiation1 (the “Guidelines”).