EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can Help

-

Our IPO destination services team can help you choose the best place to list your company — be it your home market, nearby or overseas. Learn more.

Read more

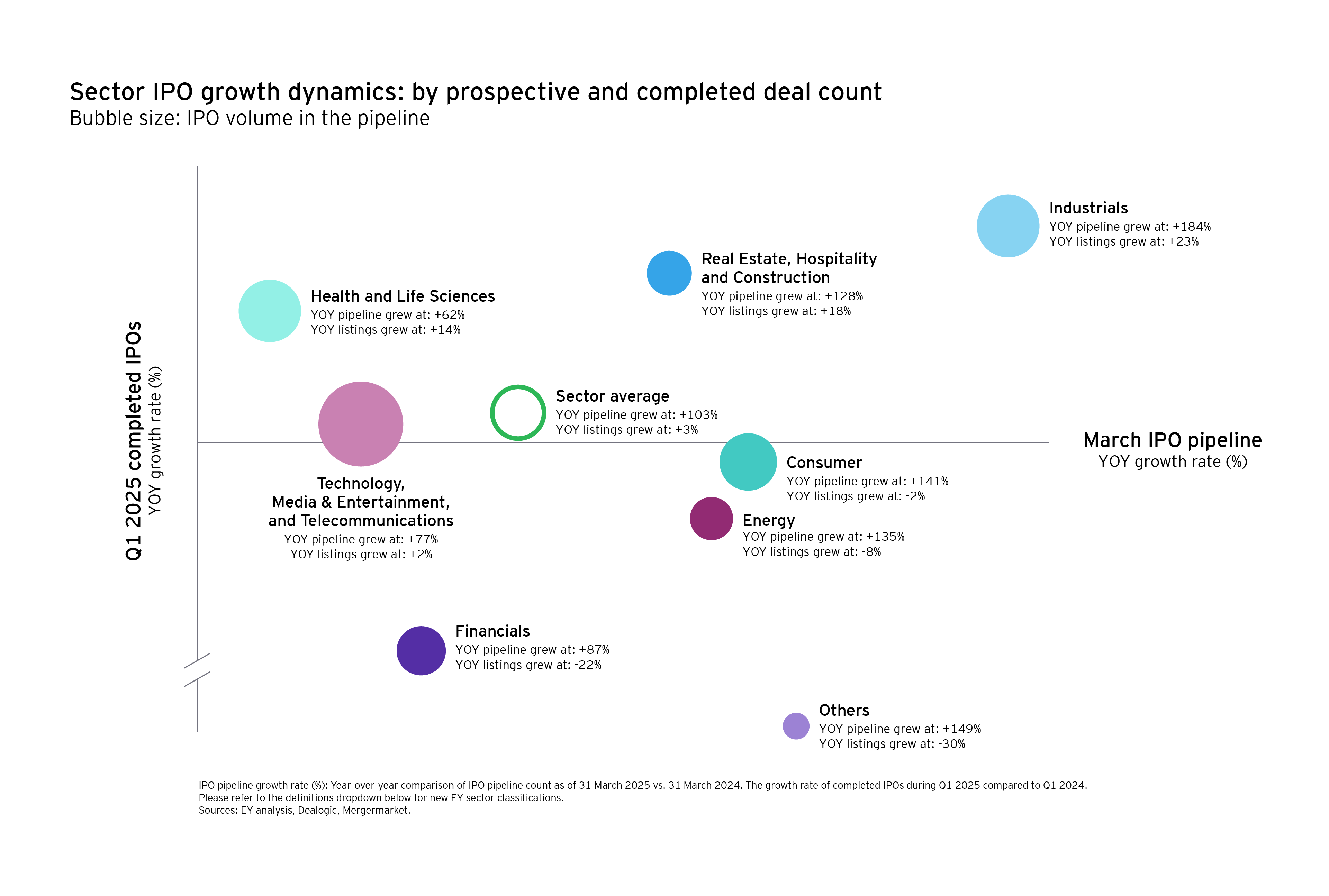

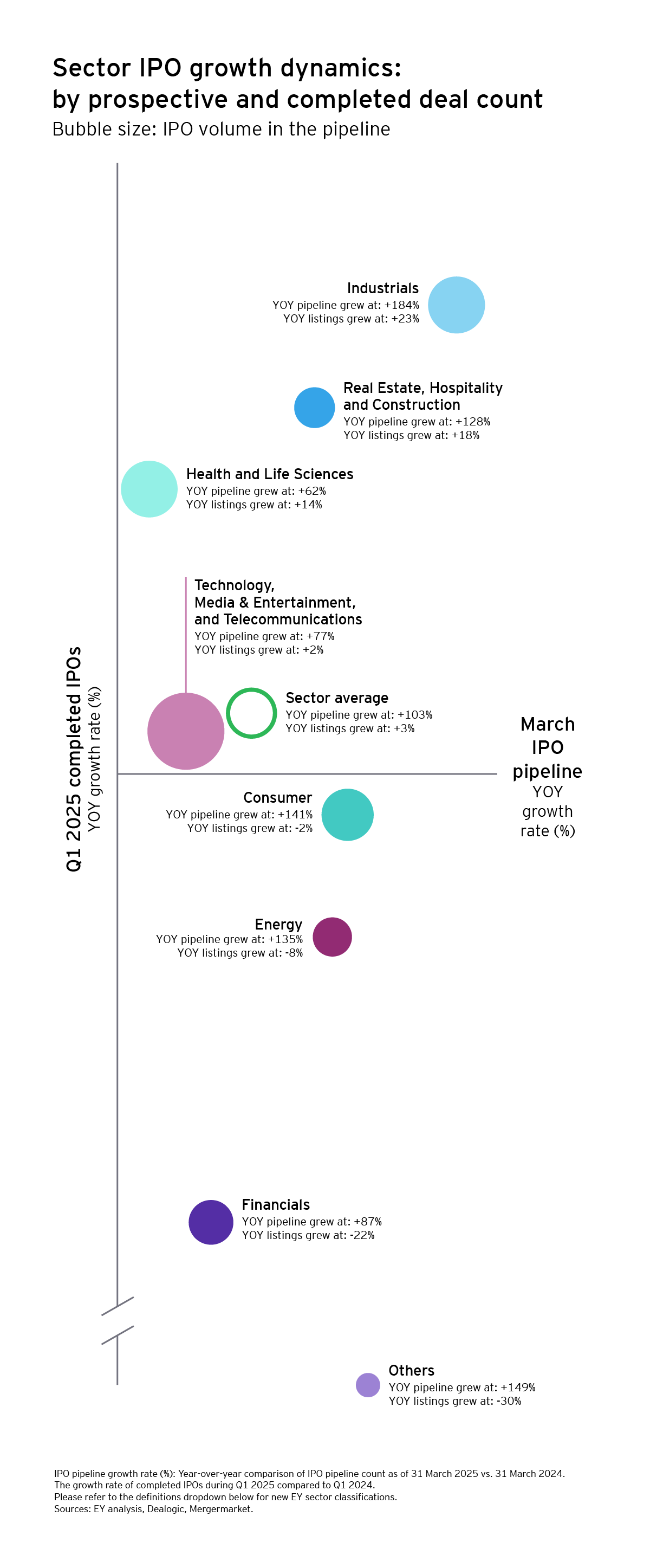

IPO pipelines are filling up, with Industrials and Real Estate, Hospitality & Construction the most confident sectors

While IPO pipelines across all sectors surged YOY in Q1 2025, completed listings rose in only half the sectors from the same period last year, curbing optimism with caution.

The Industrials and Real Estate, Hospitality and Construction sectors led the pack, demonstrating confidence in IPO pipeline growth and completions, respectively. Construction notched a record Q1 peak since 2001, driven largely by India.

The Health and Life Sciences sector also demonstrated strength in public offerings, marked by a 62% YOY expansion in the build-up of new candidates. This, alongside a 14% YOY increase in completed IPOs, signals heightened interest in public listings. The Health sector, in particular, saw 11 IPOs in Q1 2025, the highest first quarter recorded in over two decades boosted once again by India.

Activity in TMT IPOs rebounded in Q1, fueled by strong US growth, and larger technology deals in India and South Korea.

With growing pipelines but shrinking listings, the Consumer, Energy, Financials, and other sectors navigated a complex Q1 2025 with caution. This split dynamic signals pent-up potential stalled by a volatile environment, with companies eyeing markets yet restrained by a late-March crash and soaring volatility.