EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How will Cyprus compete for investment in a disrupted world?

Each year, the EY organization carries out a survey amongst global investors to assess Europe’s attractiveness as an investment destination. This year, EY Cyprus augmented that research with a survey to assess Cyprus’ position in relation to our European neighbors and to establish where the key strengths, opportunities and potential exposure lie. Additionally, a select number of interviews were held with established investors to obtain their viewpoints.

When we first launched the EY Cyprus Attractiveness Survey, two years ago, our objective was to understand the international investment community’s perception of Cyprus’ attractiveness as an investment destination, identify the country’s comparative advantages and areas to focus on, and to present recommendations for improving our competitive position. We also intended to establish this survey and the accompanying forum as a benchmark which will measure progress in the years to come. The second edition of our survey clearly shows that Cyprus is on the right course to strengthening its competitive position. Against a background of global uncertainty and turmoil, participants’ responses show a marked improvement over 2020 and a marked optimism about the future. Almost one in three respondents report that their company plans to establish or expand operations in Cyprus during the next year,

The Cyprus survey, provides an overview of the Cypriot economy, focusing on key sectors that are attracting major FDI projects and highlights investors’ perceptions of Cyprus' comparative strengths and weaknesses as an investment destination.

The European environment

Investment in Europe recovered modestly by 5% after the strong decline of 2020, but with significant variations between countries and sectors of the economy. However, the war in Ukraine, the economic sanctions against Russia and rising energy prices appear to be negatively affecting Europe’s short-term attractiveness as an investment destination and putting several investment projects on hold. Recovery was led by manufacturing and logistics, reflecting company efforts of reshoring and nearshoring, moving production bases closer to the European market.

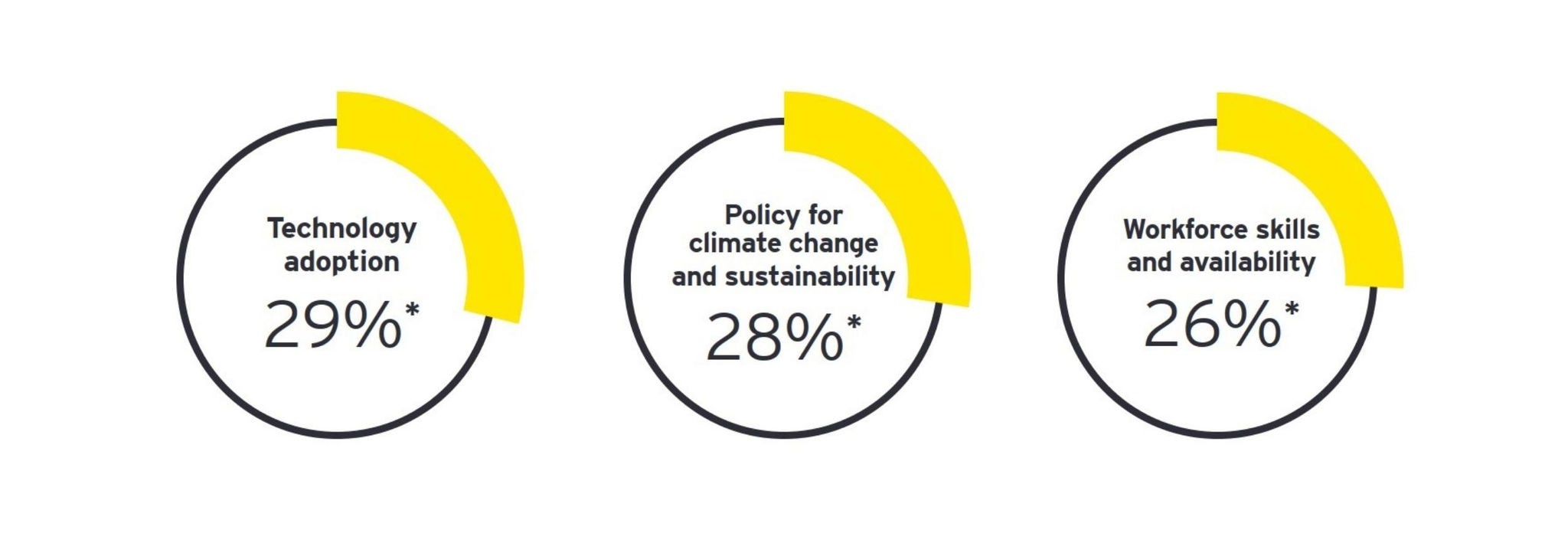

Several powerful trends influenced investment decisions in Europe in 2021, most prominently, the ongoing digitalization of the economy, the shift towards sustainable development, the efforts to upgrade skills to match current and future employment needs and the ongoing disruptions in global supply chains. Accordingly, the three most important factors determining investment destinations in Europe were:

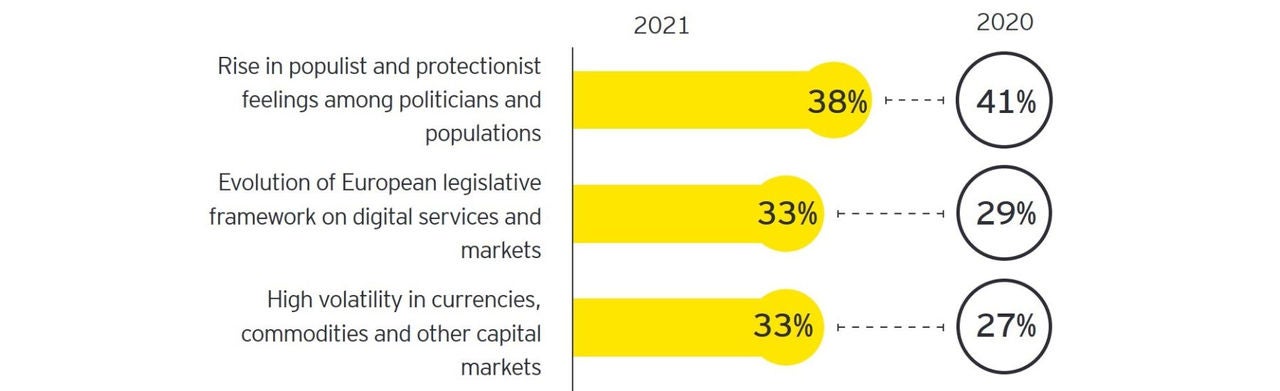

The rise in populist/protectionist feelings (38%), the high volatility facing the markets (33%) and the evolution of the European legislative framework on digital and environmental services to cope with rapidly changing developments (33%), were identified as the three main risks affecting Europe’s attractiveness over the next three years.

Survey findings on Cyprus

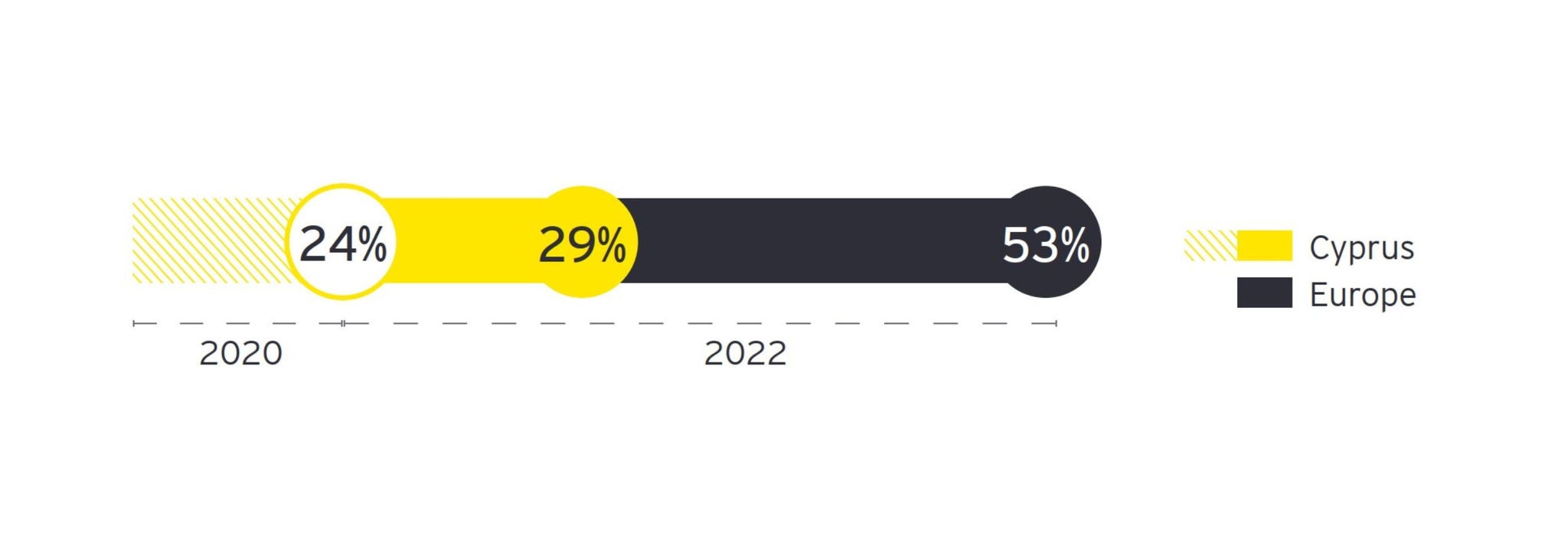

The percentage of respondents reporting that they have plans to establish or expand operations in Cyprus over the next year (29%) has increased compared to two years ago (24%), but is still well below that of other European countries and Europe as a whole (53%).

At the same time though, the majority of respondents (53%) expect that Cyprus' attractiveness will improve over the next three years, causing some optimism. In this case the figure is also closer to the European average (64%).

When asked to specify what type of investment activity they were contemplating for Cyprus, one in three companies mentioned supply chain and logistics (35%), followed by sales and marketing offices and activities (24%) and establishing headquarters (14%). Manufacturing, which did not appear among companies’ investment plans in 2020 was also mentioned by 7% of respondents, possibly driven by efforts to near-shore.

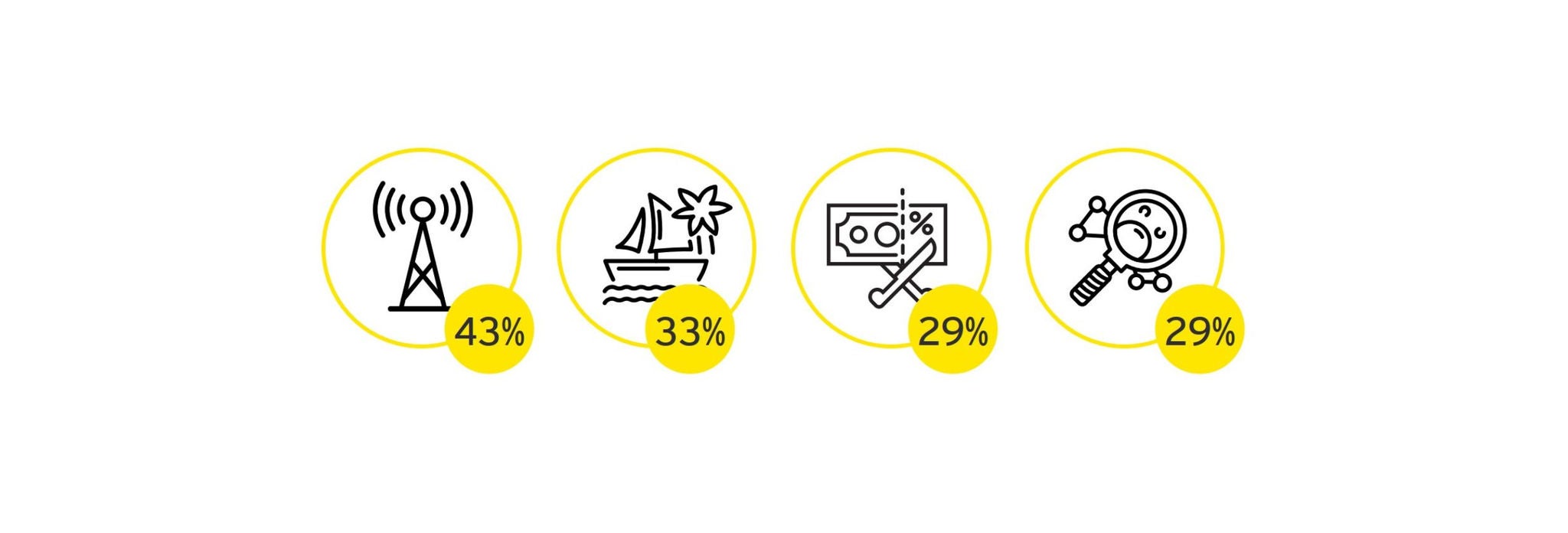

Investors perceive Cyprus' telecommunication and digital infrastructure (43%), offering a good quality of life (33%), favorable corporate taxation (29%) and R&D availability and quality (29%) as the country’s most attractive attributes as an investment destination.

Priorities identified by respondents for further improving Cyprus' competitive position in the global economy include among others allowing regulation to keep pace with technological and other disruptions (43%), support for high-tech industries and innovation (40%) and investing more in major infrastructure and urban projects (34%). Room for improvement was also identified with regards to creating a more entrepreneurial, less bureaucratic, less administrative culture, as well as being more supportive of start-ups and SMEs. Survey participants also evaluated Cyprus based on a number of criteria related to the three key pillars identified by the European survey as critical for FDI decisions going forward (i.e., technology, sustainability and local talent). In the case of technology, areas where Cyprus is seen as performing better than its European counterparts include its network of technology start-ups and research institutions (59%) and support by government bodies and regulatory authorities to drive the digital agenda (57%). Under sustainability the list includes the ecosystem of innovative cleantech and sustainability businesses (66%) and local consumer culture (54%), while under talent the list includes students’ exposure to international experiences (51%) and broad access to university education (41%) (under talent). Areas to improve under the three key pillars include the availability of venture capital and other forms of financing, intellectual property protection, decarbonization of their supply chains , developing the local workforce’s skills and competencies to facilitate sustainability projects, increased penetration of renewable energy sources (RES), more investment in digital skills and a digital culture and enhancement of the collaborations between business and academia. The performance of each country in these critical domains will largely determine its success in attracting investment and, by extension, the rate at which their economies will develop over the coming years. Cyprus will need to focus on the areas where it is seen as performing below its European counterparts, as presented above. The survey confirms that Cyprus’ broader geopolitical situation continues to cast its shadow over investors’ decisions to invest in the country, with 55% of the participants identified this as either a “critical” or a “very important” factor.

Recommendations for enhancing attractiveness

- Retaining focus on digital economy through, among other things, further investing in digital infrastructure, supporting digital skilling and re-skilling of local workforce, further digitalization of government services and actively promoting digital culture and the uptake by the general population, and encouraging public-private sector cooperation. The significant funds allocated to digital transformation through our national RRP will be key in this respect.

- Overcoming workforce challenges by helping to match skills to current and future employment needs. The development of new, and where appropriate, specialized higher-education institutions should be encouraged, and the active cooperation between the industry and academia should be promoted at all levels.

- Establishing a flourishing entrepreneurial ecosystem where startups and SMEs can flourish and grow sustainably. Simplifying processes, improving transparency and facilitating the sharing of information, transiting fully to e-government, encouraging alternative funding, and providing incentives for R&D and innovation are only some of the ways to achieve this.

- Accelerating the efforts to establish Cyprus as a regional technology and innovation hub, by joining forces with relevant stakeholders to improve incentives and build a comprehensive ecosystem to support the information and communications technology (ICT) sector and its growth. Encouraging collaboration between the public and private sector to ensure effective access to the global tech community and effective communication of Cyprus' competitive advantages.

- Intensifying diversification efforts into developing sectors and new areas, such as supply chain and logistics, energy, education, and medical. Also, it is recommended to support traditional sectors (such as tourism, professional services and shipping) to focus and transform to remain competitive in today’s dynamic and technology-driven environment.

- Supporting the efforts of the financial services sector to regain its health, transform, achieve efficiencies, and concentrate on the funding of innovative and sustainable projects.

- Embracing sustainability ahead of our European counterparts, by creating the culture, developing the necessary skills and competencies, establishing the regulatory framework, and facilitating the education of local population and the sharing of information.

- Capitalizing on recent geopolitical developments by exploiting our EU membership, strategic location and other competitive advantages in the region, in order to gain a key regional role in fields like energy and supply chain.

To read the Executive Summary Document, click here.

EY Attractiveness Survey Cyprus 2022

Summary

The second edition of the EY Cyprus Attractiveness Survey 2022, was conducted against a background of rising geopolitical tensions and economic uncertainty. While addressing the immediate challenges posed by these developments, we need to remain focused on the farreaching, long-term changes that are sweeping our world and, increasingly, influencing investment decisions.

This report, along with a plethora of thought-provoking findings, includes a wide range of proposals and recommendations which, we hope, will spark a meaningful debate. Meanwhile, EY Cyprus will repeat this survey at regular intervals in the future, to monitor progress, changes in perceptions and new trends, and identify areas of improvement.