EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

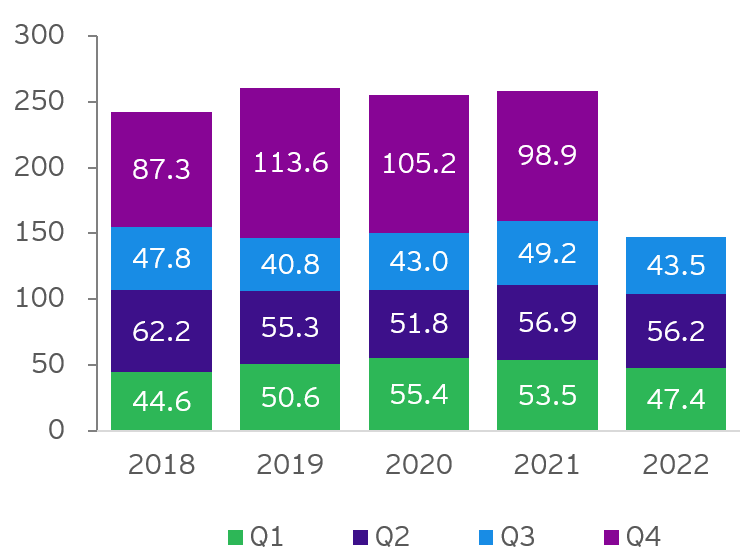

Outward direct investment generally stable with slower overseas M&A activities. China overall ODI reached US$106.8 billion in the first three quarters of 2022, down 0.3% YOY and the Q3 figure increased 10% from that of Q2.

In brief

- China overall outward direct investment (ODI) reached US$106.8 billion in the first three quarters of 2022, down 0.3% year-on-year (YOY) and the Q3 figure increased 10% from that of Q2. The non-financial ODI reached US$85.9 billion, up 6.3% YOY. The Belt and Road (B&R) non-financial ODI increased 5.2% YOY to US$15.7 billion1.

- The value of announced China overseas mergers and acquisitions (M&As) reached US$23.5 billion, down 49% YOY to a historic low compared to the same period in the past years. There were 379 China announced overseas M&A deals in the first three quarters of the year, down 6% YOY2.

- Newly-signed China overseas engineering, procurement and construction (EPC) projects decreased 7.9% YOY to US$147.1 billion1.

The global economy is filled with intensified instability and increased complexity. International Monetary Fund (IMF) projected a worldwide slowing growth by 2.3% in 2023. Developed countries might experience an estimated growth by 1.1% while emerging and developing countries by 3.7%. Against this backdrop, more challenges would be expected for international development of Chinese enterprises. In China, the 20th National Congress concluded with clear messages for upholding the national fundamental strategy of opening up, economic globalization and true multilateralism. Some development directions were outlined, for example, to further improve the international circulation, jointly build new momentum for global development, strengthen cooperation with developing countries, and promote quality development of the Belt and Road Initiative (BRI). Chinese enterprises will continue going out for long-term development through international cooperation and competition, so as to improve core competitiveness in line with the favorable national policy, tap market potential and enhance international presence.

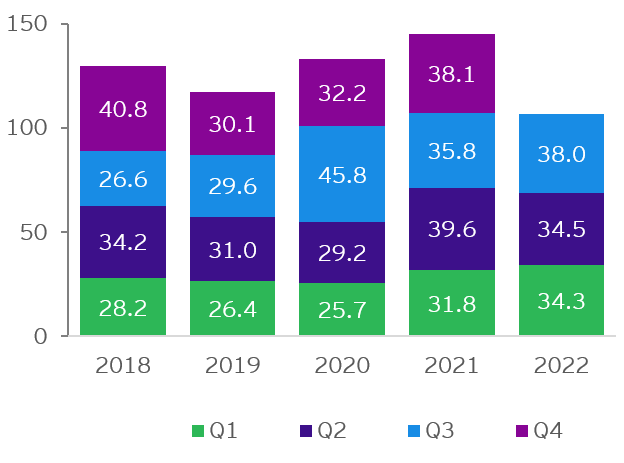

ODI develops steadily with investment in some real-economy sectors show increases

China’s Ministry of Commerce (MOFCOM) statistics showed that China overall ODI reached US$106.8 billion in the first three quarters of 2022, down 0.3% YOY and the Q3 figure increased 10% from that of Q2. China non-financial ODI reached US$85.9 billion in the first three quarters of 2022, up 6.3% YOY. Investments in leasing and business services reached US$29.3 billion (up 26.7% YOY) and those in manufacturing, wholesale & retail, construction and other sectors were also on the rise. For instance, in the green development realm, a number of Chinese electric vehicle and battery manufacturers have raised factory capacities in countries like Germany and Hungary for increased overseas presence and business development. The B&R non-financial ODI reached US$15.7 billion, up 5.2% YOY and representing 18.2% of the total. The investments were made mainly in ASEAN, Pakistan, the United Arab Emirates, Serbia and Bangladesh.

Figure 1: China overall ODI (US$ billion)

*The round-up statistics in this article may not add to the actual totals.

Source: Monthly Statistics in Brief, China MOFCOM

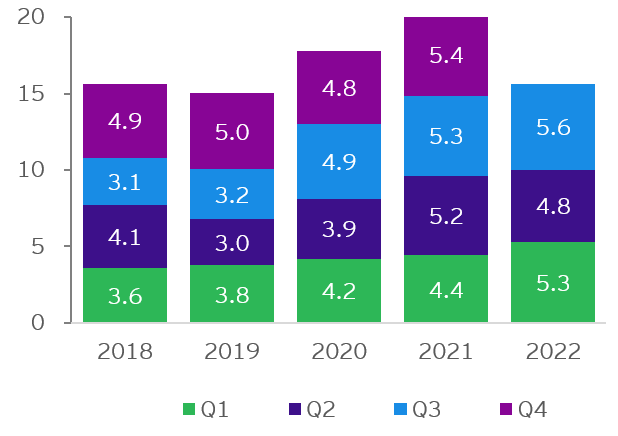

Figure 2: China non-financial ODI along the B&R (US$ billion)

*The round-up statistics in this article may not add to the actual totals.

Source: Monthly Statistics in Brief, China MOFCOM

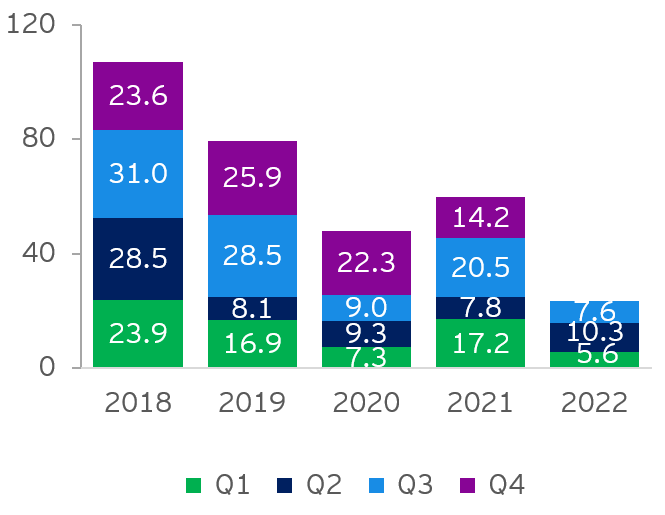

China overseas M&As continued to slow without turning point in sight

In the first three quarters of 2022, the value of China announced overseas M&As reached US$23.5 billion, down 49% YOY to a historic low compared to the same period in the past years. There were 379 China announced overseas M&A deals during the period, down 6% YOY.

Figure 3: Value of China announced overseas M&As (US$ billion)

*The round-up statistics in this article may not add to the actual totals.

Sources: Refinitiv; Mergermarket, including data from Hong Kong, Macau and Taiwan, and deals that have been announced but not yet completed, data was downloaded on 10 October 2022; EY analysis

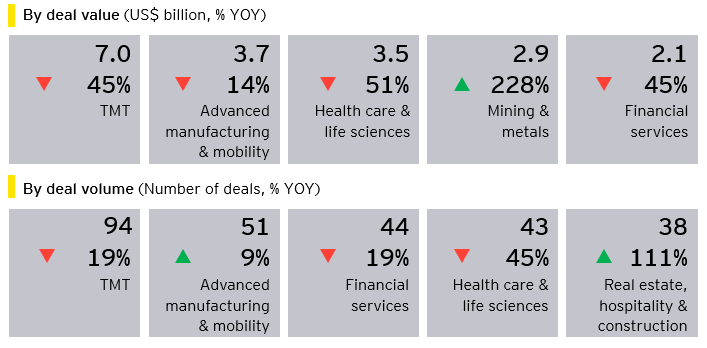

Figure 4: Deal value and volume of top five sectors of China overseas M&As in the first three quarters of 2022

Sources: Refinitiv; Mergermarket, including data from Hong Kong, Macau and Taiwan, and deals that have been announced but not yet completed, data was downloaded on 10 October 2022; EY analysis

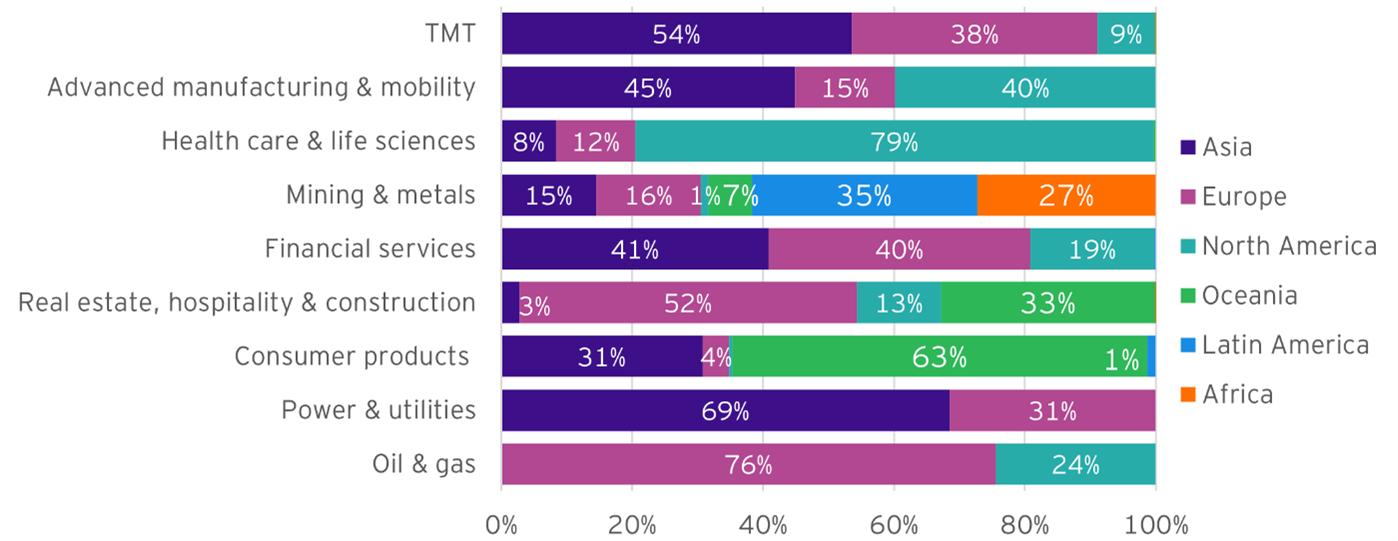

Figure 5: Geographical distribution of China announced overseas M&As by sector in the first three quarters of 2022 (by deal value)

Sources: Refinitiv; Mergermarket, including data from Hong Kong, Macau and Taiwan, and deals that have been announced but not yet completed, data was downloaded on 10 October 2022; EY analysis

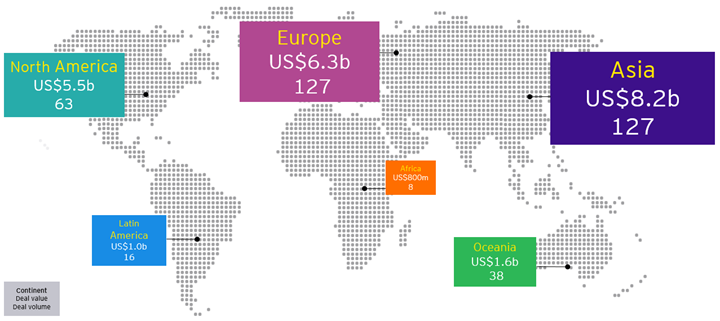

Figure 6: Deal value and volume of China overseas M&As by continent in the first three quarters of 2022

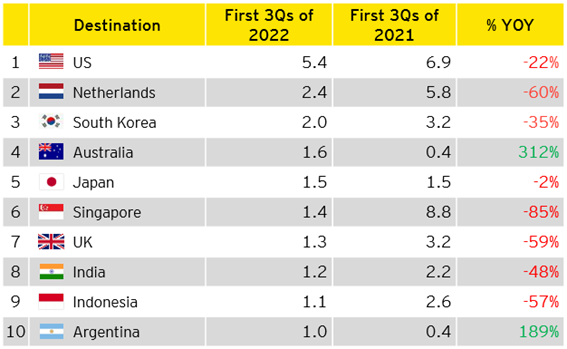

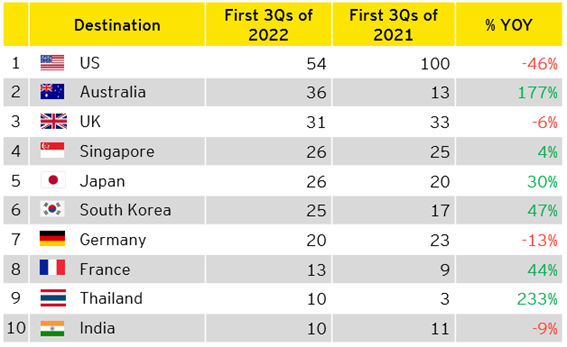

Figure 7: Top 10 destinations of China overseas M&As in the first three quarters of 2022 (By deal value: US$ billion)

Sources: Refinitiv; Mergermarket, including data from Hong Kong, Macau and Taiwan, and deals that have been announced but not yet completed, data was downloaded on 10 October 2022; EY analysis

Figure 8: Top 10 destinations of China overseas M&As in the first three quarters of 2022 (By deal volume)

Sources: Refinitiv; Mergermarket, including data from Hong Kong, Macau and Taiwan, and deals that have been announced but not yet completed, data was downloaded on 10 October 2022; EY analysis

Relatively smaller and promising EPC projects might be more attractive amid rising risk of global economic slowdown

Newly-signed China overseas EPC projects decreased 7.9% YOY to US$147.1 billion in the first three quarters of 2022. For instance, a Chinese enterprise recently signed up the largest transportation and public infrastructure project in Saudi Arabia that had a contract value of about RMB7.9 billion. Another Chinese enterprise signed up a project related to iron ore exploration in Kazakhstan that had a contract value of about US$650 million4. Overall, the volume of newly-signed mega-scale projects decreased and that of relatively smaller and promising projects increased. Relatively smaller projects are generally less risky, more financeable and manageable, whilst being close to people’s livelihood and needs. These beneficial factors might lead to higher priority for relatively smaller projects going forward. Overseas EPC turnover was US$107 billion, down 0.4% YOY. The value of newly-signed China EPC contracts in the B&R countries and regions reached US$76.7 billion, down 5.1% YOY, accounting for 52.5% of the total. The completed turnover was US$57.3 billion, down 7.2% YOY, accounting for 53.6% of the total.

Figure 9: Value of newly signed China overseas EPC contracts (US$ billion)

*The round-up statistics in this article may not add to the actual totals.

Source: Monthly Statistics in Brief, China MOFCOM

Summary

EY releases the Overview of China outbound investment of the first three quarters of 2022. The overview shows that China ODI was generally stable during the period as investment in some real-economy sectors showed increases and more Chinese enterprises have taken on greenfield investment. Nonetheless, the outbound M&A activities continued to slow recording a value drop of 49% YOY. Asia remained the top overseas M&A destination during the period.

Related articles

Overview of China outbound investment of 2022

Outward direct investment was generally stable whilst overseas M&As continued to decrease with pick-up in some regions and sectors. China overall ODI reached US$146.5 billion in 2022, up 0.9% YOY.

Overview of China outbound investment of H1 2022

Outward direct investment generally stable with a rebound of overseas M&As in Q2; caution is exercised for the future. China overall ODI reached US$68.8 billion in H1 2022, down 3.6% YOY.

Chinese companies in the US remain cautiously positive as opportunity and challenge co-exist

Chinese companies in the US remain cautiously positive as opportunity and challenge co-exist, according to 2021 Annual Business Survey Report on Chinese Enterprises in the US.