Federal government releases CERS

Tax Alert No. 54, 11 November 2020

Structured in a manner similar to the Canada Emergency Wage Subsidy (CEWS), the CERS takes over where the Canada Emergency Commercial Rent Assistance program (CECRA) left off.3 Under the CERS, qualifying organizations that have suffered a decline in revenue would be eligible to receive a subsidy in respect of certain of their real property-related expenses. There are, however, key differences between the CECRA and the CERS, including:

- Where the CECRA was only available in respect of small business tenants, the CERS can be claimed by businesses, not-for-profits and charitable organizations that own the real property that they use in the course of their ordinary activities, to assist in covering interest expenses on mortgages, insurance expenses and property taxes, except where that real property is used primarily to earn rental income from arm’s length parties, which disqualifies most commercial landlords from applying for the CERS.

- Unlike the CECRA, which was only available for small business tenants who paid a maximum of $50,000 in gross rent per location, the CERS can be claimed by renters and property owners of all sizes (assuming all other eligibility criteria are met).

- The CERS will be administered by the Canada Revenue Agency (CRA), as opposed to the Canada Mortgage and Housing Corporation.

- A frequent criticism of the CECRA was that landlords were required to apply for the rent assistance on behalf of their small business tenants. By contrast, the CERS provides benefits directly to renters, without requiring landlords’ participation (please see TaxMatters@EY September 2020 The CECRA: last chance for existing applicants for an in-depth discussion of the CECRA program and the issues inherent in requiring landlords to apply on tenants’ behalf).

The subsidy available under the CERS is generous and can be claimed in addition to CEWS. However, despite the Department of Finance’s assurance that the CERS is “simple, easy-to-understand”, the legislation is technical, and careful consideration of one’s eligibility and entitlement is required. For more information, please contact your EY or EY Law advisor.

The base subsidy and the lockdown support

The CERS can be thought of as two distinct subsidies: (i) the base subsidy and (ii) the top-up subsidy, referred to as the “Lockdown Support”.

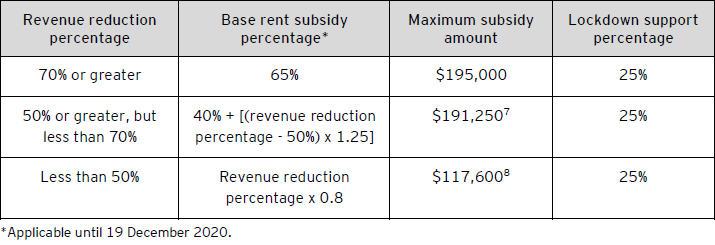

- Base subsidy – A maximum base subsidy of up to 65% of qualifying rent expenses paid, or deemed to be paid (please see below discussion regarding deemed payment of expenses), in the qualifying period will apply until 19 December 2020. Similar to CEWS 2.0, the subsidy will be calculated on a sliding scale that gives more support to those entities with higher rates of revenue decline (please see EY Tax Alert 2020 No. 42 Redesign and extension of the Canada Emergency Wage Subsidy for an in-depth analysis of CEWS 2.0).

- Lockdown Support – A 25% subsidy is available for eligible entities that have experienced any revenue drop (i.e., 1% drop in revenue would be sufficient) and are subject to a public health restriction that has been introduced in response to the COVID-19 pandemic (e.g., restaurants, fitness studios or retail stores that have temporarily shut down or have had their activities significantly limited by a mandatory public health order for a least one week). The Lockdown Support is adjusted according to the number of days in the qualifying period during which a particular property is subject to the public health restriction.

For the base subsidy, the maximum amount of qualifying rent expenses that can be claimed for each qualifying period is $75,000 per location. The maximum amount of qualifying rent expenses that can be claimed for the affiliated group of entities for a qualifying period is $300,000. Accordingly, the maximum subsidy amount available under the base subsidy is $195,000 per affiliated group of entities per qualifying period (as described below).

For the Lockdown Support, the maximum amount of qualifying rent expenses that can be claimed for each qualifying period is $75,000 per location. There is no overall cap that applies for an affiliated group of entities. Accordingly, the maximum Lockdown Support available is $18,750 per location for each qualifying period, but there is no upward limit for the amount of Lockdown Support available for an affiliated group (as described below).

Who can apply?

Recipients of the CERS must be both an “eligible entity” and a “qualifying renter”4.

The definition of eligible entity is the same for the CEWS and the CERS and includes individuals, taxable corporations and trusts, non-profit organizations, registered charities and certain partnerships, along with those entities that have been prescribed by regulation. Please see EY Tax Alert 2020 No. 34 Eligibility for the Canada Emergency Wage Subsidy extended – COVID‑19 for a discussion of the expanded list of “eligible entities”.

Recipients of the CERS must also be a qualifying renter. A qualifying renter means an eligible entity that files an application for the CERS in the prescribed form and manner within 180 days of the end of the qualifying period in question. Further, as with the CEWS, the individual who has principal responsibility for the financial activities of the eligible entity attests that the application is complete and accurate in all material respects. Lastly, a qualifying renter must meet at least one of the following conditions:

- Has a payroll account as of 15 March 2020 (or has been using a payroll service provider, as allowed for under the CEWS);

- Has a business number as of 27 September 2020 and provides records and other information satisfactory to the CRA in support of its application;5 or

- Meets eligibility criteria prescribed by future regulations.

What types of property are covered by the CERS?

The CERS is only available in respect of “qualifying property”. Qualifying property is any real property or immovable property in Canada used by the eligible entity in the course of its ordinary activities. Real property that is a self-contained domestic establishment (i.e., residential property) is excluded from the definition of qualifying property. Where an eligible entity owns property that is part residential and part commercial, further analysis may be required.

Further, the CERS cannot be claimed for expenses paid, or deemed to be paid, in respect of qualifying property owned by an eligible entity that is used by that eligible entity primarily to earn rental income (unless that eligible entity earns rental income from a person or partnership with which it does not deal at arm’s length). This rule excludes most commercial landlords that receive rental income from arm’s length parties from claiming the CERS, presumably because their tenants should separately be eligible for the subsidy and the government does not want two parties claiming the CERS in respect of a single property.

What types of expenses are covered?

There are two categories of expenses that can constitute “qualifying rent expenses” paid, or deemed to be paid, in respect of a qualifying property for a qualifying period:

- For tenants (and sub-tenants): the rental amount that is paid, or deemed to be paid, for the use of, or the right to use, the qualifying property (the Rent Expenses).

- For owners: amounts that represent mortgage interest, insurance costs and property taxes (the Property-Ownership Expenses).

These Rent Expenses and Property-Ownership Expenses must be paid, or deemed to be paid, to an arm’s length party pursuant to a written agreement (renewal or assignment of a written agreement) entered into before 9 October 2020. Accordingly, where an eligible entity pays Rent Expenses or Property-Ownership Expenses to a related party, the CERS will not be available in respect of these expenses.

Rent Expenses include gross rent, rent based on percentage of sales, or amounts required to be paid under a net lease as base rent, regular instalments of operating expenses (such as insurance, utilities and common area maintenance expenses), property and similar taxes, and regular instalments for services ancillary to the rental of real or immovable properties. Further, certain amounts received by a landlord under the CECRA program that were applied during the qualifying period, if those amounts would otherwise be required to be refunded to the renter, can be claimed as Rent Expenses. However, any sales tax component of these costs, amounts paid in lieu of or in satisfaction of damages, amounts paid under a guarantee, security, or similar indemnity or covenant, payments arising due to default, interest and penalties on unpaid amounts, fees payable for discrete items or special services, and reconciliation adjustment payments may not be claimed as Rent Expenses.

Property-Ownership Expenses include interest expenses on a debt obligation secured by a mortgage or hypothec on the qualifying property (provided the amount of the debt obligation does not exceed the cost amount of the qualifying property), amounts paid for insurance on the qualifying property, and property and similar taxes on the qualifying property, including school and municipal taxes.

An eligible entity’s qualifying rent expense must be reduced by all amounts received or receivable (directly or indirectly) by the eligible entity in respect of the qualifying period on account of rent from a party with which the eligible entity deals at arm’s length. Therefore, where a renter subleases out a portion of the qualifying property to an arm’s length party, any amounts received in respect of that sublease must be deducted from the eligible entity’s qualifying rent expense.

An eligible entity that owns qualifying property that is used primarily to earn rental income from a person or partnership with which the eligible entity does not deal at arm’s length may be able to claim the CERS. Indeed, it is common to structure operating businesses such that the real property used by the business is owned by a separate, related entity. Since qualifying rent expenses do not include such expenses paid to a non-arm’s length person, the operating company in such situations would not have qualifying rent expense. However, the entity that owns the property may qualify in respect of its qualifying rent expenses (i.e., mortgage interest, property taxes, insurance) as a consequence of the overall revenue decline of the two corporations. In such cases, the eligible entity (i.e., the property owner) will likely have to rely on one of the special rules for computing qualifying revenue, discussed below (e.g., determining the qualifying revenue of the affiliated group on a consolidated basis pursuant to paragraph 125.7(4)(b) of the Income Tax Act or using the “look through” election in paragraph 125.7(4)(d)).

Expenses paid or deemed to be paid

The original iteration of the CERS legislation adopted by the House of Commons provided that the CERS could only be claimed in respect of qualifying rent expenses that had been actually paid by an eligible entity. This was considered a major flaw, as it would force businesses experiencing severe cash flow issues to pay such expenses before they could seek partial reimbursement through the CERS. Responding to criticism of this requirement, on 5 November 2020, the Minister of Finance introduced an amendment to the CERS legislation that provides, where the individual who has the principal responsibility for the financial activities of eligible entity attests that the eligible entity intends to pay the amount of qualifying rent expenses that is owing no later than 60 days after the day on which the Minister pays the CERS amount, such expenses are deemed to be paid by that eligible entity on the date they first became due. Although this amendment has not yet been made, it is anticipated to be incorporated into the legislation.

Computing qualifying revenues for the base subsidy

Qualifying revenues, which must be computed to determine the amount of base subsidy an eligible entity is entitled to, will be calculated in the same manner as under the CEWS. Accordingly, an eligible entity’s qualifying revenue for the purposes of the CERS is its revenue from its ordinary activities in Canada earned from arm’s length sources, determined using its normal accounting practices. Revenues from extraordinary items and amounts on account of capital are excluded. Registered charities and non-profit organizations may opt to exclude revenue from government sources as part of the calculation.

Similarly, the elections available under the CEWS can be made to allow an eligible entity’s qualifying revenue to take into account certain non-arm’s length transactions, such as in circumstances where an eligible entity makes all of its sales to a related company that in turn earns arm’s length revenue. Affiliated groups that do not normally calculate revenue on a consolidated basis may elect to do so. Joint ventures may make an exceptional computation election as well. Please see EY Tax Alert 2020 No. 30 for a detailed discussion of how to compute qualifying revenues.

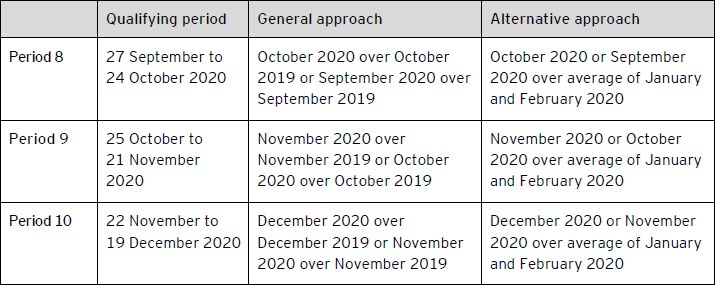

The reference periods to calculate the revenue reduction percentage for the base subsidy

The first qualifying period for the CERS commenced (retroactively) on 27 September 2020 and, for administrative simplicity, the numbering of the CERS qualifying periods aligns with that of the CEWS. So far, the legislation describes only the first three qualifying periods (Period 8: 27 September to 24 October 2020; Period 9: 25 October to 21 November 2020; Period 10: 22 November to 19 December 2020). Additional qualifying periods can be added by regulation, and it is anticipated that the CERS, like the CEWS, will be available until June 2021.6

As with the CEWS, an eligible entity’s revenue decline can be measured using (i) the general approach: by comparing monthly revenues, year over year, for the applicable calendar month; or (ii) the alternative approach: by comparing its current reference month revenues with the average of its January and February 2020 revenues. Once an approach is selected, it must be adopted for the first three qualifying periods. Further, the same approach as is used to apply for the CEWS must be used when applying for the CERS, and vice versa.

As under CEWS 2.0, an eligible entity can rely on either its revenue reduction percentage for the current qualifying period or that for the previous qualifying period, whatever provides a more favourable subsidy amount (see summary chart below).

Computing base rent subsidy percentage and base subsidy amount

Once a revenue reduction percentage is determined, the applicable base rent subsidy percentage is calculated by applying the formula in the legislation. The table below summarizes the base rent subsidy percentage and the maximum subsidy amounts available per qualifying period, assuming that the eligible entity or the affiliated group of eligible entities has more than $300,000 of qualifying rent expenses, where the rent expense at each location is at least $75,000 (i.e., four or more qualifying properties are required).

The Lockdown Support

Renters or owners that are eligible for the base subsidy may also be eligible for Lockdown Support if the qualifying property is subject to a “public health restriction”. The Lockdown Support is 25% of qualifying rent expenses paid or deemed to be paid, up to a maximum of $75,000 per location per qualifying period. The Lockdown Support is pro-rated for the number of days in the period during which the relevant location was affected by the restrictions.

A public health restriction must meet the following conditions: it is made under a public health order issued in response to COVID-19 under the laws of Canada, a province or territory (including orders made by a municipality or regional health authority under one of those laws); the public health restrictions must be limited in scope (e.g., defined geographical boundaries, type of business or other activity, or risks associated with a particular location); the restrictions must impose monetary penalties or other sanctions in the event of non-compliance; and the restrictions cannot result from the violation of an order that meets the previous conditions. In addition, the public health restrictions must result in the cessation of some or all activities of the eligible entity at, or in connection with, the qualifying property for a period of at least one week, with such cessation based on the type of activity rather than the extent to which the activity may be performed). So, for example, an order requiring the cessation of indoor dining or the closure of a gym would qualify, but an order limiting the number of people who can dine indoors or participate in a gym class would not qualify.

Finally, where a renter or owner is forced to cease some or all of the activities at the location, the renter or owner must be able to demonstrate that it is reasonable to conclude that the ceased activities were responsible for at least approximately 25% of the revenues of the eligible entity at that location. The rules relating to partial closure of a business are complex, and businesses impacted by a partial closure will want to ensure that proper documentation is collected to support their claim.

Anti-avoidance rules

Similar to the CEWS, anti-avoidance rules apply such that if a CERS applicant enters into transactions or participates in an event (or a series of transactions or events) or takes action (or fails to take action) that has the effect of reducing revenue or increasing the qualifying rent expenses and one of the main purposes of the transaction, event or action is to increase the CERS entitlement, that applicant will be denied the CERS and may be liable for a penalty equal to 25% of the CERS amount claimed.

This rule is concerningly far-reaching. Accordingly, careful consideration should be given prior to undertaking any out-of-the-ordinary transactions or events that could potentially be caught by this rule.

CRA audits

As in the case of the CEWS, it is anticipated that the CRA will be auditing CERS claims. Accordingly, businesses applying for the CERS are advised to thoughtfully prepare and maintain the necessary records to support their CERS application.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Thomas Brook

+1 403 826 7316 | thomas.brook@ca.ey.com

Emily Gair

+1 416 943 5227 | emily.gair@ca.ey.com

Philippe-Antoine Morin

+1 514 874 4635 | philippe-antoine.morin@ca.ey.com

David Robertson

+1 403 206 5474 | david.d.robertson@ca.ey.com

Daniel Sandler

+1 416 943 4434 | daniel.sandler@ca.ey.com

Jeremy Shnaider

+1 416 943 2657 | jeremy.shnaider@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.