Alberta announces Innovation Employment Grant

Tax Alert No. 44, 5 August 2020

“The Innovation Employment Grant provides an efficient and explicit incentive for growth and job creation in Alberta's tech and innovation sector. The incremental approach will be unique within Canada and will help attract start-ups and high-growth firms. Companies in pre-income and scale-up phases will benefit from the IEG, and as they become more profitable graduate to the Job Creation Tax Cut. These two initiatives will work together to support the growth of businesses of all sizes.”

Travis Toews, President of Treasury Board and Minister of Finance

On 22 July 2020, Alberta premier Jason Kenney announced the launch of the Innovation Employment Grant (IEG) set to come into effect on 1 January 2021. The IEG will provide grants worth up to 20% of a company’s research and development (R&D) costs incurred in Alberta. Supporting legislation will be introduced in the fall of 2020. Qualifying corporations will receive an 8% grant for their baseline R&D costs and an additional 20% grant on any incremental spending above the baseline up to a maximum of $4 million in annual R&D expenditures (see below).

Background

Alberta-based companies with active R&D programs have historically benefited from several federal and provincial funding programs, notably the federal scientific research and experimental development (SR&ED) program. For 10 years prior to 2020, Alberta offered a 10% refundable credit up to an annual maximum of $400k, regardless of the taxable position or size of claimants. This program made the province attractive and the support impactful to a full spectrum of innovative companies, from small technology start-ups to large resource firms.

In the 2019 provincial budget released in October 2019, Alberta’s finance minister announced that the province was cancelling its SR&ED support effective 1 January 2020.1 This step coincided with the elimination of four additional targeted business tax credits (including the Alberta Investment Tax Credit) in favour of the Job Creation Tax Cut — a stepped reduction in the provincial corporate tax rate from 12% to 8%. Motivation for these changes was apparently rooted in the government’s objective to “level the playing field for all job creators, rather than a select few.”2 This decision had a significant impact on the tech sector, where many start-ups cannot take advantage of low corporate tax rates if they are unprofitable during their early stages, a period when their greatest R&D investment typically takes place.

Responding to feedback received from stakeholders throughout the innovation space, the province assembled a working group3 to, among other things, suggest funding alternatives to the cancelled Alberta SR&ED tax credits. In part, it was recommendations of this group that led to the creation of Alberta’s IEG.

Innovation Employment Grant

Though distinct from the Alberta SR&ED tax credit it was designed to replace, the IEG will utilize the same qualifying criteria required for qualifying expenditures under the federal SR&ED program and will use qualifying SR&ED expenditures as the basis for IEG calculations. Finally, the grant will provide benefits on up to $4 million in annual R&D spending.

A distinguishing feature of the IEG is the concept of baseline spend, which will be calculated as the average R&D spend over the previous two years. Consequently, innovative start-ups will be able to immediately access the 20% grant, something the government is confident will re-invigorate investment in the province and help further promote economic diversification.

The IEG is focused on small and medium-sized entities, as it will be phased out for entities with between $10 million and $50 million of taxable capital.

Representative calculations

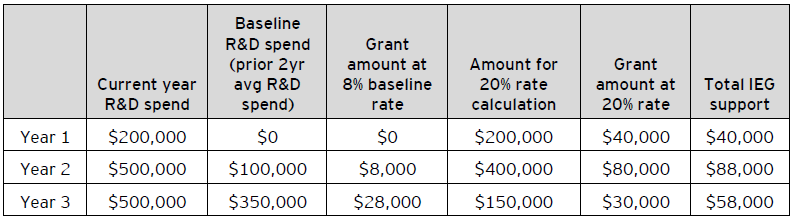

A start-up company with qualifying R&D expenditures of $200,000 will receive a $40,000 grant through the IEG. Provided it increases its R&D spend to $500,000 in the subsequent year, it will receive a $88,000 IEG grant. If it maintains its R&D spend at $500,000 in year three, its IEG support will drop to $58,000. These calculations are illustrated below.

Note – the details of the IEG presented in this tax alert are based on the announcement. As such, they are preliminary and subject to change based on the Alberta Government’s ongoing consultations with stakeholders.

Implications

This announcement of a new incentive program for Alberta is designed to instigate a return to technology investment as the province actively seeks to foster economic diversification. The IEG represents a key element of Alberta’s Recovery Plan, and while it does appear to target start-ups, it will also benefit existing firms that have previously been subscribers to the federal SR&ED tax incentive program that meet the tests outlined above. Although further details will be announced in fall 2020, the initial announcement suggests that the IEG will complement the federal SR&ED program and allow companies that qualify for the IEG to utilize existing claiming strategies and providers to access the grant. Along with the recent announcement by Alberta that it has accelerated the timeline of the Job Creation Tax Cut by 1.5 years to set the corporate tax rate at 8% as of 1 July 2020, the introduction of the IEG should improve Alberta’s national competitiveness and is welcome news for all companies currently engaged in, or planning to engage in, R&D in the province.

Learn more

For more information, please contact your EY advisor or one of the following professionals:

Korey Conroy, Calgary

+1 403 650 8571 | korey.conroy@ca.ey.com

Dean Radomsky, Calgary

+1 403 206 5180 | dean.w.radomsky@ca.ey.com

Dean Anderson, Saskatoon

+1 403 206 5180 | dean.anderson@ca.ey.com

Navid Hemmati, Edmonton

+1 780 638 6657 | navid.hemmati@ca.ey.com

Kevin Eck, Vancouver

+1 604 648 3646 | kevin.eck@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.