Redesign and extension of the Canada Emergency Wage Subsidy (CEWS 2.0)

Tax Alert No. 42, 23 July 2020

The Canadian federal government is extending the Canada Emergency Wage Subsidy (the “CEWS”) through to November 2020 and proposing major changes that will provide a wage subsidy to any employer who has experienced a revenue decline between July 2020 and November 2020 when compared, generally, to the respective prior month in 2019.

Key elements of the redesigned CEWS are:

- A base subsidy, calculated on a sliding scale that gives more support to businesses with higher rates of revenue decline;

- A top-up subsidy of up to 25% for employers most affected by the COVID-19 crisis;

- A safe harbour rule to ensure that an employer with a revenue decline of 30% or more will receive no less for periods 5 and 6 under the redesigned CEWS program than they would have under the initial design; and

- A separate CEWS rate structure for furloughed employees.

Introduced in April but made retroactive to 15 March 2020, the CEWS initially provided a wage subsidy equal to 75% of an employee’s eligible remuneration up to $847/week for a 12-week period for employers who had experienced at least a 30% drop in their arm’s length revenue.

The employer’s revenue drop was determined by comparing the relevant 2020 calendar month to either the same calendar month period in 2019 (i.e., March 2020 compared to March 2019) or to their average arm’s length revenue in January/February 2020.

In mid-May, the program was extended for an additional 12 weeks through to 29 August 2020.

On 17 July 2020, the Canadian federal government confirmed that not only would the program be extended for a further 12-week period to 21 November 2020, but in addition, eliminated the 30% revenue decline threshold for the remaining periods of the program, entitling any employer who has suffered a drop in “qualifying revenue” to qualify for the CEWS. The extent of the employer’s revenue drop will now determine the amount of subsidy to which the employer is entitled.

The CEWS has in effect been extended to 19 December 2020; however, details of the redesigned program have been announced only for qualifying periods beginning on 5 July 2020 and ending on 21 November 2020.

The filing deadline for claiming the CEWS was also extended from 30 September 2020 to 31 January 2021.

The draft proposals, which are included in Bill C-20, An Act respecting further COVID-19 measures, have received third reading in the House of Commons and are expected to be enacted in the coming days.

Structure of the CEWS program

The CEWS program is now divided into nine four-week “qualifying periods” commencing on 15 March 2020 and ending on 21 November 2020. To determine whether an “eligible entity” qualifies for the wage subsidy for a particular qualifying period, the entity compares its “qualifying revenue” for the particular 2020 calendar month that corresponds to the particular qualifying period to its “qualifying revenue” in the same calendar month in 2019. An “eligible entity” may also elect to use its average qualifying revenues in January and February 2020 as the basis for comparison.1

For the first four qualifying periods – CEWS 1.0 – if the entity experienced a decrease in its qualifying revenue of at least 30% (or at least 15% for March), then the entity was entitled to a wage subsidy of 75% of the wages and salaries payable by it to its employees in respect of the particular qualifying period, up to a maximum of $847/employee/week.

As announced on 17 July 2020, access to the wage subsidy program has been significantly broadened for the remaining five qualifying periods – CEWS 2.0.

Under CEWS 2.0, any eligible entity that has experienced a decrease in its “qualifying revenue” during the relevant calendar month compared to the corresponding 2019 calendar month will be entitled to a wage subsidy.

However, as opposed to being entitled to a subsidy of 75% of “eligible remuneration” paid during the particular qualifying period, the subsidy percentage is based upon the eligible entity’s percentage drop in qualifying revenue (known as the “revenue reduction percentage”). The amount of the subsidy also declines in later periods.

CEWS 2.0 “base percentage”

The revenue reduction percentage is then used to determine the “base percentage” of the subsidy for the eligible entity for the particular qualifying period.

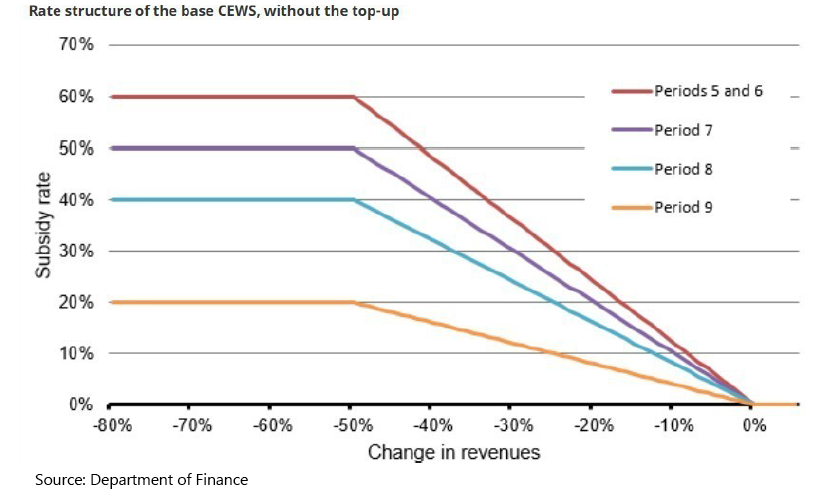

The Canadian federal government has designed CEWS 2.0 to provide for a larger wage subsidy during the summer of 2020, and then to reduce the amount of the subsidy through the fall of 2020, undoubtedly in the hope that as the provinces in Canada reopen their economies, the need for wage support will diminish as business returns to normal.

To achieve this, the “base percentage” for the first two periods of CEWS 2.0 (July and August 2020) is determined by increasing the eligible entity’s “revenue reduction percentage” by 20%; for the third period (September 2020) the eligible entity’s base percentage is equal to its revenue reduction percentage; for the fourth period (October 2020), the entity’s base percentage is equal to 80% of its revenue reduction percentage; and for the fifth period (November 2020), the entity’s base percentage is equal to 40% of its revenue reduction percentage.

The concept of “baseline remuneration” that is, the average weekly remuneration paid to the employee during the period of 1 January – 15 March 2020 (or alternate baseline period discussed below), is no longer relevant in the case of arm’s length employees.

For example, if an eligible entity experiences a 20% drop in each of the months of July through November 2020, the eligible entity’s base percentage will be 24% for July and August 2020 (being 20% x 1.2), 20% for September 2020 (being 20% x 1.0), 16% for October 2020 (being 20% x 0.8), and 8% for November 2020 (being 20% x 0.4).

A graphic representation provided by the Department of Finance is included below:

CEWS 2.0 “top-up percentage”

The Canadian federal government has also designed CEWS 2.0 to provide a greater wage subsidy to those eligible entities that have experienced (and continue to experience) a decrease in qualifying revenue of more than 50% by providing for a “top-up” to their base percentage, up to an additional 25%.

To determine whether it qualifies for a “top-up” and has met the more-than-50% threshold, the eligible entity does not compare its calendar month 2020 qualifying revenue to that in the corresponding 2019 month (which is generally used to determine its “base percentage”), but instead compares its average qualifying revenue for the three months in 2020 immediately preceding the current reference period calendar month to the average for the same three months in 2019 (or if the eligible entity has elected to use January/February 2020 as its “prior reference period”, then to its average qualifying revenue for January/February 2020).

So for example, to determine the eligible entity’s “top-up revenue reduction percentage” for July 2020, the eligible entity would compare its average monthly qualifying revenue in April, May and June 2020 to its average qualifying revenue for April, May and June 2019. If that percentage reduction is greater than 50%, the eligible entity would be entitled to a top-up to its base percentage.

To determine the actual “top-up percentage” for a particular qualifying period, the entity first subtracts 50% from its “top-up revenue reduction percentage” and then multiplies the remainder by 1.25%. This provides the eligible entity its “top-up percentage” for the current period. If the result is 25% or less, this is the eligible entity’s “top-up percentage” for the particular qualifying period. If it is greater than 25%, the entity’s “top-up percentage” is 25%.

The eligible entity then adds its “top-up percentage” (if any) to its “base percentage” for the particular period, and this is the percentage of the wage subsidy to which the eligible entity is entitled for the period, subject to application of the “prior period” deeming rule and the CEWS 1.0 safe harbour rule.

So, for example, if an eligible entity has experienced a 20% drop in its qualifying revenue for July 2020 compared to July 2019 (i.e., its “revenue reduction percentage”), its base percentage for qualifying period 5 (5 July to 1 August) would be 24% (being 20% x 1.2). If the same eligible entity had experienced a 60% drop in its average qualifying revenue comparing April, May and June 2020 to April, May and June 2019, it would be entitled to a top-up percentage of 12.5%, being (60% - 50%) x 1.25 in respect of qualifying period 5.

Therefore, the eligible entity would be entitled to a wage subsidy of 36.5% (being 24% + 12.5%) in respect of the eligible remuneration (up to $1,129) payable by it in respect of qualifying period 5 to each of its employees.

Again, though, this is subject to the “prior-period” deeming rule and the CEWS 1.0 safe harbour rule.

Prior-period deeming rule

Under CEWS 1.0, if an eligible entity qualified for the CEWS in one qualifying period (i.e., period 2), it is deemed to qualify for the CEWS in the immediate subsequent period (i.e., period 3), regardless of whether it actually experienced a percentage decrease in its qualifying revenue of at least 30% in the subsequent period.

CEWS 2.0 has a similar rule, but as the 30% revenue threshold test has been eliminated for qualifying periods 5 through 9, the new deeming rule provides that if an eligible entity’s actual “revenue reduction percentage” for the current qualifying period is lower than the immediately preceding qualifying period, the entity’s revenue reduction percentage for the current period is deemed to be equal to its revenue reduction percentage for the immediately preceding period.

So, going back to the example above, where the eligible entity experienced a 20% drop in its qualifying revenue for July 2020 (i.e., its “revenue reduction percentage”), but in June 2020, it had experienced a 25% drop in its qualifying revenue compared to June 2019, its “revenue reduction percentage” for period 5 (5 July to 1 August) is deemed to be 25%, not 20%.

So as a consequence, its “base percentage” is no longer 24%, but rather 30% (being 25% x 1.2), and its percentage subsidy rate for qualifying period 5 would be 42.5% as opposed to 36.5% (being 30% plus the 12.5% “top-up”).

Note that the prior-period deeming rule only applies to the “revenue reduction percentage” and, therefore, the “base percentage”, and not to the “top-up revenue reduction percentage”, so the top-up must be calculated period-by-period.

CEWS 1.0 safe harbour rule

CEWS 1.0 provides for a wage subsidy of 75% of an eligible employee’s eligible remuneration to a maximum of $847/week (being $1,129 x 75%).

CEWS 2.0 provides for a wage subsidy that can range from 0% to 85% of an eligible employee’s eligible remuneration in respect of qualifying periods 5 and 6. The 85% rate is achieved if the eligible entity has experienced:

a) A qualifying revenue decrease of greater than 50% in the particular qualifying period (which when multiplied by 1.2 – the multiplier rate for July and August – becomes a “base percentage” of 60%), and

b) A reduction of 70% or more in its average qualifying revenue in the immediately preceding three months compared to the average for the same months in 2019, resulting in a “top-up” revenue reduction percentage that maxes out at 25%.

But what this also means is that certain eligible entities whose “revenue reduction percentage” for July or August was 30% or greater, but their CEWS rate calculated under CEWS 2.0 (being their “base percentage” combined with their “top-up percentage”) is less than 75%, they would have been better off under CEWS 1.0.

Accordingly, CEWS 2.0 contains a CEWS 1.0 safe harbour rule. If an eligible entity’s revenue reduction percentage for qualifying period 5 or period 6 is 30% or more (either as actually determined or by applying the prior-period deeming rule), then the wage subsidy is the greater of the subsidy to which the entity is entitled under the CEWS 1.0 or CEWS 2.0 rules, whichever is greater.

For qualifying periods 7 through 9, if the CEWS 1.0 safe harbour rule no longer is necessary or applies as for period 7, the maximum subsidy rate is 75%, the same that it was under CEWS 1.0, and for periods 8 and 9, the maximum subsidy rate is 65% and 45%, respectively.

Elimination of the eligible employee 14-day rule

Under CEWS 1.0, an “eligible employee” – being one for whom the employer was entitled to a subsidy in respect of their wages, salary and other eligible remuneration – is defined as an individual employed in Canada by the eligible entity during the particular period, but excludes any employee who was without remuneration from the eligible entity in respect of 14 or more consecutive days in the qualifying period.

Under CEWS 2.0 – for periods 5 through 9 – the 14-day without remuneration rule has been eliminated.

This now means that an eligible entity is entitled to CEWS in respect of the wages, salary and other eligible remuneration of anyone employed by it during the relevant period, regardless of whether the individual was without remuneration for 14 days or more.

From a policy perspective, under CEWS 1.0, the 14-day rule was designed to align the CEWS with the Canada Emergency Response Benefit (“CERB”), so that the individual either received CERB if they were without remuneration or work for 14 consecutive days or more, or their employer received the CEWS in respect of remuneration paid to the individual.

Furloughed employees

As an incentive for employers to keep employees on payroll, even if the employee was furloughed and not performing any work, under CEWS 1.0, the federal government provided the employer with a wage subsidy with respect to the employee’s eligible remuneration (again, up to a maximum of 75% of $1,129, being $847), but an additional amount equal to the employer’s contributions to CPP/EI or QPP/QPIP.

Under CEWS 2.0, the wage subsidy to which the employer is entitled is based upon the employer’s revenue reduction percentage and top-up percentage. Recognizing that this would provide a disincentive for employers to keep furloughed employees on payroll for the balance of the CEWS program, CEWS 2.0 provides that for periods 5 and 6 (i.e., July and August), if an eligible entity is entitled to CEWS 2.0, even as little as 1%, the eligible entity’s wage subsidy in respect of the furloughed employee’s wages and other eligible remuneration will follow the same rules as under CEWS 1.0 – being essentially the lesser of 75% of the actual remuneration paid or $847/week, plus the employer’s CPP/EI (or QPP/QPIP) contributions.

For periods 7 through 9, the federal government intends to align the maximum amount of the subsidy to align with the amount the furloughed employee would receive under CERB or Canada’s Employment Insurance (EI) system. This will be done through regulations which are yet to be promulgated.

The purpose of doing so is to encourage employers to keep furloughed employees on their payroll and to ensure such employees do not have an incentive to remain on CERB or EI because they are receiving more under those programs than if they returned to employment.

Other amendments

CEWS 2.0 also contains a series of further amendments to refine the program – some of which were previously proposed and announced. These include:

- Alternate measurement period for “baseline remuneration”: Originally, baseline remuneration was defined as the average weekly remuneration paid to an eligible employee during the period of 1 January – 15 March 2020. This concept was particularly relevant for CEWS 1.0 in situations employees suffered pay cuts as it was possible, in some circumstances, for an employer to receive a subsidy of more than 75% of the remuneration paid to employees. The amendments provide that eligible entities may now elect, on an employee-by-employee basis, to use an alternate baseline period of 1 March – 31 May 2019. The stated purpose for providing for this alternate baseline period was to accommodate seasonal employees or employees returning from an extended absence. Under CEWS 2.0, the concept of baseline remuneration is no longer relevant, except in the case of non-arm’s length employees. For non-arm’s length employees, the default baseline period is still 1 January – 15 March 2020, but the eligible entity has the ability to elect a different baseline period depending upon the period in question.

- Amalgamations: If two eligible entities amalgamated between the prior reference period and the current reference period (i.e., between July 2019 and July 2020), the combined entity’s qualifying revenue would generally be greater in the current period than either of the predecessor entities in the prior period, thereby technically disqualifying the amalgamated entity from the CEWS program. As previously announced, the amended legislation will now provide that the amalgamated entity can combine its predecessors’ qualifying revenue to determine its qualifying revenue for the prior reference period.

- Asset purchases: A similar problem arises if the eligible entity acquired all or substantially all of the assets of another person’s business. The CEWS 2.0 legislation provides for an election that will allow the eligible entity to include the seller’s qualifying revenue for the relevant period in determining the eligible entity’s drop in qualifying revenue. If the seller still exists, the election must be made between the seller and the eligible entity and filed with the Canada Revenue Agency (CRA). If the seller is no longer in existence, the eligible entity can make and file the election on their own.

- Paymaster arrangements: Some corporate groups have a single paymaster that employs most or all the employees within the corporate group, but the cost of the individual employee’s remuneration is borne by the entity within the group for whom the employee is legally employed. A challenge arose under CEWS 1.0 because the employing entity did not have its own payroll account with the CRA on 15 March 2020 – which was one of the criteria for an eligible entity to become a “qualifying entity” for the CEWS. As previously announced, CEWS 2.0 addresses this, with the employing entity being able to qualify and claim the CEWS even if they did not have a payroll account on that date.

- Eligible employers: When originally announced, tax exempt entities (including indigenous government-owned corporations, registered Canadian amateur athletic associations, and registered journalism organizations) were excluded from the CEWS program. As previously announced, these organizations, as well as partnerships of up to 50% non-eligible members and non-public colleges and schools, have been included in the list of eligible entities.

- Tax Court appeal: The legislation is also being amended to provide for an appeal procedure to the Tax Court of Canada with respect to any CEWS claim that is reduced or denied.

- Cash vs accrual: Under CEWS 1.0, eligible entities can elect to use the cash method as provided for in subsection 28(1) of the Income Tax Act to determine their qualifying revenue. However, doing so requires that the cash method be used throughout the entire program. CEWS 2.0 permits entities that use the cash method to elect to use the accrual method in accordance with generally accepted accounting principles, but again, once chosen, the method must be used for all periods in the program.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Toronto

David Steinberg

+1 416 932 6206 | david.a.steinberg@ca.ey.com

Tom Di Emanuele

+1 416 932 5889 | tom.diemanuele@ca.ey.com

Lawrence Levin

+1 416 943 3364 | lawrence.levin@ca.ey.com

Edward Rajaratnam

+1 416 943 2612 | edward.rajaratnam@ca.ey.com

David Robertson

+1 403 206 5474 | david.d.robertson@ca.ey.com

Montréal

Stéphane Leblanc

+1 514 879 2660 | stephane.leblanc@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.