Prince Edward Island budget 2020-21

Tax Alert No. 39, 18 June 2020

“Budget 2020-21 is an important step on the path to recovery from COVID-19. While taking a measured response to the pandemic, with this budget we are also advancing the mandate we have been committed to since last year. We have heard from Islanders and collaborated with all parties in order to frame this budget.

We know that this is not where anyone wants to be in terms of a budget bottom line or in the current economic reality for our Island. But we also know this is where we all want to be to respond to the current circumstances.

Our plan (…) is certainly focused on short-term recovery in this year. But it also sets in motion an ambition for true growth and sustained success… for many years to come.”

Prince Edward Island Finance Minister Darlene Compton

2020–21 budget speech

On 17 June 2020, Prince Edward Island Finance Minister Darlene Compton tabled the province’s fiscal 2020–21 budget. The budget contains tax measures affecting individuals and corporations.

The minister anticipates a deficit of $172.7m for 2020–21 and projects reduced deficits for each of the next two fiscal years ($69.5m for 2021–22 and $38.4m for 2022–23).

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

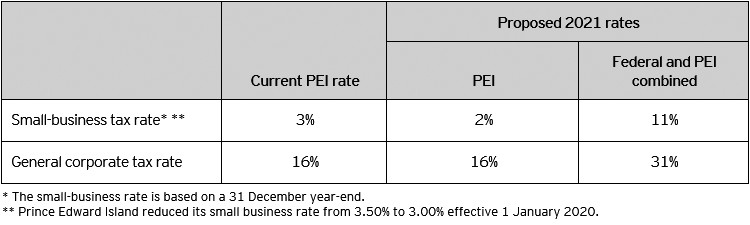

No changes are proposed to the general corporate tax rate. However, the minister announced a reduction in the small-business rate to 2% from 3%, effective 1 January 2021. The $500,000 small-business limit remains unchanged.

Prince Edward Island’s current and proposed future corporate income tax rates are summarized in Table A.

Table A – Corporate tax rates

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

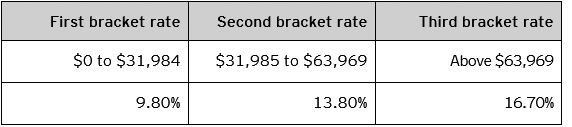

The 2020 Prince Edward Island personal tax rates are summarized in Table B.

Table B – 2020 Prince Edward Island personal tax rates

In addition, there is a 10% surtax on provincial income tax in excess of $12,500.

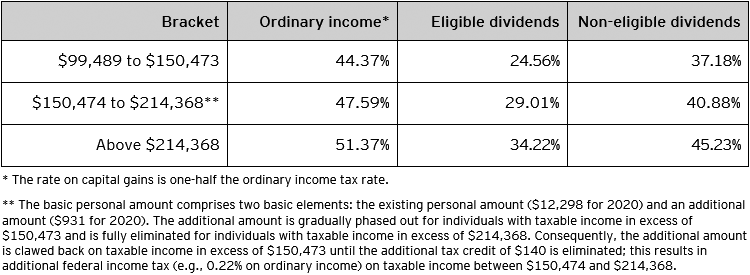

For taxable income in excess of $99,488, the 2020 combined federal-Prince Edward Island personal income tax rates are outlined in Table C.

Table C – Combined 2020 federal and Prince Edward Island personal tax rates

Personal tax credits

This budget proposes changes to the following personal credits/amounts:

- Increase in the basic personal income tax exemption to $10,500 from $10,000 as of 1 January 2021

- Increase in the low-income tax reduction threshold to $19,000 from $18,000 as of 1 January 2021

Other personal tax measures include the introduction of a new $500 non-refundable Children’s Wellness tax credit to assist families with the cost of organized activities related to their children’s well-being, effective 1 January 2021.

Other tax measures

Tobacco tax

The minister announced the increase of the tobacco tax rates to 27.52 cents per gram of tobacco and to 75% of the retail price for cigars. These increases will be effective the day following the Royal Assent of the implementing legislation.

Gasoline tax

The minister also announced that the marked fuel program will be extended to all farm plated vehicles.

Learn more

For more information, please contact your EY or EY Law advisor.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.