Saskatchewan budget 2020-21

Tax Alert No. 38, 16 June 2020

“The 2020-21 Saskatchewan Budget meets the challenges presented by the global COVID-19 pandemic. Saskatchewan is strong. Our province’s fiscal foundation remains solid and our economy will recover.”

“Our Government is helping support people through the pandemic and investing to stimulate our economy and create jobs.”

Saskatchewan Finance Minister Donna Harpauer

2020–21 budget speech

On 15 June 2020, Saskatchewan Finance Minister Donna Harpauer tabled the province’s fiscal 2020–21 budget. The budget contains no new taxes or tax increases and introduces or extends tax incentives.

The minister anticipates a deficit of $2.4 billion for 2020–21.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

No changes are proposed to the corporate tax rates or the $600,000 small-business limit.

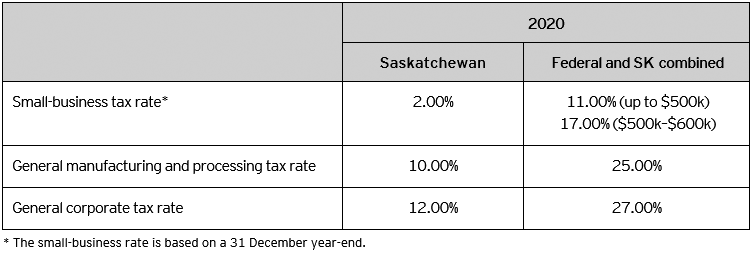

Saskatchewan’s 2020 corporate tax rates are summarized in Table A.

Table A – Corporate tax rates

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

The budget includes the re-introduction of automatic annual indexation of the personal tax brackets beginning in 2021.

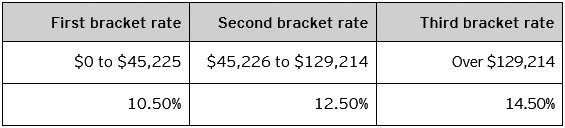

The 2020 Saskatchewan personal tax rates are summarized in Table B.

Table B – 2020 Saskatchewan personal tax rates

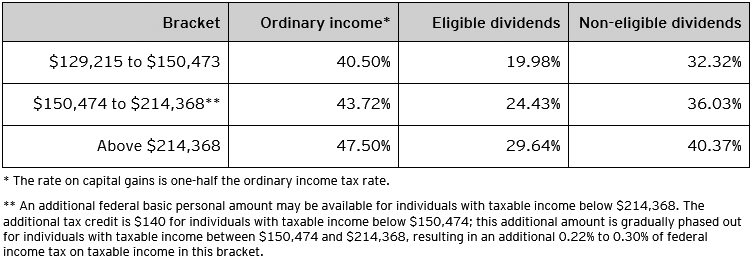

For taxable income in excess of $129,214, the 2020 combined federal-Saskatchewan personal income tax rates are outlined in Table C.

Table C – Combined 2020 federal and Saskatchewan personal tax rates

Provincial Sales Tax

- The budget confirms a Provincial Sales Tax (PST) rebate for new residential construction. The maximum eligible amount of the rebate is up to 42% of PST paid on the purchase of a new house after 31 March 2020 and before 1 April 2023. The 42% rebate is available on new houses with a total price less than $350,000, excluding land, and is reduced for houses with a total price between $350,000 and $450,000. No rebate is available for houses with a total price of $450,000 or more.

- The budget includes the reinstatement of a PST exemption for exploratory and downhole drilling activity including drilling for oil, gas and helium.

- The budget confirms initiatives will be enacted to ensure out-of-province e-commerce platforms collect and remit PST.

Other tax measures

Chemical fertilizer taxation

- The budget announces the Saskatchewan Chemical Fertilizer Incentive, which provides a 15% tax credit for new investment in the chemical fertilizer sector.

Manufacturing and processing taxation

- The budget extends the Manufacturing and Processing Exporter Tax Incentive beyond 31 December 2019 to 31 December 2022. The incentive provides rebates to hire incremental employees or additional head office employees and is available to manufacturing, processing and creative industry corporations that generate at least 25% of revenues through exports.

Oil taxation

- The budget announces the Oil Infrastructure Investment Program (OIIP) to support new and expanded pipelines and pipeline terminals. The OIIP provides a transferrable royalty credit of 20% of approved expenditures for eligible pipeline development projects with a minimum investment of $10 million to a maximum of $40 million of royalty credits. Applications will be accepted until 31 March 2025, and all credits will expire by 31 March 2035.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Ryan Ball

+1 306 649 8225 | ryan.ball@ca.ey.com

Craig Hermann

+1 306 649 8204 | craig.hermann@ca.ey.com

Wes Unger

+1 306 649 8247| wes.unger@ca.ey.com

Luke Hergott

+1 306 649 8251| luke.hergott@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.