Manitoba budget 2022‑23

Tax Alert 2022 No. 25, 13 April 2022

“We created Budget 2022 for Manitobans.

To give them hope and optimism in the future.

Because when we work together, anything is possible.”

Manitoba Finance Minister Cameron Friesen

2022–23 budget speech

On 12 April 2022, Manitoba Finance Minister Cameron Friesen tabled the province’s fiscal 2022–23 budget. The budget contains several tax measures affecting individuals and corporations.

The minister anticipates a deficit of $1.39 billion for 2021–22 and projects a deficit of $548 million for the 2022–23 year.

Following is a brief summary of the key tax measures.

Business tax measures

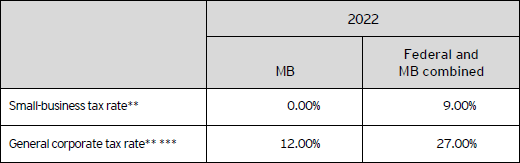

Corporate income tax rates

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

Manitoba’s 2022 corporate income tax rates are summarized in Table A.

Table A – 2022 corporate income tax rates*

* Rates represent calendar-year rates.

** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

*** The 2022 federal budget proposed an additional tax on banks and life insurers. See EY Tax Alert 2022 Issue No. 23 for details.

Other business tax measures

The minister also proposed the following business tax measures:

- Extensions to various tax credits:

- The Community Enterprise Development Tax Credit, previously set to expire on 31 December 2022, has been made permanent; and

- The Small Business Venture Capital Tax Credit, previously set to expire on 31 December 2022, has been made permanent.

- The Community Enterprise Development Tax Credit, previously set to expire on 31 December 2022, has been made permanent; and

Personal tax

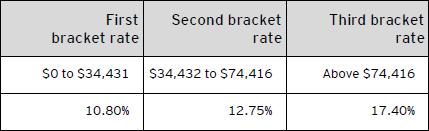

Personal income tax rates

The budget does not include any changes to personal income tax rates.

The 2022 Manitoba personal income tax rates are summarized in Table B.

Table B – 2022 Manitoba income personal tax rates

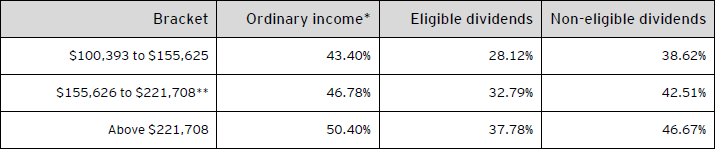

For taxable income in excess of $100,392, the 2022 combined federal-Manitoba personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and Manitoba personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Personal tax credits

This budget proposes changes to the following personal credits/amounts:

Basic personal amount

- Effective for the 2022 tax year, the basic personal amount will be increased from $9,936 to $10,145.

Other tax measures

Education Property Tax Rebate

- The Education Property Tax Rebate on residential and farm properties will increase to 37.5% in 2022 and 50% in 2023.

- Other property owners, including railway, businesses and industrial, will continue to receive 10% rebates in both 2022 and 2023, consistent with 2021.

- Other education property tax credits/rebates, such as the Education Property Tax Credit/Advance, the Seniors Education Property Tax Credit, the Seniors School Tax Rebate and Farmland School Tax Rebate, may also be available to Manitoba resident property owners, depending on the type of property they own.

Residential Renters Tax Credit

- The annual maximum amount will be fixed at $525.

- It will be calculated using a fixed monthly maximum claim amount per each month renting and will not be subject to an income test.

- New eligibility — Manitobans who live in social housing or receive non-Employment and Income Assistance Rent Assist will now be eligible for this credit.

Health and post-secondary education tax levy

Fuel tax

- Effective 1 May 2022, fuel tax does not apply to fuel consumed in operating off-road peat harvesting equipment.

Administrative tax measures

- Tax on split income – A minor change will be made to provide clarity regarding how federal provisions respecting the tax on split income are to apply to individuals in Manitoba.

- Research and development tax credit – The extended filing deadlines made by order under the Income Tax Act (Canada) in response to COVID-19 will be adopted.

- Statutory limitations – A statute of limitations will be established for audits and requests for change by taxpayers on taxes collected and administered by Manitoba Finance.

- Film and video production tax credit – Provided that proper documentation is submitted, film producers will be able to get advance credits prior to the completion of a film.

- Tax credit validation – The Manitoba government will enter into an extended service agreement with the Canada Revenue Agency to perform a more thorough validation of Manitoba tax credits.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Jason Burbank

+1 204 933 0240 | jason.a.burbank@ca.ey.com

James Jaworsky

+1 204 954 5581 | james.jaworsky@ca.ey.com

Nina Pekach

+1 204 933 0279 | nina.pekach@ca.ey.com

Matthew Lapka

+1 204 954 5541 | matthew.lapka@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.