Nova Scotia budget 2022‑23

Tax Alert 2022 No. 19, 30 March 2022

“At its core, Budget 2022–23 is about people. It invests thoughtfully in the areas Nova Scotians care about most, while also planning for the needs of a province that is growing. This government is committed to listening to Nova Scotians, finding creative solutions and taking action. This budget presents a new path forward that includes historic investments in healthcare, a renewed effort to recruit healthcare professionals and solutions to improve our workforce, economy, housing and roads.”

Nova Scotia Minister of Finance and Treasury Board Allan MacMaster

2022–23 budget press release

On 29 March 2022, Nova Scotia Minister of Finance and Treasury Board Allan MacMaster tabled the province’s fiscal 2022–23 budget. The budget contains several tax measures affecting individuals and corporations.

The minister anticipates a deficit of $506 million for 2022–23 and projects deficits for each of the next three years.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

No changes are proposed to the corporate income tax rates or the $500,000 small-business limit.

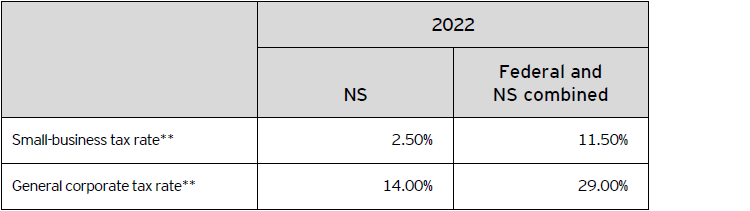

Nova Scotia’s 2022 corporate income tax rates are summarized in Table A.

Table A – 2022 corporate income tax rates*

* Rates represent calendar-year rates.

** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

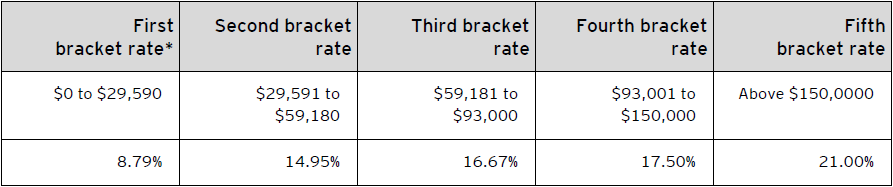

The 2022 Nova Scotia personal income tax rates are summarized in Table B.

Table B – 2022 Nova Scotia personal income tax rates

* Individuals resident in Nova Scotia on 31 December 2022 with taxable income up to $11,894 pay no provincial income tax as a result of a low-income tax reduction. The low-income tax reduction is clawed back for income in excess of $15,000 until the reduction is eliminated, resulting in an additional 5% of provincial tax on income between $15,001 and $21,000.

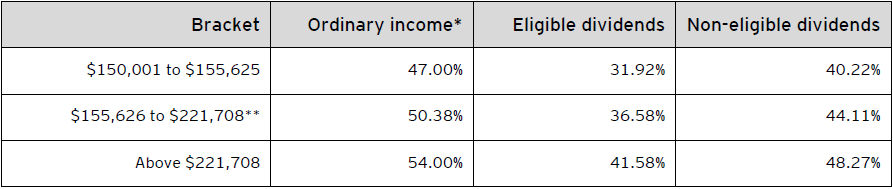

For taxable income in excess of $150,000, the 2022 combined federal-Nova Scotia personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and Nova Scotia personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Personal tax credits

This budget proposes changes to the following personal credits/amounts:

- Effective for the 2022 and subsequent taxation years, the province is introducing a $500 refundable tax credit to help parents offset the costs of artistic, cultural and physical activities for children under the age of 19. The tax credit will apply to eligible expenditures for programs in literary arts, visual arts, performing arts, music, media, languages, customs and heritage, as well as organized physical activities and programs.

- Effective for the 2022 and subsequent taxation years, the province will implement fertility and surrogacy rebates to provide financial support for Nova Scotians trying to start a family. The fertility rebate will provide a 40% refundable tax credit, up to a maximum of $8,000 per year, on expenditures for medical expenses incurred by an individual, their spouse or common-law partner for infertility treatments. The treatments must be provided by a Nova Scotian licensed medical practitioner. There is no lifetime maximum. For families employing the use of a surrogate, there will be a 40% rebate up to a maximum of $8,000 per year on medical expenses paid for on behalf of a surrogate, provided they are not claimed by the surrogate. These expenditures are not eligible for the fertility rebate.

Other personal tax measures include:

- Effective for the 2022 and subsequent taxation years, the province will implement the More Opportunities for Skilled Trades (MOST) tax refund. MOST aims to attract and retain youth in industries with labour shortages. MOST will provide a refund of personal income tax on the first $50,000 of earned income for individuals under the age of 30 who are employed and registered in selected skilled trades and occupations. To start, selected occupations in eligible sectors will include manufacturing, computer and IT, transportation, film, video and service sectors in the province, with further details to be provided in regulations.

Other tax measures

Property tax

- Effective 1 April 2022, the province will introduce a 5% provincial Deed Transfer Tax on residential real property being purchased by nonresidents of Nova Scotia. The tax will not apply to a transaction where the Agreement of Purchase and Sale was entered into prior to 1 April 2022. An exemption from the tax will be in place for nonresident purchasers who move to the province within six months of the closing date of the transaction.

- Effective for the 2022–23 fiscal year, the province will introduce a provincial property tax of $2.00 per $100 assessed value of residential property owned by nonresidents of Nova Scotia. The tax will not apply to residential properties that contain more than three units nor to residential properties that are leased to individual Nova Scotian residents for a period of at least 12 months.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Dana Birch

+1 902 470 2073 | dana.birch@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.