Canadian sanctions related to Russia: update

Tax Alert 2022 No. 14, 14 March 2022

Following the 24 February 2022 announcement of additional sanctions under the Special Economic Measures (Russia) Regulations and the Special Economic Measures (Ukraine) Regulations,1 from 3 March 2022 to 10 March 2022, Canada further amended the Special Economic Measures (Russia) Regulations and removed Russia and Belarus from entitlement to Most-Favoured-Nation (MFN) tariff treatment.

On 3 March 2022, the Department of Finance Canada issued the MFN Withdrawal Order (2022-1),2 removing Russia and Belarus from entitlement to MFN treatment under the Customs Tariff effective 2 March 2022.3 The issuance of this Order results in the application of the General Tariff for goods imported into Canada that originate from Russia or Belarus. Under the General Tariff, a tariff rate of 35% ad valorem will now be applicable on virtually all imports originating from Russia and Belarus.4 The Order is implemented under section 31 of the Customs Tariff and applies for 180 days unless extended by a resolution adopted by both Houses of Parliament.5

On 4 March 2022, Canada amended the Special Economic Measures (Russia) Regulations (Regulations) to add 10 executives in the Russian energy sector working for the state-owned or controlled oil entities Rosneft or Gazprom,6 as listed in Part 1 of Schedule 1 of the Regulations as amended.7

On 6 March 2022, the Regulations were further amended to add 10 current or former senior government officials and their close associates, as well as agents of disinformation, as listed in Part 1 of Schedule 1 of the Regulations as amended.8 The 6 March amendment also prohibits any ship that is registered in Russia or used, leased or chartered, in whole or part, by, on behalf of or for the benefit of Russia, a person in Russia or a designated person from docking in Canada or passing through Canadian waters.9

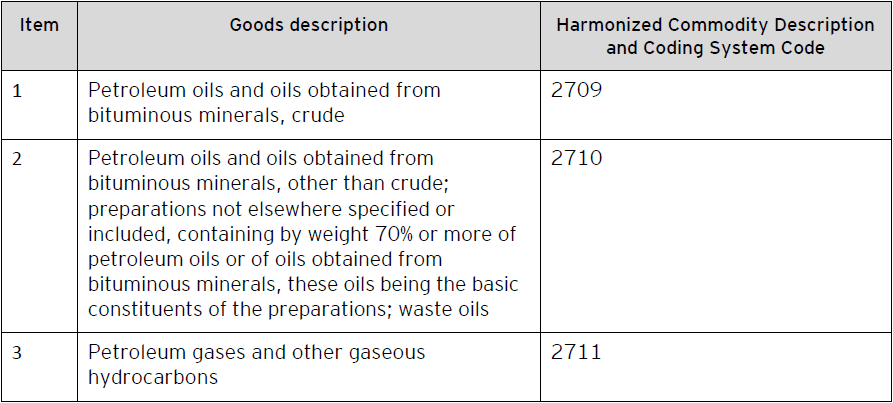

On 10 March 2022, the Regulations were amended once more to add 32 defense entities, most of which are owned by the Russian state or have contracts with the Government of Russia.10 Additionally, the amendment adds five individuals who are current and former senior officials and associates of the Russian regime.11 Furthermore, any person in Canada and any Canadian outside Canada is prohibited from importing specific petroleum products listed in a new Schedule 5 to the Regulations:12

Learn more

For more information, please contact your EY or EY Law advisor or one of the following EY Global Trade professionals:

Sylvain Golsse

+1 416 932 5165 | sylvain.golsse@ca.ey.com

Mike Cristea

+1 416 932 4432 | mihai.cristea@ca.ey.com

Denis Chrissikos

+1 514 879 8153 | denis.chrissikos@ca.ey.com

Traci Tohn

+1 514 879 2698 | traci.tohn@ca.ey.com

- Refer to EY Tax Alert 2022 Issue No. 11.

- Canada cuts Russia and Belarus from Most-Favoured-Nation Tariff treatment - Canada.ca, 3 March 2022.

- Customs Notice 22-02: Order withdrawing the Most-Favoured-Nation status from Russia and Belarus (cbsa-asfc.gc.ca), 3 March 2022.

- Canada cuts Russia and Belarus from Most-Favoured-Nation Tariff treatment - Canada.ca, 3 March 2022.

- Customs Tariff Act (S.C. 1997, c. 36), s. 31 and s. 32.

- Canadian Sanctions Related to Russia (international.gc.ca), 4 March 2022.

- SOR/2022-046.

- SOR/2022-048.

- SOR/2022-047.

- SOR/2022-052.

- SOR/2022-053.

- SOR/2022-052.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.