Yukon budget 2022‑23

Tax Alert 2022 No. 12, 4 March 2022

“Budgets are fundamentally about choices. With limited resources, choices must be made about where to focus government spending to ensure it is responsive to the needs of the present while also creating the conditions for prosperity in the future. This year’s budget addresses critical needs in the territory while making necessary investments to make sure all Yukoners benefit from our territory’s historic economic growth.”

Yukon Premier and Finance Minister Sandy Silver

2022–23 budget speech

On 3 March 2022, Yukon Premier and Finance Minister Sandy Silver tabled the territory’s fiscal 2022–23 budget. The budget contains no new taxes and no tax increases.

The minister anticipates a surplus of $25.5 million for 2021–22 and projects a surplus of $39.5 million for 2022–23 and surpluses for each of the next two years ($73.5 million for 2023–24 and $63.3 million for 2024–25).

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

No changes are proposed to corporate income tax rates or the $500,000 small-business limit.

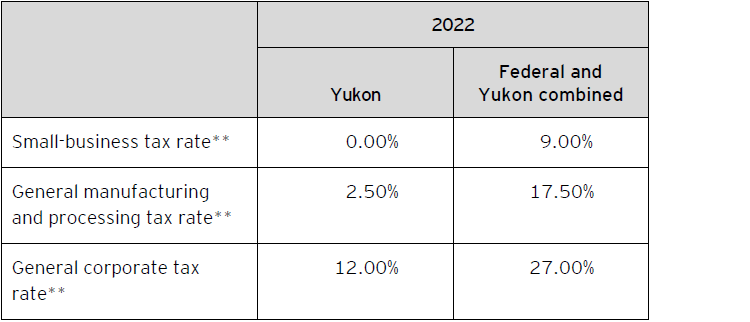

Yukon’s 2022 corporate income tax rates are summarized in Table A.

Table A – 2022 corporate income tax rates*

* Rates represent calendar-year rates.

** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

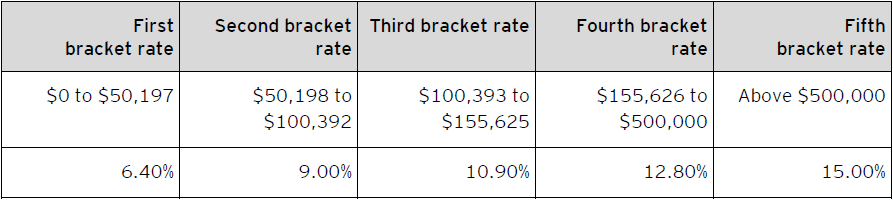

The 2022 Yukon personal income tax rates are summarized in Table B.

Table B – 2022 Yukon personal income tax rates

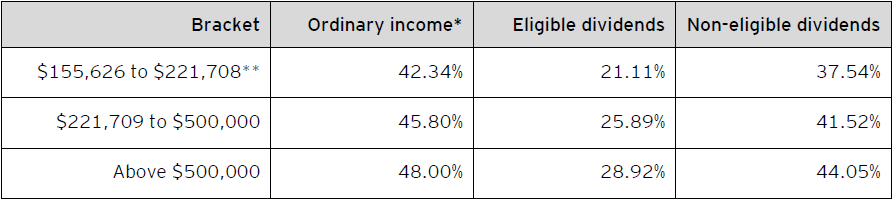

For taxable income in excess of $155,625, the 2022 combined federal-Yukon personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and Yukon personal income tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal and territorial basic personal amounts comprise two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit ($252 federally and $107 in Yukon) is eliminated; this results in additional federal and territorial income tax (e.g., 0.38% and 0.16%, respectively, on ordinary income) on taxable income between $155,626 and $221,708.

Learn more

For more information, please contact your EY or EY Law advisor.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.