Alberta budget 2022‑23

Tax Alert 2022 No. 09, 24 February 2022

“We remain relentless in our focus to position our province for, not just economic recovery, but long-term, significant, exceptional economic growth.”

Alberta Finance Minister Travis Toews

2022–23 budget speech

On 24 February 2022, Alberta Finance Minister Travis Toews tabled the province’s fiscal 2022–23 budget. The budget contains no new taxes and no income tax increases.

The minister anticipates a surplus of $0.5b for 2022–23 and projects further surpluses of $0.9b for 2023–24 and $0.7b for 2024–25.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate income tax rates

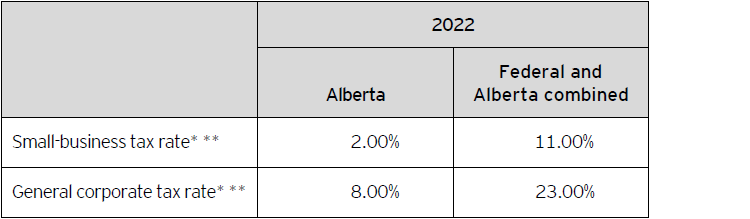

No changes are proposed to the corporate income tax rates or the $500,000 small-business limit.

Alberta’s 2022 corporate income tax rates are summarized in Table A.

Table A – 2022 Alberta corporate tax rates

* Rates represent calendar-year rates unless otherwise indicated.

** The 2021 federal budget proposed to temporarily reduce the federal corporate income tax rate for qualifying zero-emission technology manufacturers by 50% (i.e., to 7.5% for eligible income otherwise subject to the 15% general corporate income tax rate or 4.5% for eligible income otherwise subject to the 9% small-business corporate income tax rate), applicable for taxation years beginning after 2021. The reduced tax rates are proposed to be gradually phased out for taxation years beginning in 2029 and fully phased out for taxation years beginning after 2031.

Personal tax

Personal income tax rates

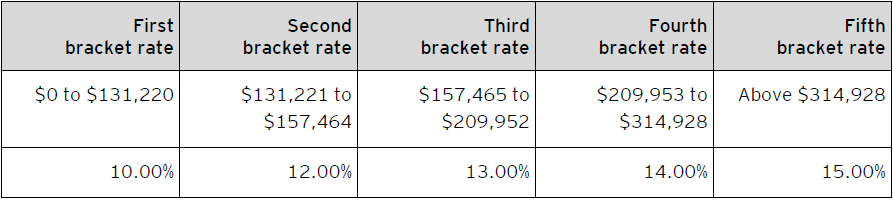

The budget does not include any changes to personal income tax rates.

The 2022 Alberta personal tax rates are summarized in Table B.

Table B – 2022 Alberta personal tax rates

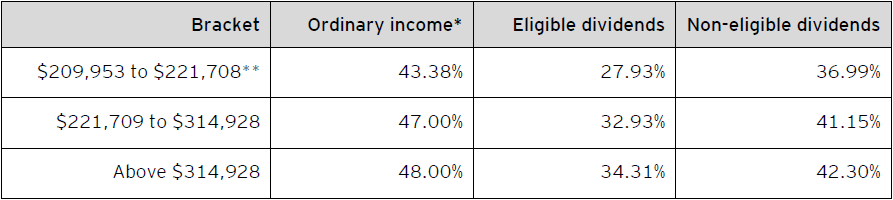

For taxable income in excess of $209,952, the 2022 combined federal-Alberta personal income tax rates are outlined in Table C.

Table C – Combined 2022 federal and Alberta personal tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,719 for 2022) and an additional amount ($1,679 for 2022). The additional amount is reduced for individuals with net income in excess of $155,625 and is fully eliminated for individuals with net income in excess of $221,708. Consequently, the additional amount is clawed back on net income in excess of $155,625 until the additional tax credit of $252 is eliminated; this results in additional federal income tax (e.g., 0.38% on ordinary income) on net income between $155,626 and $221,708.

Personal tax credits

This budget proposes no changes to personal tax credits or amounts.

Other tax measures

Education property tax

Due to the pandemic, the government had previously frozen property tax revenue at 2019 levels. Now that Alberta’s economy is beginning to recover, but in recognition that the province and households are still recovering, the requisition will be adjusted upwards by a modest 1.5% in 2022–23.

Tourism levy

The previously announced tourism levy applies to all short-term rentals offered through online marketplaces. To collect the tax more efficiently and consistently, amendments will be brought forward in 2022 to require online marketplaces to collect and remit the tourism levy on behalf of their Alberta short-term rental hosts.

Tobacco tax

Effective 1 March 2022, the tax rate on smokeless tobacco products will be reduced from 41.25 cents per gram to 27.5 cents per gram.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Calgary

Greg Boone

+1 403 206 5306 | greg.boone@ca.ey.com

Dean Radomsky

+1 403 206 5180 | dean.w.radomsky@ca.ey.com

Sanjaya Ranasinghe

+1 780 441 4692 | sanjaya.ranasinghe@ca.ey.com

Edmonton

Dustin Burbank

+1 780 441 4673 | dustin.burbank@ca.ey.com

Hayat Kirameddine

+1 780 412 2383 | hayat.kirameddine@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.