Finance announces temporary expanded eligibility for the Local Lockdown Program

Tax Alert 2022 No. 01, 10 January 2022

Enacted Bill C-2, An Act to provide further support in response to COVID‑19, includes a new Local Lockdown Program (also referred to as the public health lockdown support) to provide wage and rent subsidies to entities that become subject to a qualifying public health restriction. For further details about Bill C‑2, see EY Tax Alert 2021 Issue No. 30, Finance announces targeted COVID-19 support measures and EY Tax Alert 2021 Issue No. 37, Bill C‑2 receives Royal Assent.

On 22 December 2021, the government announced its intention to temporarily expand eligibility for the Local Lockdown Program, as well as the Canada Worker Lockdown Benefit that was also enacted in Bill C‑2. The temporary changes to the Local Lockdown Program are discussed in more detail below.

Detailed discussion

Current eligibility requirements

Bill C-2 provides that entities that become subject to a qualifying public health restriction will be eligible for wage and rent subsidies under the Local Lockdown Program, from 24 October 2021 to 7 May 2022 (with the possibility of further extension to 2 July 2022), subject to the application of the executive compensation repayment rules in respect of the wage subsidy amount as well as the restrictions in circumstances involving the payment of taxable dividends by a publicly traded company (or one of its subsidiaries) to common shareholder individuals of the public company or subsidiary.

An entity is eligible for the Local Lockdown Program if it has one or more locations subject to a public health restriction that lasts for at least seven days in a qualifying period and requires the entity to cease activities that accounted for at least 25% of its qualifying revenues during the prior reference period.

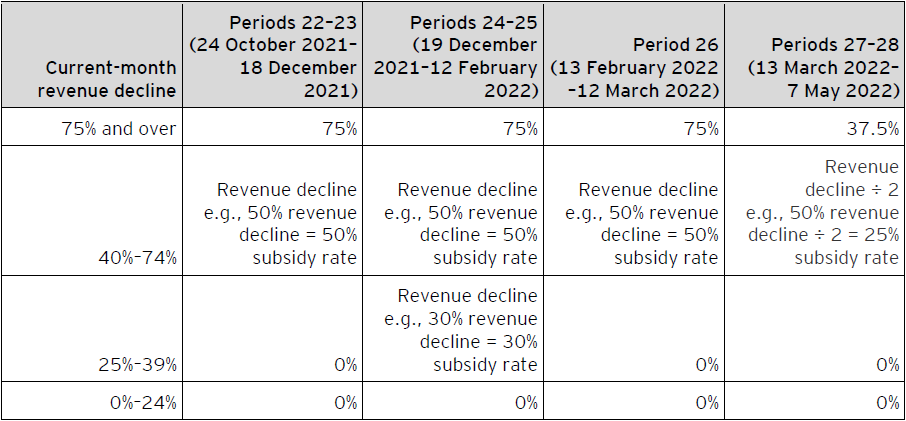

As well, the entity needs to demonstrate a current-month revenue decline of at least 40% (and not the 12-month average decline as under the new Tourism and Hospitality Program and the new Hardest-Hit Business Recovery Program, both of which were also enacted in Bill C-2). The subsidy rates begin at 40% for eligible entities with a 40% current-month revenue decline and increase thereafter in proportion to the entity’s current-month revenue decline up to a maximum rate of 75% for entities with a current-month revenue decline of 75% or higher. The subsidy rates will be reduced by half for qualifying periods 27 and 28 (13 March 2022 to 7 May 2022).

This support is available to eligible entities regardless of the sector in which they operate.

Temporary expanded eligibility requirements

The government is proposing to temporarily expand the eligibility requirements for the Local Lockdown Program so that entities can also qualify for the program if they are subject to a capacity-limiting public health order (rather than a lockdown).

Under the temporary expanded eligibility requirements, an entity would be eligible for the Local Lockdown Program under the current eligibility requirements, or if it has one or more locations subject to a public health order that has the effect of reducing the entity’s capacity at the location by at least 50%, and the activities restricted by the order accounted for at least 50% of its qualifying revenues during the prior reference period.

The government also intends to temporarily lower the current-month revenue decline threshold from 40% to 25%. The subsidy rates would begin at 25% for eligible entities with a 25% current-month revenue decline.

These temporary changes would apply from 19 December 2021 to 12 February 2022 (qualifying periods 24 and 25).

The table below details the subsidy rates for entities that qualify for the Local Lockdown Program, including the proposed rates for qualifying periods 24 and 25.

Next steps

The government intends to use the regulatory authority given under Bill C-2 to temporarily amend the eligibility requirements for the Local Lockdown Program. As of the date of writing, the regulations have not been released.

For further information on the announcement, refer to the Department of Finance Backgrounder, Temporarily Expanding Eligibility for the Local Lockdown Program and the Canada Worker Lockdown Benefit - Canada.ca.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Toronto

Uros Karadzic

+1 416 943 2087 | uros.karadzic@ca.ey.com

Tom Di Emanuele

+1 416 932 5889 | tom.diemanuele@ca.ey.com

Lawrence Levin

+1 416 943 3364 | lawrence.levin@ca.ey.com

Caitlin Morin

+1 416 943 3133 | caitlin.morin@ca.ey.com

Edward Rajaratnam

+1 416 943 2612 | edward.rajaratnam@ca.ey.com

Calgary

+1 403 206 5474 | david.d.robertson@ca.ey.com

Montréal

Stéphane Leblanc

+1 514 879 2660 | stephane.leblanc@ca.ey.com

Philippe-Antoine Morin

+1 514 874 4635 | philippe-antoine.morin@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.