Manitoba budget 2021‑22

Tax Alert 2021 No. 17, 8 April 2021

“We know Manitobans deserve a break, especially during this pandemic.

That’s why we will take even more steps to protect your incomes by reducing the taxes you pay and helping you keep more of your hard-earned money with you, where it belongs.”

Manitoba Finance Minister Scott Fielding

7 April 2021 press release

On 7 April 2021, Manitoba Finance Minister Scott Fielding tabled the province’s fiscal 2021–22 budget. The budget contains several tax measures affecting individuals and corporations.

The minister anticipates a deficit of $2.08 billion for 2020–21 and projects a deficit of $1.597 billion for the 2021–22 year.

Following is a brief summary of the key tax measures.

Business tax measures

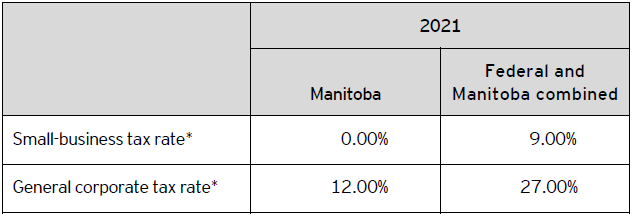

Corporate tax rates

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

Manitoba’s 2021 corporate tax rates are summarized in Table A.

Table A – 2021 corporate tax rates

* Rates represent calendar-year rates unless otherwise indicated.

Other business tax measures

The minister also proposed the following business tax measures:

Film and Video Production Tax Credit

- The frequent filming bonus, under the Cost-of-Salaries Tax Credit, is temporarily paused for two years.

- The time period continues as normal for production companies that have continued to produce.

Small Business Venture Capital Tax Credit

- Effective for the 2021 taxation year, the maximum eligible investment by an investor increases from $450,000 to $500,000. Additional to this, the maximum tax credit that can be claimed against Manitoba income tax in a given year increased from $67,500 to $120,000.

Interactive Digital Media Tax Credit

- Effective for the 2021 taxation year, the eligible activities for the Interactive Digital Media Tax Credit will be expanded to include the following:

- Add-on digital media and content, such as downloadable content;

- On-going maintenance and updates; and

- Data management and analysis that are complementary to the main product being developed.

Extensions to various tax credits

- The Interactive Digital Media Tax Credit, previously set to expire on 31 December 2022, has been made permanent.

- The Book Publishing Tax Credit, previously set to expire on 31 December 2024, has been made permanent.

- The Cultural Industries Printing Tax Credit and the Community Enterprise Development Tax Credits, previously set to expire on 31 December 2021, have been extended to 31 December 2022.

Personal tax

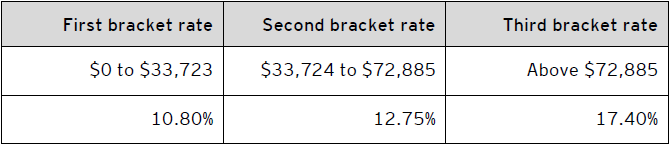

Personal income tax rates

The budget does not include any changes to personal income tax rates.

The 2021 Manitoba personal tax rates are summarized in Table B.

Table B – 2021 Manitoba personal tax rates

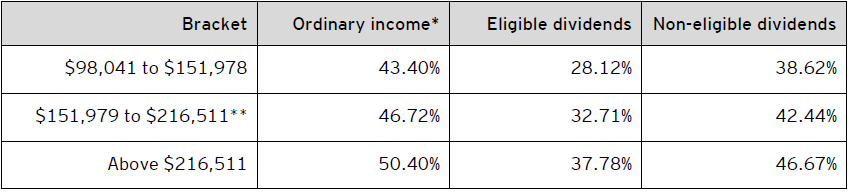

For taxable income in excess of $98,040, the 2021 combined federal-Manitoba personal income tax rates are outlined in Table C.

Table C – Combined 2021 federal and Manitoba personal tax rates

* The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with net income in excess of $151,978 and is fully eliminated for individuals with net income in excess of $216,511. Consequently, the additional amount is clawed back on net income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Personal tax credits

This budget proposes changes to the following personal amounts/credits:

Basic personal amount

- Effective for the 2021 tax year, the basic personal amount will be increased from $9,838 to $9,936.

Teaching Expense Tax Credit

- Effective for the 2021 taxation year, educators will be able to claim the new Teaching Expense Tax Credit on the purchase of eligible teaching supplies that are not reimbursed by their employer.

- The tax credit will be calculated at 15% refundable for up to $1,000 in eligible teaching supplies ($150 maximum refund). The eligibility criteria will parallel the existing federal Eligible Educator School Supply Tax Credit.

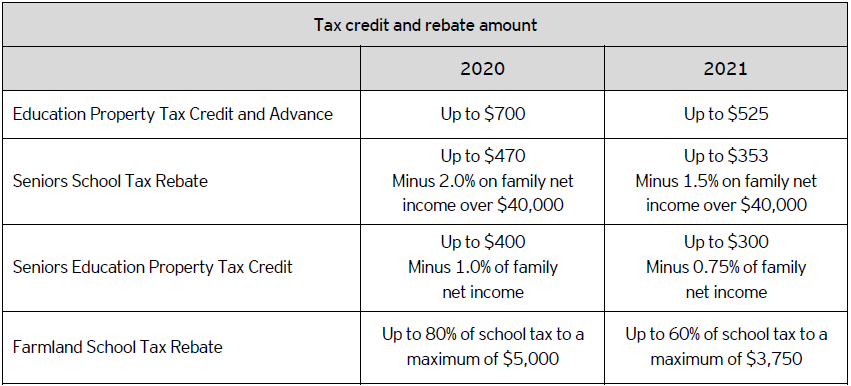

Other tax measures

Education Property Tax Rebate

Property owners will begin receiving the Education Property Tax Rebate beginning in 2021. The rebate amounts beginning in 2021 will be as follows:

- Residential and farm property owners will receive a 25% rebate of the school division special levy and community revitalization levy payable (before the Education Property Tax Credit Advance); and

- Other property owners (such as commercial, industrial, railways, pipelines, institutional and designated recreational) will receive a 10% rebate of the total applicable school division special levy and the education support levy payable.

Property owners will continue to pay education property taxes; however, they will automatically receive the Education Property Tax Rebate in the same month that their municipal property tax payments are due (or earlier). Farm property owners must continue to apply for the Farmland School Tax Rebate.

In conjunction with the Education Property Tax Rebate, existing education property tax offsets will be proportionally reduced by 25% in 2021, as follows:

* The information above was obtained from Manitoba provincial information bulletin no. 121 issued in April 2021.

Retail sales tax

Exemption for personal services – Effective 1 December 2021, the following personal services will be exempted from tax:

- Hair services;

- Non-medical skin care and aesthetician services; and

- Body modifications and spa services.

Online services changes

Effective 1 December 2021, streaming service providers will be required to collect and remit retail sales tax on the sale of audio and video streaming services.

Effective 1 December 2021, online marketplaces will be required to collect and remit retail sales tax on taxable goods sold by third parties on their electronic platforms. Additionally, online accommodation platforms will be required to collect and remit retail sales tax on the booking of taxable accommodations in Manitoba.

Health and Post-Secondary Education Tax Levy

The exemption threshold will increase from $1.5 million to $1.75 million of annual remuneration, and the threshold below which employers pay a reduced rate will increase from $3.0 million to $3.5 million, both of which are effective 1 January 2022.

Learn more

For more information, please contact your EY or EY Law advisor or one of the following professionals:

Jason Burbank

+1 204 933 0240 | jason.a.burbank@ca.ey.com

James Jaworsky

+1 204 954 5581 | james.jaworsky@ca.ey.com

Matthew Lapka

+1 204 954 5541 | matthew.lapka@ca.ey.com

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.