Prince Edward Island budget 2021–22

Tax Alert 2021 No. 07, 12 March 2021

”[O]n the whole, our economy has done well, and that has helped us in ensuring that the COVID-19 pandemic will go down in history as an economic shock, and not a dire economic blow.”

“Thanks to strategic investments on the part of our administration, and administrations that came before us, we are in a good position to rebound from this great disruption at a much faster pace than many of our partner provinces.”

Prince Edward Island Finance Minister Darlene Compton

2021–22 budget speech

On 12 March 2021, Prince Edward Island Finance Minister Darlene Compton tabled the province’s fiscal 2021–22 budget. The budget contains tax measures affecting individuals and corporations.

The minister anticipates a deficit of $120.0m for 2020–21 and projects a deficit of $112.1m for 2021–22, followed by further reduced deficits for each of the next two fiscal years ($45.7m for 2022–23 and $27.9m for 2023–24).

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

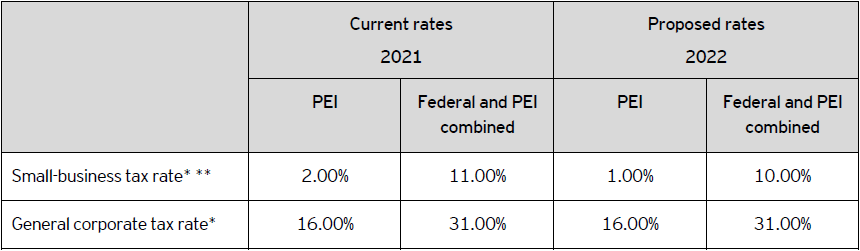

No changes are proposed to the general corporate income tax rate. However, effective 1 January 2022, the small-business tax rate will decrease to 1% from 2%. The $500,000 small-business limit remains unchanged.

Prince Edward Island’s current and proposed future corporate income tax rates are summarized in Table A.

Table A – Corporate tax rates

* Rates represent calendar-year rates unless otherwise indicated.

** In accordance with its 2020–21 budget tabled on 17 June 2020, Prince Edward Island has reduced its small-business rate from 3.00% to 2.00% effective 1 January 2021.

Personal tax

Personal income tax rates

The budget does not include any changes to personal income tax rates.

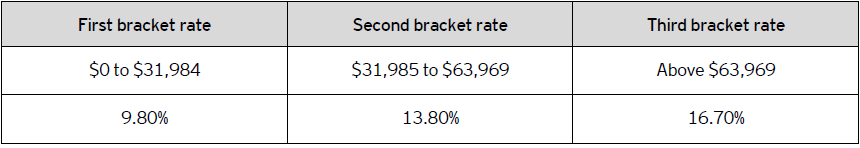

The 2021 PEI personal tax rates are summarized in Table B.

Table B – 2021 Prince Edward Island personal tax rates

In addition, there is a 10% surtax on provincial income tax in excess of $12,500.

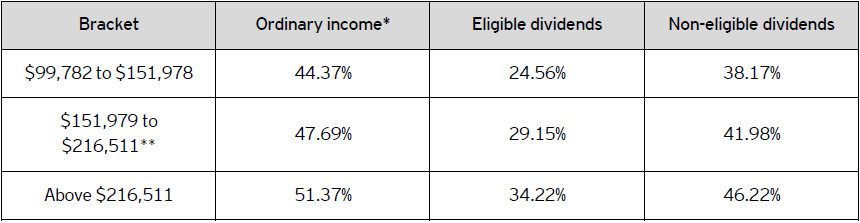

For taxable income in excess of $99,781, the 2021 combined federal-Prince Edward Island personal income tax rates are outlined in Table C.

Table C – Combined 2021 federal and Prince Edward Island personal tax rates

*The rate on capital gains is one-half the ordinary income tax rate.

**The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with net income in excess of $151,978 and is fully eliminated for individuals with net income in excess of $216,511. Consequently, the additional amount is clawed back on net income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Personal tax credits

This budget proposes changes to the following personal credits/amounts:

- Increase in the basic personal income tax exemption to $11,250 from $10,500 as of 1 January 2022 (the intent of the government is to raise the exemption to $12,000 over the course of its mandate, which started in 2019)

- Increase in the low-income tax reduction threshold to $20,000 from $19,000 as of 1 January 2022

Learn more

For more information, please contact your EY or EY Law advisor.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.