Nunavut budget 2021‑22

Tax Alert 2021 No. 03, 23 February 2021

“[W]e continue to manage our fiscal purse well. Despite the unforeseen challenges we faced this past year, our financial situation is such that we can be comfortable leaving it to the next government.”

Nunavut Finance Minister George Hickes

2021–22 budget speech

On 23 February 2021, Nunavut Finance Minister George Hickes tabled the territory’s fiscal 2021–22 budget. The budget contains no new taxes and no tax increases.

The minister anticipates an operating deficit of $21.4 million for 2020–21 and projects an operating deficit of $14.3 million for 2021–22.

Following is a brief summary of the key tax measures.

Business tax measures

Corporate tax rates

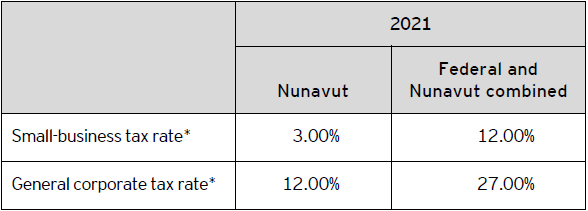

No changes are proposed to the corporate tax rates or the $500,000 small-business limit.

Nunavut’s 2021 corporate tax rates are summarized in Table A.

Table A – 2021 Nunavut corporate tax rates

* Rates represent calendar-year rate unless otherwise indicated.

Personal tax

Personal income tax rates

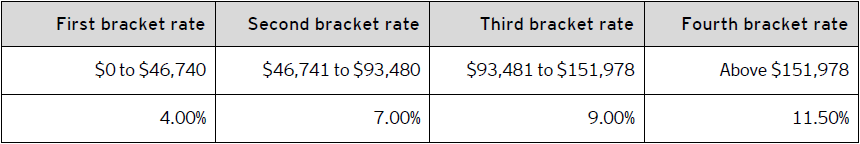

The budget does not include any changes to personal income tax rates.

The 2021 Nunavut personal tax rates are summarized in Table B.

Table B – 2021 Nunavut personal tax rates

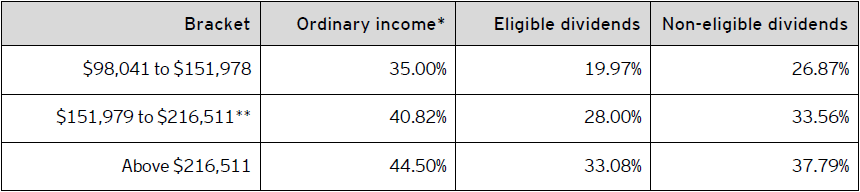

For taxable income in excess of $98,040, the 2021 combined federal-Nunavut personal income tax rates are outlined in Table C.

Table C – Combined 2021 federal and Nunavut personal tax rates

*The rate on capital gains is one-half the ordinary income tax rate.

** The federal basic personal amount comprises two elements: the base amount ($12,421 for 2021) and an additional amount ($1,387 for 2021). The additional amount is reduced for individuals with taxable income in excess of $151,978 and is fully eliminated for individuals with taxable income in excess of $216,511. Consequently, the additional amount is clawed back on taxable income in excess of $151,978 until the additional tax credit of $208 is eliminated; this results in additional federal income tax (e.g., 0.32% on ordinary income) on net income between $151,979 and $216,511.

Learn more

For more information, please contact your EY or EY Law advisor.

Budget information: For up-to-date information on the federal, provincial and territorial budgets, visit ey.com/ca/Budget.