Tracking emissions through tokenization

For organizations looking to meet their ESG goals, they need to consider ways to build their resilience and secure their license to operate by committing to sustainable value creation that considers the needs of people and the environment. Through tokenization, companies can gain visibility into both their products’ direct and indirect emissions; from a direct perspective by mapping Scope 1 emissions, which are direct emissions from owned or controlled sources, and an indirect perspective through the tracking of Scope 3 emissions, which are emissions resulting from an organization’s operations, including upstream and downstream activities.

Customers can now track and trace all emissions associated with their product through the entire supply chain lifecycle. Organizations can use this information to develop data-driven strategies and verify sustainability compliance claims from suppliers, and adhere to ESG reporting standards at every stage in a supply chain. This builds trust and confidence in consumers, business partners and purchasing decisions.

How to prove physical real-world assets exist off a blockchain

One of the biggest challenges in digitizing RWAs is the ability to prove the physical inventory exists in the defined state and quantity. This challenge exists both when creating a token as well as selling it. However, through the use of robust and accepted inventory management systems and practices, proof of existence can be accomplished via an attestation service.

While RWA tokenization will not replace traditional inventory management systems any time soon, it will instead be integrated in a blockchain network, which would validate the inventory or sales transactions. Examples of attestations could either be through a traditional barcode or RFID scan, or via a third-party vendor-managed inventory program.

Effectively valuating real-world assets through DeFi

The ability to showcase the financial value and proof of ownership of a product through its lifecycle provides additional benefits not realized with traditional inventory management and valuation practices. It not only provides value for an organization’s assets, but also enables the value to be set by the market. This enables an organization to take advantage of how the market values these tokens, rather than its assets book values.

Immutable proof also leads to more financing opportunities like lending and borrowing services; since the token has been backed by the RWAs, organizations can use this as collateral. This concept represents a disruption to a global treasury function, transferring power to individual organizations, similar to how DeFi disrupted traditional finance.

Operational and commercial excellence

Real-time commercial compliance

Traditionally, contracts are managed inadequately with a reliance on auditing past invoice data to identify and reduce value leakage. Due to human error and other inefficiencies, there exists a risk that commercial terms are not validated correctly. Often, suppliers are resistant to refund the full value of identified contractual non-compliance, leading to significant contract value leakage.

To address these inefficiencies, companies are seeking alternatives to embed a real-time component in their vendor audit processes. Real-time audit and commercial compliance can be seamlessly integrated with blockchain technology through the help of smart contracts. Smart contracts are self-executing contracts that have the terms of an agreement written by lines of code. Smart contracts can track performance in real time and can take immediate action based on pre-defined conditions, thereby replacing human error and fraud-prone processes.

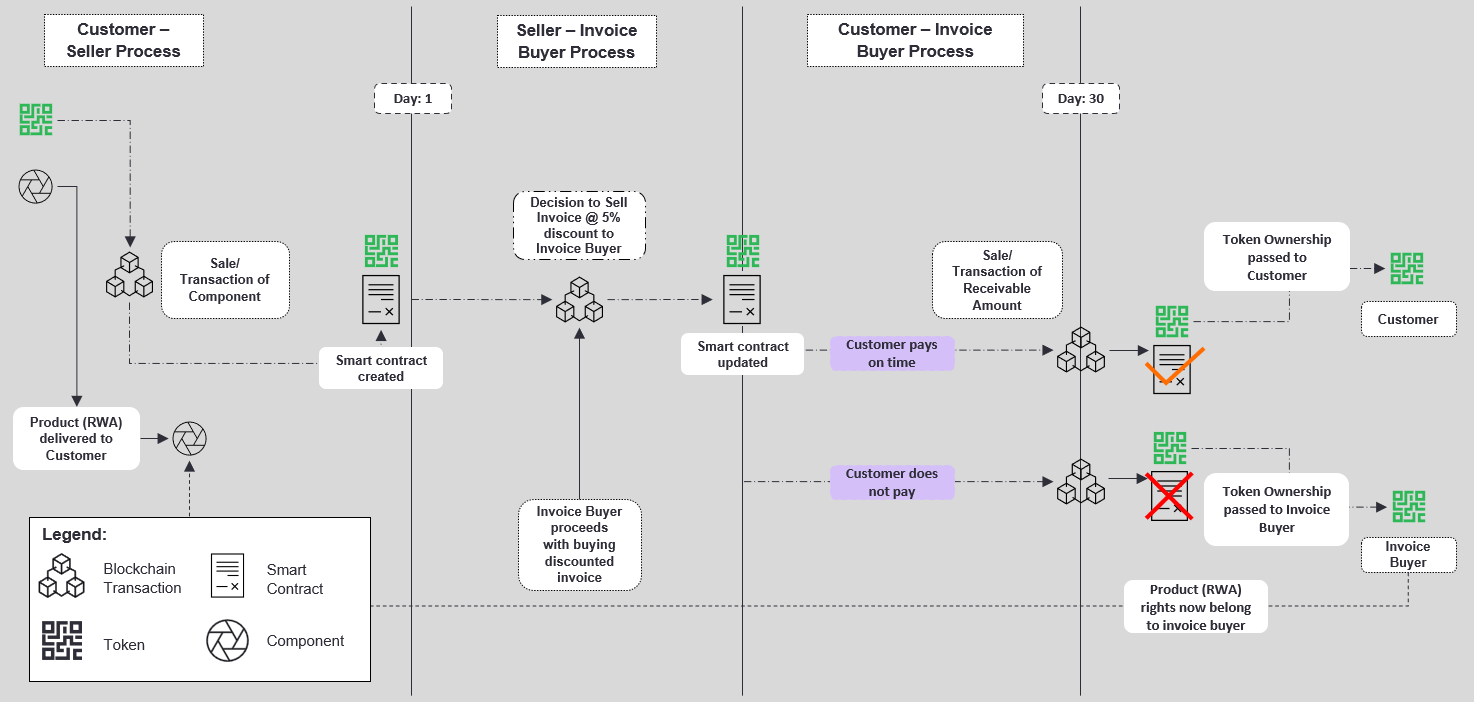

Improving cash flow through invoice factoring

Many organizations have outstanding accounts receivables, often waiting anywhere from 30 to 60 days or more for the payment of goods or services. For many organizations, having fluid access to cash is of vital importance. From paying your workforce or suppliers to investing in new services or technologies, organizations cannot be effective without cash.

To address this, a practice known as invoice factoring can be applied which works to improve the outstanding time waiting for cash. The process works by having an organization sell its outstanding accounts receivable invoice amounts to an invoice buyer at a discount. Although the invoice is sold at a discount, this allows the organization quicker access to cash rather than waiting 30 to 60 days. When the invoice is paid by the third-party customer, the invoice buyer will then receive the full invoice amount from the third-party customer, and the invoice buyer will gain a profit on the spread.

The process is often quite convoluted, requiring an agent or middle organization to be involved to facilitate the sale and the final receipt of payment. However, due to the decentralized and trusted nature of blockchain, organizations can take advantage of this new process and look to gain additional efficiencies for saving money and improving cash flow.