EY’s Sector focused quarterly recaps

Ontario transactions

The following is a snapshot of transactions that occurred in Ontario during the quarter, with a focus on mid-market, private company transactions. Companies headquartered in Ontario are noted in yellow.

- Jan 1, 2021: Affirm Canada Holdings Ltd. acquired Ontario‑based PayBright Inc., a provider of point-of-sale consumer financing and installment payment plans, for CDN$340m. The acquisition will enable Affirm to expand its offerings and reach across North America and attract new customers.

- Jan 4, 2021: Spin Master Corp. acquired UK‑based Rubik’s Brand Limited (Rubik), a designer, manufacturer and seller of Rubik’s Cube, for CDN$50m. The acquisition will help Spin Master transition into a blended model of direct sales in combination with existing partners globally. Also, Spin Master plans to expand the distribution of Rubik’s Cube using its global footprint.

- Jan 4, 2021: Calian Group Ltd. acquired Québec‑based InterTronic Solutions Inc., a manufacturer of antenna systems, surveillance and radar, satellite communications, remote sensing, and radio astronomy systems, for CDN$24.5m. The acquisition will allow diversification of Calian’s customer base and will extend Calian’s satellite gateway, modulator and monitoring portfolio, which broadens its ground system offerings.

- Jan 4, 2021: Rogers Media Inc. acquired Ontario‑based Rouge Media Group Inc., a media company that provides out‑of‑home (OOH) media services. The acquisition will allow Rogers an entry into the OOH space and provide diversified offerings to customers and advertising partners.

- Jan 5, 2021: SLC Management acquired California‑based Crescent Capital Group, LP, an employee-owned investment management firm, for US$276m. The acquisition will extend SLC Management’s solutions in alternative credit, which will benefit existing and prospective clients.

- Jan 8, 2021: Prysmian S.p.A. acquired Ontario‑based EHC Global Inc., a manufacturer and supplier of escalator handrails, rollers, elevator belts, strategic components and integrated solutions to the vertical transportation industry, for CDN$130m. The transaction value implies a TEV/revenue multiple of 1.1x and a TEV/EBITDA multiple of 7.2x. The acquisition is in line with Prysmian’s strategy to grow and reinforce its value‑added businesses.*

- Jan 11, 2021: CloudMD Software & Services Inc. acquired Ontario‑based HumanaCare Inc., a provider of mental and physical wellness services, for CDN$17.5m. The acquisition will position CloudMD as one of the only providers to address the short‑term and long‑term mental and physical health care needs of employees. It will also allow CloudMD to optimize and cross‑sell into HumanaCare’s current client network.

- Jan 13, 2021: Tophatmonocle Corp. acquired Texas‑based Fountainhead Press, LLC, a publishing house specializing in English composition and communication. The acquisition will help Top Hat expand its broad portfolio of content designed to support, engage and motivate the modern student inside and outside the classroom.*

- Jan 25, 2021: Mogo Inc. acquired Ontario‑based Carta Worldwide Inc., a provider of transaction processing and payment technologies and services, for CDN$24.2m. The transaction value implies a TEV/revenue multiple of 2.8x. The acquisition will enhance Mogo’s digital wallet capabilities by leveraging Carta’s processing engine and will launch peer‑to‑peer payment solutions.

- Jan 29, 2021: TFI International Inc. acquired Ontario‑based Fleetway Transport Inc., a full‑service provider of truckload and heavy‑haul transportation solutions and logistics services, for CDN$21m. The transaction value implies a TEV/revenue multiple of 0.8x. The acquisition will enable Fleetway to expand its business and the combined entity will explore synergies.

- Feb 1, 2021: Genius Brands International, Inc. acquired Ontario‑based ChizComm Ltd., a provider of public relations, digital marketing, social media, promotions, events and product launches and creative services, for CDN$25.7m. The acquisition will allow Genius Brands to leverage ChizComm’s expertise in media planning and buying and their deep industry relationships.

- Feb 16, 2021: Fastfrate Group acquired Ontario‑based ASL Distribution Services, a logistics services company that offers transportation and warehouse-related services for time‑critical products. The acquisition will allow Fastfrate an entry into the e‑commerce marketplace, enhance its product offering and supply chain and support its growth strategy. Terms of the transaction were not disclosed.*

- Feb 22, 2021: Borrowell Inc. acquired British Columbia‑based Refresh Financial, a provider of cash secured savings loans and secured credit cards for people to build their credit. The acquisition will accelerate the extensiveness and approachability of Borrowell’s product offering. Terms of the transaction were not disclosed.*

- Feb 26, 2021: Andrew Peller Limited acquired Ontario‑based Riverbend Inn & Vineyard, an operator of a hotel and restaurant, for CDN$10m. The transaction will allow Riverbend to complement the Peller Estates Winery, with the new vineyards managed by Riverbend’s winemakers.

- Mar 2, 2021: Entrepreneurial Equity Partners, L.P. (E2P) acquired Ontario‑based Ya YA Foods Corporation, a contract manufacturer of aseptic food and beverage products, including plant‑based and high-protein beverages, fruit juices, sports drinks, and specialty milk and dairy beverages. The acquisition will help E2P leverage Ya YA’s contract manufacturing capabilities and provide high‑quality products and services to its customers. Terms of the transaction were not disclosed.

- Mar 4,2021: Organic Garage Ltd. acquired Ontario‑based The Future of Cheese Inc., a producer of plant‑based cheese products, for CDN$7.7m. The acquisition will help Organic Garage expand its current product offerings and enhance its in‑store experience.

- Mar 8, 2021: Snap‑on Incorporated acquired Ontario‑based Dealer-FX Group, Inc., a developer and provider of automotive retail marketing solutions, including integrated service retention and service drive sales tools to dealers and OEMs, for US$200m. The transaction value implies a TEV/revenue multiple of 5.4x. The acquisition will expand Snap‑on’s existing OEM and dealership business. It will also expand the reach of Snap‑on’s shop management software, and enhances its expertise with respect to dealership service and repair operations.

- Mar 16, 2021: Axonify Inc. acquired Georgia‑based MLevel, Inc., a developer of cloud‑based microlearning platforms for corporate learning. The acquisition will allow Axonify to expand its current service offerings. The combined entity will provide significant benefits of the complementary capabilities to its customers and drive the future of modern learning. Terms of the transaction were not disclosed.

- Mar 18, 2021: Maropost Inc. acquired Australia‑based Neto E‑commerce Solutions Pty Ltd., a provider of e‑commerce platforms for retailers, wholesalers and eBay traders, for CDN$58m. The acquisition will help Maropost expand its presence in the e‑commerce marketing space. The combined functionality will provide greater value for its customers of all sizes.

* EY acted as financial advisor.

Sources: S&P Capital IQ, Mergermarket, secondary research.

Historical M&A activity

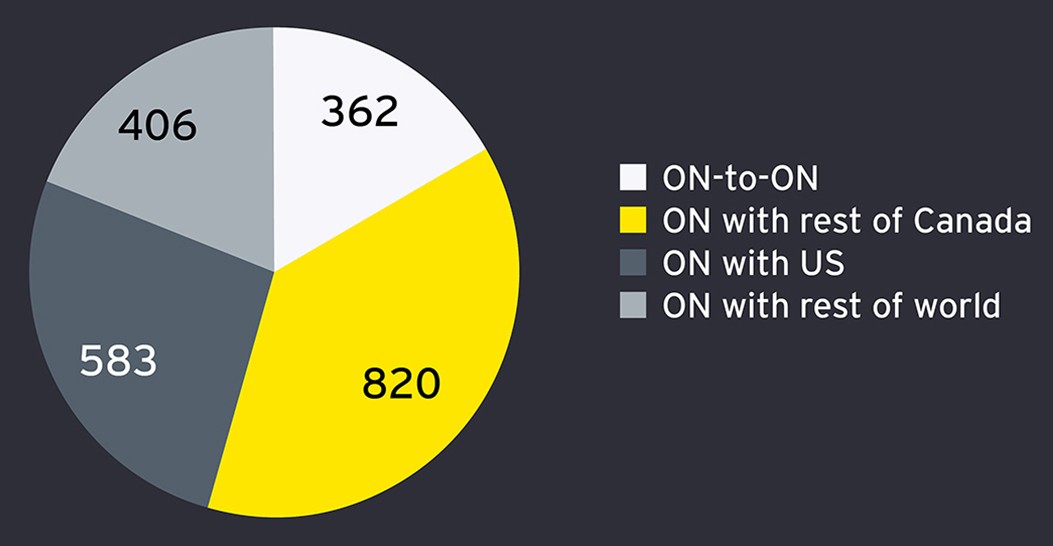

Counterparty mix over the last eight quarters

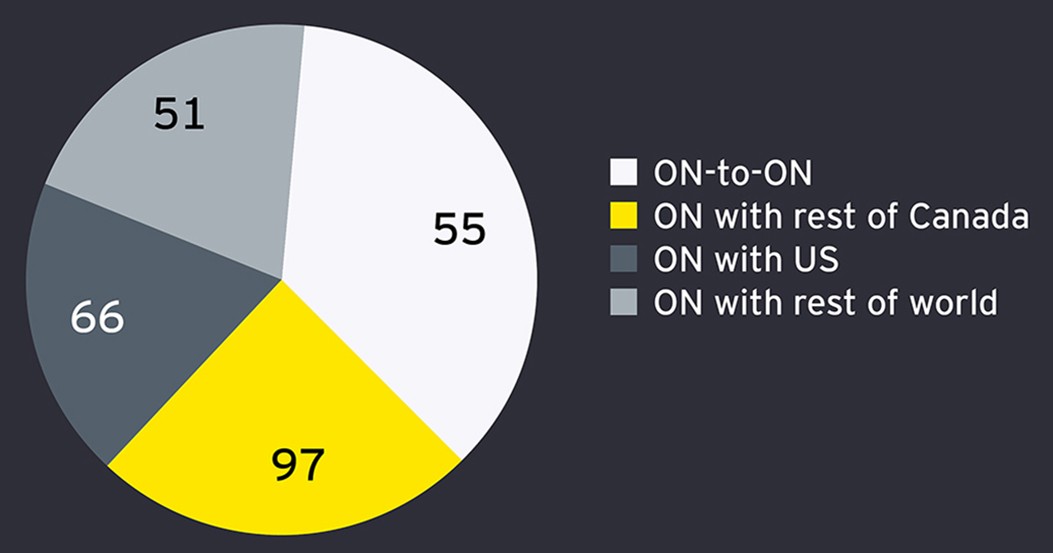

Counterparty mix over the last quarter

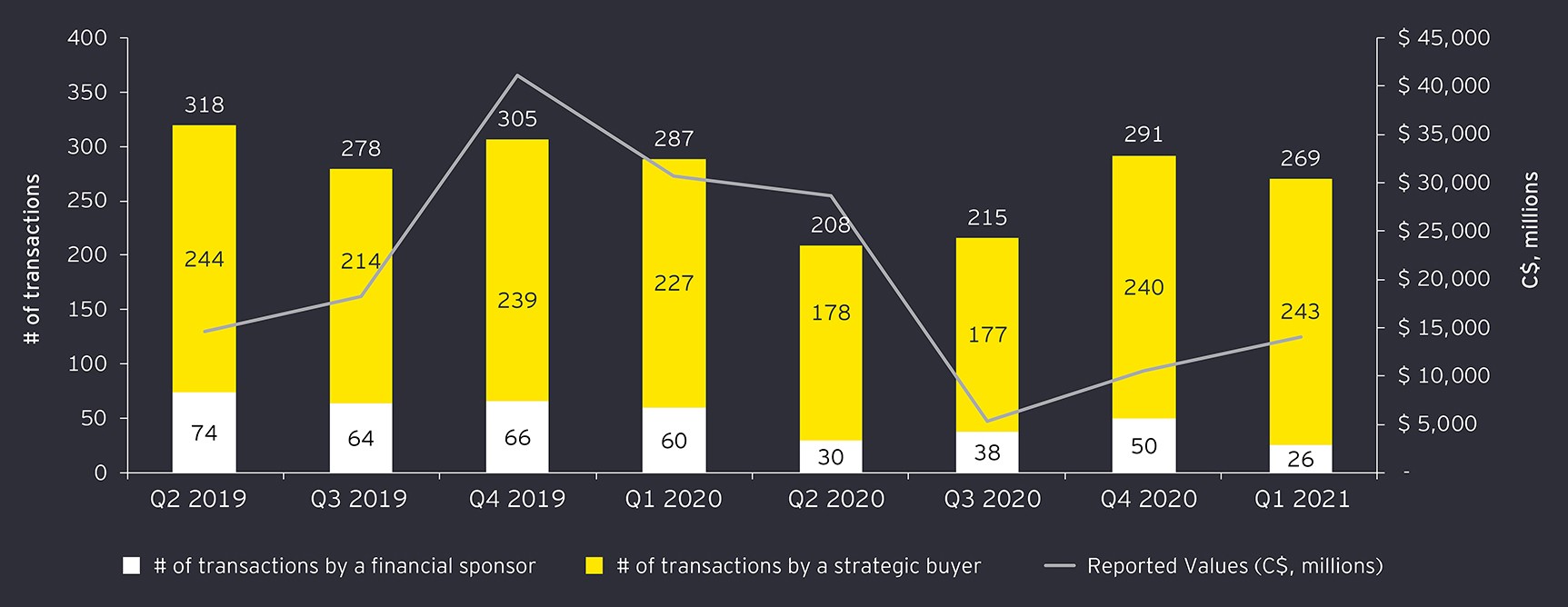

Transactions involving Ontario-based companies over the last eight quarters

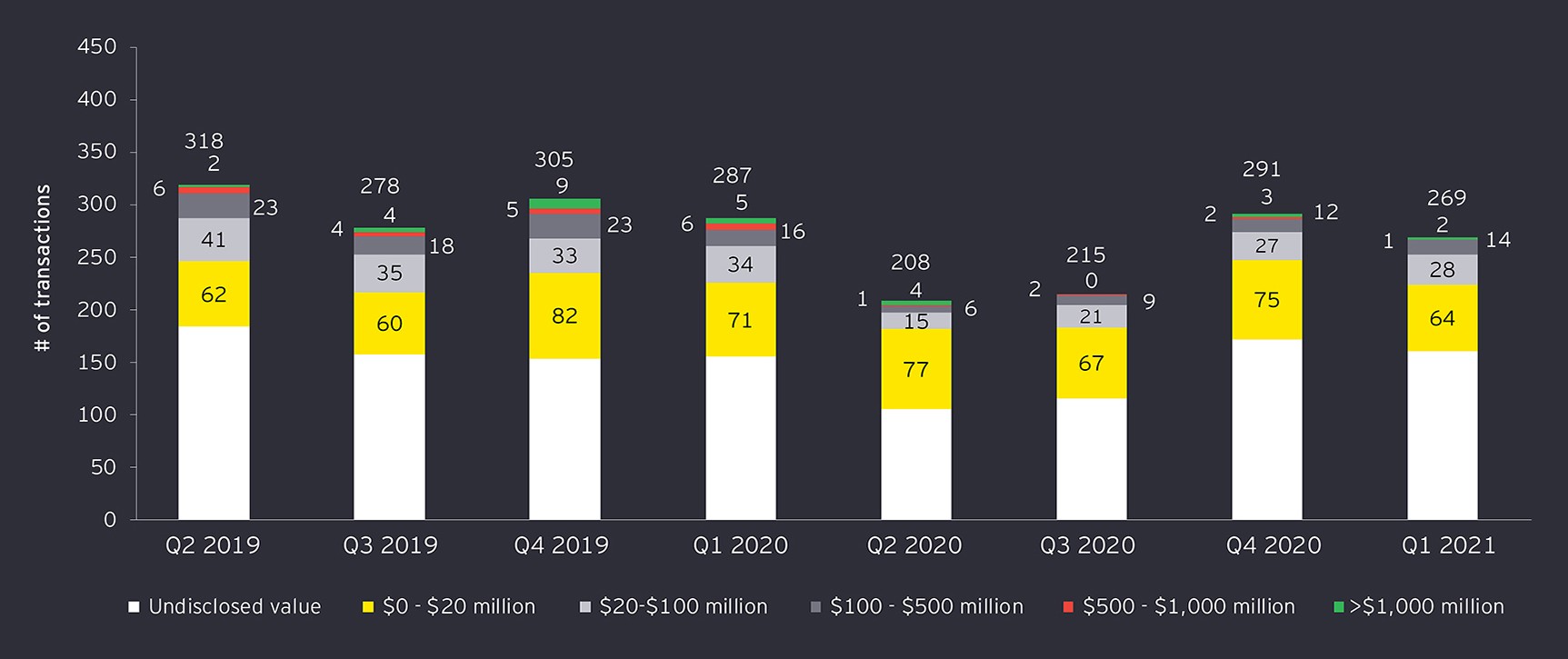

Transactions involving Ontario-based companies over the last eight quarters by deal size (in C$) millions)

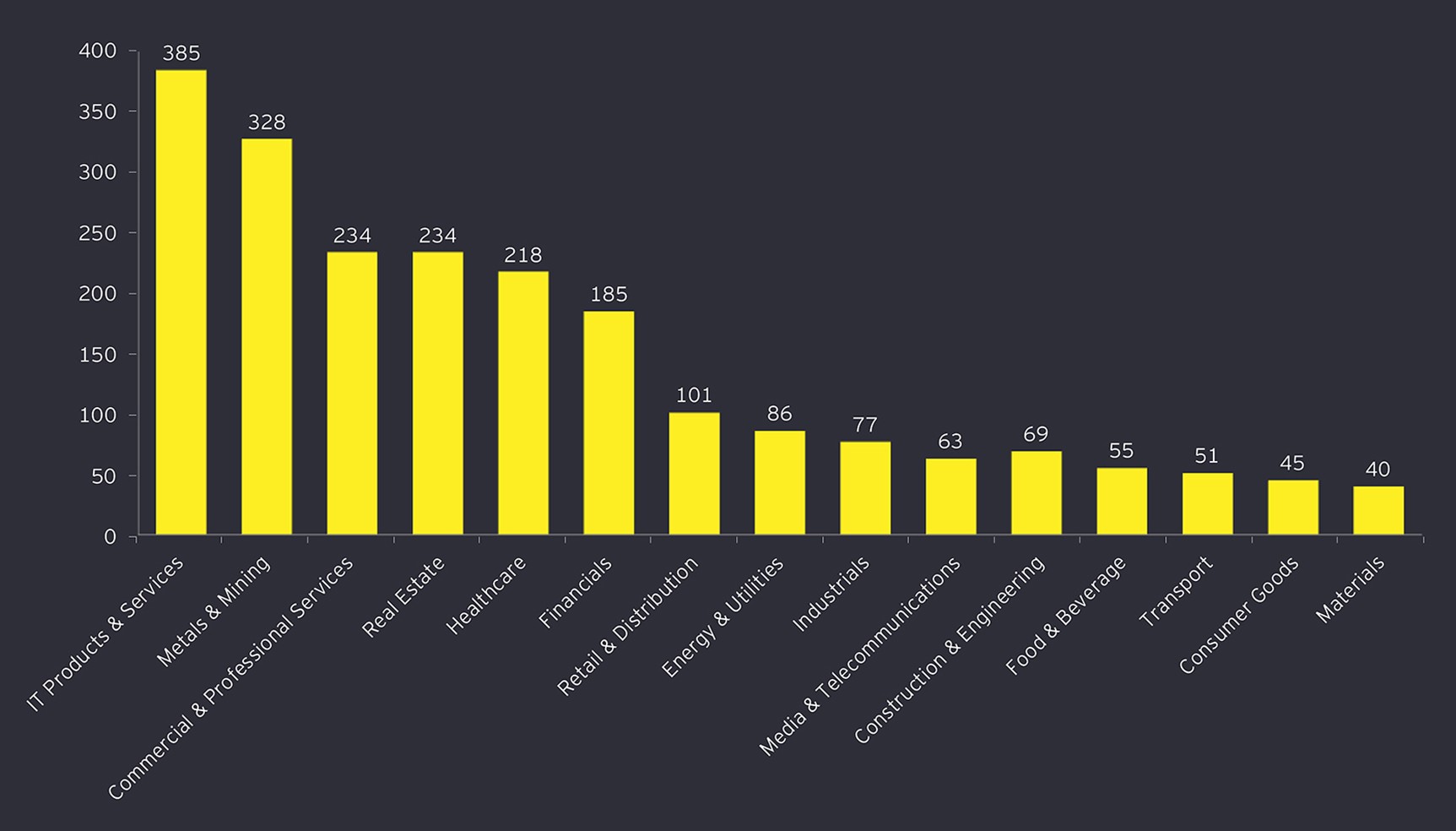

Number of Ontario transactions by industry over the last eight quarters

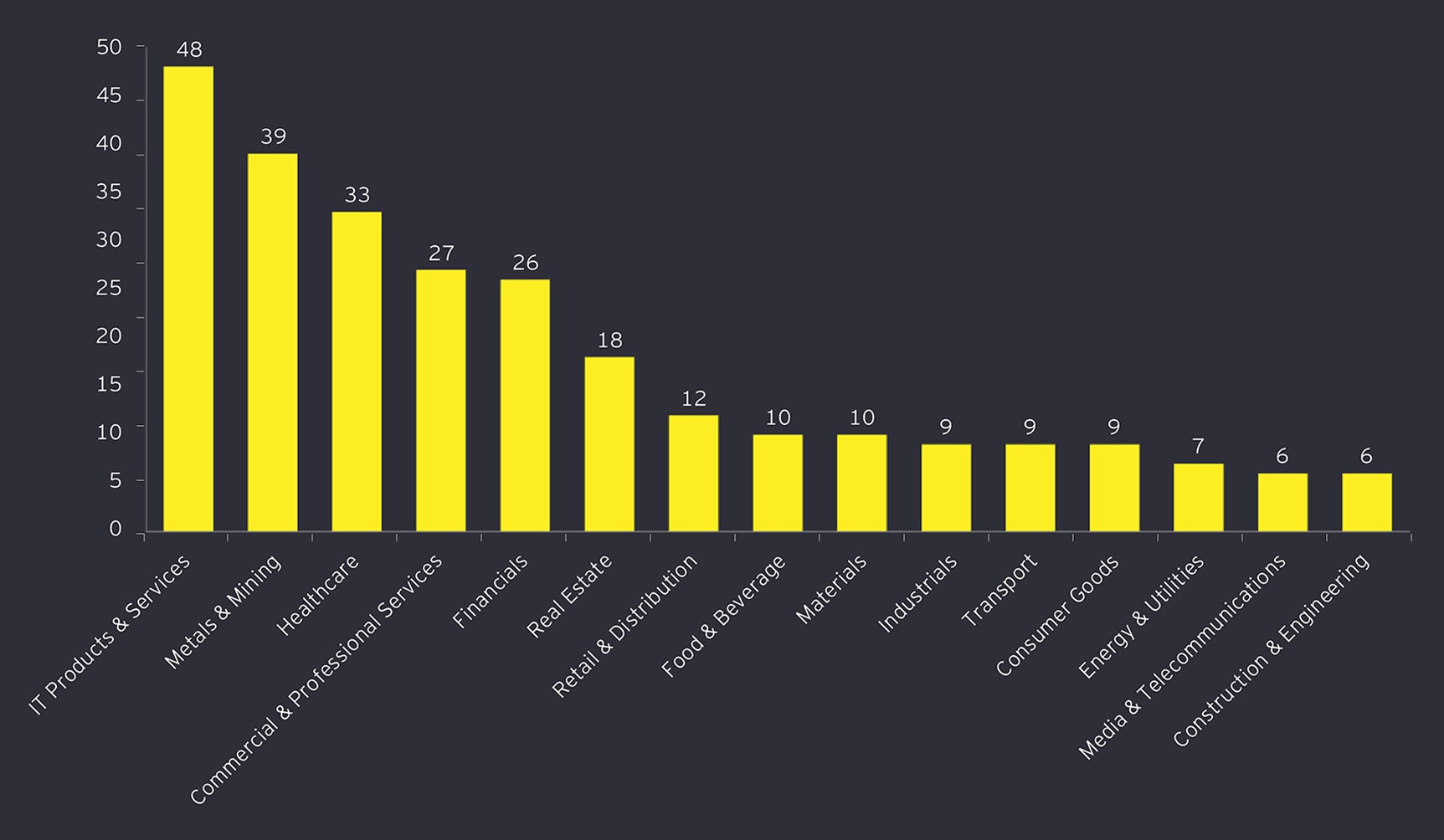

Number of Ontario transactions by industry over the last quarter

Summary

While Q1 2021 deal volumes were slightly below Q4 2020, they are still much higher than Q2 2020 and Q3 2020, when uncertainty around COVID‑19 was impacting deal completion. Based on M&A activity in Q1 2021, we expect strong M&A activity this year driven by strategic acquisitions and consolidation, increased cross border activity given increased confidence in virtual deal processes, and a potential rebound in M&A activity in sectors affected by COVID‑19.