Selected transactions in H1 2020

- June 11, 2020 Collaborative Solutions, a provider of consulting services specializing in workday enterprise cloud applications for finance and human resources, was acquired by Cognizant (Nasdaq: CTSH) for a transaction value of $385m.

- June 1, 2020 BCE, a provider of communication services, announced the sale of 25 data centre facilities to Equinix, Inc. for a transaction value of $756.1m.*

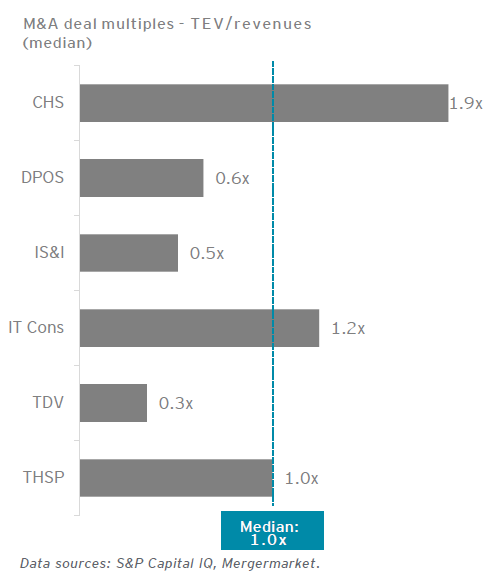

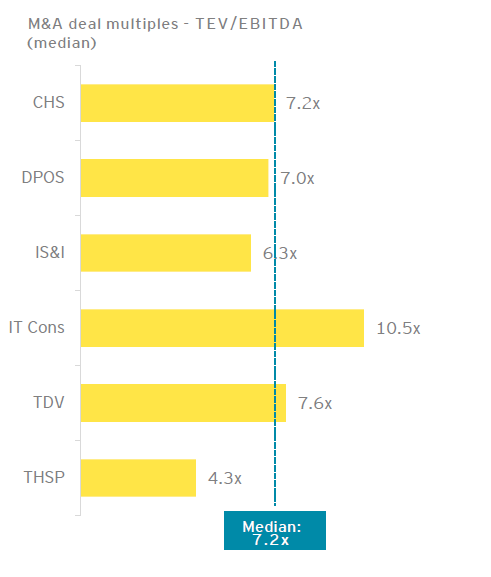

- March 13, 2020 The US Federal business of Unisys Corporation (NYSE: UIS), a provider of digital transformation services, was acquired by Science Applications International Corporation (NYSE:SAIC) for a transaction value of $1.2b. The acquisition represents an enterprise value of 1.7x revenues.

- March 13, 2020 Macquarie Infrastructure and Real Assets announced the acquisition of Cincinnati Bell (NYSE:CBB), a provider of diversified telecommunications and technology services, for a transaction value of $2.9b. The acquisition represents an enterprise value of $1.9x revenues and 7.7x EBITDA.*

- March 13, 2020 DXC Technology Company (NYSE:DXC), a provider of information technology services and solutions including IT modernization, optimization of data architecture and security, announced that its US state and local health and human services business will be acquired by Veritas Capital for a transaction value of $5b. The acquisition represents an enterprise value of 3.6x revenues.*

- February 23, 2020 Xperi Corporation (Nasdaq: XPER), a developer and provider of licences for miniaturization technologies for chip-scale, multichip and wafer-level packaging, announced that it has received a non-binding proposal from Metis Ventures for a transaction value of approximately $1.6b. The acquisition represents an enterprise value of 5.2x revenues.*

- February 13, 2020 Regulatory DataCorp, Inc., a provider of automated, intelligent customer screening and decision-ready intelligence solutions for financial institutions and technology companies, was acquired by Moody's Corporation (NYSE: MCO) for a transaction value of $700m.

- February 3, 2020 Askida, a provider of software quality assurance and application development and modernization services, was acquired by Alithya Group Inc. (TSX:ALYA) for a transaction value of $12m. The acquisition represents an enterprise value of 1.2x revenues.

- January 31, 2020 Incentive Technology Group, a digital consulting firm delivering IT systems modernization and business transformation, was acquired by ICF Incorporated, Inc. for a transaction value of $255m. The acquisition represents an enterprise value of 2.8x revenues.

- January 27, 2020 Blackstone Federal, a provider of application development, cloud modernization and systems architecture, cybersecurity, user experience design and branding services to government clients, was acquired by ECS Federal for a transaction value of $85m. The acquisition represents an enterprise value of $1.9x revenues.

Deals indicated are Canadian deals.

Note: Selected US- and Canada-based transactions.

* Deal announced but not closed. Data sources: S&P Capital IQ, Mergermarket

Summary

During the first few weeks of the pandemic, IT teams and MSPs focused on supporting a large number of employees in working remotely using virtual private networks (VPNs). Now that employees have spent so much of their time working from home, organizations need to prepare for and cope with this new reality for the long term. Moreover, employees spending time between home and office creates several challenges and opportunities for MSPs.

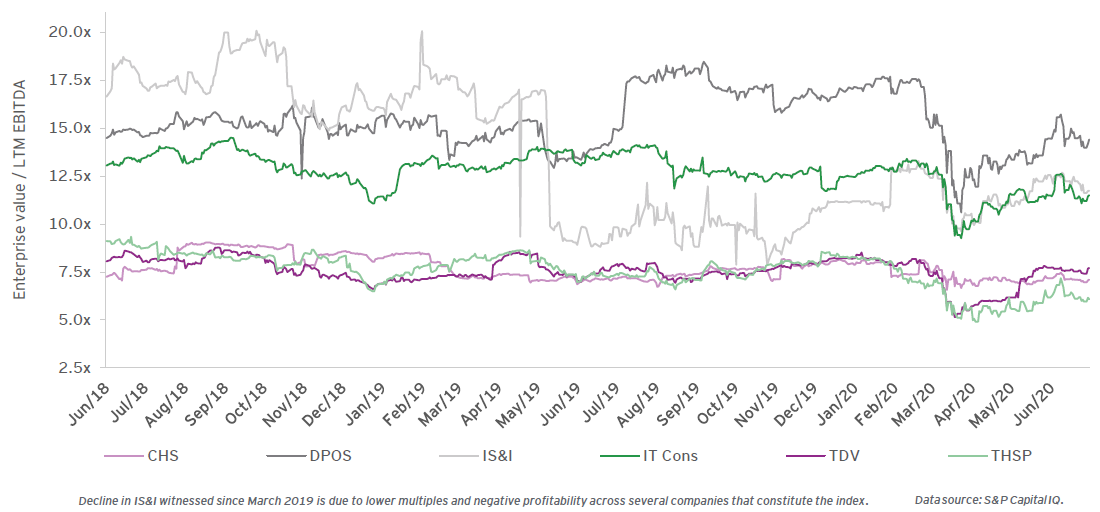

The indices used in this document have been compiled by EY Orenda Corporate Finance Inc. solely for illustrative purposes. The companies chosen are publicly traded companies that are commonly used for industry composites to show stock performances within a sector. The indices do not include all public companies that could be categorized within each sector, and were not created as benchmarks, nor should they imply benchmarking or recommendations for a particular stock and/or sector.

The information and opinion within this document has been derived from various sources of research including but not limited to Capital IQ, Mergermarket, and Company filings.

This publication contains information in summary form, current as of the date of publication, and is intended for general guidance only. It should not be regarded as comprehensive or a substitute for professional advice. Before taking any particular course of action, contact Ernst & Young or another professional advisor to discuss these matters in the context of your particular circumstances. We accept no responsibility for any loss or damage occasioned by your reliance on information contained in this publication.