Chapter 1

Harnessing the power of data

In a 2021 global EY survey of small and medium enterprises (SMEs), 74% of Canadian respondents reported they are willing to share more data with their financial services providers in exchange for better services/products.¹

SMEs are demanding more tailored and contextualized solutions from their financial institutions that align with their needs as defined in the business lifecycle stages. The EY’s global SME survey found that SMEs are underserved by financial institutions’ legacy solutions and are taking greater control of their data and willing to share it if it means they will receive customized solutions.

An increasing number of non-traditional institutions are developing solutions with intermediaries like data aggregators to address SMEs’ challenges. Data aggregators act as the highway between SMEs, financial institutions and FinTechs. By collaborating with data aggregators, financial institutions and FinTechs alike can differentiate themselves by transforming their standardized products and services into curated solutions that meet the needs of SMEs as they grow and evolve.

Chapter 2

SMEs have traditionally been underserved

SMEs play a significant role in the Canadian economy. There were more than 1.22 million businesses as of December 2022, the majority (~98%) of which were small businesses.² SMEs throughout the country contribute significantly towards revenue creation and employment. Small businesses employed almost 2/3 of the total labour force in 2023, just under 11 million people.³

However, approximately 31% of Canadian SMEs are not satisfied with their financial services providers.⁴ Based on the CFIB 2020 report card, third-party assessment of service quality from financial institutions for small businesses remains low; while credit unions score a middling 6.19 out of 10, most banks ranged from 2.49 to 4.42.⁵

Small business owners have unique needs, many of which are not addressed by traditional retail or commercial banking propositions. The EY survey revealed the top three aspects of dissatisfaction for Canadian SMEs:

1. Lack of regular connections –Most SMEs would like their financial service providers to stay connected and proactively reach out to help support their business.

2. Lack of customized digital experience – SMEs often use offline channels such as branches, relationship managers or even brokers because they are not aware of the online solutions or lack knowledge of digital offerings that can meet their business needs.

3. Lack of product flexibility– SMEs would like flexibility to switch products and services that best suit their business needs. There are great products and services for consumers and large businesses, but products and services for SMEs are limited and outdated and have cumbersome processes and requirements.

Banks are still the most trusted financial services providers in SMEs’ eyes. However, FinTech players are quickly catching up and increasing their market share. Before offering any value-added services, 75% of Canadian SMEs would like their financial institution to do the “basics” well.⁶

The key to providing better solutions for SMEs is through a deeper understanding of the needs that are required the most in the SME business lifecycle.

SME challenges in the business lifecycle: when and where they require support

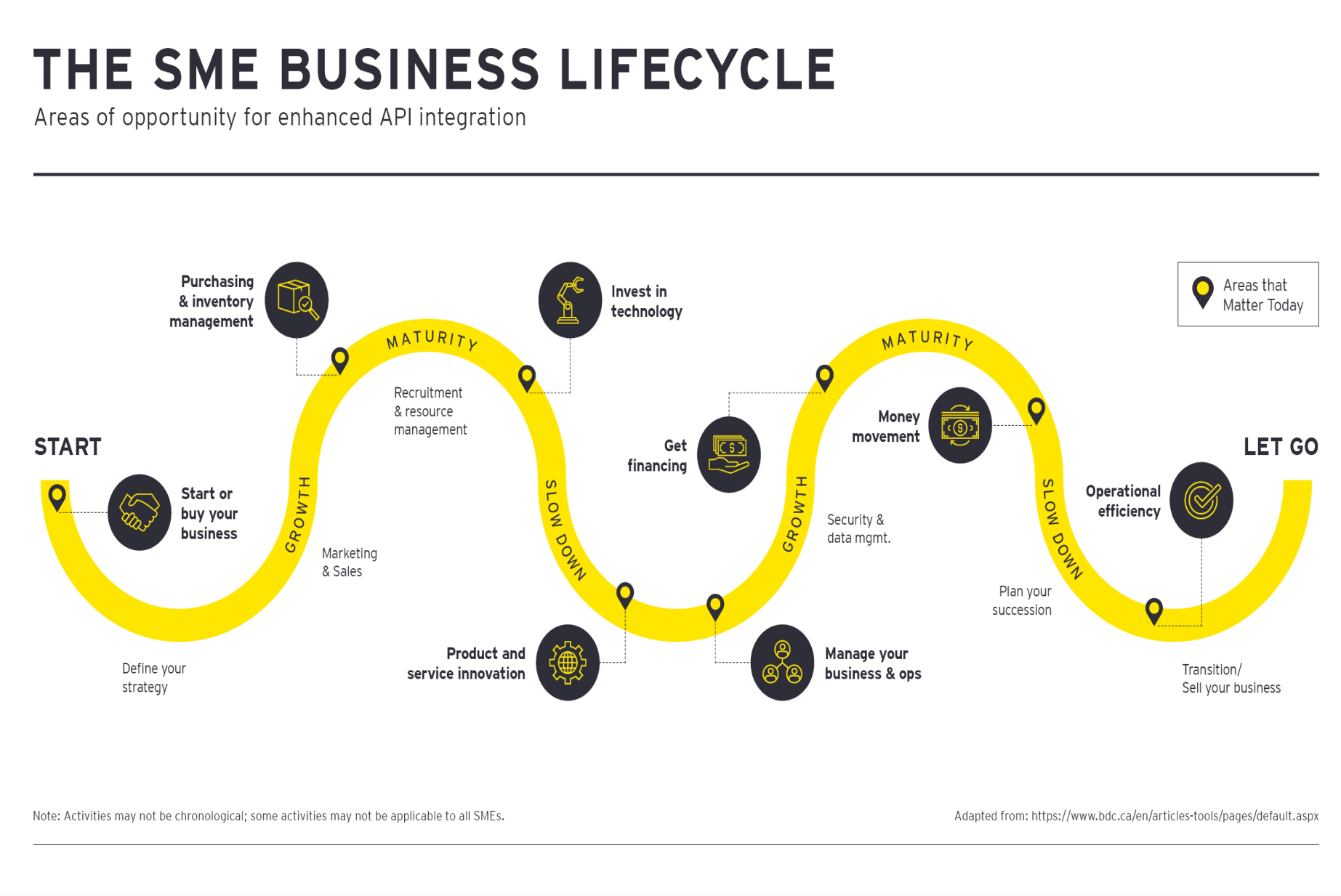

Financial institutions should aim to understand the SME lifecycle and the various stages a typical SME goes through and anticipate their needs at each stage. During its lifecycle, a SME usually goes through five stages; start, growth, maturity, slowdown and let go. Their expectations from their financial services providers evolve at each stage.

Application programming interface (API) connections with data aggregators can offer solutions at each of those lifecycle stages:

- Start – At this critical time for businesses, it’s important for SMEs to find the right financial institution that understands their business and provides services and solutions that offer great experiences every time, such as rapid onboarding.

- Growth – To sustain growth, seamless access to working capital becomes a larger focus for many businesses specially to meet demand. Other areas of value include offerings for core business solutions in sales, marketing and resource management.

- Maturity – Most SMEs seek out support to optimize various aspects of their business, such as liquidity, payables, receivables, purchasing and inventory management capabilities.

- Slowdown – A business typically has slowdown periods multiple times throughout its life, and a common need during those times is support to manage the business and its operations through an enterprise resource platform (ERP).

- Let go – A lot of the focus here with SMEs has been transitioning and succession planning to take over the business going forward. Many SMEs are interested in integrations with tools to support planning for changes — for example, exit, succession or sale.

Understanding the different stages an SME navigates can allow financial institutions to proactively offer innovative and tailored solutions. To achieve that, it’s important to understand the business’s key pain points.

Understanding the key pain points

The global SME banking survey EY teams conducted included 300+ Canadian SMEs to understand their challenges and pain points. The survey results present opportunities for traditional and non-traditional financial institutions to act on. The survey found the top three areas of concern for SMEs:

1. Onboarding: 42% of SMEs are not satisfied with the speed of the onboarding process. 36% of the Canadian respondents are not satisfied with the degree of automation in the onboarding process.⁷

2. Credit decisioning/lending: More than half (52%) of SMEs look for funding within seven days of applying, as short-term funding is vital to unlock opportunities to grow and scale; 25% of SMEs seek funding within three days.⁸ Complex loan applications and lengthy documentation processing lead to delays in the release of funds, thus creating a gap between when the credit is required and when it’s available.

3. Cash management: The majority of SMEs surveyed indicated that cashflow management is a recurring challenge. Lack of central or aggregated views of the business cashflows leads to less control over liquidity management and cashflow forecasting activities.

SMEs are increasingly turning to challenger banks, FinTechs or non-financial institutions to service their financial needs through secure channels. Data aggregators are uniquely positioned to address these pain points through their unique value proposition which makes use of a network of FinTechs and financial institutions.

Aggregator applications and SMEs

Data aggregators are connected to multiple FinTechs, or data recipients, that range in category. These FinTechs use the data available from financial institutions to develop and offer solutions. Below are a few examples of applications used today:

- Lending: Validation of income and aggregation of data from various sources (e.g., transaction data across financial institutions) to better inform creditworthiness and provide solutions tailored to an SME’s financial health in real time.

- Liquidity management: Enabling SMEs to effectively manage their funds across multiple accounts and institutions in a single dashboard and supporting the movement of money across institutions.

- Know your customer (KYC): Accelerates and simplifies the KYC process by aggregating solutions such as fraud, account verification and identity validation in single experience.

- Account integrations: Seamless, real time connectivity between financial accounts and third-party applications via data aggregators, reducing time and costs.

Creating an SME ecosystem through data aggregation

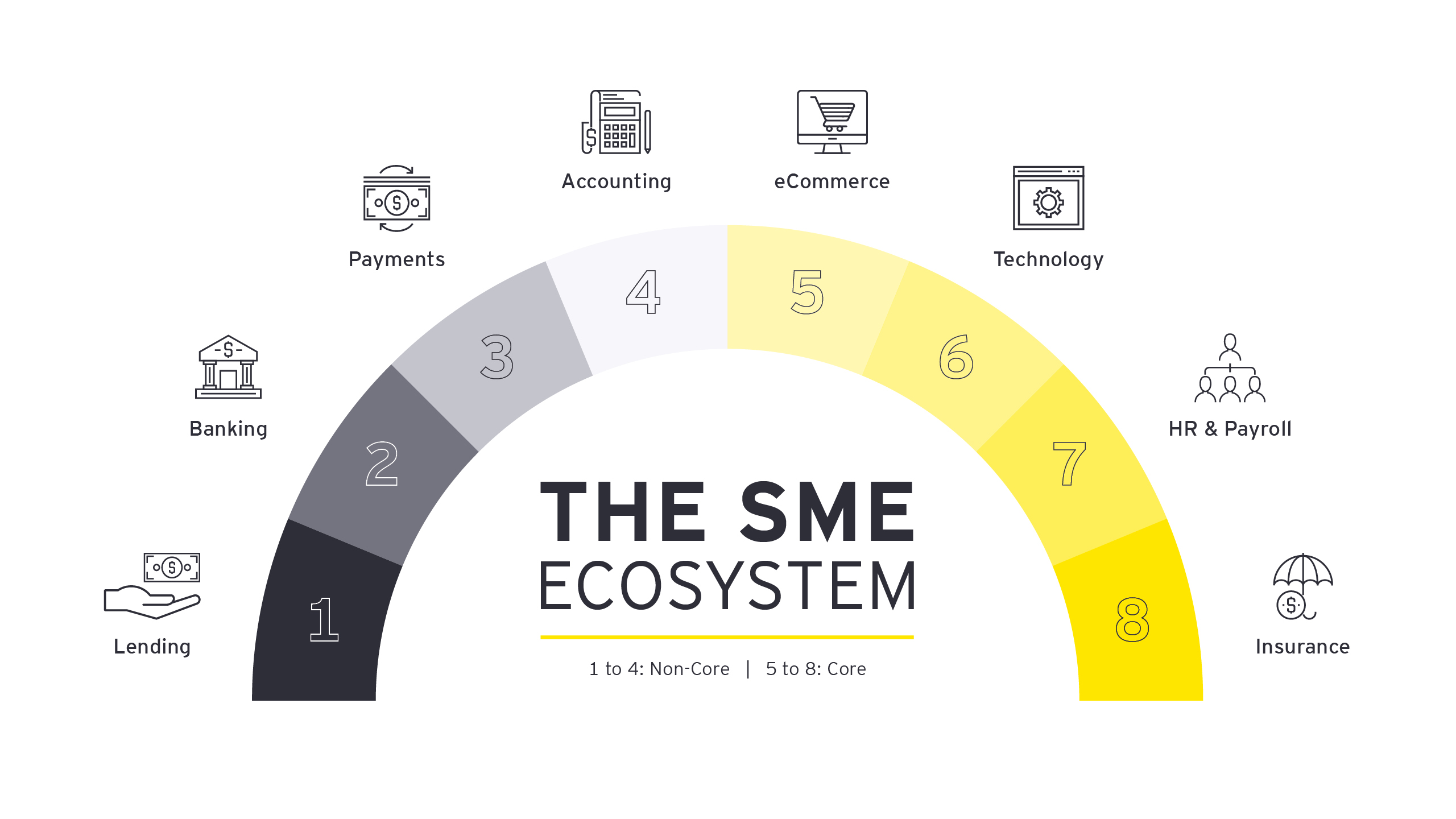

There is an opportunity for financial institutions to create an ecosystem of core and non-core services to better meet the needs of their SME clients. Integration with data aggregators and FinTechs can unlock value for SMEs in a variety of ways.

Data aggregators and FinTechs can play a strong role in creating a seamless experience by providing integrated solutions to meet SMEs’ core and noncore needs. Some of the benefits of data aggregators and FinTechs include:

- Streamlined onboarding: By aggregating and consolidating SME data from a variety of sources, financial institutions can better understand SMEs’ needs, preferences and behaviors. This can reduce the time and effort required to gather information and complete the onboarding process, minimizing delays and inefficiencies with legacy processes.

- Customized lending: Data aggregators can transform lending experiences by accessing non-traditional data in real time via APIs. This can allow lenders to evaluate creditworthiness differently than traditional data sources and not have to turn away a potential customer. Non-traditional data can include utility bills, sales data through point-of-sale systems and more. This allows lenders to give SMEs access to lending tailored to their financial health.

- Efficient cash management: A significant number of SMEs surveyed indicated that cashflow management is a recurring challenge. Providing SMEs with a consolidated view of their financial position is one example of how SMEs can better manage their cashflows and improve their liquidity management and cashflow forecasting abilities. Financial institutions can also streamline the entirety of money movement, facilitating all cases through a single platform, eliminating cumbersome inefficiencies that come with using multiple platforms.

The SME’s expectation is that in exchange for their data, they receive richer and deeper insights about their business and more tailored advice and offerings to help them grow their business.

Chapter 3

The augmented SME experience

The augmented SME experience can redefine interactions between financial institutions, SMEs, data aggregators, FinTechs and third-party applications. Based on SMEs’ willingness to share data, below are three different use cases with data aggregators and FinTechs that can address SMEs’ most common pain points and needs.

Use case 1: business onboarding and account maintenance

Business onboarding is the process whereby a business provides all the required KYC, legal and other statutory documents to onboard the business with a financial institution. Typically, this is the first experience an SME goes through with their financial services provider. The documentation required can be extensive and varies at each of the business’s lifecycle stages. Adding to the complexity is the “physical document verification process,” which is human led and highly manual, leading to delays in the onboarding process.

In an ideal state, financial institutions can look to integrate several anti-money laundering (AML), fraud, business and personally identifiable information verification checks during the onboarding process, helping save significant time and effort. Financial institutions can ensure a smooth and quick onboarding by working with data aggregators and FinTechs to build integrated onboarding solutions.

Data aggregators and FinTechs can accelerate the onboarding process by deploying solutions to automate key elements of the process, enabling SMEs to opt in to these solutions and enhance their onboarding.

The images below shows what drives the satisfaction during the onboarding process.

Use case 2: traditional and non-traditional data sources for credit evaluation for lending

For SMEs, the demand for quick and on-time disbursement of credit will always be high as they progress through various stages in their business lifecycle.

According to EY’s global SME survey in 2021, approximately two-thirds of SMEs would have liked to receive faster access to credit when they needed it, and over half of them needed it within seven days.⁹ SMEs felt the speed of the decision to lend and the time required to release the funds were as critical as the lending rate.

Lenders facing a more competitive market and changing economic landscape can benefit from focusing on building the most compelling consumer experiences, while also improving backend processes to increase efficiencies and reduce risk. Data aggregation can enable this in three key ways.

1. Enhanced creditworthiness evaluation

Through the integration with payroll providers, government databases, ecommerce platforms and other data sources, financial institutions can have direct access to the most up-to-date financial and sales data to enrich the consumer’s lending journey and expedite decision-making.

2. Manage evolving risk

By having direct access to SMEs’ real-time financial picture, financial institutions can better monitor and maintain existing lending facilities. This allows financial institutions to optimize repayment schedules, decrease insufficient funds scenarios and reduce overall portfolio risk.

3. Fraud reduction through automated lending processes

Financial institutions implement strict KYC and AML procedures to prevent fraudulent transactions. By incorporating automated capabilities that monitor unusual client behavior and screen for falsified income documentation into the underwriting and maintenance processes, financial institutions can reduce losses due to fraud.

Use case 3: integrated working capital management

- Cashflow management

Unique to each SME, the management of cashflow will vary in complexity as it correlates to the number of relationships the SME has with financial institutions. This can lead to challenges in cashflow forecasting, as SMEs do not have a frictionless method of consolidating their financial position in one single view.

SMEs ranked cash management as their top transaction service need. There is an opportunity for financial institutions or FinTechs to provide an integrated solution to enable SMEs to perform liquidity management and cashflow forecasting, provide a consolidated view of all banks accounts, and fund transfer capabilities, all within one single system.

- Accounts payable and accounts receivable

Apart from cashflow management, the other areas of working capital SMEs struggle with are accounts payable (AP) and accounts receivable (AR).

Working capital management has been plagued by the challenge of reconciling AR flows with the right invoice and sending AP payments to the right destination on time. This has remained a pain point for many businesses. In the absence of a digitized integrated solution, SMEs often rely on manual reconciliation workarounds and traditional routes such as validating through penny test transactions or official documents like using a copy of a cheque as verification of a payee’s bank account. This process is time consuming and prone to errors, and causes delays in the overall AR/AP payment and reconciliation cycle.

SMEs need products and platforms to send and receive payments in cheaper, better and faster ways. Synergies can be built to provide AR, AP and cash management solutions under one platform to enable better control and management of operations.

Chapter 4

Bringing data aggregation into reality in your financial institution

SMEs are increasingly seeking solutions and services that are flexible, fast and convenient. With the rise of FinTechs and challenger banks, the former default decision of only working with incumbents is changing. Financial institutions and FinTechs alike can partner with data aggregators to deliver value through solutions across the entire business lifecycle and remain competitive in the evolving market.

Benefits for financial institutions

- Greater market share through enhanced customer relationships: More than half (52%) of Canadian SMEs surveyed showed an interest in having a single integrated platform that offers a 360-degree view of their financials.¹⁰ Financial institutions can further provide more personalized and targeted services through innovative onboarding and lending processes that enhance SMEs’ satisfaction.

- Increased revenue streams: Offering beyond-banking solutions for cash management, lending and business management functions can generate new revenue streams and boost the institution's bottom line, helping it stay competitive in the market. The majority (57%) of Canadian SMEs surveyed expressed a strong interest in receiving support in these areas.¹¹

- Comprehensive risk management: With more insight-driven focus on data, financial institutions can make better-informed decisions, reducing the risk of credit losses and fraud while simultaneously providing comprehensive customer journeys by using data from both traditional and non-traditional sources.

Benefits for data aggregators and FinTechs

- Access to data: Through partnerships with financial institutions, data aggregators and their networks of FinTechs gain access to the customer data necessary to build solutions that meet SMEs’ needs throughout the business lifecycle, solutions that are flexible, scalable and efficient.

- Greater market reach through embedded solutions: Data aggregators can go beyond integrating solutions with financial institutions and begin embedding their platforms with market leaders in various sectors such as retail, hospitality and travel.

- Extended reach: FinTechs will have the opportunity to reach a vast number of SMEs by partnering with financial institutions to power new features and capabilities within the institutions’ respective ecosystem.

As SMEs gain more control of their data and their options for financial services broaden, financial institutions and FinTechs can mutually engage with data aggregators to provide holistic, personalized, far-reaching products and services.

In this rapidly evolving landscape, the establishment of new payment systems such as closed-loop networks for e-commerce and social media entities, bolstered by leaders in the payments industry, not only facilitates seamless peer-to-peer and SME money transfers, but also streamlines data aggregation services.

Successfully interweaving the nascent technologies to develop innovative solutions that deliver value requires earning the trust of SMEs by meeting their current and future needs in this growing space.

Summary

In Canada, 74% of small and medium enterprises (SMEs) are willing to share more data with financial service providers for better, personalized services/products. Among those SMEs, 31% are not satisfied with their current financial service providers. The three main areas of dissatisfaction include lack of regular connections, lack of tailored digital experience, and lack of product flexibility. Even with these issues, banks remain the most trusted financial providers for SMEs. An increasing number of non-traditional institutions are creating solutions for SMEs by collaborating with data aggregators, which act as intermediaries between SMEs, financial institutions, and FinTechs.