Who are designated as PSPs?

The RPAA defines a PSP as “any individual or entity that performs one or more of the payment functions as a service or business activity that is not incidental to another service or business activity”. Entities covered under this act include payment processors, digital wallets, currency transfer services and other payment technology companies that do not hold funds for end users.

RPAA applies if individuals or entities meet all four of the following criteria:²

1. Act as a PSP, performing one or more of the five payment functions:³

- Provision or maintenance of an account

- Holding of funds on behalf of an end user

- Initiation of an electronic funds transfer

- Authorization of an electronic funds transfer or an instruction in relation to an electronic funds transfer

- Clearing or settlement services

2. Perform a retail payment activity.

3. For PSPs with a place of business in Canada, RPAA applies to all payment activities; for foreign PSPs, the RPAA applies to payment activities the PSP directs to and performs for end users in Canada.

4. Perform payment activities that are not excluded from the RPAA and associated regulations (e.g., prudentially regulated financial institutions).

The registration process

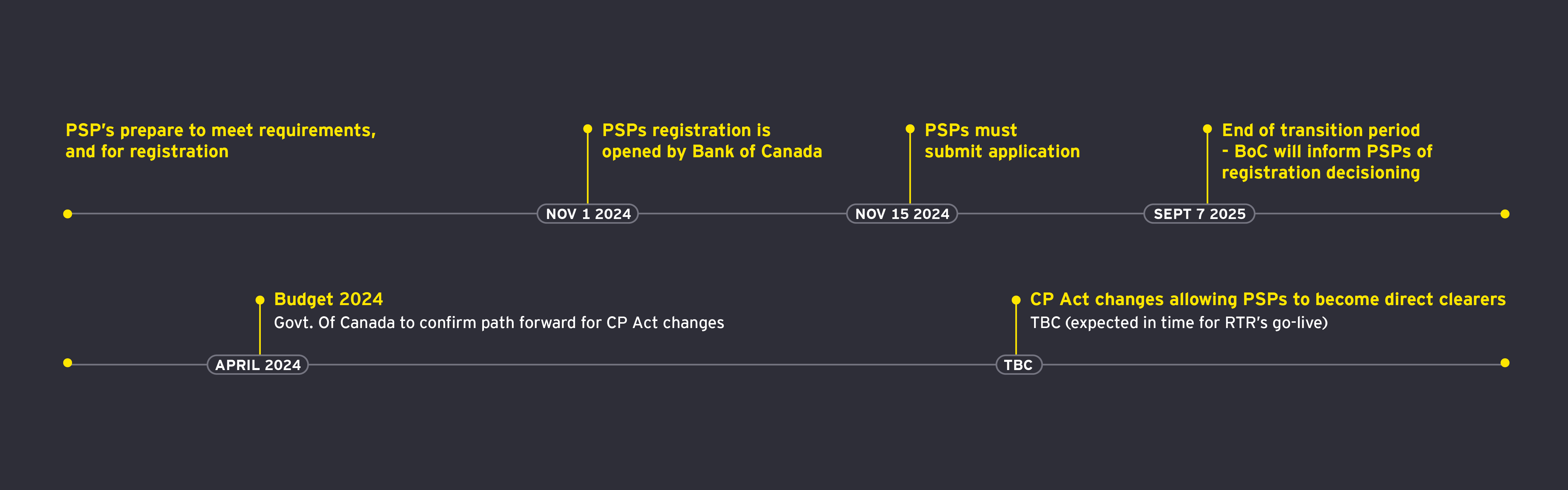

The Bank of Canada is working to deploy a portal where PSPs can complete their registration and submit the requisite supporting information.⁴ At the time of writing, the Bank was running a pilot phase for the portal registration process to assess its effectiveness.

The registration window is expected to open from November 1 to 15, 2024. All PSPs are required to complete the registration application and meet any outstanding requirements by September 8, 2025.

The Bank of Canada has shared draft requirements so that PSPs can start gathering the required information before the window opens. The draft requirements include the following:⁵

- Contact information, including for any third parties, agents and mandataries, and affiliated entities

- Business structure, ownership, debtholders and key staff

- Retail payment functions that PSPs perform or plan to perform, including any agents and mandataries or affiliates that may be performing retail payment functions on their behalf

- The actual or projected values and volumes of end-user funds held both inside and outside of Canada

- The actual or projected number of end users, both in and outside Canada

- The method(s) PSPs use or plan to use to safeguard end-user funds

- Whether PSPs have in place or have plans to establish a risk management and incident response framework

- Any registrations for retail payment activities with FINTRAC or under any other federal, provincial or territorial act

In addition, the Bank of Canada recently released a step-by-step guide to completing the registration application.