EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Payroll Operate

Key benefits

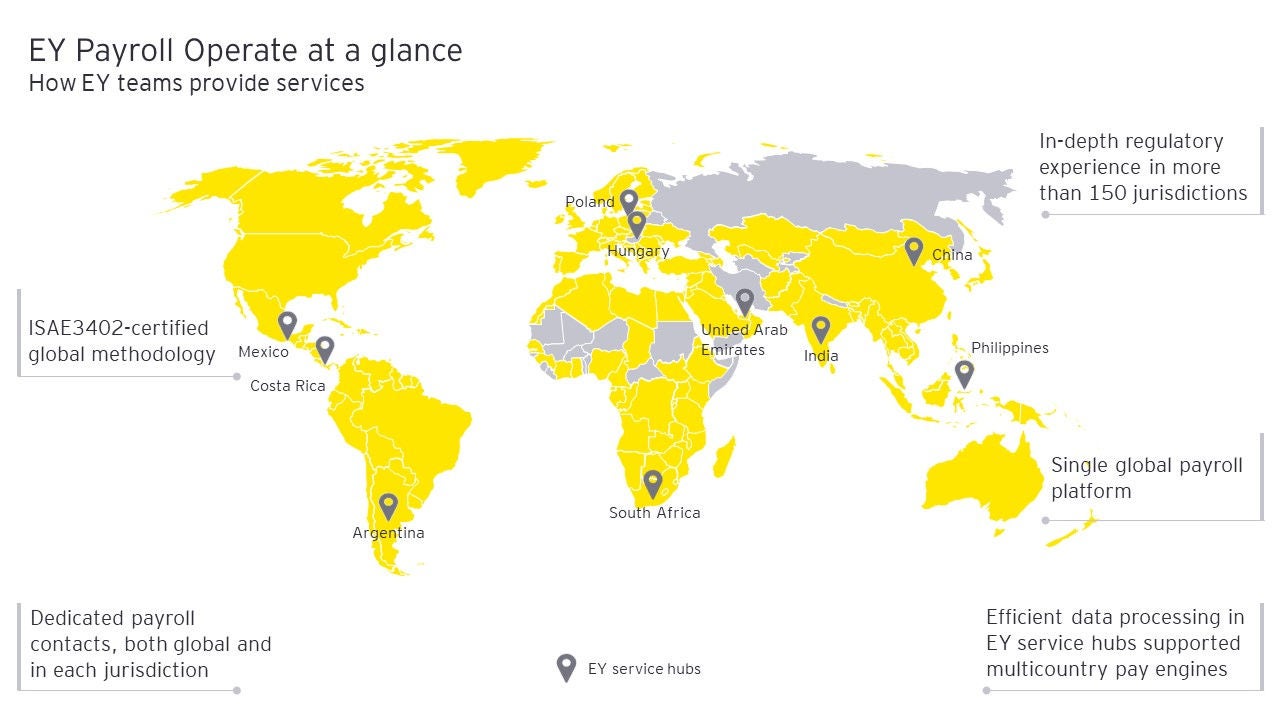

EY Payroll Operate answers a clear demand in the market: a global payroll solution that provides a single framework that can be scaled by you as your business needs evolve. EY professionals operate clients’ payroll as a managed service from data collection, preparation and source-to-gross right up to statutory reporting, payment preparation and employee communication.

This is the transformative age and we put the power of the possible to work for you:

- Gain flexibility and agility to enter in new markets while reducing fixed cost structures

- Streamline your payroll program in a unified global operation

- Reduce costs from your current program

- Improve the user experience for your employees

Key features

Watch this short video to learn more about how EY Payroll Operate can help you transform payroll processing for your entire organization.

EY Payroll Operate provides a distinctive experience.

- Globally consistent — One global platform that relies on a certified methodology delivered by a highly integrated team comprised of EY professionals and eliminates the need for multiple vendors or vendor aggregators.

- Connected services — Our holistic approach addresses your most pressing challenges — from connecting payroll to mobility, people advisory, finance, tax and law, to leveraging investments in automation, artificial intelligence and machine learning.

- Intelligent automation — EY Interact supports automated connectivity to all major HR and financial systems. Our Payroll Command Center offers a consolidated view of workforce, operations and payroll processes leveraging the leading-class technological capabilities of EY Global Tax Platform. Highly intuitive analysis supported by advanced data visualization helps drive well-informed decisions and strategies while also driving down costs.

- Continuous compliance — In-country professionals and relationships with tax authorities in over 150 countries, with real-time reporting, analytics and payroll controls to check every production on discrepancies and anomalies, along with built-in governance that applies to your immediate requirements and is agile enough to keep pace with changes in the landscape.

The Team

Our latest thinking

How can payroll build value in an organization

The 2021 EY Global Payroll Survey shows organizations continue to deal with challenges in achieving the payroll function of the future. Learn more