EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

The latest CFO Barometer analyses how CFOs experience the tax function and what drives the tax function transformation.

In brief

- Regarding tax and sustainability, the trend is to outsource ESG reporting to a third party.

- The tax function needs a more strategic position, yet two-thirds of respondents report that organizations still view the tax department as a cost center.

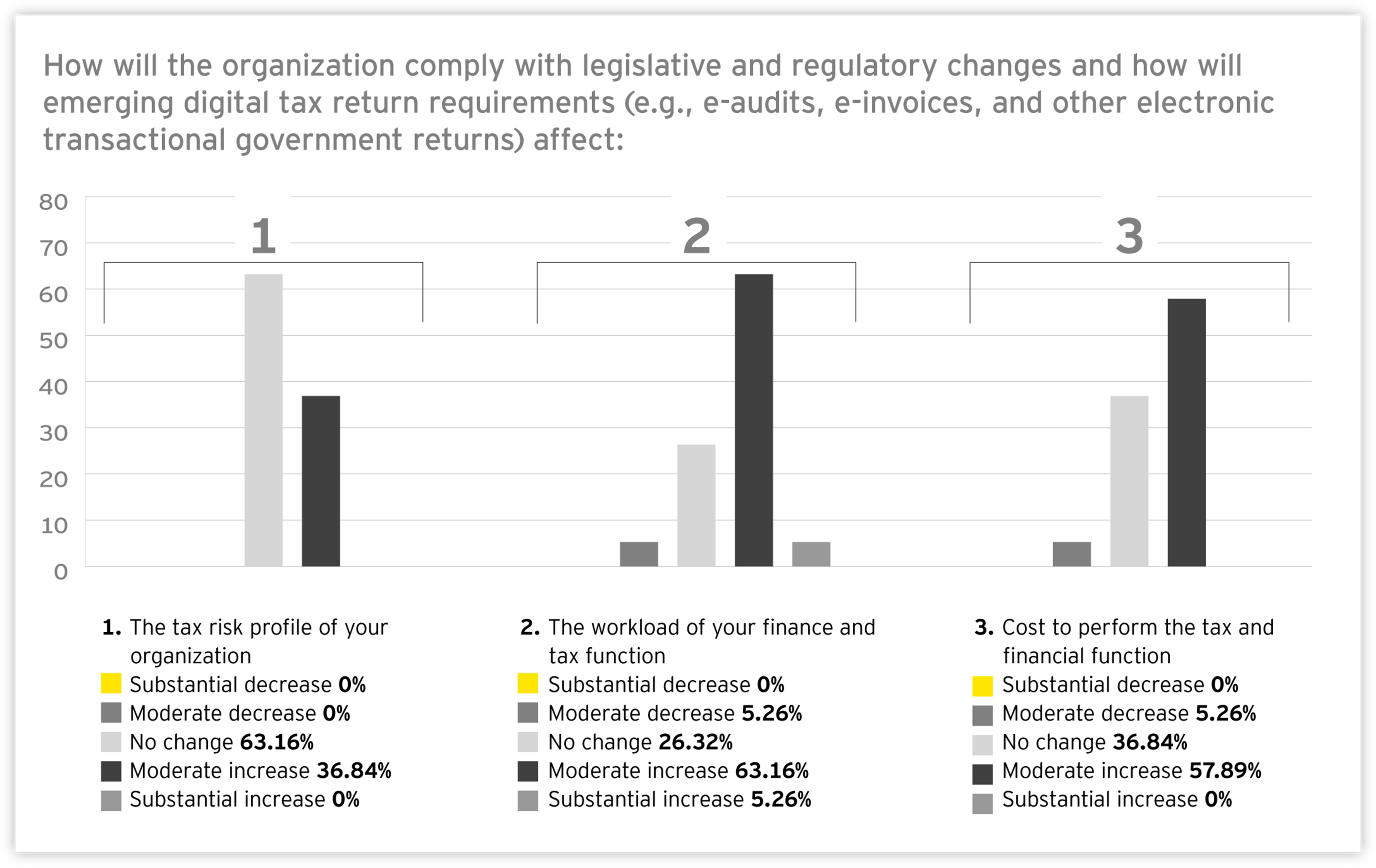

- E-filing and e-invoicing are coming. One-third of CFOs believe they will need to invest in scaling up the technology expertise of the tax team.

A number of external factors are causing the tax function to have to deal with increasing changes:

- The tax administration conducts much more focused and performant audits.

- The budgetary pressures companies have been experiencing since the beginning of the COVID-19 pandemic.

- The OECD's BEPS action plan creates a lot of additional reporting requirements and increasing complexity.

Aside from the external factors, internal factors also strongly influence tax function transformation. Such as the change of the business operating model due to the current economic situation and the impact of COVID-19 on the one hand and digitalization on the other. If the operating model changes rapidly, the tax function must also adapt rapidly.

Taxation and ESG

30 percent of respondents say they see ESG reporting as a very important action item. Furthermore, 3 in 4 respondents say they plan to outsource ESG reporting to a third party. We often still see a lack of clarity within organizations internally to determine what sustainability exactly belongs to. This has led to a significant increase in sustainability advisory. This is partly why outsourcing seems very attractive to them.

The added value of the tax function

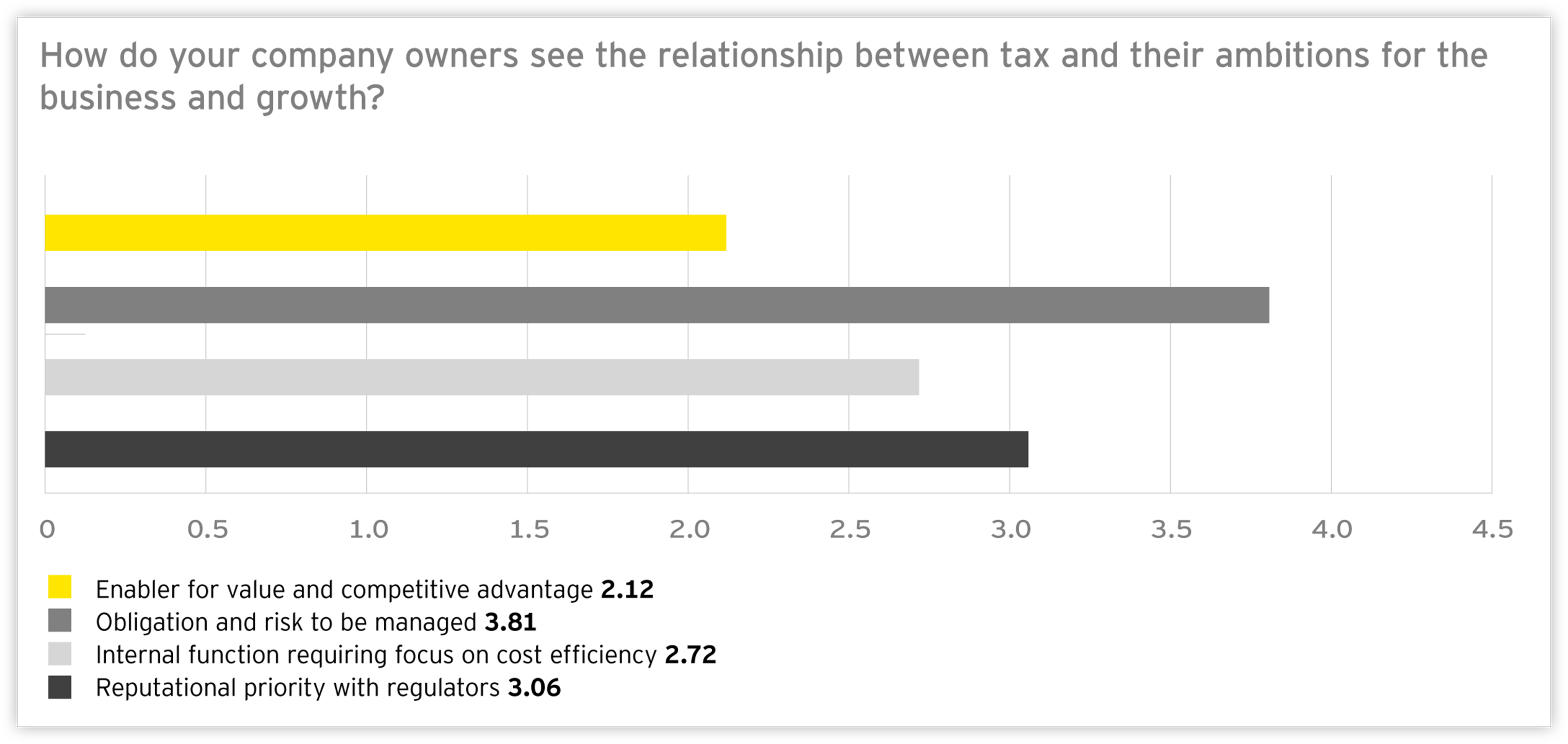

It is extremely important that tax experts monitor what is happening within the tax world. They must be able to provide information and visibility, demonstrate urgency and visualize potential impact. An important element in this is that experts must be able to point out the value of the tax function and what added value can be created in the process. 30 percent of those surveyed confirm that they see the demand for that added value increasing. At the same time, two-thirds of respondents report that organizations still view the tax department as a cost center. The tax manager therefore has every interest in taking on this more strategic role. They must help shape how to create long-term value, but also measure and report from a financial perspective.

Investing in technology and processes

As a result, tax leaders are moving toward a kind of business partnering role in which they can put forward the tax function as a facilitator rather than a mere obligation. The typical in-house tax advisor of 20 years ago no longer exists. We see that, in the tax department, there is a great need for people with knowledge of technology, ERP systems, ... But they also need to understand the organization and have a clear view of the various stakeholders so that they can write down the necessary processes, implement them efficiently and interpret the risks for the organization. It is becoming increasingly important to document all this well and get buy-in from the entire organization for the practical implementation of the tax framework.

Action plan: harmonizing data

One-third of CFOs believe they will need to invest in scaling up the technology expertise of the tax team. In fact, three-quarters of CFOs indicate that their organization has undergone an ERP transformation in the last two years or is planning an ERP transformation in the next two years. And that's a potential tool for the tax function to help take control of the data. A data structure is needed so that even in finance and tax you are working with the same source data every time. Without harmonization and data integration, there is still a long way to go.

But also: automating data

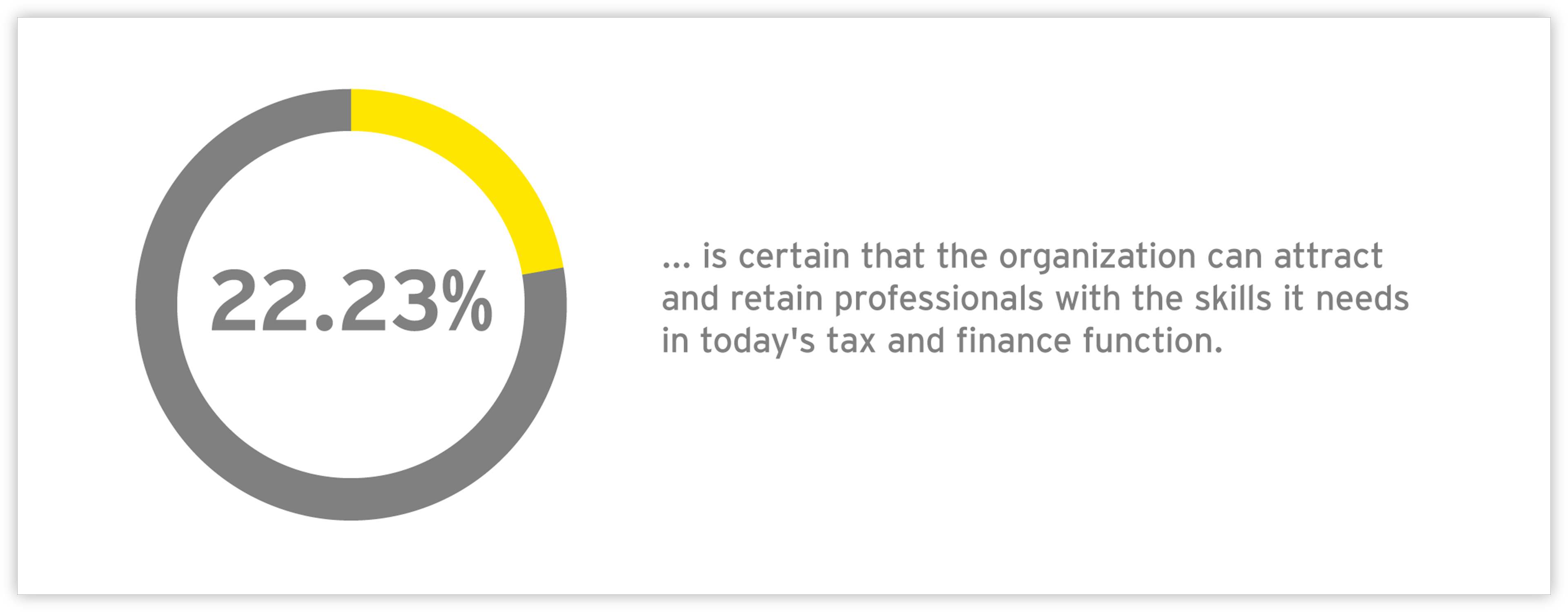

Only 22 percent of respondents are sure they can retain and/or attract the right people. This shows that there is a real "war for talent" here as well. So how can the tax function act quickly? In regard to compliance and pure obligation that follows from the tax landscape, you want to automate as much as possible. You need a clear framework for the tax organization that lightens manual tasks and gives more time for actions with real added value. That way, tax can demonstrate that it can have a powerful impact on the organization, also P&L-wise.

Biggest concern: the budget

The greatest concern of respondents regarding the future of the tax function is a lack of budget to be able to evolve in line with the organization or simply to continue investing in the tax function. These fears are certainly not unfounded as we are also seeing more and more digitalization. For Belgium, we know a more extensive implementation of e-filing and e-invoicing is coming. Companies will have to invest in technology to remain compliant in the long term. And companies must also look at a strategy regarding digitalization that goes beyond national borders. It is necessary to look at the entire tax footprint. As more and more obligations come in, you need to address them holistically and look at what technologies and service providers can help your business.

How EY can Help

-

Our dedicated tax professionals can help you enhance or transform your tax function with a cost-effective, connected operating model. Learn more.

Read more -

Our tax and finance operate solution can help your business manage risk, realize value from data, drive innovation and improve efficiencies. Find out how.

Read more -

EY Sustainability Tax professionals can help your business realize your corporate sustainability strategy. Learn more.

Read more

EY Belgium newsletter

Subscribe to our monthly newsletter and stay updated on our latest insights.

Summary

The tax function is seriously challenged by both external and internal factors. Therefore, it should not be surprising that 94.45% of CFO Barometer respondents indicated that tax personnel needs to expand their tax technical skills over the next three years to include data, process, and technology skills. But it is not just about acquiring and retaining data skills, but also about strategically positioning the tax function as one that helps create long-term value. Those tax organizations that manage to demonstrate consistently added value within their field of expertise are significantly more likely to obtain budget for necessary investments.