EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

The EY Net Zero Centre brings together EY’s intellectual property, strategic insight, expertise and deep knowledge in energy and climate change leadership to solve the big problems ahead as we move towards net zero emissions by 2050.

Read more

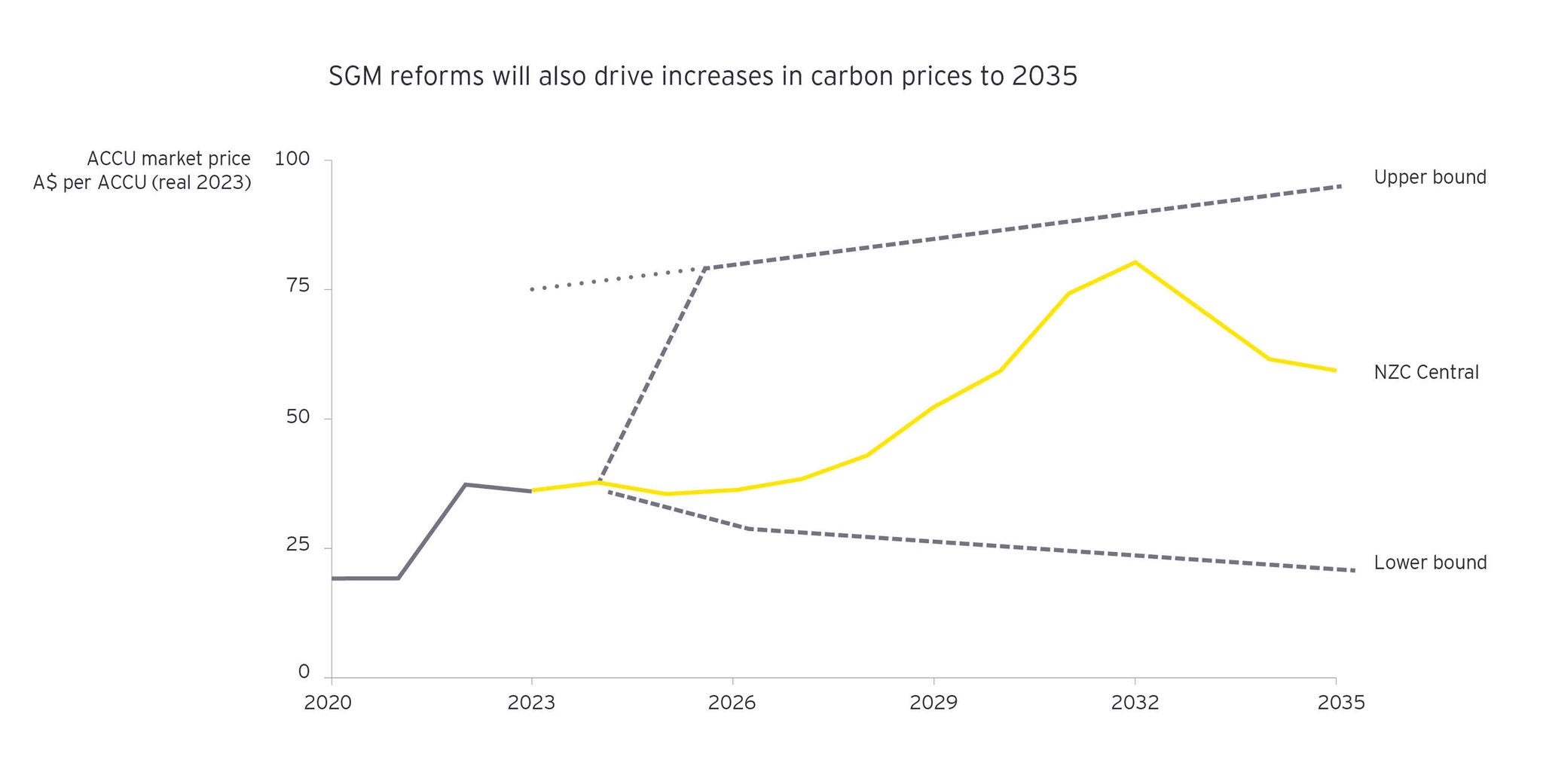

Steep abatement trajectories drive demand for credits and higher prices. Now, with Australia’s largest emitters compelled to purchase ACCUs to cover excess emissions, the EY Net Zero Centre has modelled multiple potential scenarios, to test how the market may evolve.

The insights from this analysis will be released in a new Net Zero Centre report, Changing gear: Australia’s carbon market outlook 2023 in August 2023.

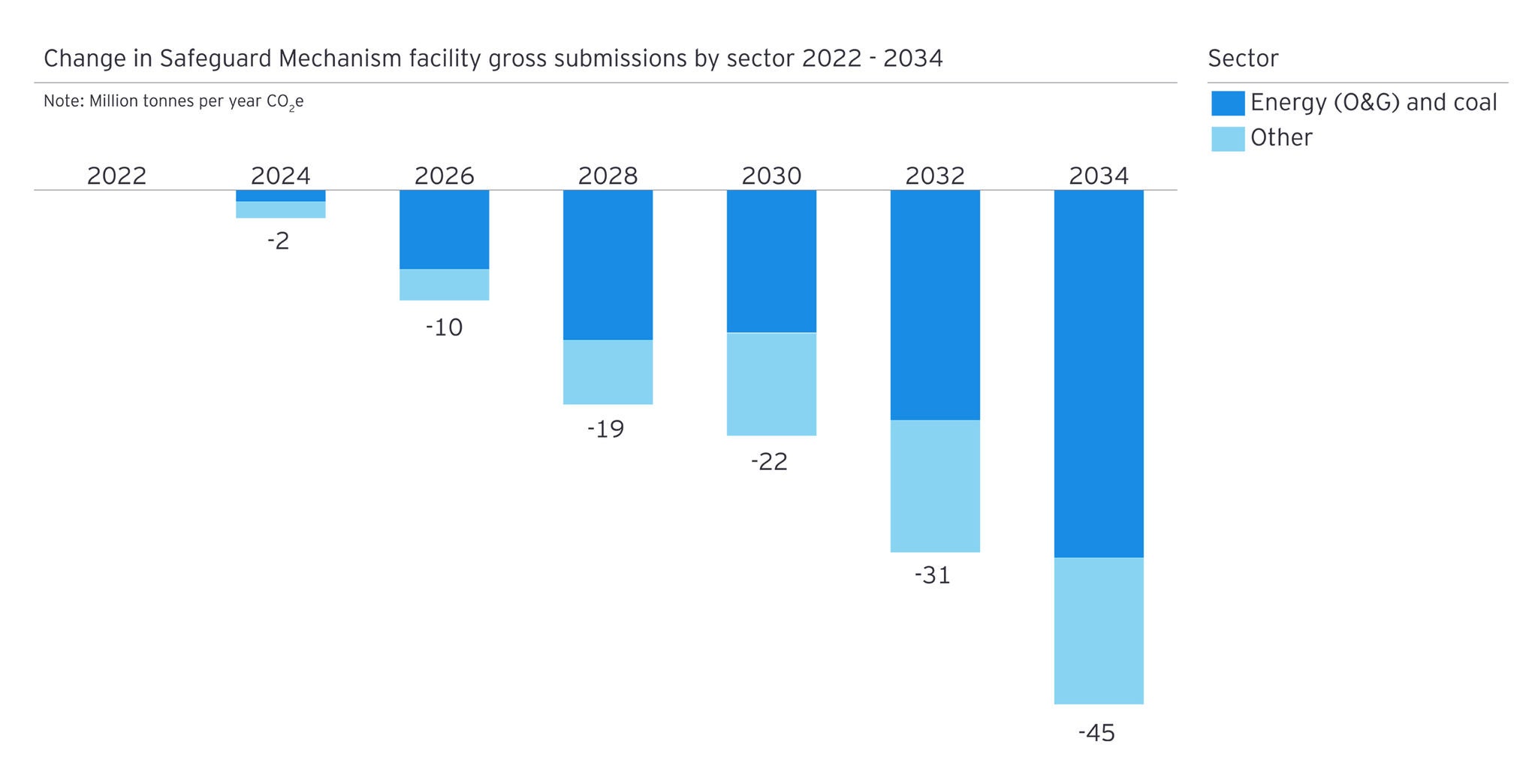

We find facilities captured under the SGM will have significant abatement potential available under A$50 per tonne, with coal and oil and gas facilities accounting for 70% of abatement until 2035.

But we also estimate the price of ACCUs could double before 2035, from around A$40 a tonne today to around A$80 (or $60per ACCU in real 2023 dollars) – just below the Australian Government’s price cap.

As part of the SGM reforms, the Australian Government introduced a cost containment measure to make ACCUs available to liable entities at $75 per tonne CO2-e in 2023-24, increasing with CPI plus 2%. This sets a price ceiling – at least initially. But our modelling suggests prices could come close to hitting this ceiling before 2035.