EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Sustainability has landed on the desk of the chief financial officer – and this has profound implications for how Australian landlords and tenants value green buildings.

In brief :

- Most Australian landlords and tenants see sustainable buildings through one of either two lenses: compliance or reputation.

- A new EY Net Zero Centre report finds incoming regulation and reporting standards place sustainability at the heart of financial decisions and business operations.

- With sustainability embedded in reporting and finance, corporate occupiers are expanding their view of green buildings from a cost to a source of value.

Australia cannot achieve net zero without the real estate sector. The buildings that must be net zero in 2030 are in design today and will be sold, leased and occupied tomorrow.

Despite decades of effort to drive down emissions, Australia’s commercial buildings are still responsible for a quarter of our national energy consumption, and 10% of our emissions footprint.

But game-changing regulatory developments and new reporting standards are changing the way companies look at commercial space.

A new report from the EY Net Zero Centre, Zeroing in on net zero buildings, finds net zero targets are locked and loaded – but acting on emissions is not yet understood as an opportunity to create new value.

Our research suggests those that can draw a direct link between green building credentials, asset value and share price will unearth new areas of commercial advantage.

Selina Short

EY Oceania Markets Leader

Extracting the gold from green

To understand how real estate companies and corporate occupiers could create new value from the net zero transition, we surveyed executives who lead some of Australia’s largest property companies and who occupy some of the country’s largest corporate tenancies.

Every corporate tenant we surveyed had set net zero or greenhouse gas emissions reduction targets, as well as 86% of property companies.

Within property companies, our survey uncovered two ‘archetypes’. One subset of companies is compliance-oriented and stepping up their ESG efforts to stay on the right side of regulation. The compliance-oriented companies are investing in green buildings to minimise downside risk and reduce costs. They are less motivated by new opportunities hidden within the net zero transition.

The other subset sees sustainability as a brand booster and a way to communicate and connect with their customers. These brand-oriented companies are willing to take risks with green buildings to win new business and customers. But they see new standards and regulations as a chance to showcase their leadership, rather than an opportunity to drive down costs.

None of the real estate companies we surveyed had aligned the two objectives. A net zero strategy, executed well, can achieve both ambitions and also create new value simultaneously.

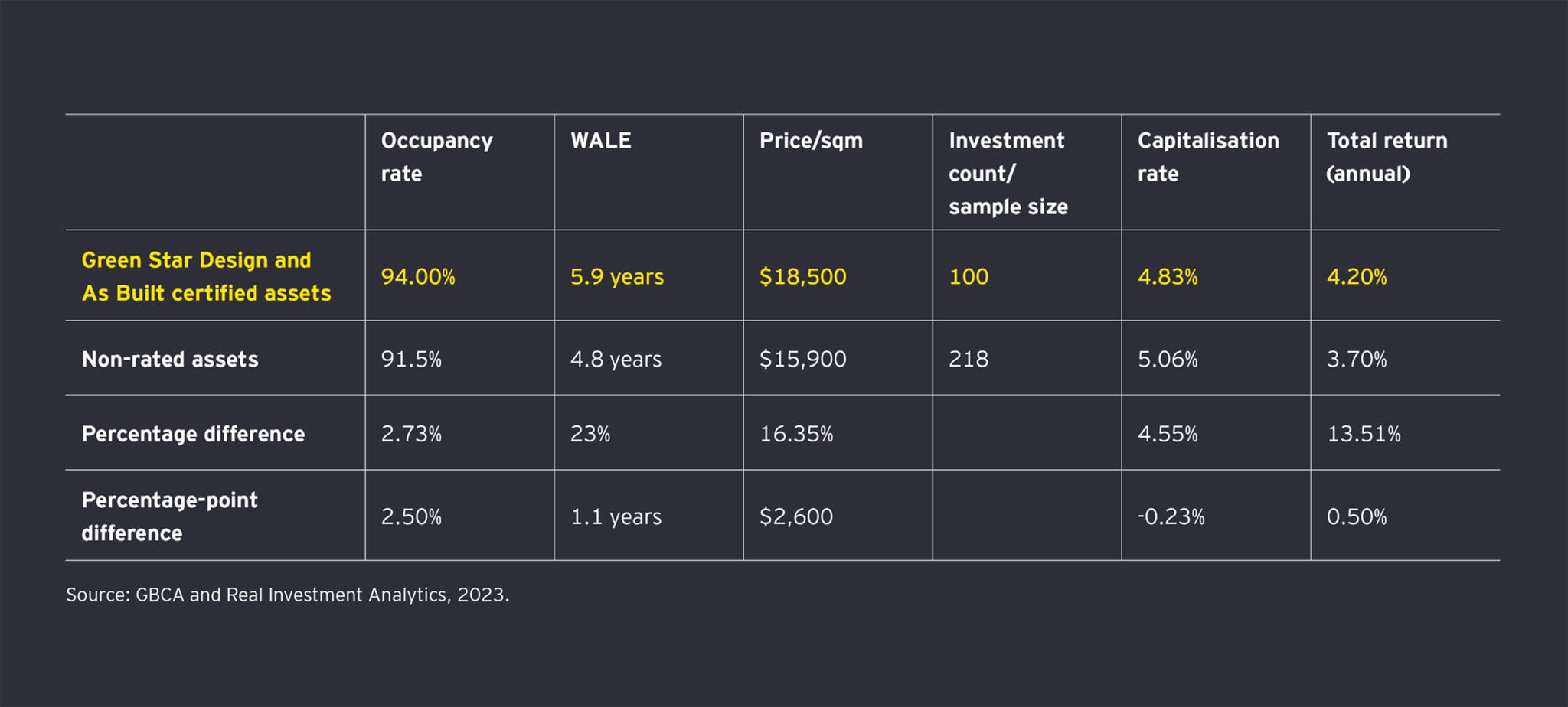

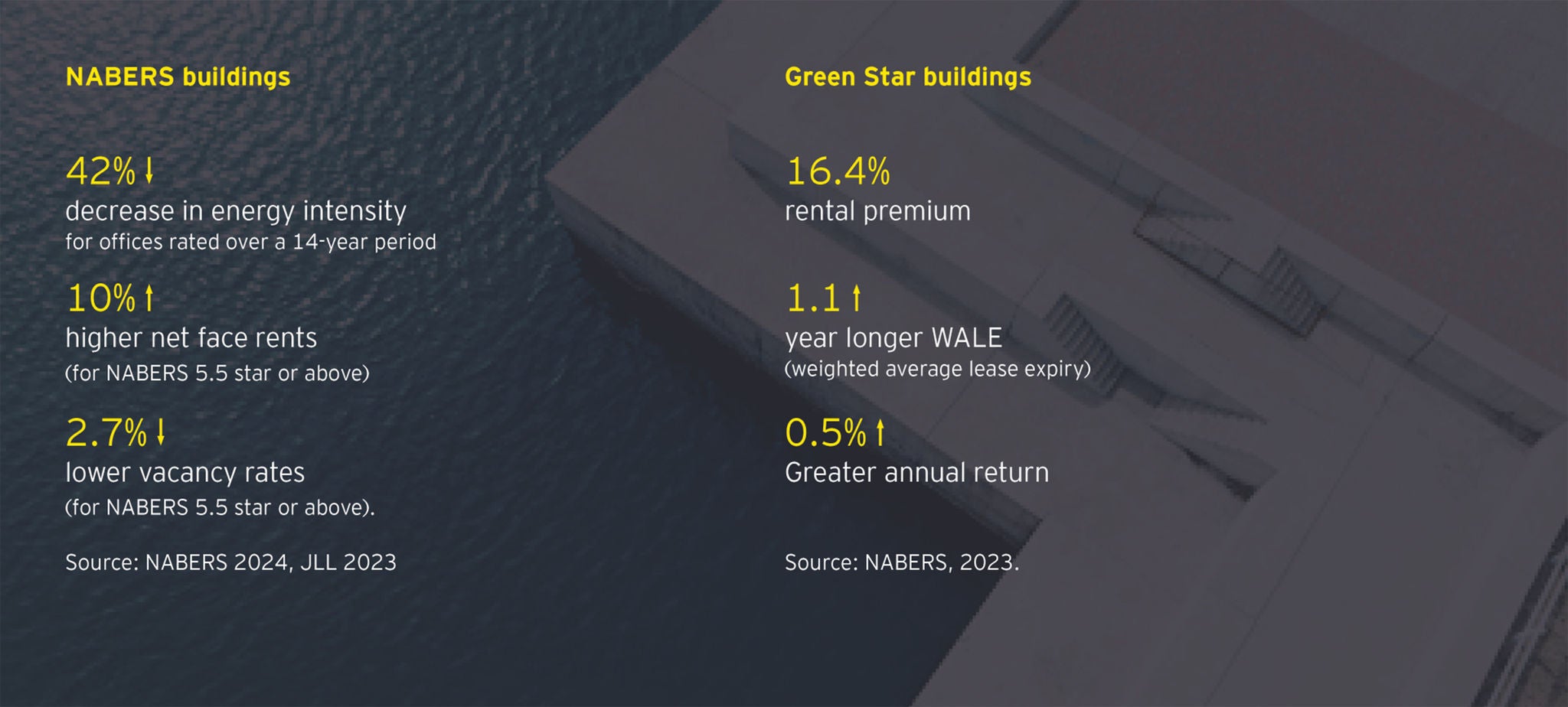

For instance, our survey found 92% of corporate tenants are more likely to stay in a property if it has strong green credentials, and they are more likely to pay a green premium. This aligns with observed market data.

When we asked tenants specifics about green premiums, they were slightly more cautious. Nearly half (46%) said they were prepared to pay a premium of up to 5%. On the other hand, one in 10 tenants said occupying better performing buildings was generally cost neutral, as savings from energy efficiency offset any rental premium. The rest weren’t sure what they would pay.

But every chief financial officer will soon be thinking about what they are prepared to pay to occupy a green building.

Finance stands at the sustainability frontier

New reporting standards and disclosure requirements are recalibrating the way the market values green buildings. IFRS Sustainability Disclosure Standards: IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2 Climate-related Disclosures (IFRS S2) are intended to be effective for annual reporting periods from 1 January 2025.

Together, these standards represent one of the most significant shifts in financial reporting that businesses in Australia have encountered. IFRS S1 and IFRS S2 ‘hardwire’ sustainability into reporting. Climate, emissions and sustainability must now be considered as part of business strategy, key risks and opportunities.

The Australian Government has proposed amendments to the Corporations Act 2001 to introduce a mandatory climate-related financial disclosure regime in line with these international standards. This will require companies to prepare a ‘sustainability report’ in accordance with Australian Sustainability Reporting Standards.

Financial auditors will be required to sign off climate disclosures. This brings a new level of scrutiny to sustainability reporting and an uplift in data expectations that will flow through every supply chain.

For the first time, responsibility for sustainability is now sits squarely on the shoulders of chief financial officers and audit committee chairs.

Emma Herd

Co-Leader, EY Net Zero Centre Partner, Climate Change & Sustainability Services, EY Australia

Even companies that are not required to report will be approached by their clients and customers for input to verify Scope 3 emissions – and this is particularly relevant for the built environment’s complex and interconnected value chain.

For Australia’s property industry, the reporting requirements have other implications. Up until now, energy and emissions reduction have been viewed through the lens of operational efficiency and cost reduction. Putting this at the heart of financial disclosures shifts the focus from cost to value.

Buildings are responsible for a quarter of Australia’s emissions, but they are also among the ‘lowest hanging fruit’ of emissions reduction. Our research finds tried-and-true technologies can do most of the heavy lifting of emissions reduction in buildings. Zeroing in on net zero also identifies five ‘big rocks to crack’: electrification; energy efficiency; grid interactivity; renewables; and embodied carbon.

We also find tenant expectations and willingness to pay will remain front-and-centre of investment decisions for both building owners and developers. Both groups report the main barriers to investment in green technologies to reduce emissions are cost, return on investment and access to capital.

To paraphrase economist Paul Krugman, while the returns on investing in greener buildings is not the only thing that matters, in the long run it is almost everything. Widespread transformation of commercial buildings can only be achieved when the numbers are seen to add up.

Steve Hatfield-Dodds

Associate Partner, EY Port Jackson Partners

Arguably the most revealing insight is that our research suggests neither tenants nor landlords have reaped the full benefits of sustainable building. Most businesses have not landed on an ESG strategy that clearly addresses how it lifts profits and creates advantage through better sustainability outcomes in the built environment.

Summary

Australia’s new climate reporting regime will change the way we think about real estate. The choice of commercial space can meet regulatory requirements, strengthen reputation and be a powerful tool for value creation. We expect to see more nuanced conversations about emissions reduction opportunities across the real estate supply chain as more occupiers look to mine the opportunities of green buildings.