EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Financial boardrooms across Europe accelerate female and sustainability appointments

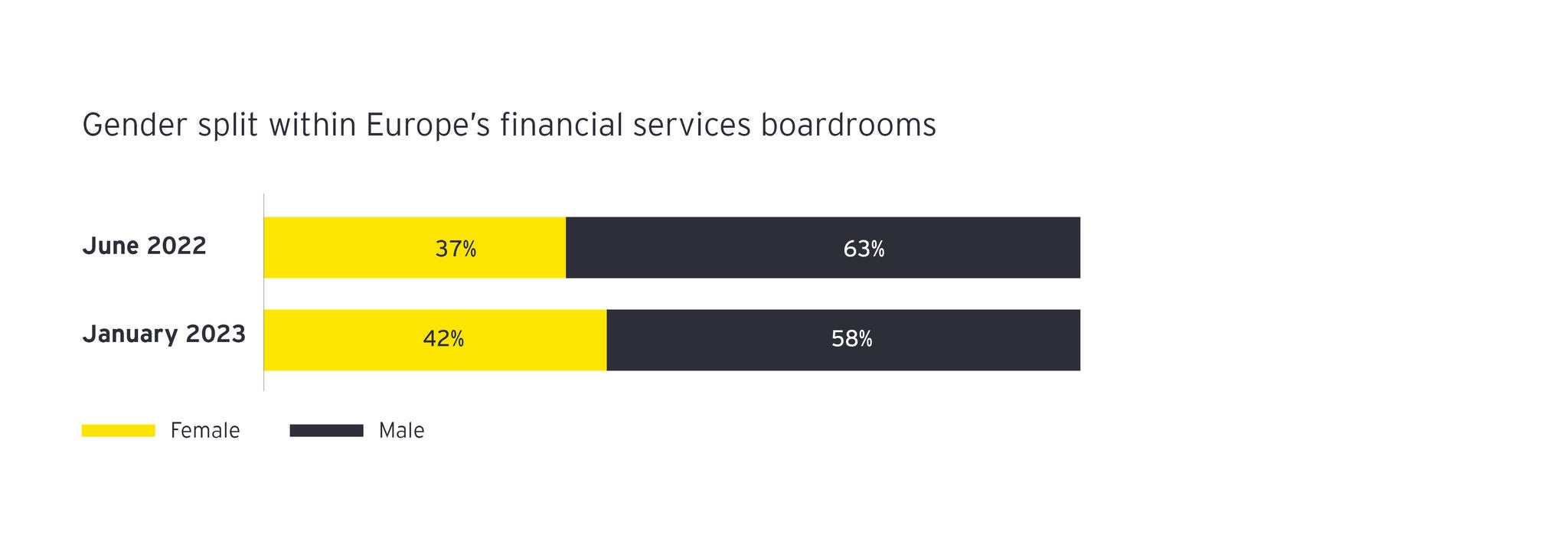

- European financial services firms’ new board appointments have been evenly split by gender over the last year, improving on the 58% male and 42% female split of appointments the prior year

- Research shows fewer female board members have C-suite experience than their male counterparts; 62% of men monitored hold or have held a C-Suite role, compared to 51% of women

- Almost a third (32%) of companies monitored now have board directors with professional sustainability experience; a significant rise from 19% in June 2022

- Sustainability experience is most prevalent among female board members, and more likely to be accompanied by higher-level educational qualifications

Europe’s largest financial services firms are taking proactive steps to increase female representation and enhance their sustainability expertise at boardroom level – both identified as priority areas for investors – according to the latest EY European Financial Services Boardroom Monitor, which charts the profile, experience, training and skillsets of board directors in the MSCI European Financials Index.

Gender and age diversity advances across European financial services boards

Forty-four per cent of European financial services investors state that gender diversity in the boardroom significantly influences their decision to invest in a financial services company, compared to just 16% who say it does not influence their decision at all.

EY Boardroom Monitor data shows that European financial services firms are responding to investor expectations, and 50% of board appointments over the last year were female. Of board appointments made the year prior, 58% were male and 42% were female.

All European financial services businesses monitored have female representation at boardroom level and the current gender split of board members across all businesses stands at 58% male and 42% female. This is a five-percentage point rise in the share of female board members from June 2022, when the gender split stood at 63% male and 37% female.

The average board tenure for female directors is 54 months, down from 55 months in June’s report; the average board tenure for men is 66 months, up from 65 months in June. The average age of female board directors is 57, marginally younger than their male counterparts, who have an average age of 60.

The EY Boardroom Monitor also provides clear evidence that women are less likely to have worked in C-suite roles. While 62% of male board members at financial companies monitored either hold or have held a C-Suite role, this figure is only 51% among current female board members. The recent EY-supported Female FTSE Board Report 2022 by Cranfield University – which provides a snapshot view – also found a low prevalence of C-suite experience among female board directors, finding that of all female board directors in the FTSE 100, only 17% currently hold executive director roles. Only 2% of female board directors at companies monitored in the EY Boardroom monitor currently hold a C-suite role.

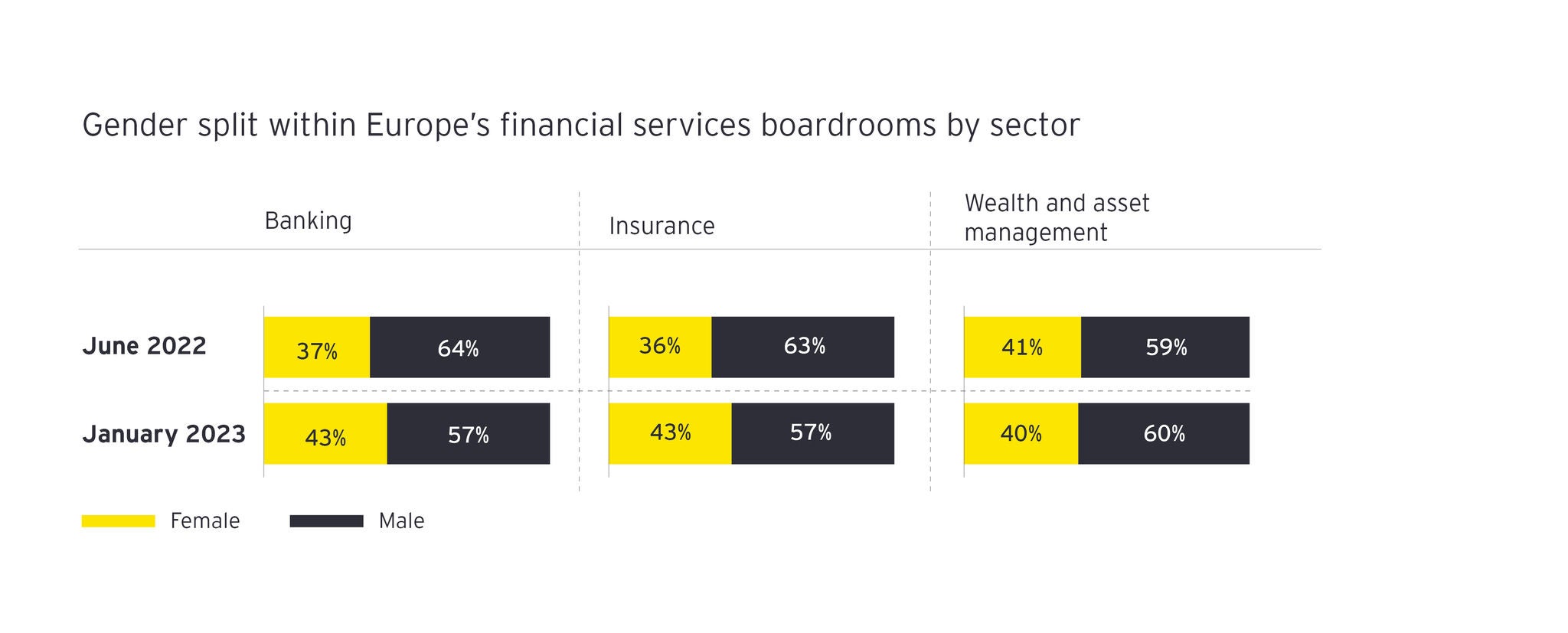

Gender diversity is highest across bank and insurance boards, where 43% of board members are female and 57% male. Gender diversity is lowest among boards at wealth and asset management firms, where the gender split stands at 40% female and 60% male, although, this is still in scope of incoming European gender diversity regulation (June 2026).

A minority of financial services firms have taken steps to improve age diversity albeit from a low base. Only 10% of companies monitored have any board members under the age of 40, up from 8% in June 2022, and a fifth (20%) of board members under 40 have been appointed in the last year.

Omar Ali, EY EMEIA Financial Services Managing Partner, comments: “Across Europe, boards and company management are taking clear steps to increase diversity across a range of measures. Achieving greater gender balance and ensuring that boardrooms reflect the diversity of the customers and societies they serve is a work in progress, but leaders across the financial sector are driving change. Progressive businesses are anticipating regulation, and view diversity as a strategic priority, understanding that more diverse views, backgrounds and experience play a role in identifying and responding to risks, and ultimately create more effective boards.

“The 2022 participants in the EY European Financial Services Chairs’ Interview Series made clear that proactive steps to enhance gender diversity at boardroom level are at the forefront of their board appointment strategies. Alongside increasing female representation across boards, Chairs of European financial services firms are also prioritizing cultural diversity, relevant business specific credentials and international experience, to reflect the increasing complexity of operating cross border.”

Wim Mijs, European Banking Federation (EBF) Chief Executive Officer, adds: “Banks stand to gain tangible benefits from greater diversity in their workforce, management and financing activities; the EBF will continue to take an important role in helping more European banks to embark on and advance in their diversity journeys.”

Accelerating trend in the appointment of board members with sustainability expertise

More than half (51%) of investors believe boardroom experience in sustainability has a ‘significant’ impact in terms of making a company an attractive investment, with 22% indicating it has a ‘highly significant’ impact on a company’s investment case.

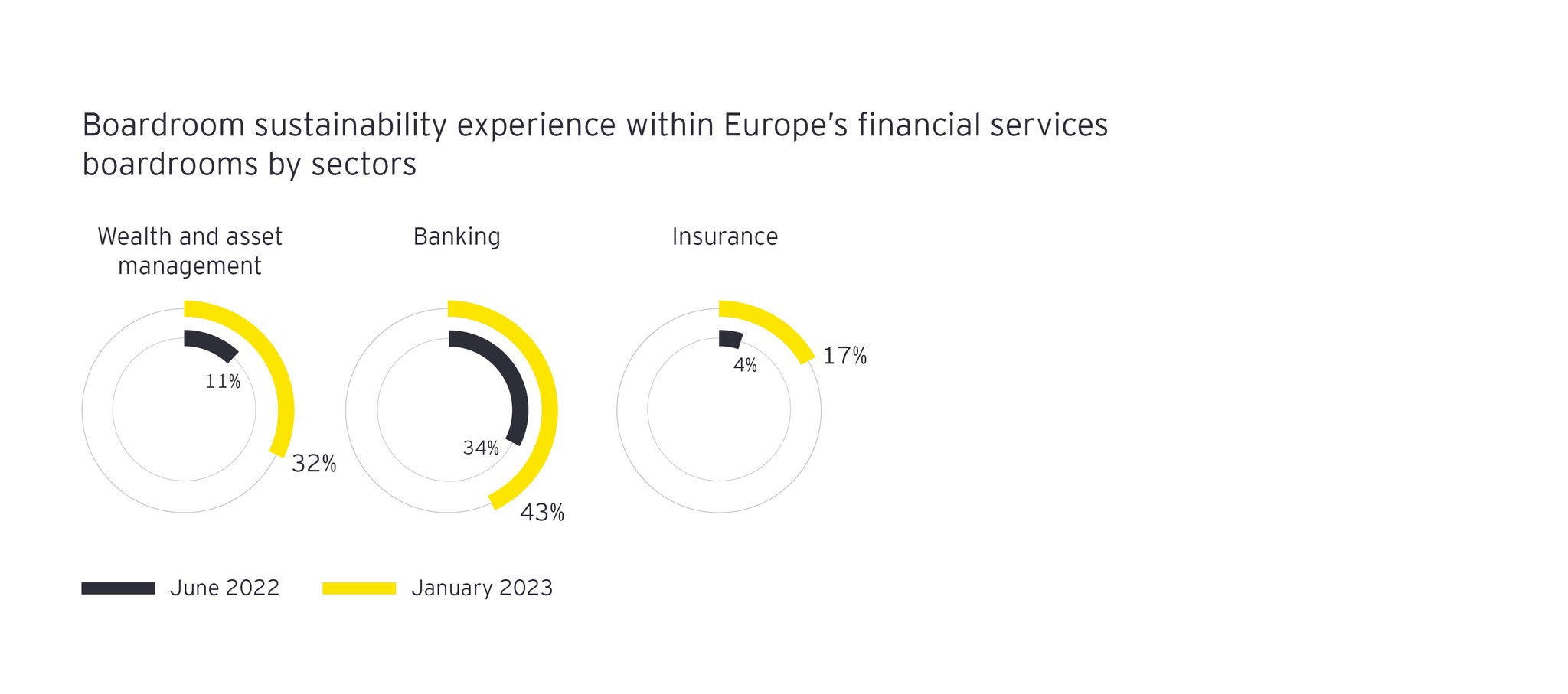

The EY Boardroom Monitor confirms that just under a third (32%) of companies currently have board directors with professional experience or expertise in sustainability. This is, however, a significant rise since the inaugural EY Boardroom Monitor in June 2022, when just 19% of boards monitored listed sustainability expertise.

European financial services firms are stepping up their efforts to appoint board members with this expertise across sectors, yet, despite progress, wealth and asset management firms and insurers continue to lag the banking sector.

Forty-three per cent of bank boards (up from 34% in June) include individuals with sustainability backgrounds, compared to 32% of wealth and asset managers (up from 11% in June), and just 17% of insurers (up from 4% in June). The figures do, however, show clear and strong progress across all sectors.

EY analysis shows that 65% of directors with sustainability experience have been appointed to their position in the last three years, up from 45% in June, reinforcing the accelerating growth of this skillset in the last few months alone. The average tenure of all directors with sustainability experience is 31 months, down from 49 months in June, compared to the average for all board directors of 61 months, up from 59 months in June.

EY analysis also shows that 46% of board directors with experience in sustainability have been appointed within the last year. Of all board directors, 13% have been appointed within the last year, 15% of whom bring sustainability expertise.

Omar Ali comments: “In the past six months we have seen a big increase in the number of directors with sustainability experience appointed to financial services boards, albeit from a low base. Climate change presents both a systemic risk and significant opportunity for financial services, and we expect boards to continue to build this expertise at this accelerated pace. Achieving net zero is impossible without financial services – a key message coming out of COP27.

“From a governance and risk management perspective, to manage the transition and to attract essential investment, having a deep understanding of the materiality of climate risks and opportunities is seen by investors as a competitive advantage. While most firms already count highly technical, specialist sustainability teams within their structure, they also need the right expertise at board level if they are going to make the progress, they want to on the green agenda.

“If firms maintain the recent pace of appointing board members with sustainability credentials and continue to develop and grow the talent pipeline, the European financial industry will strengthen its position as a leading force on the path to net zero. As more firms look to make these appointments, competition for the best talent will increase.”

Sustainability experience is most prevalent among female board members, and more likely to be accompanied by higher-level educational qualifications

Female board directors for financial institutions are far more likely to have professional experience in sustainability than their male counterparts according to the EY Boardroom Monitor. While the current gender split across financial services boardrooms stands at 58% male and 42% female, 72% of board directors with experience in sustainability are female.

Board directors with experience in sustainability are also more likely to hold high-level educational qualifications. For example, 19% of board members with sustainability experience hold a PhD, relative to just 11% of all board members across European financial services firms.

While 18% of board members across all European financial services firms monitored have an MBA, this rises to 26% of board members with sustainability experience. There is not a significant difference in terms of the gender or age of board members with higher educational qualifications.

Omar Ali concludes: “Board composition is fundamentally changing, and companies are building out their sustainability expertise and increasing female representation.

“Chairs participating in the EY Financial Services Chairs’ Interview Series told us that the best board members are those with the ability to think long-term, are resilient to short-term trends and stand up for their beliefs. They are looking to blend broad experience and specialist expertise to ensure the optimal position to pre-empt risks and change.

“Boards need to be future-proofed and built to contend with long-term structural shifts. This requires Chairs to navigate the balance of traditional and new skills on a space-limited board, which is particularly challenging currently, as firms operate in a heightened geopolitical and economic climate.”

About the EY Boardroom Monitor

- This is the second launch of the EY European Financial Services Boardroom Monitor and data collection ran between January - November 2022, and updates on the previous launch from June 2022.

- The EY Financial Services European Boardroom Monitor tracks and analyses data across a wide range of factors, including gender, age, professional experience and skills. It does not track the race and ethnicity of board members, as there is no standardized format for directors to disclose against.

- The EY Financial Services European Boardroom Monitor is comprised of disclosable, publicly available data on board appointments at listed banks, wealth and asset managers, FinTechs and insurers across the UK, Austria, Belgium, Denmark, Finland, France, Germany, Italy, Netherlands, Norway, Spain, Sweden and Switzerland, using the MSCI European Financials Index as the core universe.

- This release incorporates a survey of 300 European and UK-based fund managers who have, or are able to have, exposure to European financial services companies within their portfolios. The survey asks about the biggest risks to European Financial Services companies and where investors see the biggest skillset gaps within boardrooms.

Related news

LONDON, MONDAY 11th DECEMBER 2023: Mortgage lending across the eurozone is expected to record decade-low growth in 2023 and 2024, according to the latest EY European Bank Lending Economic Forecast, as high borrowing costs, weak economic growth and falling housing market sentiment drive down demand.

Financial boardrooms across Europe accelerate female and sustainability appointments

LONDON, 9TH JANUARY 2023: Europe’s largest financial services firms are taking proactive steps to increase female representation and enhance their sustainability expertise at boardroom level – both identified as priority areas for investors – according to the latest EY European Financial Services Boardroom Monitor, which charts the profile, experience, training and skillsets of board directors in the MSCI European Financials Index.

European financial services M&A deal volume fell in 2023, and total deal value hit a decade-low

LONDON, 19 JANUARY 2024. The European financial services industry announced a 3% year-on-year fall in M&A deals in 2023, with 641 deals across the region, compared to 661 deals in 2022, according to the latest EY financial services M&A analysis.

London, Monday 15 JANUARY 2024: Appointments of female board directors to Europe’s largest financial services firms declined seven percentage points year-on-year, according to the latest EY European Financial Services Boardroom Monitor, which reports that 44% of all appointments last year were of women, down from 51% in 2022.