EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Family Enterprise Business Services

What EY can do for you

As a family business owner, you naturally want to take your company to the next level. But your path to growth and challenges are unique and more complicated due to accelerating change and competition. External investors don’t drive your decisions, but a broadening base of family owners and your collective needs, cultures and values do.

The operating business typically generates most of the family’s wealth and income. That means you have even more at stake. You want your business to survive and prosper, professionalize performance and maintain your ideals. Your employees, local economy and community depend on your success, and so does your family.

You need professionals who understand these distinct pressures, as well as the macroeconomic and industry forces that could disrupt your business or plans for the future. EY Family Enterprise Business Services are designed to support enterprising multigenerational families grow larger, more valuable businesses that will last for generations to come.

An integrated approach

EY Family Enterprise Business Services comprise a team of family business advisors who are passionate about the important purpose, role and value that business-owning families bring to our economy and society. We understand that cultivating larger, more valuable businesses while preparing the next generation for ownership is challenging. And balancing the capital needs of a growing business with the periodic liquidity needs of your shareholders must also be considered. Paramount, however, is the need for fostering stewardship to create an enduring, long-term legacy.

We support business-owning families to tackle these questions and more:

- Is our business growth strategy keeping pace with customer demands and competitive forces?

- Do we have sufficient capital to fund current operations and propel future growth?

- How do we engage the next generation and prepare them to take ownership?

- Have we evaluated the advantages, risks and costs of our shareholder liquidity plan?

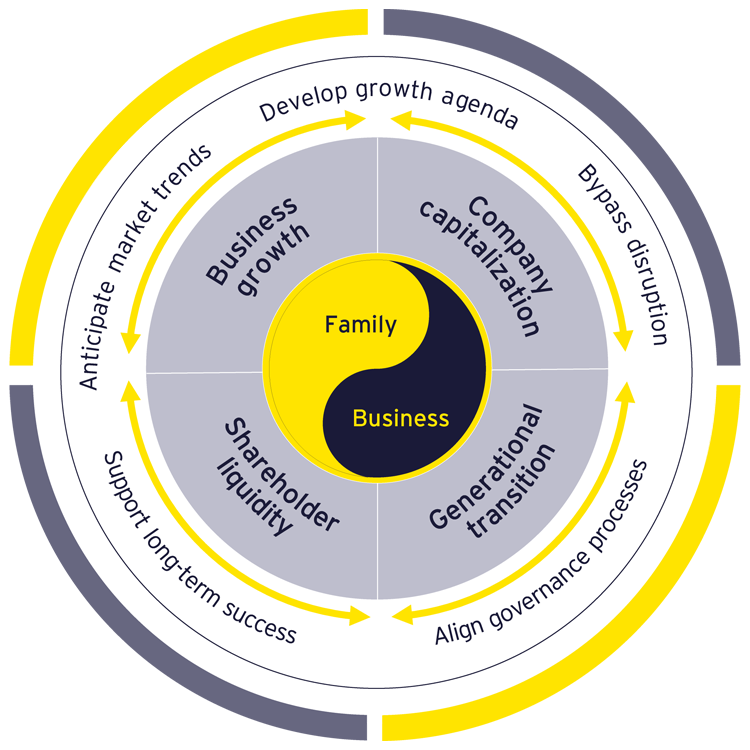

Our multidisciplinary team can advise you in creating and executing the strategies necessary to prosper as an enterprising family. It starts with an integrated approach across four key competencies: business growth, company capitalization, generational transition and shareholder liquidity.

You have options. We can work with you to assess and design internal and external alternatives to provide liquidity mechanisms in the context of your objectives and priorities. We employ a range of customized tools and methodologies to evaluate the requirements, risks and costs of each option.

No matter where you are on your journey, our multidisciplinary team can support you on executing the strategies successful multigenerational families need to bypass disruption, achieve long-term growth and have successful generational transitions.

Our latest thinking

How to reduce family business generational transition failure

Family businesses face six key risks during generational transitions. Strong governance and independent directors are crucial to enduring lasting success.

How corporation and pass-through taxation impacts family enterprises

Discover how tax impacts pass-through entities versus corporations for family enterprises.

How to prepare heirs for tomorrow’s family business

Future-ready leaders can be fostered through strategic development and diverse experiences.

The value creation advantage: boosting cash flow in family offices

Discover how family offices can unlock additional cash flow through targeted value creation without disrupting their investment strategies. Read more.

Understanding the value (and values) of Gen Z

Key strategies family enterprises can implement to connect with Gen Z for long-term success. Read more.

How the world’s 500 largest family businesses build and sustain value

The 2025 EY and University of St.Gallen Global 500 Family Business Index ranks the world’s largest family businesses. Read more.

How an advanced materials player successfully enters new markets

SAES transformed its high vacuum business and grew revenues by 300% with the support of EY. Now they’re taking on the cosmetics space. Learn more.

How strong capital planning helps protect a family business’s legacy

Family enterprises need a structured capital strategy to address the various needs of the business and shareholders. Learn more.

How family businesses can build a resilient shareholder liquidity plan

Discover how to strategically balance the short- and long-term capital needs of your family-owned business and the growing liquidity needs of your owners.

Why the family office of the future needs refreshed operating models

Tech and talent need highlight opportunities for family offices to evolve, Wharton Global Family Alliance survey shows. Here are actions to take today.

5 megatrends shaping the world: how to stay ahead of the curve

The world is transforming, and megatrends are helping shape it. To thrive in a global economy, family enterprises must be forward-looking and resilient.

How your shareholder liquidity strategy can be made future-proof

Meeting the liquidity needs of the family and the business is a balancing act that can help continue growing the enterprise. Read more.

Preparing the family business wealth transition plan

Wealth transition plans are essential for family businesses. Learn more about the core strategies for updating your company’s wealth transition plan.

How family businesses can prepare for cybersecurity threats

Family businesses are attractive targets for cybercriminals. Learn more about proactive measures that family businesses can take against cyber attacks.

How family businesses can plan their company capitalization strategy

Planning for the capital needs of a family enterprise requires balancing business growth objectives with stakeholder liquidity expectations. Read more.

How family businesses can cultivate resilient growth

Family businesses are in a new economic environment that requires rethinking business strategy to deliver ongoing growth and profitability. Read more.

How parallel governance can guide generational transition

Clear communication and strategy between the family and the business creates capable shareholders alongside a sustainable enterprise. Read more.

Seven capital planning questions for family businesses

In a tough capital-raising environment, family enterprises are revising their approach to budgeting, forecasting and financial decisions. Read more.

How to manage risks and protect family offices

Single family offices should implement a risk framework and management system to recognize potential areas of concern. Learn more.