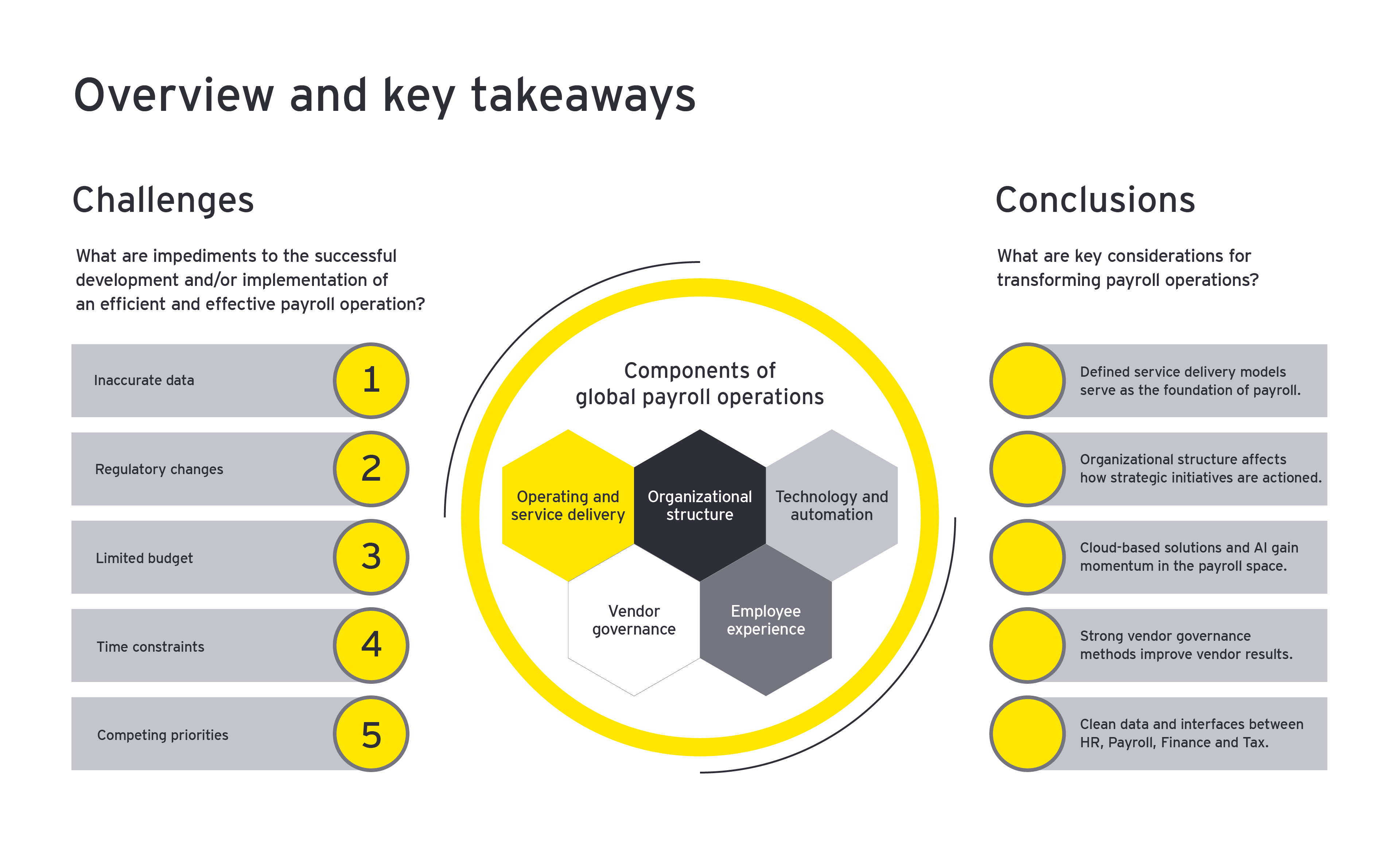

Chapter 1

COVID-19 creates big challenges for payroll

The COVID-19 pandemic has changed how and where we work, perhaps forever. This means significant change and risk are still ahead for the Payroll and HR functions.

Hybrid work risk

According to the survey results, the primary challenge for the Payroll function is evaluating hybrid, flexible, or “new ways of working” policies and their impact on multi-jurisdictional payroll withholding. The past year has demonstrated that when required — and with the right tools and technology — many jobs and roles can successfully work from anywhere. Now, many organizations are considering how to leverage the experience of the pandemic to introduce and maintain greater long-term flexibility for their workforce. A hybrid work model can offer this flexibility by blending in-office and remote work while delivering a seamless employee and customer experience, regardless of physical location.

Survey respondents also cite that keeping up with regulatory compliance changes is their second highest compliance challenge. Perhaps surprisingly, 37% of organizations do not have a plan of action to address hybrid- or flexible - work employees working in a different jurisdiction.

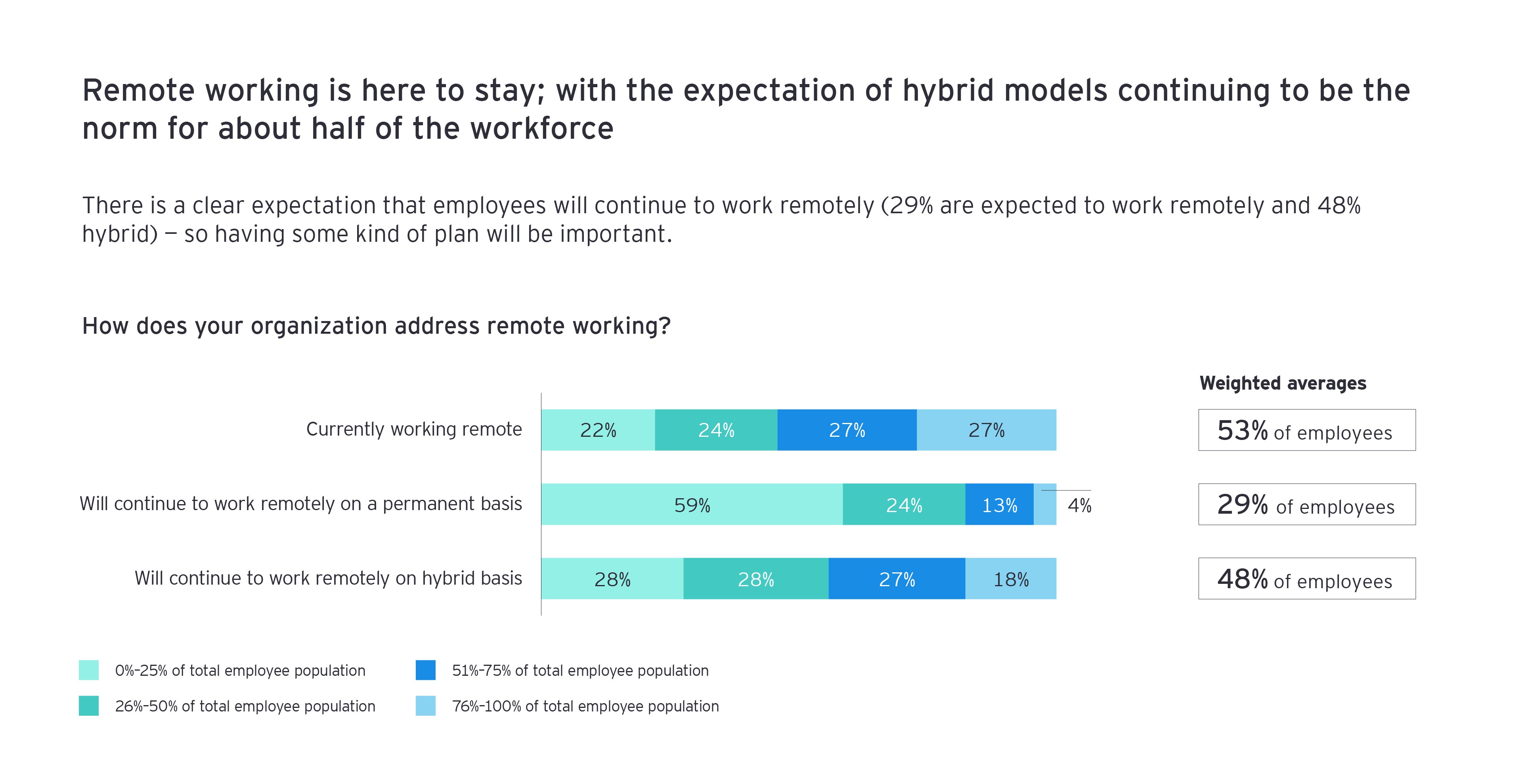

Having no formal plan may be a deliberate strategy. By allowing employees to self-declare their location via employee self-service (ESS) tools and time sheets, firms avoid having to go through the considerable effort of proactively tracking and confirming work locations. But this could also create problems, and increase risk, for years to come, as remote working is likely to be here for the foreseeable future. Organizations expect 29% of employees to continue to work remotely and 48% in some sort of hybrid model. Interestingly, in the EY 2021 Work Reimagined Employee Survey, 54% of employees said they are prepared to resign, if not given the flexibility they desire.

Attraction and retention of talent

Talent and labor shortages are another external factor putting immense pressure on payroll, and HR, at organizations worldwide. Multiple data points over the past year show that employers globally are facing the biggest talent shortages in years, leading to what many are calling “The Great Resignation.” This creates challenges for the Payroll function and has significant implications for wider HR strategy, including:

Talent pool

Identifying and recruiting talent for the Payroll function. It’s common for Payroll function employees to be in these roles for multiple years. Departures take with them significant institutional knowledge and are more difficult to replace.

Labor shortage

Many global markets and sectors continue wrestling with the effects of acute talent shortages. This goes for the Payroll function as well. Organizations should consider adding the Payroll function to rotational opportunities to grow an internal pipeline of talent.

Training

Based on the strategic placement of Payroll within the organization (i.e., reporting to the HR or Finance functions), it’s important to develop upskilling and reskilling programs which support a seamless transition for employees moving into payroll from other functions.

The Great Resignation

This global shift of talent places enormous pressure on payroll to process a higher volume of transactions between terminations and new hires. If Payroll is already shorthanded, this increased volume can negatively impact Payroll. In addition, the consequences of talent shifts are felt within the Payroll function itself.

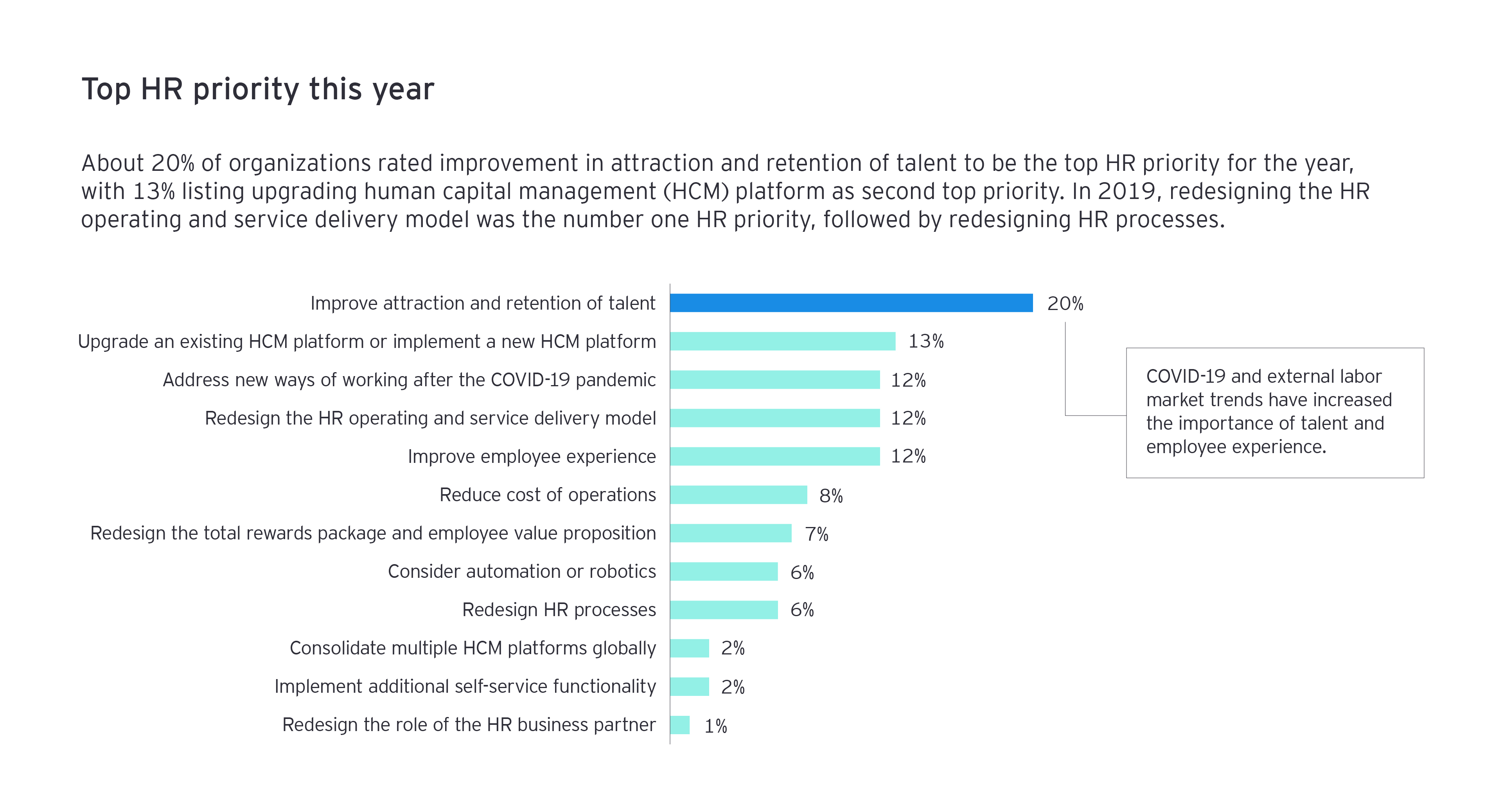

The attraction and retention of talent has always been an issue for Payroll, but this is being felt more acutely now – with the pandemic and other labor market trends creating greater challenges for organizations being able to secure the talent they need. Our survey shows that the number one HR priority for the following year is the attraction and retention of talent.

Where do we start?

How can the Payroll and HR functions build a strategy that limits risk and increases compliance while attracting the right talent for their strategic goals?

- Understand the footprint, technology landscape and risk of your existing payroll operation.

- Build a comprehensive payroll strategy around your organization’s long-term strategic goals, that considers hybrid or remote work policies, and limits corporate risk.

- Partner with HR to create programs that focus on upskilling and reskilling of your existing workforce and build flexibility to increase attraction and retention.

- Consider additional investment in payroll technology to streamline payroll, tracking of employee work locations, improved interfaces, and payroll dashboard, such as EY Payroll Intelligence Center to monitor payroll performance and compliance.

Chapter 2

Data, compliance, and the Payroll function

Most Payroll and Finance functions are familiar with the challenges of poor data and associated compliance issues, and these challenges predated the COVID-19 pandemic.

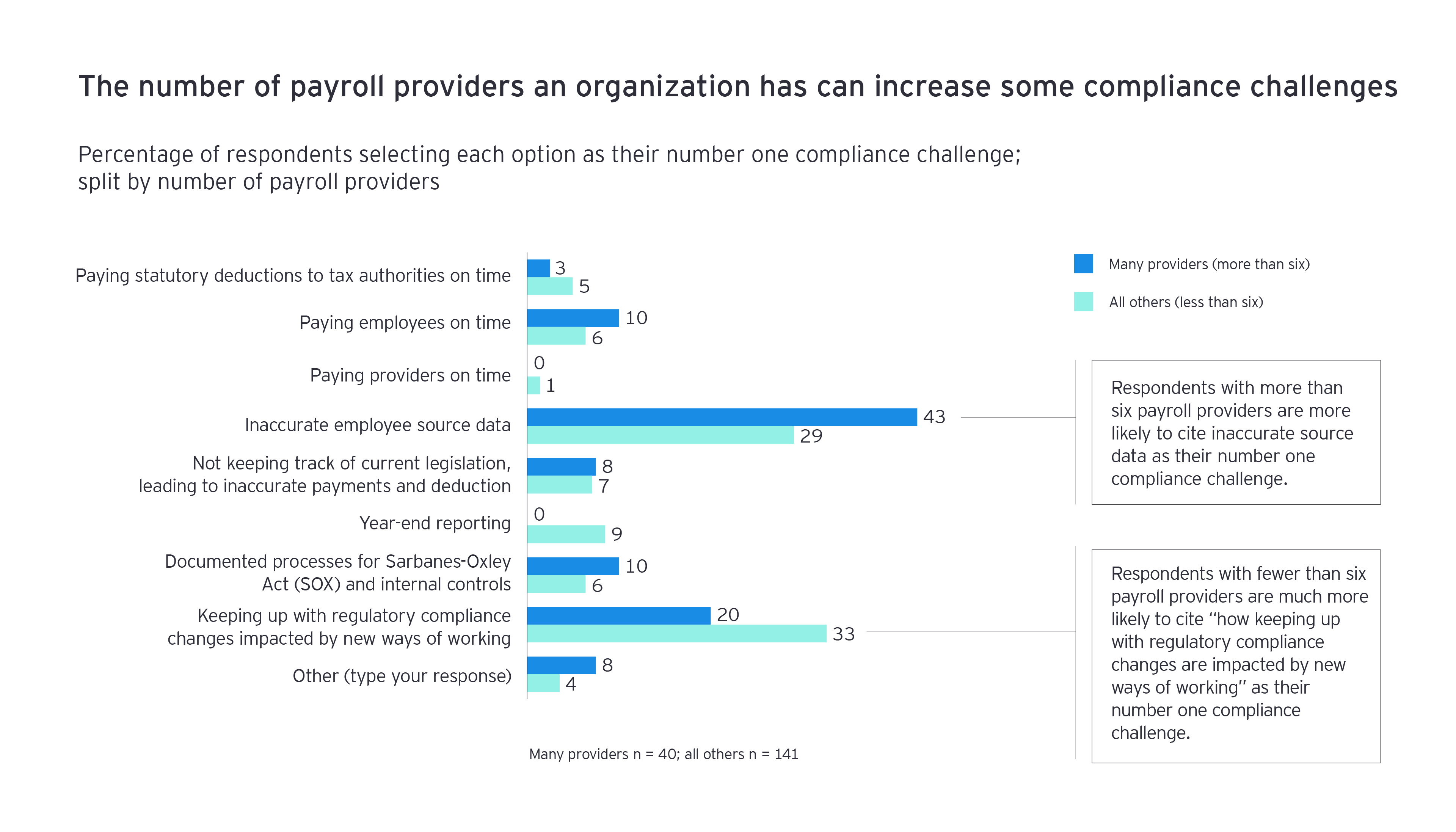

This year, poor source data and keeping up with regulatory compliance challenges are rated as the top two challenges faced by payroll functions globally. Both challenges are typically due to disparate systems that do not properly talk to each other, or due to nuances in global processes.

Poor source data

The difficulty of poor downstream data is particularly acute if the Payroll and HR functions are not well-connected, highlighting the need for better alignment between Payroll and from where their data are sourced. Now, more than ever, organizations need the ability to access payroll data efficiently and accurately as teams continue to work remotely or in hybrid work models.

Poor source data is an ongoing, recognized challenge for the Payroll function. So, what can organizations do to mitigate their risk and increase their data quality?

- Partner with the HR function to redesign a process for data responsibility to ensure the impact of bad data is reduced. Define who owns the data and assign responsibility to resolve data errors or gaps.

- Utilize current technology to track, resolve and process data and compliance issues that have come downstream from payroll.

- Determine the communications strategy with employees affected by payroll errors. What are the employee consequences? How was the issue resolved? And how will the organization help the employee respond to the error?

- Require proper work location reporting. COVID-19 has forced employees to work away from their typical work location and organizations don’t always know where their employees are located. If organizations require proper location reporting, this will reduce risk.

- Ensure employees understand the organization’s time sheet and reporting processes to correctly report their own information. If the data are not reported correctly, the organization may not be in compliance. The responsibility is on the employee to self-report data accurately.

Compliance and regulatory changes

The second challenge for payroll professionals stems from keeping up with compliance and regulatory changes. As the number of jurisdictions where an organization processes payroll increases, so does the volume of compliance challenges. What can payroll professionals do to develop a global strategy and reduce risk?

- Build relationships with your payroll provider, or advisors, such as EY, to help track legislative changes influencing Payroll function.

- Leverage technology, such as AI or robotics, to track work location of your employees.

- Build a process that is collaborative and works together with Payroll, HR and Finance to improve data flow.

- Understand compliance changes and how they are impacted by policies such as the General Data Protection Regulation (GDPR.)

- Reduce turnover, recruit new talent and incentivize payroll professionals. As seen in Chapter 1, improving attraction and retention of talent will be a challenge for HR professionals for the foreseeable future.

Where do we start?

How can the Payroll function address data and compliance challenges?

- Build a plan for data sourcing and sharing within your Payroll, HR and Finance functions. Consider what short- and longer-term improvements can be made to increase payroll accuracy.

- Align payroll goals with the larger HR and organization’s strategy for maximum impact.

- Access what the optimal service delivery model is for your organization to deliver payroll (including for example, outsourcing, insourcing, co-sourcing, shared services, etc or any combination of these service delivery model options.)

- Implement intuitive dashboards to monitor payroll analytics, outcomes, metrics and trends.

Chapter 3

Optimizing your payroll operating model

Many global organizations find the task of finding the right global payroll operating model difficult.

What is the right mix of in-house processing capability, external expertise, the optimal number of vendors, and which model is best for each country or region? These decisions depend on several factors – including existing shared service capability, country employee population size, budget, vendor governance model effectiveness, global expansion and global reach of the organization.

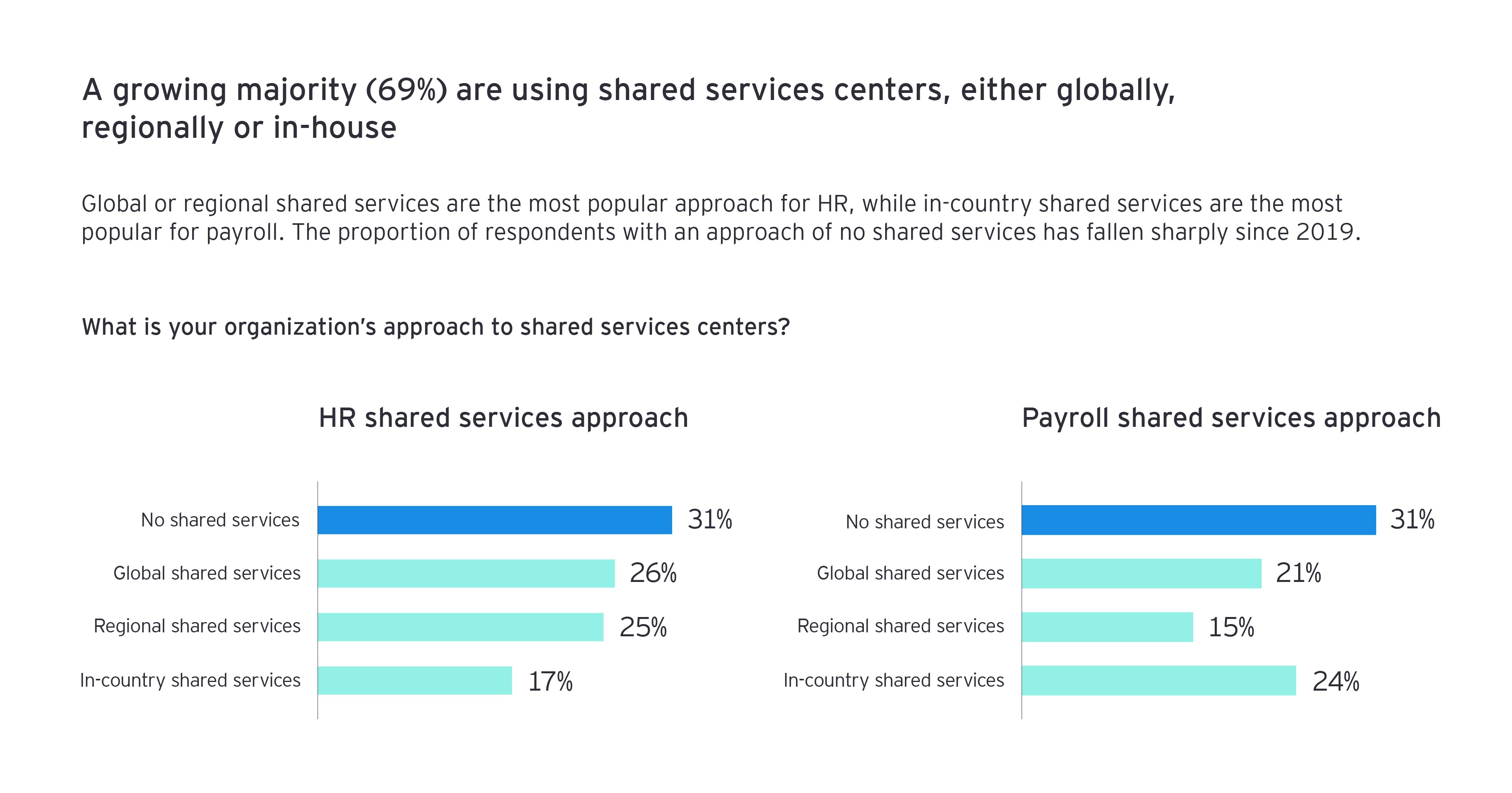

Most survey respondents tell us they are using shared service centers to deliver aspects of payroll to their workforce. In fact, 69% of organizations say they utilize shared services in some form for both HR and payroll delivery in 2021, which is up from 57% in 2019.

How much should we outsource or co-source?

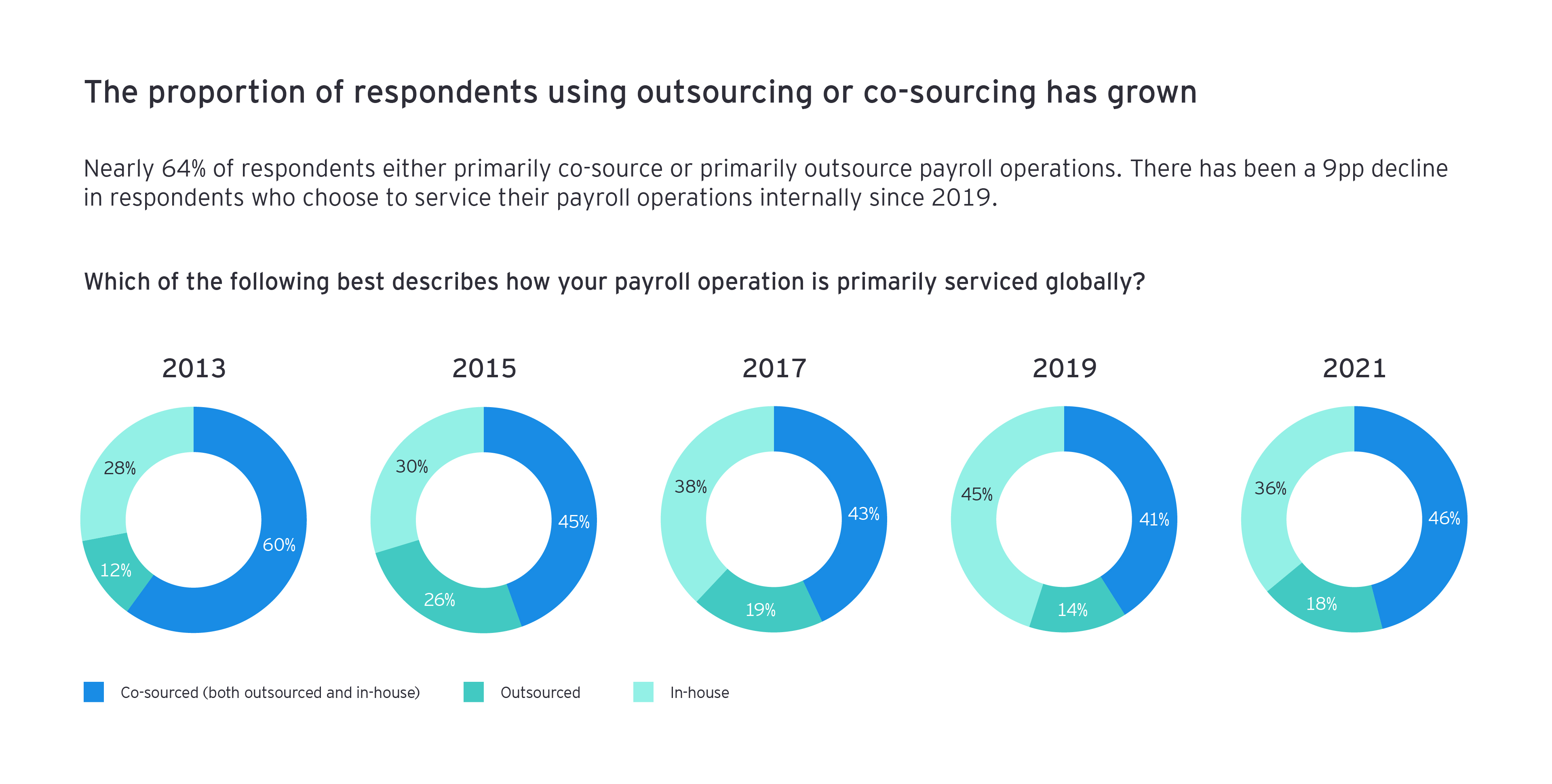

An increasing number of organizations are outsourcing to some degree, but there are clear challenges with doing so, including managing multiple providers, vendor governance and response times from providers when issues occur. According to our research, 64% of respondents either primarily co-source or primarily outsource payroll operations. Since 2019, there has been a 9-percentage point decline in respondents who choose to primarily service their payroll operations internally.

The desire to outsource illustrates the challenges organizations face in delivering payroll internally. This is further illustrated by the fact that only 22% of respondents agree that bringing previously outsourced payroll services back in-house would bring significant benefits to their organization. When deciding to outsource and determining the right number of providers for your organization, consider the following:

- The processing of payroll must be very clean (with limited exceptions) to ensure a quality outcome. As payroll professionals know, external vendors do not clean up poor data and this can cause issues with payroll is processed.

- Your mix of organization size, process standardization, global reach and the number of providers can impact the way you process payroll.

- The processes such as collection of variable pay data, and employee self-service are rated to be managed internally by over 80% of organizations. On the other hand, the remit of statutory filings, post payroll processing and payroll processing are the processes being outsourced the most. Organizations must assess their internal strengths and weaknesses and determine which processes are best for outsourcing.

Outsourcing isn’t always easy

Just 42% of respondents say that conducting business with their payroll provider is easy. Furthermore, when asked how they would rate their payroll provider across multiple areas, very few survey participants select “Excellent” in any area – with the percentages selecting “Fair” or “Poor” often outweighing those selecting either “Excellent” or “Very Good”. If your organization is in the 58% that has challenges with outsourcing, there are solutions you can apply right now to improve your situation.

While in some cases it may make sense to change an organization’s vendor landscape, there are opportunities to evaluate current systems and partners in place to improve operations. Initiatives which are highly beneficial include assessments of technologies to determine functionality which hasn’t been set up properly, or where additional modules can be added. Firms can establish, or enhance rigor in key performance indicators (KPIs) with payroll providers; refresh processes inclusive of step redundancies and clear roles and responsibilities; and identify proper thresholds and controls for approvals.

What is the right number of payroll providers?

Many organizations ask EY what the right number of payroll providers for their organization. While there isn’t a one-size-fits-all approach, the survey data do give us a great picture of what is and isn’t successful. One key insight is that respondents have consistently indicated, since the inception of the survey in 2013, that one provider can’t handle all their needs. Still, firms do believe some consolidation in the number of providers used would be beneficial.

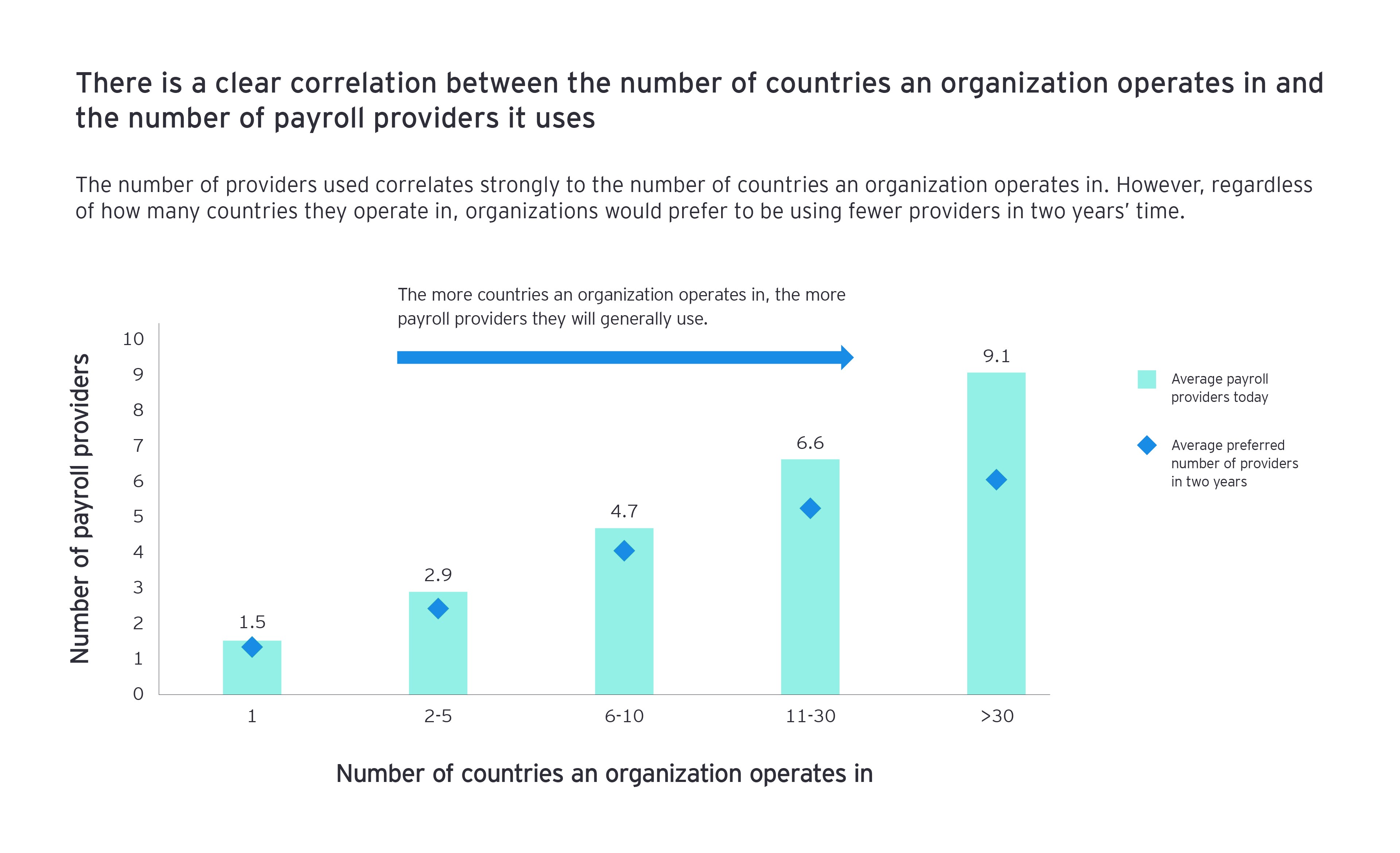

There is a correlation between number of countries where an organization operates to recommended payroll providers

From this year’s survey, the average number of payroll providers is five. Unsurprisingly, larger global organizations with a larger global footprint use more providers and there is a strong correlation between the number of countries and number of providers for an organization’s operations.

Using multiple providers can create challenges

Our data show that organizations using six or more payroll providers are more than twice as likely to cite difficulties in management and global reporting. These organizations are also significantly more likely to specifically cite issues with data as a key challenge.

As noted in our section on compliance and data challenges, there are a handful of actions a payroll professional can take to develop a global strategy and reduce risk, such as:

- Build relationships with your outsourcing provider, or advisors, such as EY, and keep them close.

- Leverage technology, such as AI or robotics to optimize payroll processing.

- Build a process that is collaborative and works together with Payroll, HR and Finance to improve connectivity between HR data, payroll and finance.

- Understand compliance changes and how they are affected by policies such as GDPR. Reduce turnover, recruit new talent and incentivize payroll professionals. As seen in Chapter 1, improving attraction and retention of talent will be a challenge for HR professionals for the foreseeable future.

With these challenges in mind, organizations say they would like to use fewer providers and consolidate. Overall, 55% believe some consolidation would be beneficial and organizations, on average, would like to be using four providers within two years. However, despite the desire for consolidation, organizations don't believe one provider is the solution to their organization. Notably, only 38% agree that one provider can meet all their needs and strategic goals.

Payroll vendor selection

Vendor satisfaction continues to be a challenge for outsourcing providers, encouraging organizations to rethink the way they view their outsourcing relationships. This focus pushes the desire to alter operating models or obtain more from their current vendors. Organizations are frequently shifting vendors or bringing aspects of their payroll operations in-house to improve the end-customer experience. Vendors are offering more globally consolidated and user-friendly solutions to improve the service quality and drive innovation within the marketplace

Where do we start?

How can organizations determine the best global payroll operating model including the number of vendors, what processes to outsource and meet our strategic goals? How do you select them?

- Review your payroll vendors and internal capability to determine the optimal mix to meet your short and longer-term goals.

- Build a business case to support the transition to a different model. This business case should include both quantitative data (i.e., cost savings) and qualitative data (e.g., improved employee experience).

- To address the new and longstanding challenges they face, organizations are looking to a variety of different payroll operating models and are having to partner with external providers and vendors.

Related articles

Summary

Our survey found organizations faced three primary challenges with regards to payroll: COVID-19; data and compliance; and their Payroll operating model.