EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

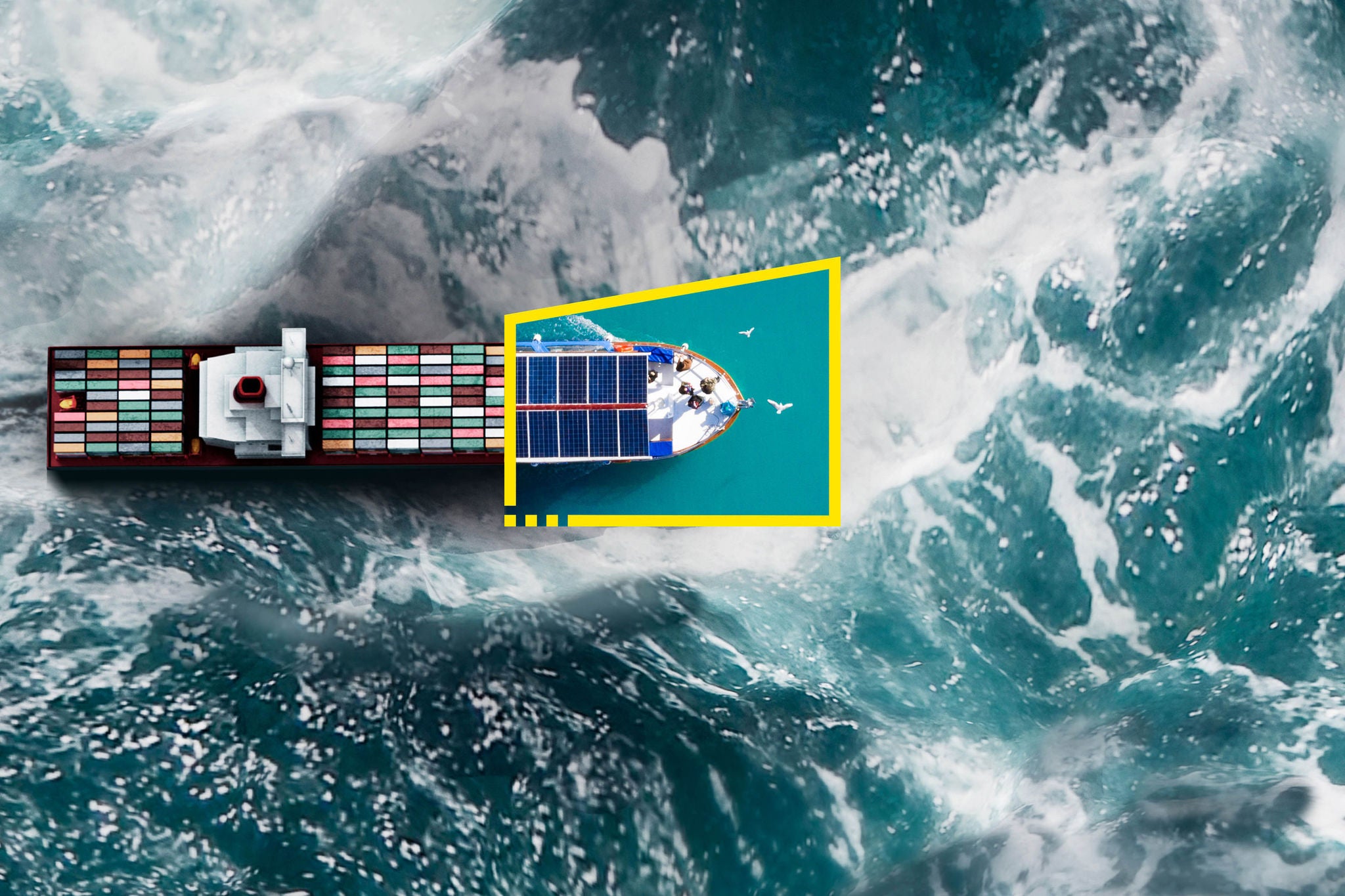

The EY Center for Sustainable Supply Chains helps companies in Southeast Asia accelerate the transition to sustainable supply chains. Learn more.

Read more

CSOs (in their various guises) have played a major part in elevating sustainability in corporate agendas. EY analysis of corporate data from the Forbes Global 5002 indicates that organizations with a CSO are more committed to sustainability, have more ambitious emission reduction targets (54% vs. 44% of organizations without a CSO), and have reduced their emissions 3.6% over three years (vs. a 5% increase in companies without a CSO).

Far deeper reductions are needed and require transformative changes to organizations and their business models: a clearly defined vision, identification of risks and opportunities and robust governance structures. Operational models must be adapted, portfolios adjusted, and supply chains more actively engaged.

CSOs can’t do this alone — they need to empower the whole C-suite to effect business change, drive value and produce results.

Searching for satisfied CSOs

The CSO role may once have amounted to what Robert Eccles and Alison Taylor, in a recent Harvard Business Review article,3 refer to as “stealth PR executives.” Not anymore. “The CSO role is finally becoming strategic,” they wrote, as the focus moves from “feel-good corporate social responsibility to hard-nosed sustainable value creation.”

CSOs are being tasked with identifying the sustainability issues that have a substantial impact on an organization’s financial performance and risk profile, but even those in the most committed organizations are struggling with inadequate cross-functional collaboration and a slow pace of progress. These factors are helping drive worrying levels of CSO dissatisfaction — only 17% of CSOs and equivalents in our survey are “highly satisfied” in their roles, and 42% are not committed to staying with their current employer. This jeopardizes further progress and poses considerable risks to the future continuity and strategic planning of sustainability programs.