EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Building an Effective Culture of Data Privacy: EY and Mastercard Co-host Seminar on Personal Data Protection in Vietnam Financial Sector

Hanoi, 31 May 2023 – EY Law Vietnam Limited Liability Company (EY) and Mastercard joined forces to co-host a seminar titled "Decree 13 on personal data protection: Impacts on the Financial sector". The event aimed to shed light on the regulatory landscape surrounding personal data protection and its impacts on businesses and organizations in financial sector. Additionally, the event also introduced best practices to participants on how to build and effective culture of data privacy.

Lawyers and professionals from EY and Mastercard took the stage to share their expertise on several key topics, including:

- Key considerations of Decree 13/2023/ND-CP on personal data protection on 17 April 2023 (Decree 13)

- Vietnam's cyber threat landscape and security controls across the data lifecycle, with highlights on financial sector

- Going beyond compliance: How to build an effective culture of data privacy

Decree 13, released on 17 April 2023, scheduled to take effect on 1 July 2023, signifies Vietnam's efforts to constitute a first-ever consolidated and comprehensive legal instrument on personal data protection in Vietnam, which potentially paves the way for Vietnam to be more in alignment with the international standards of the EU’s General Data Protection Regulation issued on 27 April 2016 by European Union (GDPR).

Decree 13 is anticipated to reshape the local regulatory landscape and have far-reaching impacts due to its extraterritorial scope. Irrespective of whether an organization operates within Vietnam or abroad, this decree is likely to capture all entities engaged in the processing of Vietnamese personal data, including foreigners residing in the country. Releasing Decree 13, Vietnam joins groups of other ASEAN countries, most of which have already set and implemented their laws and regulations on personal data protection.

One month before becoming effective, Decree 13 is expected to have deep impacts on current practices of personal data processing since now. Entities and individuals under Decree 13 control must perform several activities, such as implementing new data protection technical solutions, developing new policies and procedures, modifying communicating approaches with clients, and preparing new types of reports to submit to the authorities.

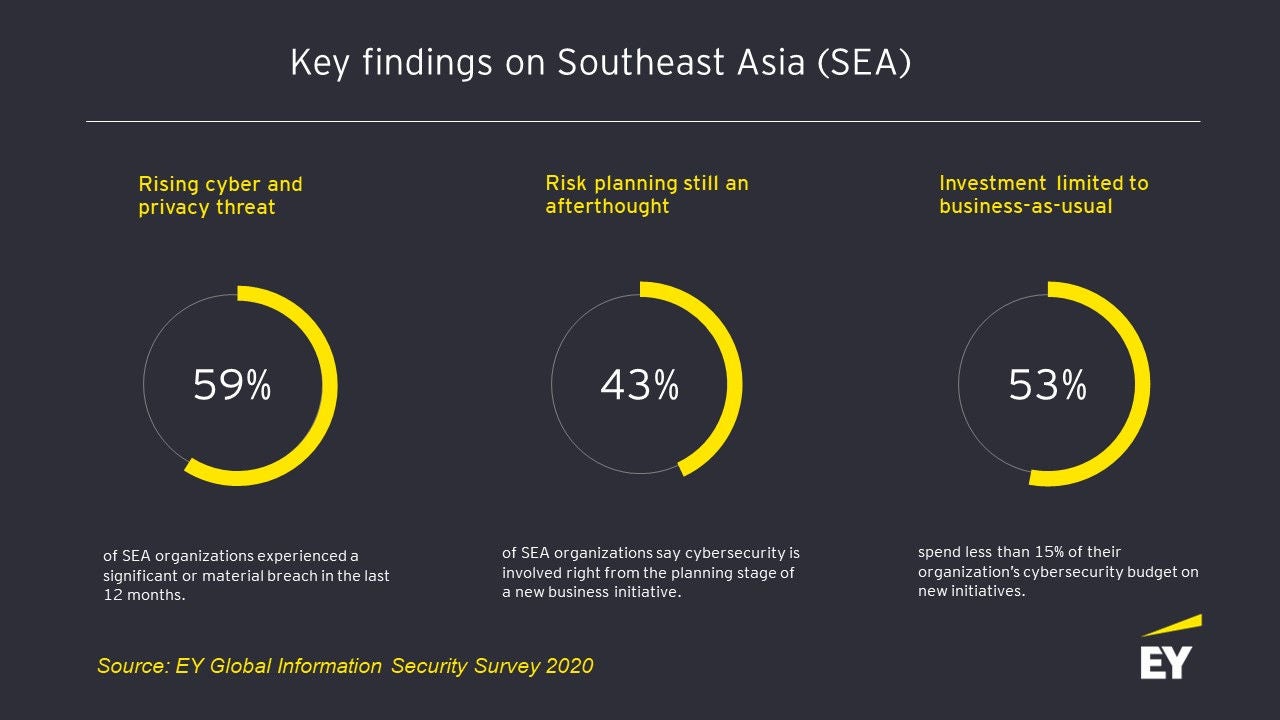

According to the EY Global Information Security Survey 2020, cyber and privacy threats are on the rise, with 59% of Southeast Asia (SEA) organizations experiencing a significant or material breach in the past 12 months. However, despite this growing risk, only 43% of SEA organizations involve cybersecurity right from the planning stage of new business initiatives. Furthermore, 53% of SEA organizations allocate less than 15% of their cybersecurity budget to new initiatives.

According to Michael Beckman, Partner, EY Law Leader, EY Law Vietnam Limited Liability Company, “new risks demand new approaches. To avoid risks and penalties for non-compliance with Decree 13, organizations and businesses operating in Vietnam should study and have plans to comply with regulatory requirements as soon as possible.”

Robert Tran, Partner, Cybersecurity & Technology Risk Leader, EY Vietnam Cybersecurity Services Company Limited, emphasized the importance of fostering a culture of data privacy within businesses. "To earn and maintain customer trust in products and services quality, data privacy must be ingrained within organizations. Failure to respect the culture of protecting personal data can lead customers to believe that their personal data is not respected, ultimately damaging the business's reputation”, said Robert.

“As individuals increasingly embrace digital-first lifestyles, safeguarding data has become paramount for businesses to protect consumers and mitigate the consequences of data breaches. Mastercard aligns and complies with the Vietnamese government’s efforts to enhance personal data protection,” said Winnie Wong, Country Manager for Vietnam, Cambodia and Laos, Mastercard. “As a central player in the digital ecosystem, Mastercard is committed to leverage its global expertise to support businesses and partners navigate the regulatory changes, improve cyber readiness and implement robust data protection practices, and in doing so, bolstering Vietnam's cyber security.”

Amidst regulatory changes and escalating cyber and privacy threats, personal data protection has become a paramount concern for organizations and businesses.

-end-

Notes to editors

About EY

EY | Building a better working world

EY exists to build a better working world, helping to create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws. For more information about our organization, please visit ey.com.

This news release has been issued by EY Law Vietnam Limited Liability Company, a member of the global EY organization.

ey.com/en_vn

About Mastercard (NYSE: MA) www.mastercard.com

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.