Chapter 1

Using circular principles to create value

Three key actions help develop new revenue streams and strengthen supply chains while benefiting society.

Accelerating value chain collaboration to achieve mutual goals for supply chain resilience and net beneficial societal outcomes is driving the development of new revenue streams, which are proving to be sustainable over the long term.

1. Strengthen local supply chains

As borders closed to both humans and international trade during the COVID-19 pandemic, the global supply chains of various industries were rattled by disruption, and demand-based shortages from lumber to chlorine began to emerge. Focus on the benefits of local sourcing has intensified, as operational strategists look to strengthen domestic supply chains and design new processes to make their companies more resilient.

LCY Chemical Corporation − one of the largest chemical producers for semiconductor makers − is one such company that has recognized the value of relocating its supply chain closer to its customers. The producer is considering building a factory in Arizona (its largest outside of Taiwan) to supply Taiwan Semiconductor in Phoenix. The proposed plant would have a strong focus on recycling semiconductor chemicals, which can be used in other industries and applications, such as coatings and construction.2

2. Advance the sustainability goals of your customers

Around 2017, a handful of global consumer companies began announcing a series of ambitious goals to improve the recyclability of their packaging and to increase the volume of recycled content they utilize. Today, thousands of companies worldwide across a wide range of industries have made similar commitments, with initiatives such as the New Plastics Economy and The Plastics Pact helping to define the level of ambition required to enable transformative change at a global level.

This presents a significant level of opportunity for chemical companies that can create − and articulate − their value proposition in helping their customers achieve these goals. Additives and catalysts that can reduce the amount of virgin polymers required during production processes, improve recycling yields, or reduce degradation, are just some examples of products that are increasing customers’ abilities to achieve their packaging goals in a resource-efficient manner.

3. Drive new revenue sources

EY analysis identified that more than 35% of innovations announced by top global chemical manufacturers in 2020 included investment in the circular economy or hydrogen technology.3 Of these, over 40% are related to bio-based or recycled material for feedstock, and another 35% are intended to make processes more sustainable.4

Circular economy could unlock GDP growth of US$4.5 trillion by 2030.5 However, in this growth and transition phase, the chemical industry will have to gradually increase its share of alternative feedstock. Value chains and capital markets are strengthened by bold quantitative company commitments to new technologies and products.

BASF is one of a handful of leading chemical companies that have set a clear societal, and commercial, ambition for their circular economy solutions. “BASF will aim by 2030 to double its sales generated with solutions for the circular economy to €17 billion, and by 2025 will aim to process 250,000 metric tons of recycled and waste-based raw materials annually, replacing fossil raw materials,” the company says on its website.6

How EY can help

ESG and sustainability

Integrate ESG and sustainability into business strategy, and improve and communicate performance to stakeholders with help from EY teams.

Read more

Chapter 2

Circular business models are continuing to develop and evolve

Four promising categories exist, spotlighting both the challenges and the opportunities ahead for chemical players.

A variety of circular models is continuing to develop7 with the majority of them falling into four promising categories:

1. “Leasing” or “renting” chemicals

The ownership of the product (chemical) remains with the producer. Companies no longer buy and handle chemicals, but instead purchase them as a service. In this way, manufacturers are compensated by the chemicals’ end use, not volume − for example, number of assembly line machines cleaned or product components painted or coated.8 This further incentivizes the producer to focus on developing the efficiency of products and reducing waste.

2. Incentivizing return

Extended producer responsibility programs are an increasingly common model that assigns responsibility for recovery of a product at its end of life to its producer, to encourage reuse, repurposing, or proper disposal. Legislated programs are common in the EU, with well-established programs for tires, waste oil, batteries, plastic bags, photo-chemicals and chemicals, refrigerants, pesticides and herbicides, and electronics, among others.

3. Enhancing recyclability

Chemical and plastics producers can enhance the recyclability of material by designing products to enable easy separation through additives, catalysts and more. The shorter the reverse cycle, the less embedded energy, labor and material is lost.

4. Ecosystem collaboration

As customers look to extend product life cycles through repairs, upgrades, and repurposing post-consumer waste, joining the expertise of vendors and customers through online “circular economy marketplaces” can be a useful platform to enable innovative new circular value chains to form.

Building circular economies poses enormous opportunities and challenges, as shown in the current state of plastics recycling, to take one example elaborated upon below.

Next, we discuss what companies can do to adapt and convert these challenges into opportunities.

Chapter 3

What should chemical companies do to adapt?

Today, they should be establishing the right foundation for a circular supply chain. And there is more to achieve in the next and beyond.

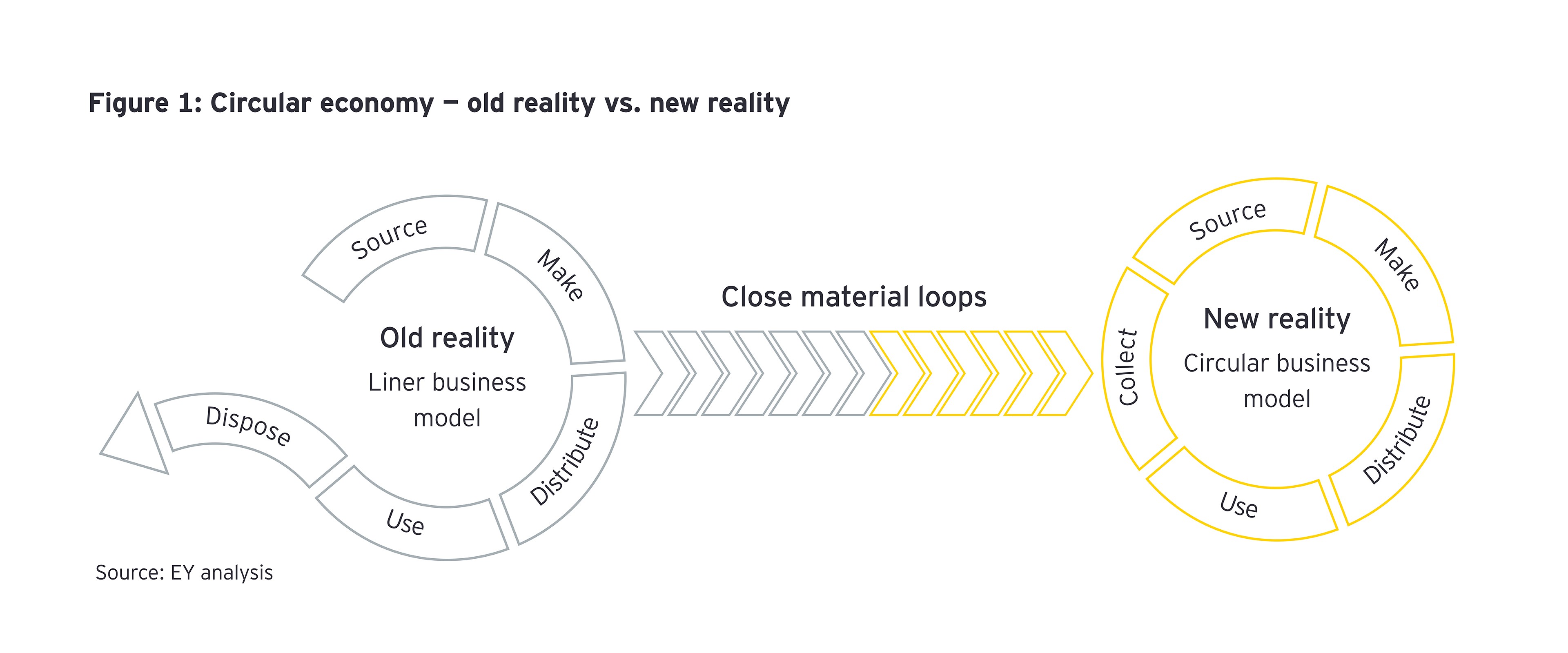

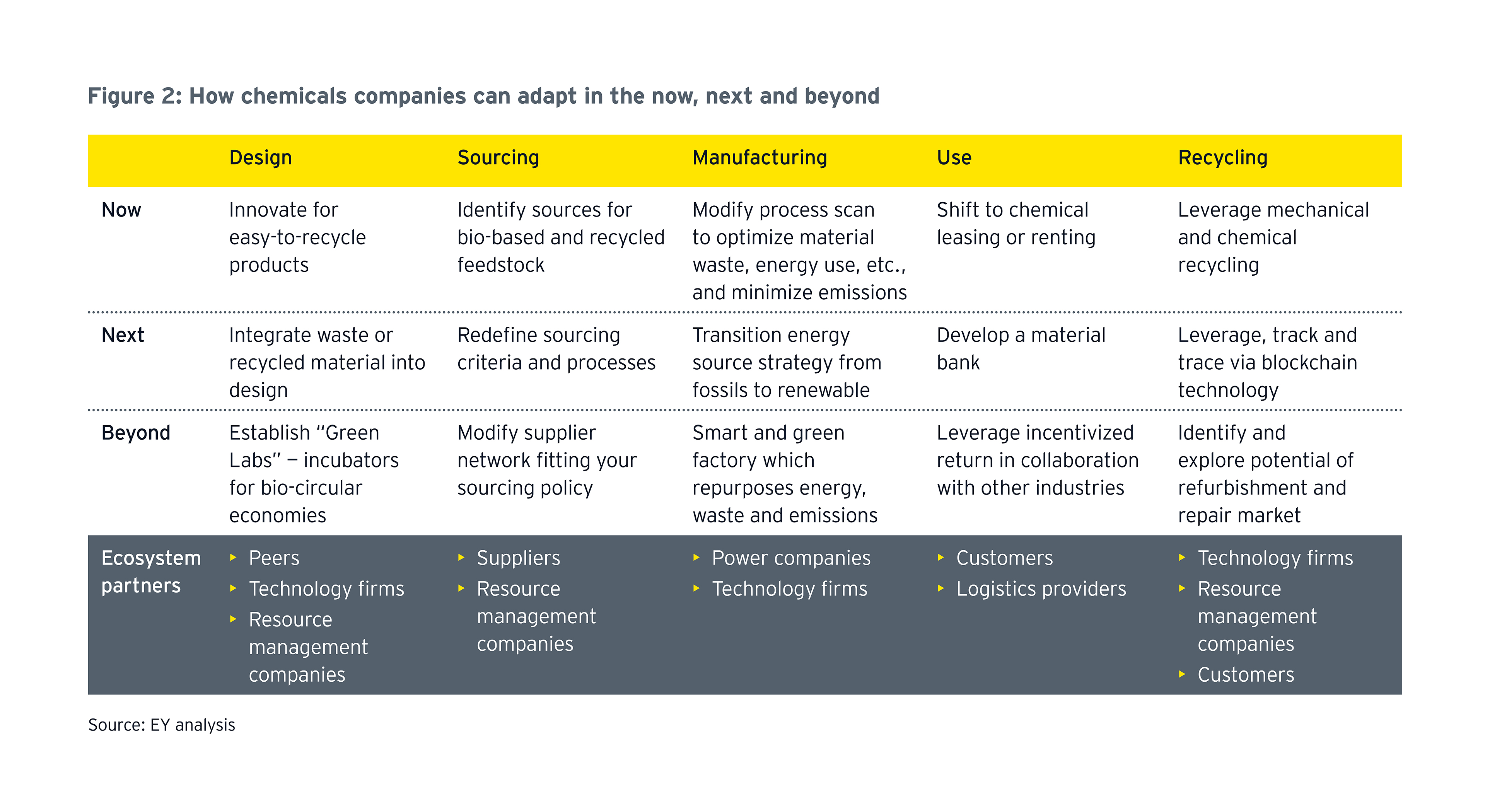

In the near term, chemical companies should look to their own operational processes and value chains to identify opportunities for circular material loops that enable reuse and minimize waste, and to evaluate potential processes where feedstocks (including energy) could be substituted for bio-based or recycled sources.

Encouraging innovation from within the business can also be catalyzed through employee innovation challenges and direct investment in the organization’s R&D capabilities. However, to seek direction on where to invest, the organization must look outward to emerging regulations and the long-term net-zero waste goals of cities, countries and regions, which offer both disruption and also immense opportunity for companies that can align their organizational purpose to these objectives. Yet to truly demonstrate commitment and to spur market confidence (and investment), ambitious and actionable goals should be set and publicly communicated.

What’s next? (6 to 18 months) — integrating advanced digital technologies within the circular economy

Once the company has top-down buy-in on the importance of circular economy principles and how the organization can support them, product design should come to the forefront, as a new lens can be taken to re-evaluate existing products and services. Directly engaging your customers in conversations about their sustainability objectives can spur new ideas and opportunities to consider the viability of alternate partnership models, such as chemicals leasing.

Advances in digital technology could also be leveraged to enhance transparency and credibility of circular value chains. Use of artificial intelligence and blockchain solutions for tracking and tracing material can provide increased confidence in the true source and circular nature, which a customer may be paying a premium for.

Recycled content certifications are another promising mechanism to do this. Whether for mechanical or chemical recycling, committing to a fully certified value chain (in alignment with your partners) strengthens the commercial value of the end product, and provides options for participating in potential credit-trading schemes (such as for plastics) as they emerge and mature.

Looking beyond (18 months to 5 years) — developing a wider circular community and culture

Once a chemical company has solidified its circular ambitions and has identified new revenue opportunities to do so, it should focus on encouraging the growth of the broader circular economy industry. Startup accelerator programs and incubators are one way a more established company may look to source new ideas and technologies, while offering a framework for replicating and scaling business models and technologies that demonstrate promise.

Investing in solutions to address upstream and end-of-life product challenges is another mechanism for companies to partner and magnify their impact. Strengthening collection, sorting and waste infrastructure, whether through voluntary or regulated requirements, provides the opportunity for a producer to obtain and reuse its own raw materials. Partnering with brands and retailers to address harder-to-recycle products, such as apparel, toys, and automotive parts, could offer significant goodwill for companies that can identify commercially viable models to incentivize return, repair or refurbishment.

Lastly, numerous cross value-chain initiatives, alliances, and marketplaces have formed in recent years to bring together entities interested in addressing issues of waste and reuse. The Global Alliance on Circular Economy and Resource Efficiency (GACERE) is one such alliance worthy of consideration. Formed in 2021 by the EU, the United Nations Environment Programme (UNEP), and the United Nations Industrial Development Organization (UNIDO), GACERE offers a platform for stakeholders to advance a global circular economy and take forward partnership initiatives, including with major economies. With participation from 12 member countries and the EU, it’s clear that the call for circular economy investment and transformation is now at the world scale.

The path forward toward a circular tomorrow

Whether you are just beginning your transition toward a circular business mindset or your journey is already well underway, here are some critical questions to consider:

- How could circular strategies align with − and advance − our organizational vision and strategy?

- Which circular models could generate reciprocal value and incentive for our customers and our business?

- Could a model focused on domestic supply chain loops help us to reduce supply chain vulnerabilities?

- What are the timeline considerations for the development, pilot, trial and commercialization of new products or models?

- Have we identified existing and new potential partners who might share our sustainability objectives and have a similar risk tolerance for new ideas?

- What metrics and tools will we use to measure our progress?

- How will we define success internally, and are there relevant external recognition goals that we should aspire to?

Those able to successfully make the transition have significant opportunity to generate long-term value, per the Embankment Project for Inclusive Capitalism framework . New revenue streams, strengthened brand value and competitiveness as a supplier and an employer,23 and potential cost savings as traditional waste outputs are reused or on-sold are just some potential benefits.

For the less agile, the pace of change could soon challenge existing chemicals business models and revenues. As customer preferences transition toward recyclable products and packaging, and regulators strengthen their positions on single-use levies and extended producer responsibilities, investor and consumer enthusiasm for traditional take-make-waste businesses may wane.

Summary

The time is now for companies to acknowledge the strain on planetary boundaries through society’s present path, and to identify the strategic opportunities that can truly position them to be leaders of the circular economy of tomorrow.